Palo Alto Networks OT Security Strategy 2025: Securing Energy Infrastructure with AI

Palo Alto Networks’ Commercial Scale OT Security Projects: A 2025 Analysis

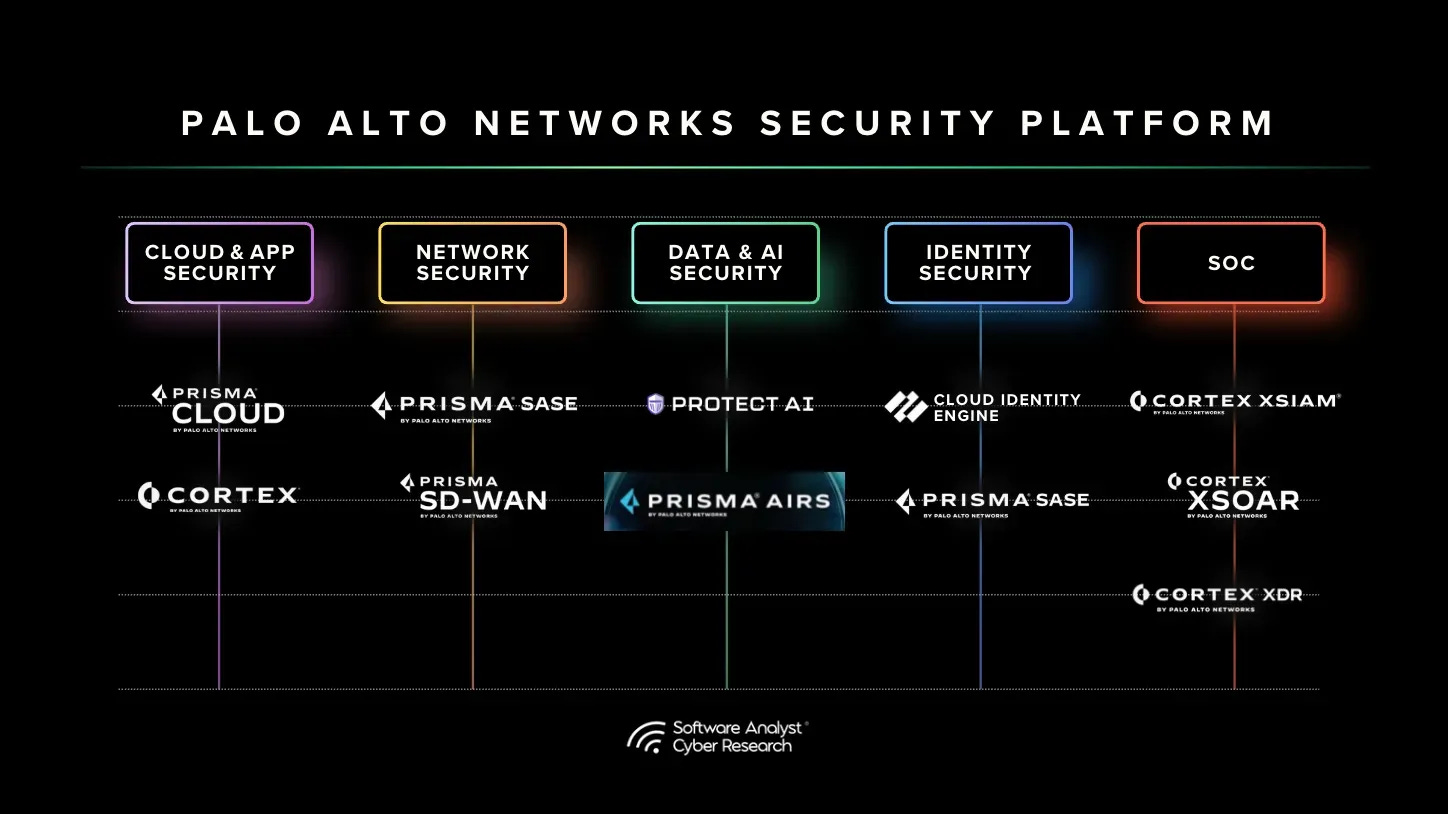

Palo Alto Networks has shifted from foundational AI development to aggressive commercial deployment of security solutions for industrial operations, directly addressing the growing attack surface in the energy sector.

- Between 2021 and 2024, the company laid the groundwork by launching its AI-driven Cortex XSIAM platform and developing its proprietary Precision AI, but specific OT security applications were nascent.

- A significant pivot occurred in October 2024 with the launch of AI-powered OT Security solutions designed to protect critical infrastructure, signaling a direct move into the industrial and energy markets.

- In 2025, this strategy accelerated with the launch of Cortex AgentiX and Prisma AIRS 2.0, platforms designed to secure automated AI agents and their underlying infrastructure, which are increasingly being adopted in industrial control systems.

- The breadth of applications, from securing remote OT access to protecting medical IoT devices, shows a platform-based approach to secure all connected devices in critical sectors, not just traditional IT endpoints.

Palo Alto Networks’ Multi-Billion Dollar Investment in AI Security: A 2025 Financial Breakdown

Palo Alto Networks is executing a multi-billion-dollar acquisition strategy to rapidly buy, not build, the core components needed to dominate the AI and OT security markets.

- The company’s spending spree in 2025 totals over $28 billion, demonstrating an urgent and large-scale commitment to integrating best-in-class technologies into its platform.

- The $25 billion acquisition of CyberArk in August 2025 is a monumental investment aimed at securing machine identities, a critical vulnerability in automated OT environments and AI agent-driven systems.

- The $3.35 billion purchase of Chronosphere in November 2025 adds essential AI-era observability, providing the data necessary for securing complex Kubernetes and microservices architectures common in modern industrial platforms.

- This investment strategy is validated by financial performance, with AI-related Annual Recurring Revenue (ARR) reaching approximately $545 million by Q4 FY25, a nearly threefold increase year-over-year.

Table: Palo Alto Networks’ Strategic AI Security Investments

Palo Alto and CyberArk Reshape Identity’s Future.

This analysis from Software Analyst Cyber Research visualizes the expanding Machine Identity Management market. It underscores the strategic rationale behind Palo Alto Networks’ major acquisition of CyberArk.

| Acquired Company | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Chronosphere | Nov 2025 | Acquired for $3.35 billion to integrate next-generation observability into Cortex AgentiX, enhancing security for Kubernetes and microservices in industrial AI environments. | Palo Alto Networks Chronosphere deal shows its spending … |

| CyberArk | Aug 2025 | Acquired for approximately $25 billion to integrate privileged access and identity security, critical for managing machine identities in automated OT and agentic AI systems. | Five Companies That Came To Win This Week |

| Protect AI | Apr 2025 | Acquired for over $500 million to bring advanced AI model security, posture management, and red teaming capabilities directly into the Prisma AIRS platform. | Palo Alto Networks buys Protect AI for reported $500M+ … |

Palo Alto Networks’ Strategic AI Alliances: A 2025 Partnership Analysis

Palo Alto Networks is creating a powerful go-to-market ecosystem by forging deep, multi-billion-dollar alliances with hyperscalers and global systems integrators to embed its AI security platforms as the industry standard.

- The landmark partnership with Google Cloud, announced in December 2025 with a reported value approaching $10 billion, deeply integrates Prisma AIRS with Google’s AI services, creating a default security layer for AI workloads.

- The May 2024 agreement with IBM is a strategic market capture, transitioning IBM’s QRadar SaaS clients to Cortex XSIAM while establishing IBM as a preferred managed services provider for Palo Alto Networks’ platforms.

- In November 2025, the company partnered with Arista Networks to secure AI data center networks, a collaboration critical for protecting the high-performance computing environments that power OT and AI systems.

- The ecosystem expansion includes global integrators like Accenture, Deloitte, and NTT DATA, which are now trained to deliver managed services on Palo Alto Networks’ platforms, scaling its reach into enterprise and industrial sectors globally.

Table: Palo Alto Networks’ Key AI and OT Security Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google Cloud | Dec 2025 | A multi-billion dollar deal approaching $10 billion to integrate Prisma AIRS with Google Cloud’s AI services, including Vertex AI and Gemini models, to deliver end-to-end AI security. | Google Cloud lands deal with Palo Alto Networks ‘ … |

| Arista Networks | Nov 2025 | Strengthened partnership to provide secure AI data center networks, combining high-performance networking with Zero Trust security for critical AI infrastructure. | Arista and Palo Alto Networks Strengthen Partnership in … |

| NTT DATA | Oct 2024 | Partnership to deliver AI-driven managed security services leveraging Cortex XSIAM, enhancing cyber resilience for enterprises from cloud to edge. | NTT DATA Partners with Palo Alto Networks to Deliver AI- … |

| IBM | May 2024 | Landmark agreement for Palo Alto Networks to acquire IBM’s QRadar SaaS assets and migrate clients to Cortex XSIAM, with IBM becoming a preferred MSSP. | Palo Alto Networks and IBM to Jointly Provide AI-powered … |

Global Expansion: Palo Alto Networks’ Regional OT Security Growth in 2025

Palo Alto Networks is leveraging its global partnership network to drive its AI security platform adoption primarily in North America and Europe, with a clear strategy to expand into the Asia-Pacific region.

- Between 2021 and 2024, the company’s focus was predominantly on the mature North American market, building its core customer base and technology foundation.

- In 2024 and 2025, Palo Alto Networks initiated a significant global push, evidenced by its expanded alliance with Deloitte in October 2024 to cover EMEA and JAPAC, and a strategic Canadian partnership with Bell in December 2024.

- The partnership with IBM, a global entity, provides immediate international reach for Cortex XSIAM by targeting IBM’s existing global customer base for migration.

- The alliance with Japan-based NTT DATA in October 2024 is a strategic entry point into the Asian market, leveraging a major regional player to deliver its AI-driven managed security services.

From Pilot to Commercial Scale: Palo Alto Networks’ AI-Powered OT Security Maturity in 2025

Palo Alto Networks’ AI security technology has rapidly progressed from development to commercial-scale deployment, validated by major product launches and integrations in 2025 that directly support complex OT environments.

- The 2021-2024 period was characterized by foundational development, with the October 2022 general availability of Cortex XSIAM representing the first major step toward an AI-native security platform.

- In 2025, the technology reached commercial maturity with the launch of Prisma AIRS 2.0 and Cortex AgentiX, platforms designed not just for threat detection but for securing the entire AI agent workforce and runtime environments.

- The acquisition and integration of technology from Protect AI into Prisma AIRS 2.0 within months demonstrates an ability to rapidly operationalize new capabilities, such as autonomous red teaming and AI model security.

- The planned integration of Chronosphere’s observability platform into Cortex AgentiX further validates maturity by addressing the need for deep visibility in production-grade Kubernetes environments, which are essential for modern industrial applications.

SWOT Analysis: Palo Alto Networks’ Competitive Position in AI Security for 2025

Palo Alto Networks Delivers Strong Q1 Results.

Data from Constellation Research shows Palo Alto Networks’ strong Q1 performance against its own guidance. This reflects the successful industry shift toward security platformization, a key company strength.

(Source: Constellation Research)

The company’s greatest strength is its aggressive “platformization” strategy, which unifies disparate security functions into a single AI-driven offering, creating a significant competitive moat against both legacy vendors and point-solution startups.

- Strengths are centered on its comprehensive platform, strong brand, and rapidly growing Next-Generation Security ARR, which reached $5.9 billion in Q1 FY26.

- Weaknesses include potential integration friction from its massive acquisition spree and a reported deceleration in the growth rate of its NGS ARR from 47% to 34%, suggesting intensified competition.

- Opportunities are immense, driven by the projected growth of the AI security market to $234.3 billion by 2032 and the fragmented nature of the current market, which is ripe for consolidation.

- Threats primarily come from hyperscalers like Microsoft, which leads in overall cybersecurity market share with 11.4%, and agile competitors like CrowdStrike.

Table: SWOT Analysis for Palo Alto Networks

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong brand in network security; initial growth in cloud security; launch of Cortex XSIAM platform in 2022. | Aggressive “platformization” strategy; rapid NGS ARR growth to $5.9 billion; established AI-native platforms like Prisma AIRS 2.0 and Cortex AgentiX. | The company successfully pivoted from a portfolio of products to a unified platform strategy, validated by the rapid growth of its NGS ARR. |

| Weaknesses | Perceived as a collection of separate products rather than a unified platform; reliance on legacy firewall business. | High capital outlay on acquisitions (over $28 billion); decelerating NGS ARR growth rate (from 47% to 34% YoY). | The heavy investment in acquisitions validates the need to buy key capabilities, but introduces significant integration risk and financial pressure. |

| Opportunities | Nascent AI security market; customer frustration with managing multiple point solutions. | Market consolidation; booming AI security market projected to reach $234.3 billion by 2032; securing OT and critical infrastructure. | The acquisitions of CyberArk and Chronosphere and the launch of OT security products confirm a strategic move to capture the industrial and AI infrastructure markets. |

| Threats | Competition from specialized cloud-native security vendors like CrowdStrike and Zscaler. | Intensifying competition from hyperscalers (Microsoft leads with 11.4% market share); risk of AI-generated attacks outpacing defensive capabilities. | The competitive environment has shifted from smaller specialists to large platform players, validating Palo Alto Networks’ strategy but also increasing the competitive stakes. |

Future Outlook 2026: Palo Alto Networks’ Next Move in Autonomous OT Security

Palo Alto Networks is positioned to deliver a fully autonomous security platform for industrial operations in 2026, leveraging its recent acquisitions of identity and observability technologies to counter AI-driven threats with AI-driven defense.

- The company’s prediction for 2026 as the “Year of the Defender” directly aligns with its product strategy of building an autonomous AI workforce for security, a critical need for understaffed OT security teams.

- The integration of CyberArk’s identity security will be crucial for managing the explosion of machine and agent identities in automated industrial environments, moving beyond traditional user-based security.

- The addition of Chronosphere’s observability technology will provide the necessary real-time data from complex cloud-native OT systems, enabling the AI models in Cortex AgentiX to detect and respond to threats without human intervention.

- Expect Palo Alto Networks to focus its go-to-market efforts in 2026 on converting its massive investments into platform adoption, using its global partners to drive consolidation deals within the energy and critical infrastructure sectors.

Frequently Asked Questions

What is Palo Alto Networks’ core strategy for securing energy infrastructure and other OT environments in 2025?

Palo Alto Networks’ strategy is to aggressively “platformize” security by unifying disparate functions into a single, AI-driven offering. They are rapidly buying core technologies through multi-billion-dollar acquisitions like CyberArk and Chronosphere, and forging deep partnerships with hyperscalers and systems integrators to embed their Cortex and Prisma platforms as the industry standard for securing OT and AI systems.

What were the most significant acquisitions made by Palo Alto Networks in 2025?

In 2025, Palo Alto Networks spent over $28 billion on acquisitions. The most significant were the $25 billion purchase of CyberArk to secure machine identities in automated OT systems, the $3.35 billion acquisition of Chronosphere for AI-era observability, and the $500M+ purchase of Protect AI to add AI model security to its Prisma platform.

Which new products did Palo Alto Networks launch in 2025 to address AI and OT security?

In 2025, Palo Alto Networks accelerated its strategy by launching Cortex AgentiX and Prisma AIRS 2.0. These platforms are specifically designed to secure the automated AI agents, underlying infrastructure, and runtime environments that are increasingly being adopted in industrial control systems.

How is Palo Alto Networks using partnerships to expand its market reach?

The company is creating a powerful go-to-market ecosystem through major alliances. Key partnerships include a multi-billion dollar deal with Google Cloud to integrate Prisma AIRS, an agreement with IBM to migrate QRadar clients to Cortex XSIAM, a collaboration with Arista Networks to secure AI data centers, and leveraging global integrators like Accenture, Deloitte, and NTT DATA to deliver managed services.

According to the SWOT analysis, what are the primary threats to Palo Alto Networks’ competitive position in 2025?

The main threats identified are intensifying competition from hyperscalers like Microsoft, which holds the largest overall cybersecurity market share, and agile competitors like CrowdStrike. Another significant threat is the risk that sophisticated, AI-generated cyberattacks could evolve faster than defensive security capabilities can keep up.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.