Case Study

Tracking Negative News and Events to Manage Business Risk

A financial institution tracks business risk signals on over 1,000 companies that are current clients and prospects. One of the key metrics of business risks is any negative news and events on the monitored companies and executives. Previously, the firm, with a team of eight analysts, had been manually monitoring the negative events. In addition, the team had to prepare monthly reports on monitored companies.

The Challenge

Tracking companies and executives manually and reporting the outcome was very challenging:

- Large Scale: The team needed to deal with many keyword combinations to find issues, challenges, and negative press. It was a time-consuming, labor-intensive, and repetitive task.

- High Noise Level: Automated news feeds such as RSS feeds were too noisy and provided too much irrelevant information.

- Delay in Notification: The team repeated the process monthly because of the dynamic nature of news cycles. If an event happened in the middle of the month, it would take a few weeks to record.

- Missing Negative Events: The analyst team was missing events not covered in major news outlets.

Solution

To automate and optimize the process of finding business risk signals, the analyst team turned to Enki. Firstly, the analyst team defined the negative events to track. Unlike other solutions, Enki does not come with predefined categories. Instead, users define the events based on their business needs. For example, the firm wanted to capture cyber-related risks such as outages, network crashes, malware, and lawsuits.

Pain Points

are negative news and events that the firm wanted to track. The firm optimized the keywords based on their needs.

Running Analysis

The analyst team entered the companies and risk factors that they have been monitoring.

Differentiation

Most of the solutions in the market today extract the headlines and are limited to major news sources. As a result, they miss events not widely covered in major news outlets. Since Enki monitors the entire web and extracts insights from the body of the texts, the team was able to find insights missed by major news sources.

Enki notified the analyst team of business risk signals about executives, key decision-makers, and board members, unlike other solutions that track company-related events. This capability made their analysis even more robust.

Our client trained Enki by tagging insights as relevant and irrelevant. Enki continually refined its NLP model only to provide useful information with this feedback, making it an indispensable team player. By creating daily alerts of negative news, the analyst team has stayed on top of events and ever-changing situations.

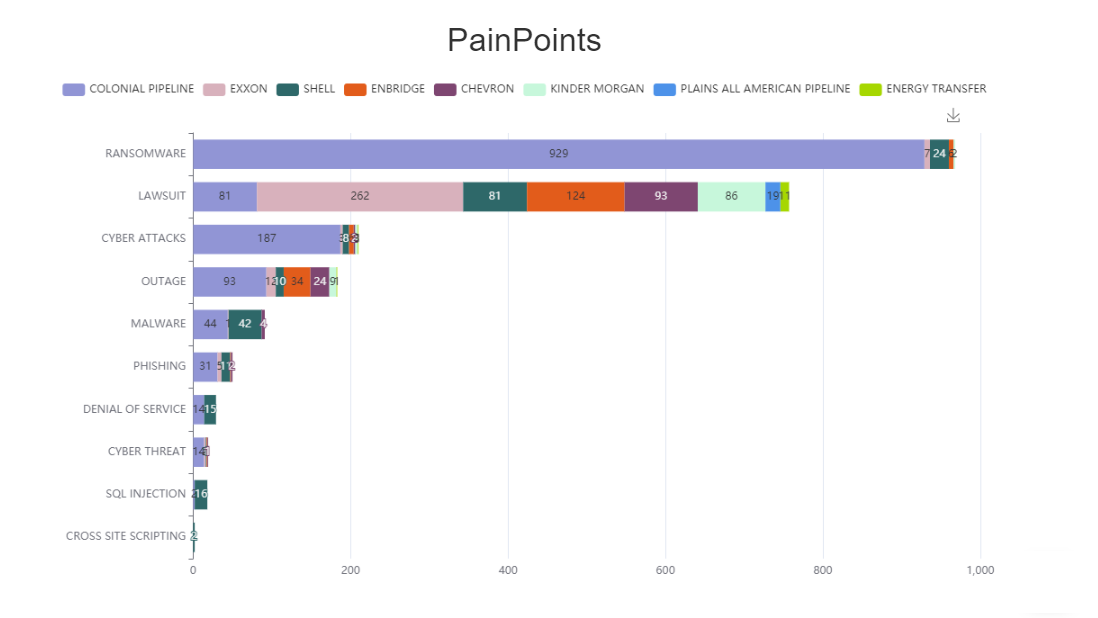

What were the top negative events for the monitored companies?

Enki showed the leading companies by the type of negative events. For example, Colonial Pipeline led with ransomware and cyber security challenges. Exxon led its peers with lawsuits.

What negative events were the monitored companies facing?

The analyst team drilled down further to understand the risk factors within each company. For example, Colonial Pipeline mostly talked about cybersecurity-related challenges and initiatives. Exxon Mobile had many upcoming State lawsuits about climate change.

Benefits

- Enki significantly improved the turnaround time by automating the entire process of tracking negative news.

- Enki flagged seven companies that increased the firm's risk exposure that the analysts previously missed.

- Enki saved 50% of the clients' analysts' time, equivalent to four full-time employees.