Insight as Fast as You Think

Answers in Minutes — Not Days

Map the Market in Real Time

Your Analyst on Call

Proof, Not Just PR

Before Enki vs. After Enki

How Enki transforms guesswork and delays into real-time, source-backed insights.

You waste hours (or days) answering questions

that should take minutes

You chase scattered signals

digging through PDFs, pitch decks, and press releases.

You rely on internal teams or vendors to tell

you where the market is going — and wait days for data

You scramble to respond to leadership

without a clear, trusted view of what's real

You rely on gut feel, generic dashboards

or delayed vendor updates

You can't tell if a technology is truly scaling

or just making noise

You get answers in minutes

not hours or days — with source-backed clarity

You see real commercial activity

pilots, partnerships, and product launches, all in one place

You stop waiting on vendors

and lead with real-time intelligence at your fingertips

You brief leadership with confidence

backed by verified data and structured insights

You make decisions based on reality

not dashboards built on lagging or recycled data

You know what’s scaling and where

tracking deployments, not just press releases

Before Enki, answering a basic go-to-market question could take me hours — chasing PDFs, old reports, or waiting on internal teams. Now I can just type a question like ‘Where is SOFC scaling in maritime?’ and get a structured, source-backed answer in seconds.Director of Strategy, Clean Tech OEM

Go to Market Intelligence for Emerging Clean Tech

Real-time signals to validate where, when, and how to commercialize clean technologies — with source-backed signals delivered in minutes, not months

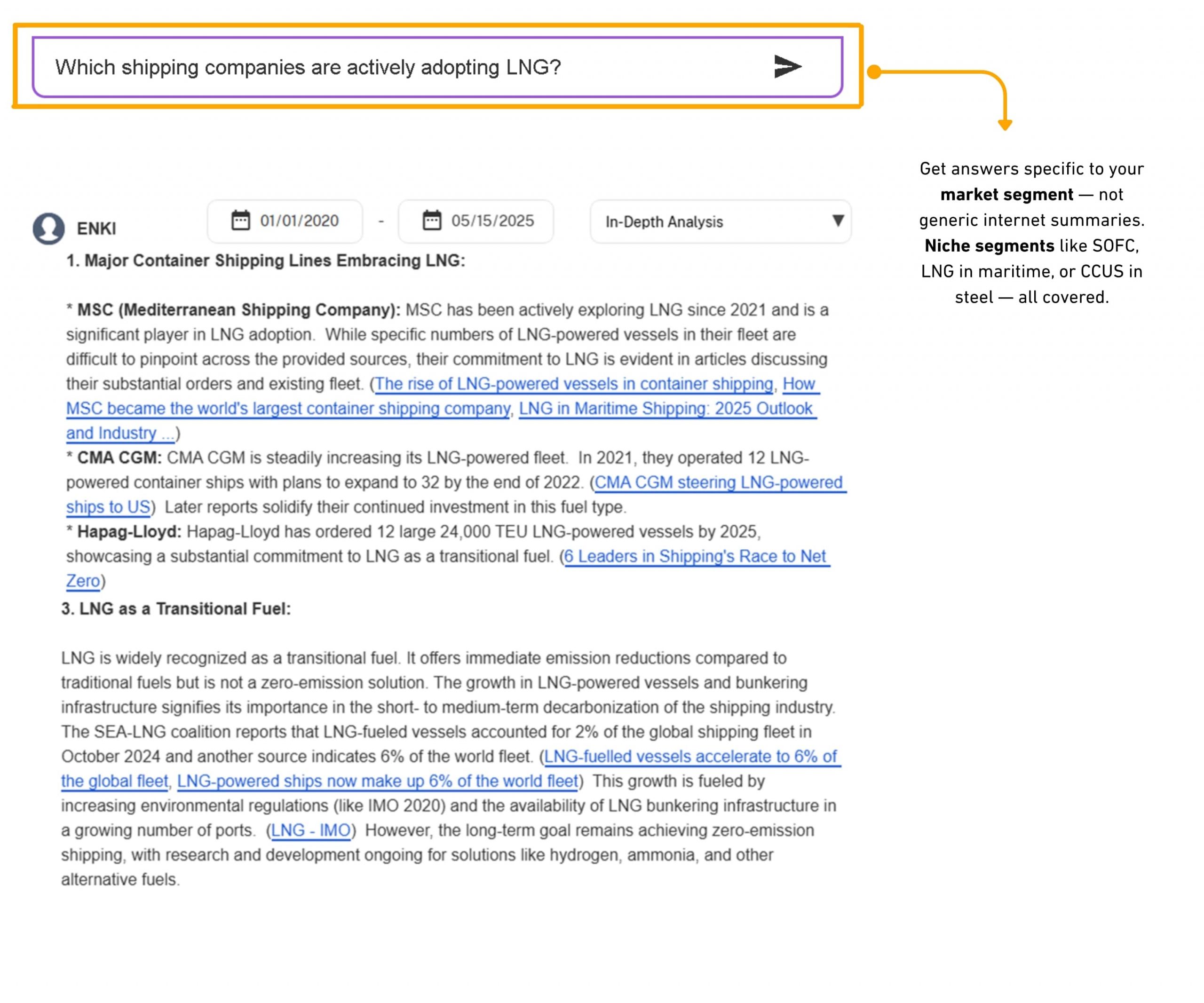

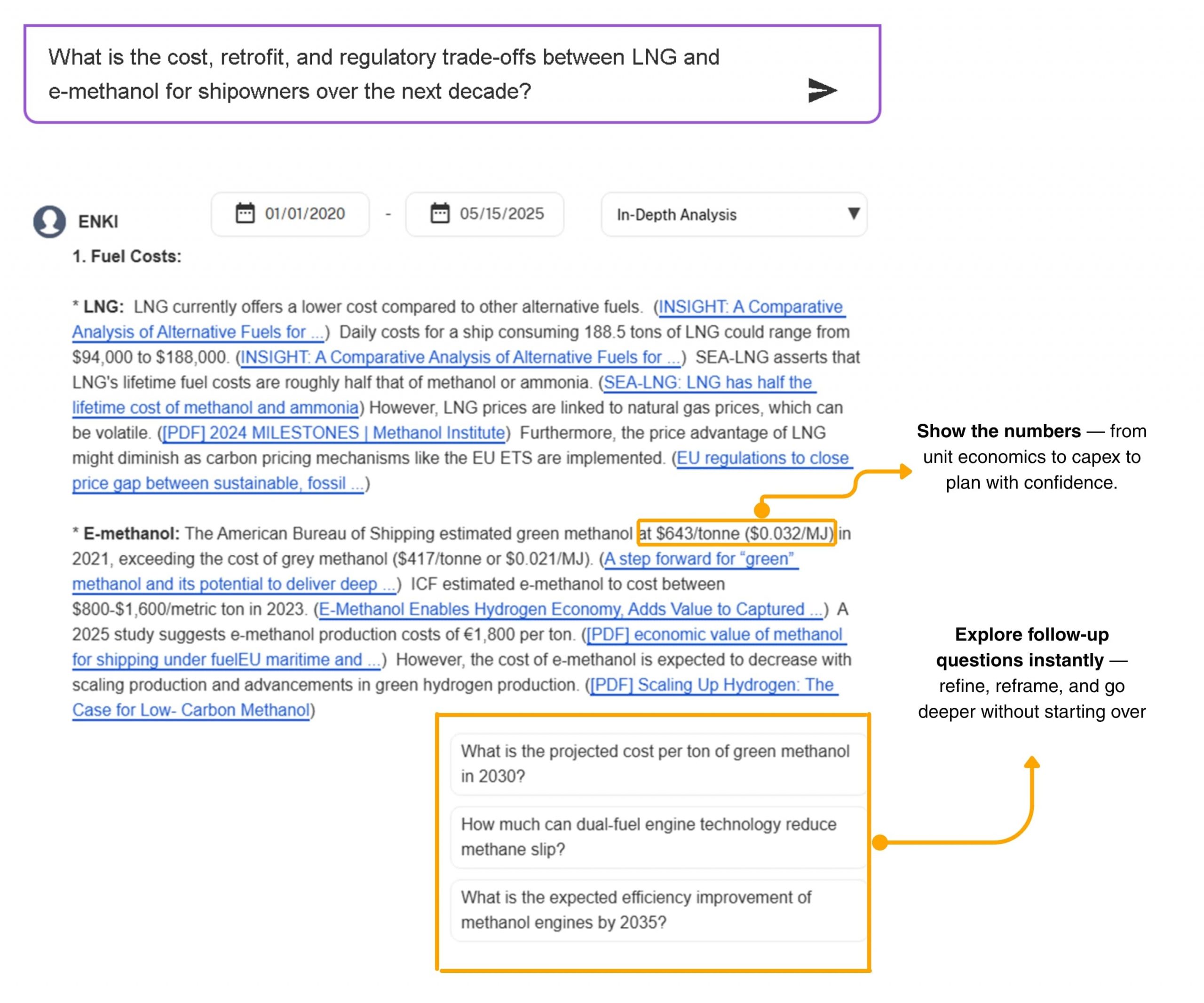

Answer complex trade-off questions in minutes — not hours

Compare technologies, costs, regulatory fit, and readiness without digging through PDFs, reports, or scattered links.

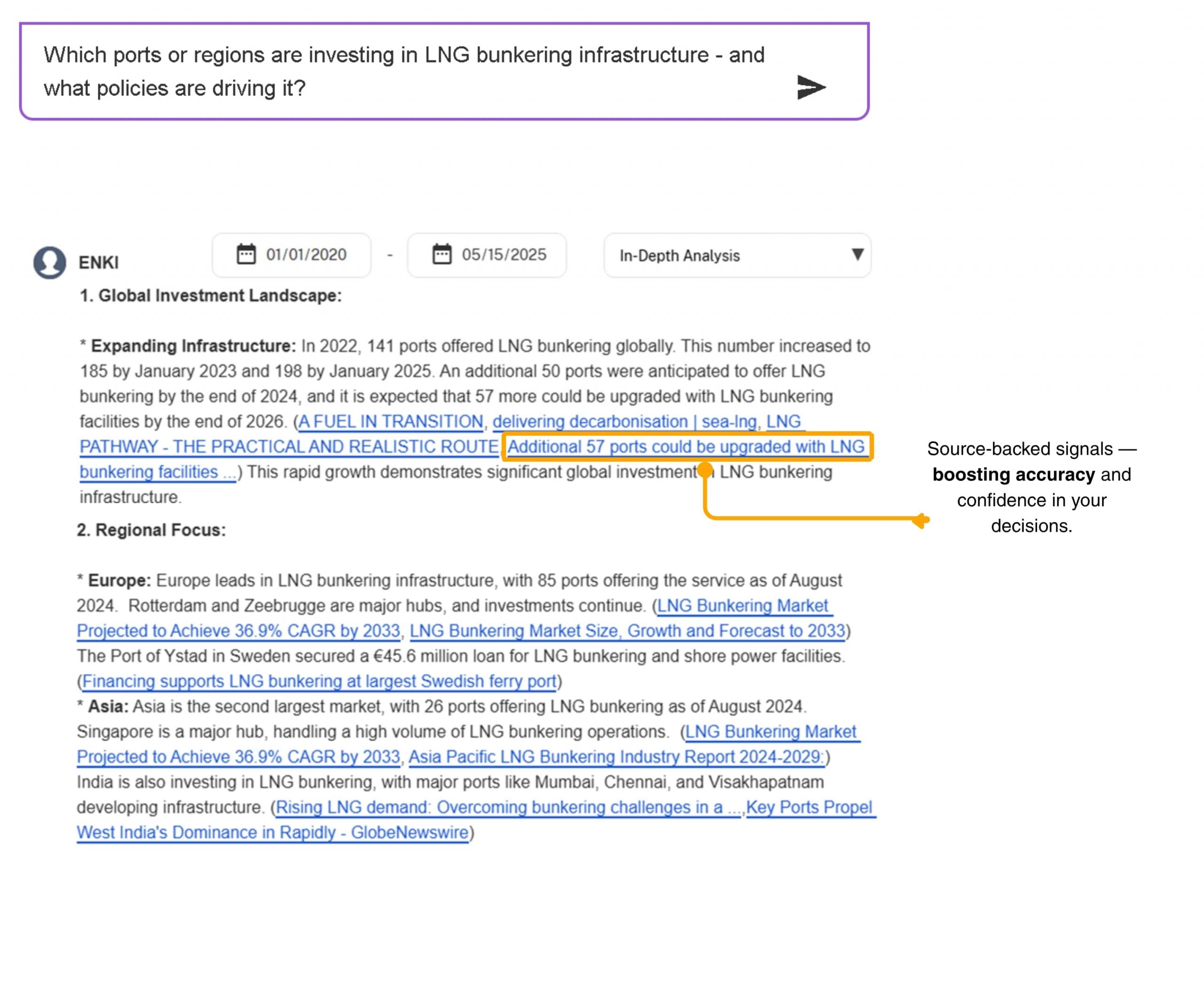

Stay ahead of infrastructure and policy shifts

Monitor regional developments, incentives, and regulatory moves that directly affect your go-to-market timing and strategy.

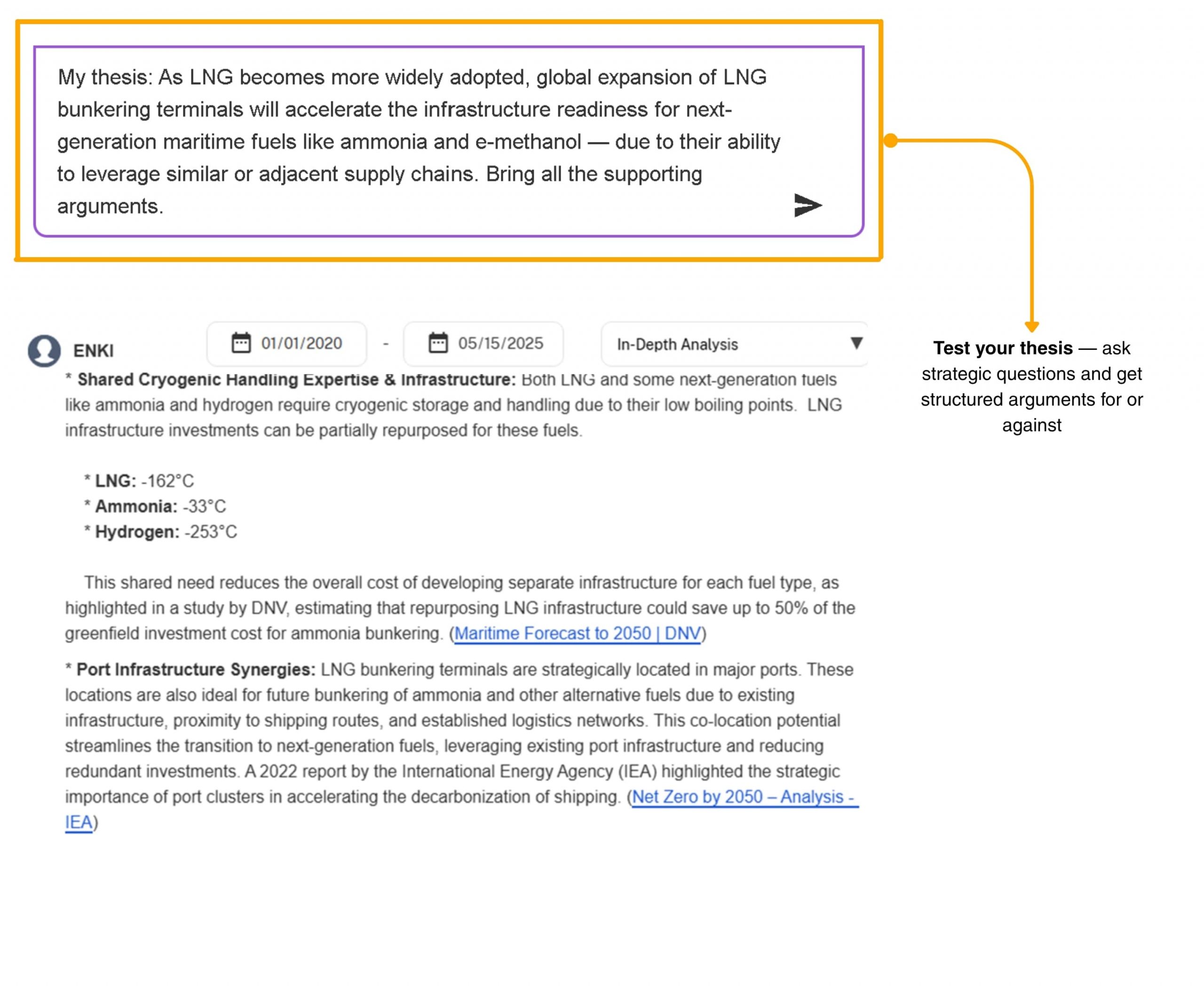

Validate strategic decisions with real commercial signals

Use live, source-backed insights to support go/no-go choices, thesis development, and long-term planning — not assumptions.

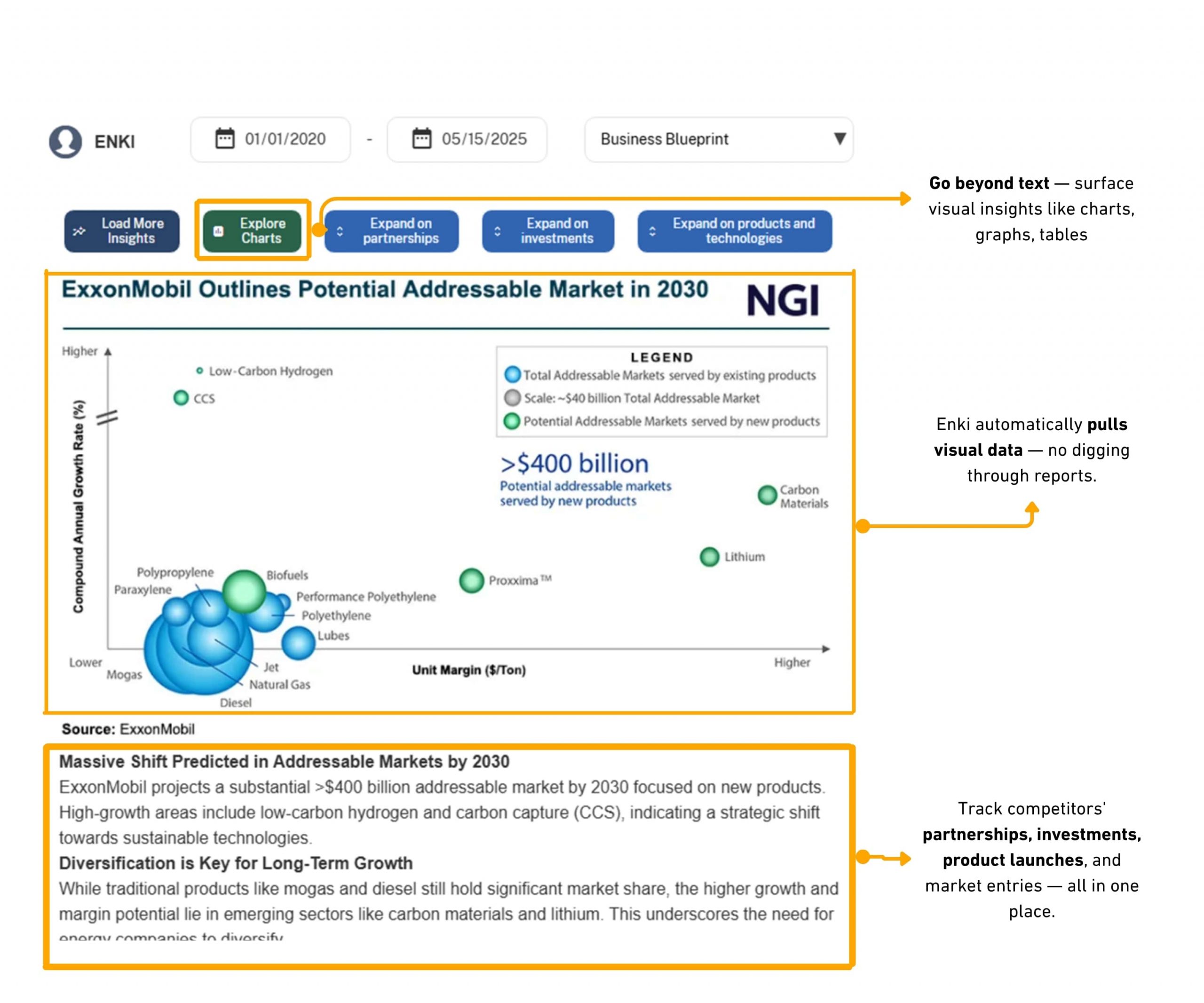

See who’s moving first — and why

Track which companies, regions, and technologies are leading — based on real partnerships, pilots, and deployments, not just headlines.

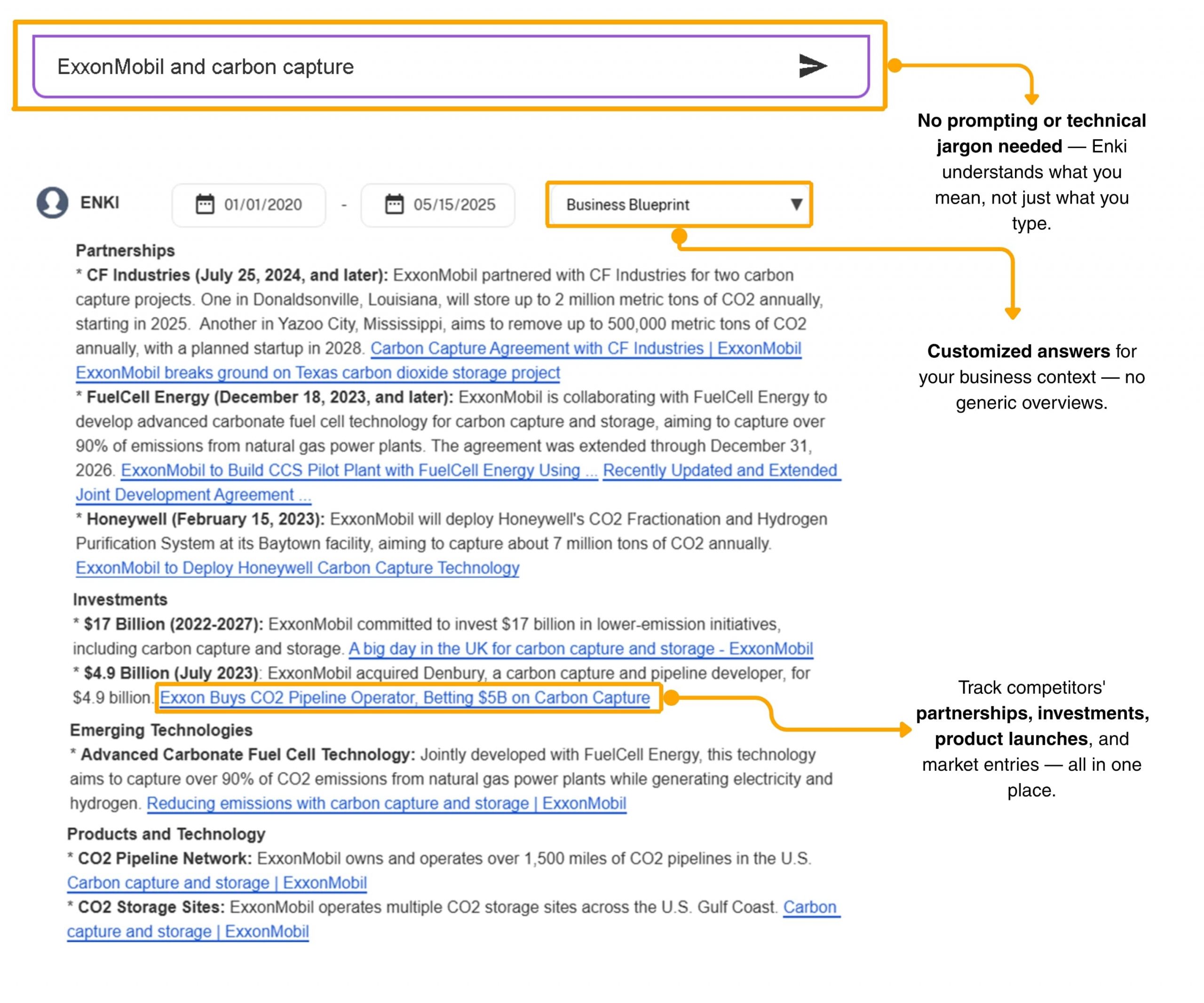

With Enki, I can track competitor moves in carbon capture as they happen — not weeks later. It’s helped us spot partnerships early and stay ahead of shifts in the market.Market Intelligence Manager, Oil and Gas Industry

Spot. React. Win.

Track commercial moves as they happen — and act before your competitors do.

Stay ahead of the competition by spotting strategic moves

Track pilots, partnerships, investments, and product launches in real time — so you never miss the moment to react, reposition, or partner first.

Map ecosystems and uncover hidden opportunities

See how companies, technologies, and markets are connected — and find whitespace your competitors haven’t reached yet.

Save hours of research and get a complete picture in seconds

Skip the PDFs, pitch decks, and Google rabbit holes. Enki delivers structured, source-backed intelligence — instantly.

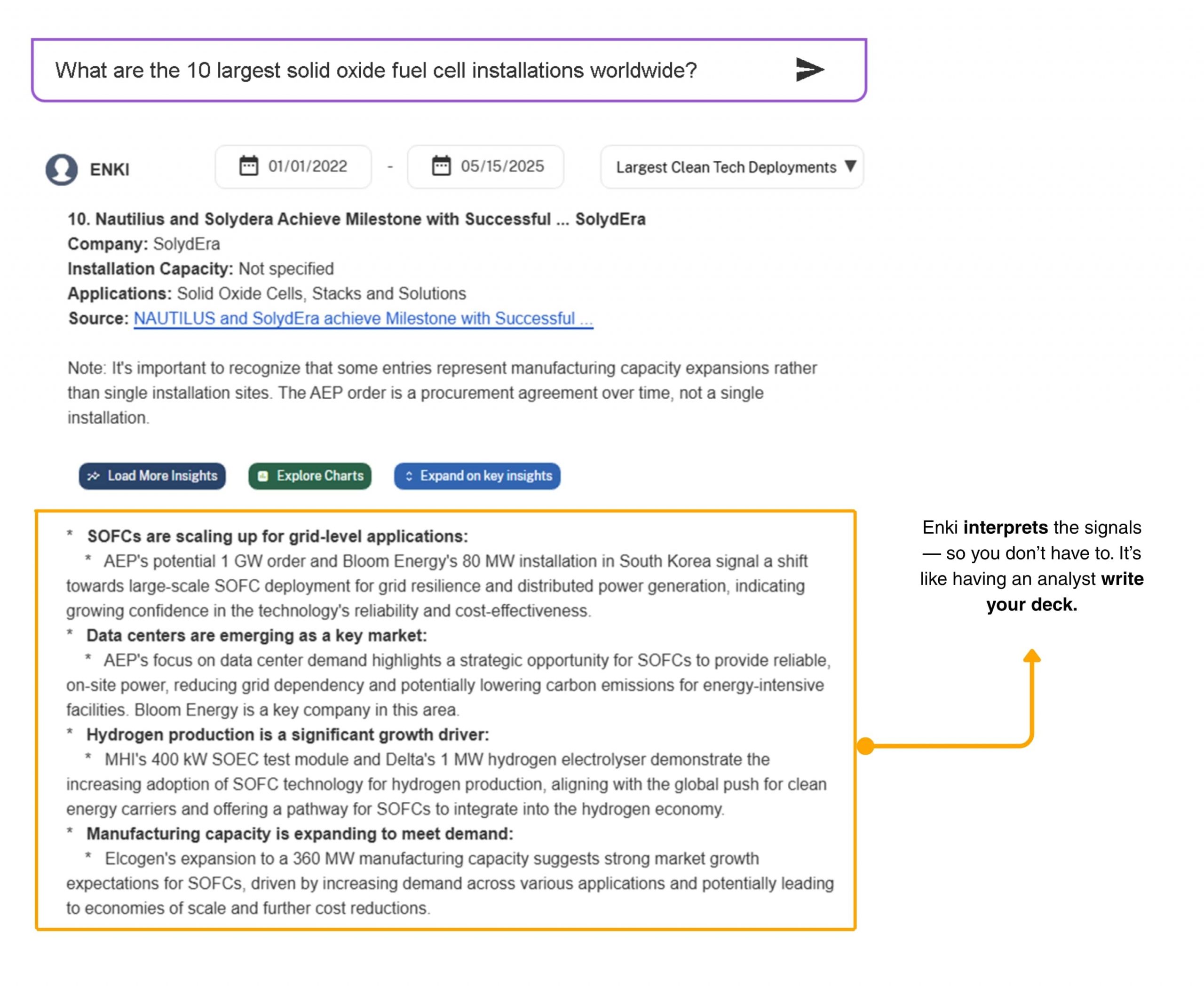

Brief leadership with clarity and confidence

Back every insight with trusted sources — so you can make recommendations that are fast, focused, and verifiable.

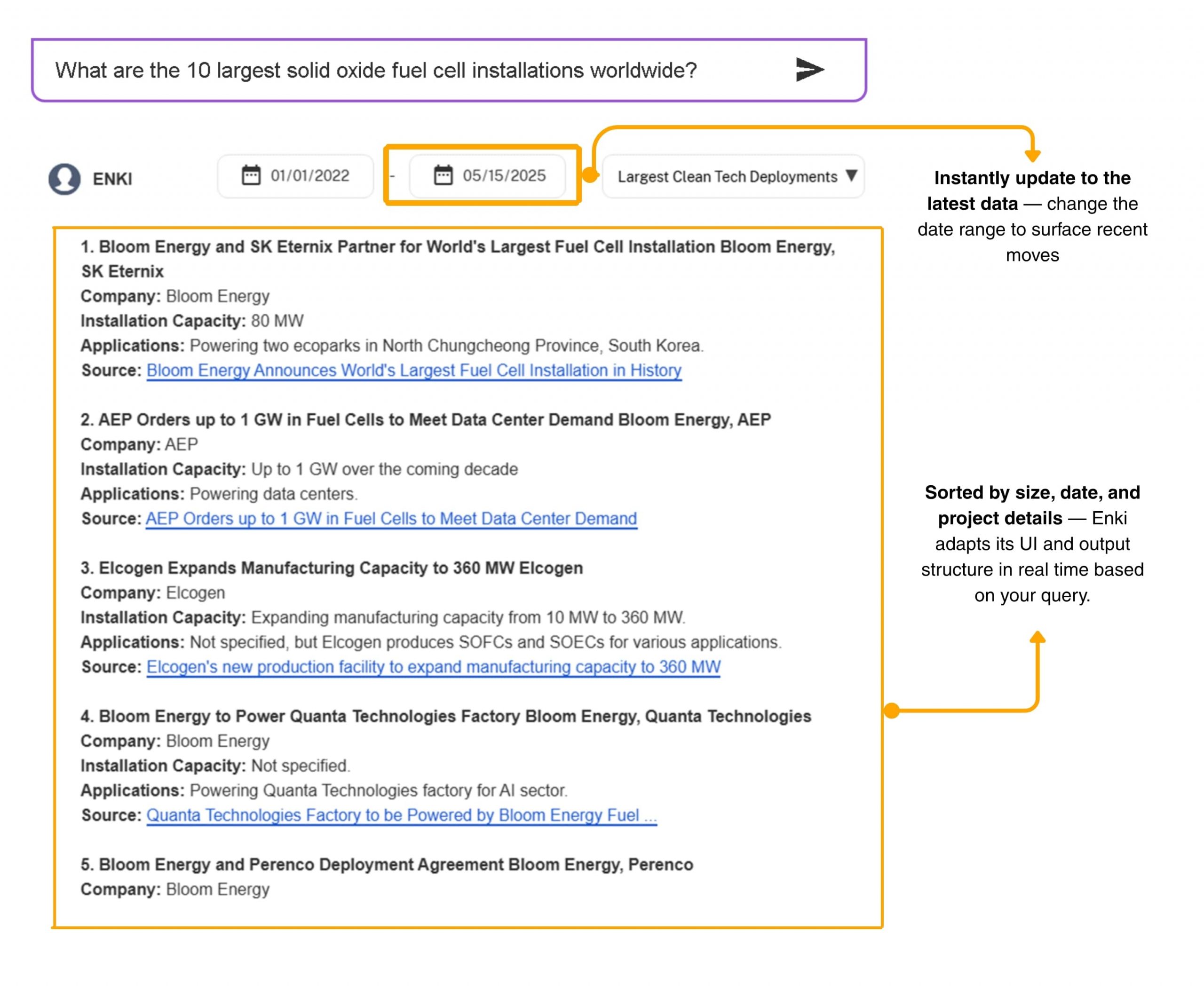

Enki helped us track SOFC deployments year over year — without spreadsheets or guesswork. It’s not just faster — it helps me move with confidence. I use it to validate market timing, spot infrastructure gaps, and brief leadership without second-guessing the data.Product Manager, Fuel Cell Manufacturer

Follow the Infrastructure, Not the Hype

Track clean tech buildouts in real time — and see which technologies are actually scaling.

See what's scaling — without the noise

Spot which technologies and emerging applications are being built, where, and by whom — based on actual deployments, not media hype

Track growth year-over-year

Use Enki’s date filters to compare deployments over time — and see if tech adoption is accelerating or stalling.

Save hours of manual research

No more building spreadsheets or scanning PDFs. Just set your filters and ask — Enki finds the projects and backs them with real sources.

Inform high-stakes decisions with infrastructure data

Deployments are multi-billion-dollar commitments. Use them to brief leadership, validate strategy, and de-risk investment.

Why Enki Beats Traditional Market Intelligence

Most tools weren’t built for how strategy, product, and market teams actually work — under pressure, with little time, and high stakes.

| Category | Capability | Enki | Traditional Reports + Google | Generic AI (ChatGPT) | Consultancies | AI Market Platforms |

|---|---|---|---|---|---|---|

| 🕒 Access & Speed | Pricing | $ | $$$ | $ | $$$$ | $$$ |

| Real-time data | ✅ Live signals from deployments | ❌ Reports months old | ❌ No live data | ❌ Consultant cycle delays | ⚠️ Often delayed | |

| Time to insight | ✅ Minutes, not days | 🐢 Days to months | ⚡ Instant (but vague) | 🐢 3–6 months | ⚠️ Days to weeks | |

| Iteration speed | ✅ Instant re-asks, no bottlenecks | ❌ Must wait for new report | ⚠️ Manual re-prompting | ❌ Requires new engagement | ⚠️ Limited flexibility | |

| 🎯 Strategic Fit | Built for clean tech | ✅ Purpose-built for energy markets | ❌ Generic reference | ❌ Not domain trained | ⚠️ Consultant-dependent | ❌ Finance-first |

| Focus on commercialization signals | ✅ Tracks pilots, partnerships, installs | ❌ Not covered | ❌ Not visible | ⚠️ Indirect, interview-based | ⚠️ Analyst-prioritized | |

| Decision-ready output | ✅ Structured and linked to action | ❌ Unstructured PDFs | ❌ Unverified and vague | ✅ Polished but slow | ❌ Often too high-level | |

| 🧩 Ease of Use | Plain language input | ✅ No prompting required | ❌ Must interpret documents | ⚠️ Requires careful prompting | ✅ Direct client engagement | ⚠️ Menu-limited |

| Structured summaries | ✅ Analyst-style synthesis | ❌ User must extract manually | ❌ No summary layer | ✅ Delivered insights | ⚠️ Chart-first, little narrative | |

| Customizable by segment | ✅ Query by company, tech, region | ❌ Static segmentation | ❌ Limited by prompt scope | ✅ Tailored by scope | ⚠️ Depends on analyst coverage | |

| 🔎 Trust & Transparency | Source-backed answers | ✅ Every insight linked to source | ❌ Little to no citation | ❌ No verification | ⚠️ Varies by consultant | ⚠️ Limited access to source data |

| Verifiable insights | ✅ Click-through evidence | ❌ Hard to verify | ❌ Fabrication risk | ⚠️ Not always disclosed | ⚠️ Analyst assumptions | |

| Analyst-grade synthesis | ✅ Summarizes what matters | ❌ Too much noise | ❌ No prioritization | ✅ Yes (but slow) | ⚠️ Requires internal analyst team | |

| 🌍 Coverage & Relevance | Tracks niche verticals (SOFC, DAC, etc.) | ✅ Full ecosystem visibility | ❌ Focused on mainstream only | ❌ Limited market understanding | ⚠️ Consultant expertise required | ⚠️ Limited clean tech depth |

| Ecosystem mapping | ✅ Company + tech + commercial links | ❌ Scattered sources | ❌ No mapping capabilities | ⚠️ Report-dependent | ⚠️ Analyst-defined relationships | |

| Deployment visibility | ✅ Largest projects auto-tracked | ❌ Only in headlines or buried | ❌ Not available | ⚠️ Project-by-project manually | ⚠️ Infrequent updates |

Enki surfaced and ranked startups we hadn’t seen in any database. It helped us spot early movers in emerging segments — well before they showed up on anyone else’s radar — and then track their progress in real time.Managing Director, Energy Company

Frequently Asked Questions

1. Getting Started (Ease of Use)

2. Trust & Security

3. Coverage & Accuracy

4. Features & Collaboration

5. Credibility & Story

- Opportunity identification

- Market mapping

- Competitive intel

- Trend analysis

- Techno-economics

- Policy/regulation