Trump’s Energy Policies: A Balancing Act Between Hydrocarbons and Clean Tech🌍⚡

Trump’s energy policies reshaped the U.S. landscape significantly. They emphasized oil and gas dominance through deregulation and subsidies. However, support for renewable energy was scaled back. This balancing act between hydrocarbons and clean tech marked a pivotal shift in the U.S. energy transition. For example, sectors like solar and wind showed resilience despite the challenges.🛢️🌱.

Despite these obstacles, sectors like solar ☀️, wind 💨, and clean tech M&A 💼 proved resilient. In addition, tate leadership, declining costs, private-sector decarbonization goals, and corporate investments drove growth and innovation. Moreover, merging technologies like small modular reactors ⚛️ received strong backing, reflecting Trump’s interest in advancing nuclear innovation. Althhough blue hydrogen 🔵 showed potential but faced barriers under a fossil fuel-focused agenda.

This article analyzes Trump’s energy policies and renewable energy transition policies—both supportive and opposing—to offer forward-looking insights into what his second term might mean for clean tech and the future of the U.S. energy transition 🔋🌎.

🌞 Trump’s Solar Energy Policies: A Tale of Support and Setbacks

Supportive Policies under Trump

- Approval of Large-Scale Solar Projects: During Trump’s first term, large-scale solar projects demonstrated support for renewables. The Gemini Solar Project (Nevada) was approved in May 2020. This $1 billion project includes 690 MW of solar capacity and 380 MW of battery storage, powering 260,000 homes. Thus, it remains one of the largest U.S. solar installations.

- Tax Credit Extensions: In 2019, Trump extended the Investment Tax Credit (ITC) for one year, providing a 30% tax credit for solar installations. As a result, this short-lived measure supported ongoing projects and maintained momentum in the sector.

Opposing Policies under Trump

- Solar Panel Tariffs: In 2018, Trump imposed a 30% tariff on imported solar panels under Section 201 of the Trade Act to protect U.S. manufacturers. While tariffs were later reduced to 15% in the 4th year, they raised project costs and delayed or canceled $2.5 billion in investments.

- Budget Cuts for Renewable Research: Proposed cuts of up to 70% to the Department of Energy’s Renewable Research budget hindered innovation in solar technologies. Although, congressional intervention mitigated some reductions, but funding remained constrained.

Forward-Looking Insights: Economic Realities Favor Solar

Despite federal headwinds, solar power remains resilient under Trump’s energy policies. In 2023, solar accounted for 40% of new electricity generation, driven by declining costs (down 80% since 2010) and rising demand.

State Leadership: Additionally, states like California, Texas, and Florida lead solar adoption, with Texas adding over 10,000 jobs in 2023. Moreover, ambitious targets like California’s 100% clean energy by 2045 continue to propel growth.

Corporate Investments: Companies like Amazon, Google, and Microsoft have committed heavily to solar, ensuring sustained demand independent of federal policies.

💨 Trump’s Wind Energy Policies: Onshore Gains vs. Offshore Hurdles

Supportive Policies

- Permitting Reforms:

The Trump administration streamlined permitting processes for energy projects, including wind farms, through initiatives like the NEPA Reform (National Environmental Policy Act) and prioritization by the Bureau of Land Management (BLM).

Environmental impact statements (EIS) timelines were reduced from 4.5 years to 2 years or less, with page limits capped at 150 pages. These reforms accelerated onshore wind projects and indirectly benefited offshore projects, supporting the overall energy policies and renewable energy agenda by simplifying federal land and ocean lease processes. - Lease Auctions for Offshore Wind:

In 2018, the Department of the Interior conducted a record-breaking offshore wind lease auction for Massachusetts areas, generating $405 million. By contrast, by 2020, offshore wind lease areas expanded, furthering the goals of energy policies and renewable energy development.

Opposing Policies

- Reduced Federal Incentives:

The Trump administration allowed the Production Tax Credit (PTC), which provided a 2.3-cent-per-kWh incentive, to phase out in 2020, reducing financial support for new wind projects. This reduction negatively impacted the energy policies and renewable energy landscape. - Hydrocarbon Prioritization:

Under the “energy dominance” agenda, the administration focused on hydrocarbons, leasing substantial federal land for oil and gas, and limiting access to renewable energy projects. - Offshore Wind Delays:

Projects like the Vineyard Wind Project faced delays due to additional environmental reviews, slowing the momentum of offshore wind expansion and hindering the progress of energy policies and renewable energy initiatives.

Forward-Looking Insights

Economic Realities Drive Momentum:

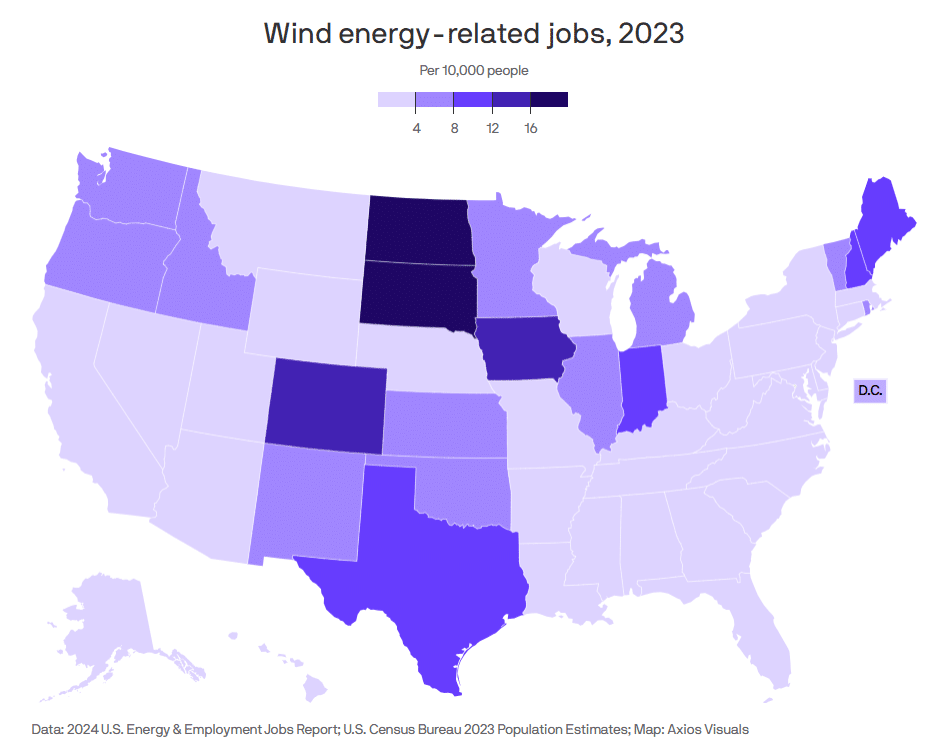

Wind energy remains a key economic driver in red states like Texas and Iowa under Trump’s energy policies and renewable energy framework, pressuring the administration to maintain support. In 2023, Texas alone employed over 25,000 wind workers, and Iowa generated over 50% of its electricity from wind.

US Jobs Generated from the Wind Energy

US Jobs Generated from the Wind EnergyChallenges for Offshore Wind

Delays in permitting and reduced incentives under Trump’s policies could hinder offshore wind growth. However, corporate commitments from Ørsted and Avangrid signal continued private-sector investment.

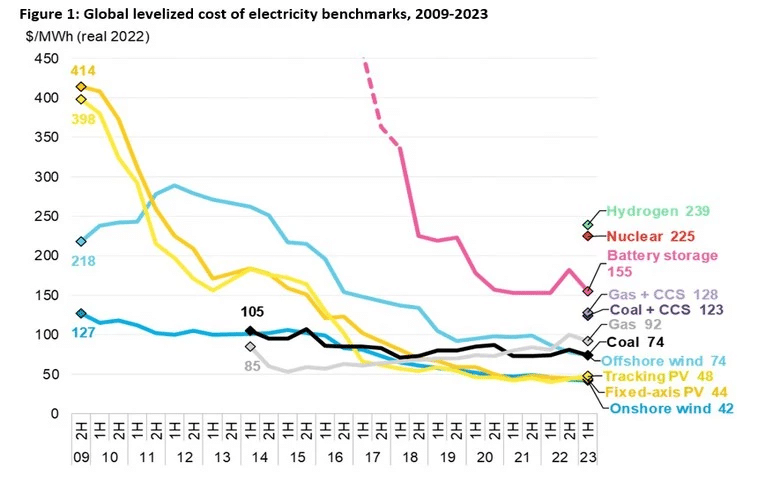

Global Levelized Cost of Electricity Benchmarks BNEF

This chart illustrates the global levelized cost of electricity (LCOE) for various energy technologies from 2009 to 2023, measured in $/MWh (real 2022 dollars).

Under a potential second Trump presidency, wind and offshore wind may face reduced federal support due to a continued focus on fossil fuels. However, the economic competitiveness of wind energy, with onshore wind at $42/MWh and offshore wind at $74/MWh (2023), ensures sustained growth driven by state-level policies, corporate demand for renewables, and global markets. In fact, onshore wind could further drop below $35/MWh by 2030, while offshore wind may reach $50–60/MWh. Ultimately, offshore wind’s scalability and synergies with green hydrogen could attract private investment, especially in regions like the Northeast and Midwest. Thus, growth will rely on market forces, private funding, and state initiatives.

Hydrogen: Boosting Blue 🔵, Stalling Green 🔋

Supportive Policies

- Hydrogen Research Funding:

The Department of Energy (DOE) continued supporting hydrogen advancements during Trump’s first term. In particular, in 2020, $64 million was allocated to 18 projects focused on green hydrogen production, storage, and distribution. This funding drove cost reductions for green and blue hydrogen technologies. - Blue Hydrogen Support:

Trump’s administration emphasized hydrogen derived from natural gas, aligning with its hydrocarbon agenda. The DOE’s Hydrogen and Fuel Cell Technologies Office received about $150 million to continue its research, development, and demonstration activities in hydrogen production, storage, and utilization. - State-Led Hydrogen Initiatives:

States like Texas and Louisiana leveraged federal incentives for hydrogen development. For example, Texas launched plans for a hydrogen hub, integrating oil and gas infrastructure with blue hydrogen technologies.

Opposing Policies

- Hydrocarbon Prioritization:

Trump’s “energy dominance” agenda prioritized fossil fuel extraction, increasing public land leasing by more than 70% and diverting focus from renewable hydrogen projects. - No Federal Standards:

Trump did not establish a national clean hydrogen strategy or incentives like green hydrogen tax credits, stalling progress on zero-emission hydrogen. - Paris Agreement Withdrawal:

The 2017 withdrawal reduced U.S. involvement in international hydrogen partnerships, limiting collaboration opportunities.

Forward-Looking Insights

Blue Hydrogen as a Bridge:

Support for blue hydrogen may accelerate near-term adoption but risks delaying the transition to green hydrogen.

State and Corporate Leadership:

Without federal incentives, states like Texas and private players like Chevron will likely lead hydrogen development.

🌍 Methane Emissions: Easing the Pressure

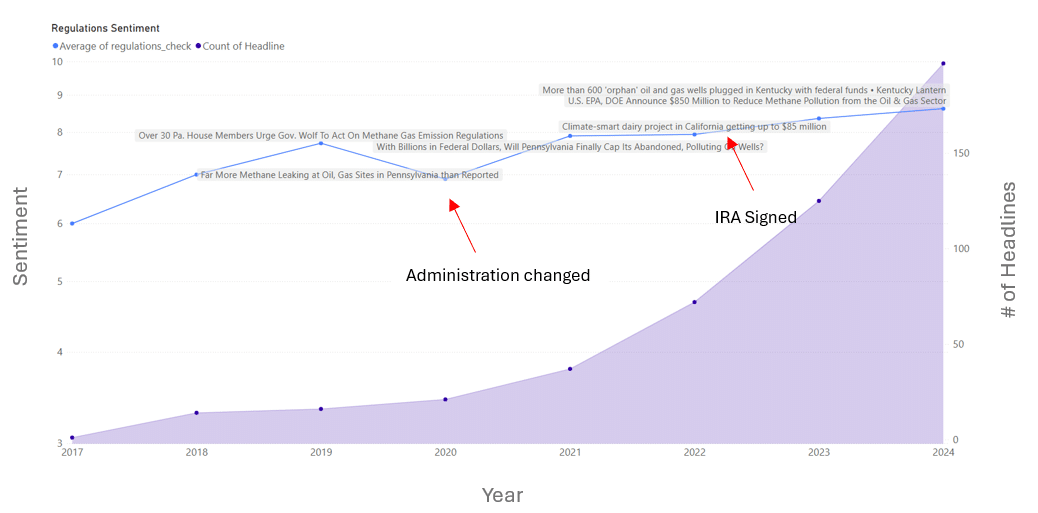

Enki analyzed thousands of methane-related headlines, regulations, fines, and incentives over the last seven years. This analysis highlights shifting sentiments toward reducing methane emissions. Sentiments peaked during the Biden administration, boosted by the Inflation Reduction Act (IRA) in 2022. However, if Trump wins a second term, a decline in sentiment is expected. Regulatory rollbacks may outweigh the voluntary programs and investments seen during his first term.

Source: Enki AI. Methane Emissions Sentiment Analysis – A score of 8 or higher indicates robust actions, including fines and incentives, to reduce methane emissions.

Supportive Policies

1. Voluntary Industry Programs: In 2020, the EPA launched programs encouraging oil and gas companies to adopt best practices for methane reduction.

2. Investment in Methane Capture Technology: $30 million was allocated in 2019 for methane capture systems targeting leaks in oil and gas operations.

Opposing Policies

1. Rollback of Methane Regulations: In 2020, Trump’s EPA rescinded Obama-era rules requiring leak monitoring and repairs:

- The rollback impacted 300,000 wells, increasing methane emissions.

- Methane emissions from oil and gas operations rose 10% from 2016 to 2020, according to the Environmental Defense Fund (EDF).

2. Expanded Fossil Fuel Extraction: Federal land leases for fossil fuel extraction increased 50% from 2017 to 2020, driving higher methane emissions.

- Economic Cost of Methane Leaks: Methane leaks wasted $1.2 billion annually—enough natural gas to power 5 million homes.

Forward-Looking Insights

Global Pressure and Missed Targets: With initiatives like the Global Methane Pledge, over 100 countries aim to cut methane emissions by 30% by 2030. Under Trump, the U.S. risks lagging due to less stringent policies.

Nuclear Power: A Pivotal Role in the Energy Transition ⚛️

Supportive Policies

1. Advanced Nuclear Technology Support: In 2020, the Department of Energy (DOE) allocated $230 million to the Advanced Reactor Demonstration Program (ARDP). This funding accelerated the development of small modular reactors (SMRs) and micro reactors, benefiting companies like TerraPower and X-energy.

2. Deregulatory Measures: The Nuclear Regulatory Commission (NRC) streamlined licensing, cutting timelines for new nuclear designs, reducing costs and expediting market entry.

3. Energy Independence Agenda: Nuclear energy was considered essential for U.S. energy independence and national security, securing its place in policy discussions.

Opposing Policies

1. Limited Federal Funding: Budget proposals in 2019 and 2020 suggested eliminating up to $300 million for ARPA-E, a key supporter of nuclear innovations. Although Congress maintained and even increased ARPA-E funding, the proposals created uncertainty.

2. Lack of National Strategy: Unlike China and Russia, the U.S. lacked a cohesive nuclear energy policy.

Global Comparison: U.S. nuclear capacity was 96.5 GW in 2020, while China plans to reach 200 GW by 2035.

Source: ThundersaidEnergy: Global Nuclear Energy Capacity and Forward-Looking Insights

Key Insights: Nuclear’s Global Landscape

- Global Shift: Nuclear leadership is shifting from early adopters like the U.S. and Europe to emerging leaders in Asia (China, India).

- Future Trends: New technologies, such as SMRs and micro reactors, will sustain nuclear energy’s critical role in the global energy mix.

- Energy Transition: The growing emphasis on decarbonization and clean energy ensures that nuclear remains a cornerstone of the energy landscape.

Forward-Looking Insights

Opportunities in Advanced Reactors

- Investments in SMRs and microreactors position the U.S. to reclaim leadership in nuclear innovation.

- SMRs offer 30–50% cost reductions compared to traditional reactors, making them an economically viable solution.

LNG: Powering U.S. Energy Dominance Under Trump 🚢🌍

Liquefied Natural Gas (LNG) is vital to U.S. energy strategy. It strengthens the nation’s role as a global leader in LNG exports. Under a second Trump presidency, LNG and export terminal development will likely thrive. This growth will stem from policies promoting energy independence, deregulation, and market expansion.

Supportive Policies

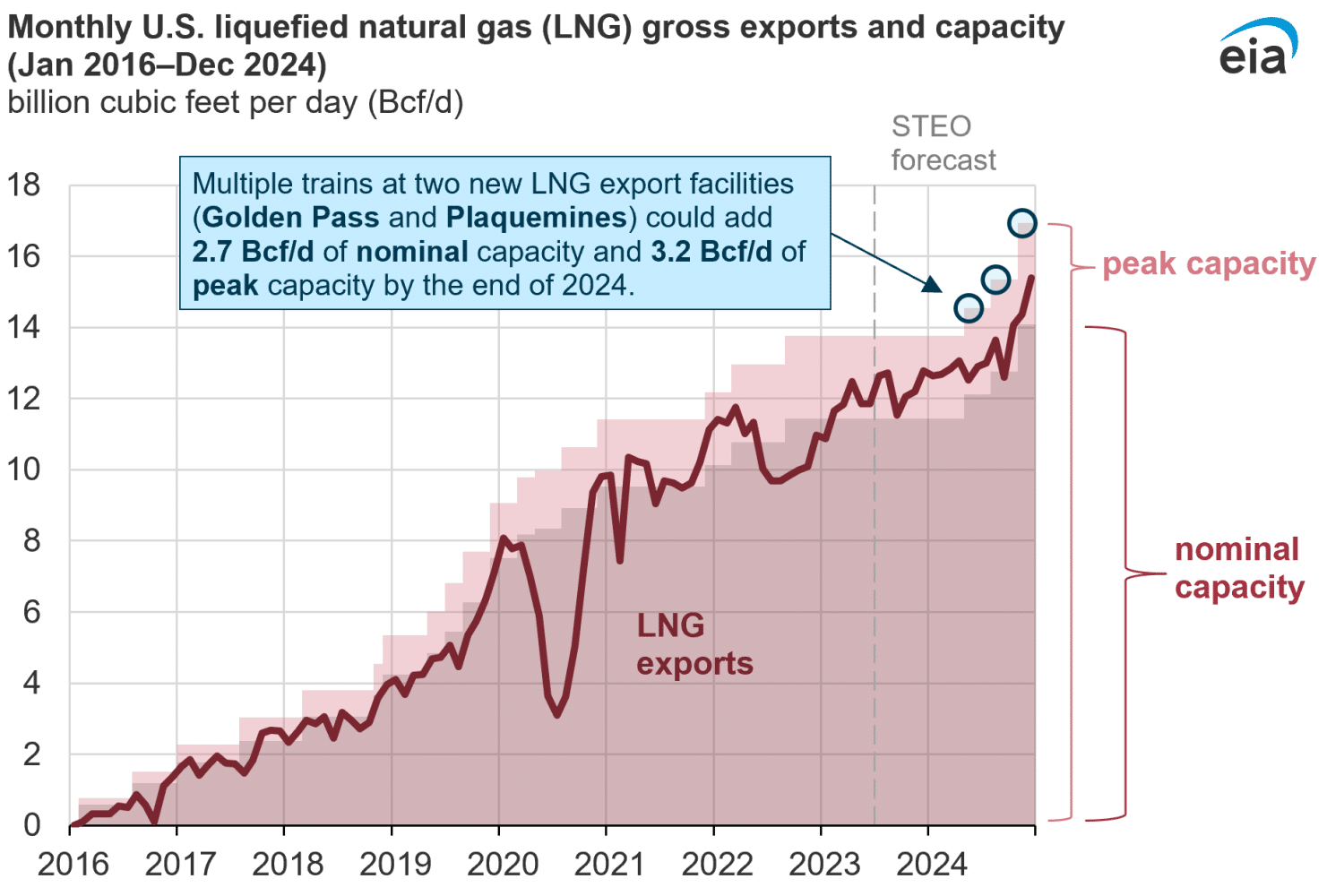

- Expansion of Export Terminals: From 2017 to 2020, the Department of Energy (DOE) approved 14 LNG export terminal licenses, boosting U.S. export capacity from 3.6 Bcf/d to 10.78 Bcf/d. This expansion propelled the U.S. to become the world’s second-largest LNG exporter by 2020 and the biggest LNG exporter as of 2023.

- Streamlined Permitting: The Trump administration, through the Federal Energy Regulatory Commission (FERC), reduced project approval times, enabling faster development of LNG terminals. Trump said, “We’re cutting the red tape to unleash America’s energy dominance.”

- Boosted Exports via Trade Deals: The 2020 Phase One trade deal with China committed the country to purchasing $52.4 billion worth of U.S. energy products, including LNG, over two years.

Opportunities for LNG in a Second Trump Term

- Enhanced Export Capacity: With continued expansion, U.S. LNG export capacity could surpass 20 Bcf/d by 2030, reinforcing the country’s leadership in global LNG markets.

- Geopolitical Influence: U.S. LNG exports could reduce Europe’s reliance on Russian gas, strengthening American influence. Asia’s growing industrial needs also present a significant market opportunity for U.S. LNG.

- Economic Growth LNG infrastructure projects are poised to create jobs and stimulate local economies in energy hubs like Louisiana and Texas. By 2024, the U.S. is on track to become one of the world’s top LNG exporters, further bolstering its energy independence.

Source: EIA – US Liquefied natural gas (LNG) gross exports and capacity.

Source: EIA – US Liquefied natural gas (LNG) gross exports and capacity.LNG’s Role in the Global Energy Shift 🌎🔥

LNG exports support U.S. energy independence goals and enhance geopolitical influence, especially in Europe, as countries reduce reliance on Russian gas. In 2023, the U.S. became one of the world’s top LNG exporters, meeting the growing energy needs of Europe (reducing reliance on Russian gas) and Asia (supporting industrial growth). The expansion will create jobs, boost infrastructure investment, and drive growth in energy hubs like Texas and Louisiana.

Clean Tech M&A: Surging Amid Deregulation and ESG Goals 💼🌱

Supportive Policies: Driving M&A Growth 🚀

- Deregulation Streamlining M&A: NEPA Reform and energy project reviews were streamlined, cutting timelines and expediting deal closures. The 2017 Tax Cuts and Jobs Act reduced corporate tax rates from 35% to 21%, increasing liquidity and enabling strategic acquisitions.

- Energy Independence Strategy: The “America First” policy encouraged energy companies to diversify into clean tech. Oil majors like Chevron and ExxonMobil acquired clean tech startups, leveraging policies promoting domestic investments.

Opposing Policies: Hindering Renewable M&A Growth 🚧

- Reduced Federal Support for Renewables: The phase-out of the Production Tax Credit (PTC) in 2020 made renewable assets less attractive for investments. Proposed cuts of $300 million to the DOE’s renewable innovation programs in 2019 and 2020 added further challenges. Renewable energy assets struggled to compete with fossil fuel investments for acquisitions.

- Fossil Fuel Focus Overshadowing Clean Tech: Federal fossil fuel leasing increased 70% from 2017–2020, drawing attention and resources away from clean tech. $100 billion in subsidies to the fossil fuel industry further diminished clean tech’s appeal.

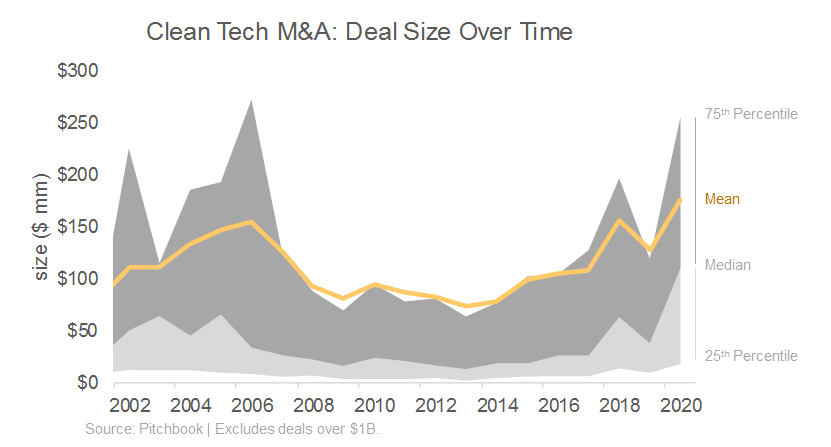

Source: Pitchbook. The chart shows a spike in cleantech M&A activity in 2019 and 2020, with larger deal sizes and increased variability.

Key Drivers of Clean Tech M&A 🌎💡

- Corporate Interest in ESG Goals: Despite Trump’s focus on fossil fuels, global momentum toward sustainability and corporate social responsibility (CSR) grew, driving clean tech.

- Energy Transition Shift: Many businesses anticipated a long-term energy transition despite deregulation, positioning themselves in clean technology markets.

- Corporate Tax Cuts: The Tax Cuts and Jobs Act (2017) reduced the corporate tax rate from 35% to 21%, freeing up capital for M&A and strategic investments.

- Deregulatory Agenda: Trump’s administration removed several environmental regulations (e.g., repealing the Clean Power Plan), which could have initially slowed some clean energy activities. However, this created opportunities for private players to acquire undervalued clean tech firms.

Forward-Looking Insights: Opportunities for Growth 🔮

- Market-Driven Deals: Private-sector decarbonization goals will continue to drive M&A in energy storage, hydrogen, and carbon capture technologies.

- State-Led Initiatives: States like California and New York will sustain M&A momentum through robust renewable energy mandates, offsetting limited federal support.

- Investor Liquidity: Tax cuts and deregulation have unlocked investor liquidity, enabling continued growth in clean tech investments.

Conclusion:

- In summary, the Trump administration deprioritized clean tech incentives, focusing on deregulation and market-driven policies while heavily supporting fossil fuels through subsidies and leases. Nevertheless, despite reduced federal support, solar energy is expected to grow, driven by declining costs, state leadership, and corporate investments.

- Conversely, onshore wind may continue its steady growth under Trump, but offshore wind could face delays due to reduced federal incentives and regulatory challenges.

- Additionally, near-term support for blue hydrogen may drive adoption, though it could delay the transition to green hydrogen. Moreover, methane emissions will likely rise under Trump due to regulatory rollbacks and expanded fossil fuel activities, undermining global reduction goals.

- Ultimately, small Modular Reactors (SMRs) offer 30–50% cost reductions, making them an economically viable pathway for nuclear growth. Furthermore, nuclear energy has great potential to drive the clean energy transition. Advanced reactors, streamlined regulations, and energy independence strategies can pave the way for U.S. leadership.

- Finally, LNG’s rapid growth under Trump strengthened U.S. energy independence and international influence. Continued investments will ensure economic and geopolitical stability.

Want to have more information? Get in touch with us.

Let us know what you think below.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.