There were almost 2 new B2B sales and marketing-related companies founded every week in 2020. In addition, there have been 28 mergers in the first half of 2021. What is fueling these activities? Every day, I talked to countless end users, sales and marketing data providers to solve their data challenges. I have summarized my work below on staying competitive in this environment.

Three fundamental trends shape the future of sales.

- Virtual Selling is the norm: Many sellers fully embraced technology such as sales enablement and sales intelligence tools that they had previously kept at arm’s length. Social Distancing and digitization of the B2B buyer just accelerated this adoption. In the LinkedIn State of Sales 2021 Report, 77% of sales professionals say their org plans to invest in more sales and intelligence tools. Craig Rosenberg, VP-Analysts Gartner, summarized, “virtual selling has driven rapid digital transformation in sales.”

- Commoditization of sales and marketing data: An explosion of third-party data sources and collection methodologies has turned contact databases, firmographic, and demographic data into a commodity. There are many companies formed to satisfy the data need. For example, almost 2 new sales marketing-related companies started per week during 2020. One of the Marketing Data Founders put it this way “Nobody cares about another data provider.”

- Sales and Marketing data is getting more fragmented: No silver bullet exists for B2B sales and marketing data. Forrester Research talked to 30 reference customers and indicated that most firms are still working with multiple data providers. This is because they need specialist firms focused on a specific data type, vertical market, or geography. This strategy requires selecting a core vendor with the breadth, depth, and quality of the data needed to serve that role successfully.

These trends push Sales and Marketing Data Providers to mergers and partnerships.

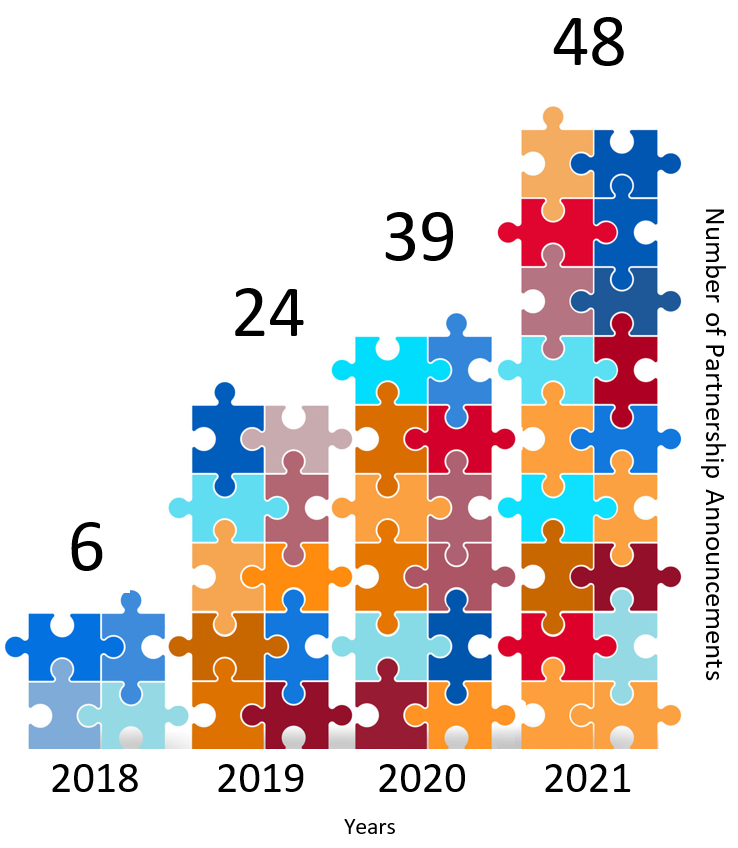

Figure 1. Partnership activities in major Sales and Marketing Providers.

According to Enki, 2021 has so far been the golden year for partnership announcements. Enki tracked the major 18 Sales and Marketing Data Providers and analyzed their partnership-related activities. So far, there have been 48 partnership announcements, although the year has not ended. Most of the partnerships are happening around Account-Based Marketing and gathering insights on Key Decision Makers. For example, Dun & Bradstreet and Zeta formed an alliance for “Enterprise-to-Particular person” marketing. Moreover, ZoomInfo formed a partnership with Leandata to take advantage of prospects intelligence.

In addition to partnership announcements, there are lots of M&A activities in the market. According to the Gartner Sales Tech Mayhem report, “The market is fast moving from a wide set of categories into a narrow list of vendors with wide portfolios of capabilities.” Besides, big platforms such as ZoomInfo, Dun & Bradstreet, SalesLoft aren’t necessarily buying competitors in the same category – they are buying into adjacent categories.

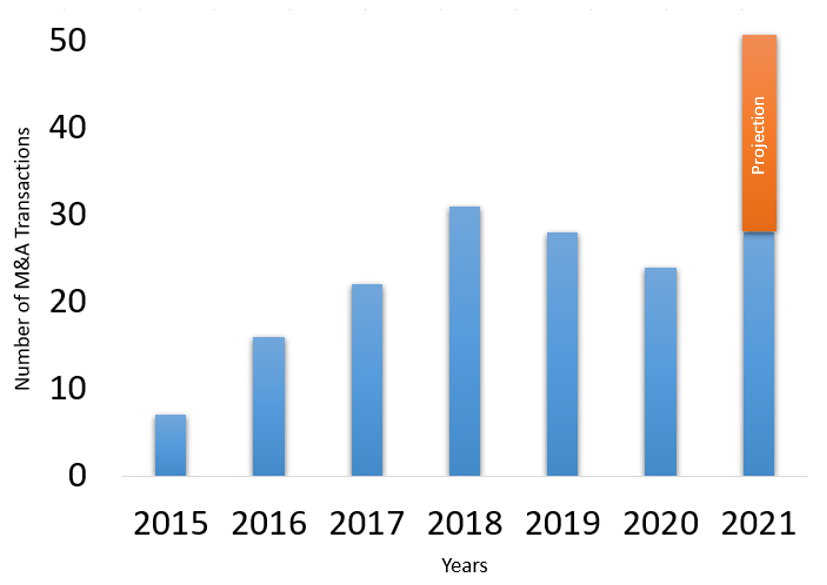

We analyzed all the sales marketing-related M&A within the 7 years.

Figure 2. Number of M&A Transactions in Sales Tech

With this transaction speed, there could be about 40+ mergers and acquisitions in 2021. So this will make 2021 a golden year for M&A as well.

If you are a product or technology leader in this market, how can you stay competitive?

- Offer the most comprehensive data to your end-users. Your solution may not have all the data points, but you can provide the most comprehensive data for your customers through partnerships. For example, one of our clients develops a relationship intelligence platform. They were able to able to map over 300 million professional and consumer profiles to help their users. Their users requested people intelligence on decision-makers, such as their opinions, talking points on various topics. Enki brought these insights into their solutions.

- Focus on differentiated use cases. The leading vendors in this market offer various value-added solutions for specific use cases and user personas. For example, one of our clients built a contact database with 100 million professionals with revenue, headcount, company information. However, their solutions did not have any Pain Points, Corporate Strategic Initiatives, Executive Talking Points insights. Enki augmented their existing data to differentiate their contact database in the market.

What do you do to stay competitive? Let’s discuss.