Geopolitical Risk & Critical Minerals: The Top Supply Chain Constraint for Data Center Expansion in 2026

Data Center Critical Mineral Risks: How Resource Nationalism Shifted from Theory to Commercial Threat

The risk to data center expansion has shifted from a theoretical supply chain vulnerability between 2021 and 2024 to an immediate commercial threat driven by escalating resource nationalism and the weaponization of mineral processing dominance in 2025. The voracious demand for critical minerals from the AI-driven data center boom is now on a direct collision course with geopolitical realities, creating tangible cost, timeline, and viability risks for an industry projected to require $6.7 trillion in investment by 2030.

- The pre-2025 period was characterized by an awareness of supply chain concentration, with data from the IEA and CSIS highlighting China’s control over processing for minerals like cobalt (73%) and heavy rare earths (nearly 100%). This was largely viewed as a strategic but manageable risk.

- In 2025, this risk materialized into a direct commercial threat. The focus is no longer just on China’s market share but on the active use of this dominance as leverage, with the potential for a single policy decision in Beijing to halt global production lines for essential data center hardware.

- Compounding the issue, a new wave of resource nationalism has emerged in Africa and Latin America since early 2025. These nations are aggressively renegotiating mining contracts and imposing export restrictions to maximize domestic value, introducing significant uncertainty and higher costs for downstream users, including data center developers.

- The direct impact on data centers is now clear: rare earth elements such as neodymium for cooling systems and cobalt for battery backup are at the center of this geopolitical competition, linking digital infrastructure viability directly to international resource politics.

Strategic Investment Analysis: The West’s Scramble to De-Risk Critical Mineral Supply Chains

In response to escalating supply chain risks, strategic investment has pivoted from broad-based policy initiatives seen between 2021 and 2024 to targeted, large-scale capital deployment in 2025 aimed at creating alternative, non-Chinese processing and recycling capacity. This reactive investment surge underscores the severity of the perceived threat to both the energy transition and the AI infrastructure buildout.

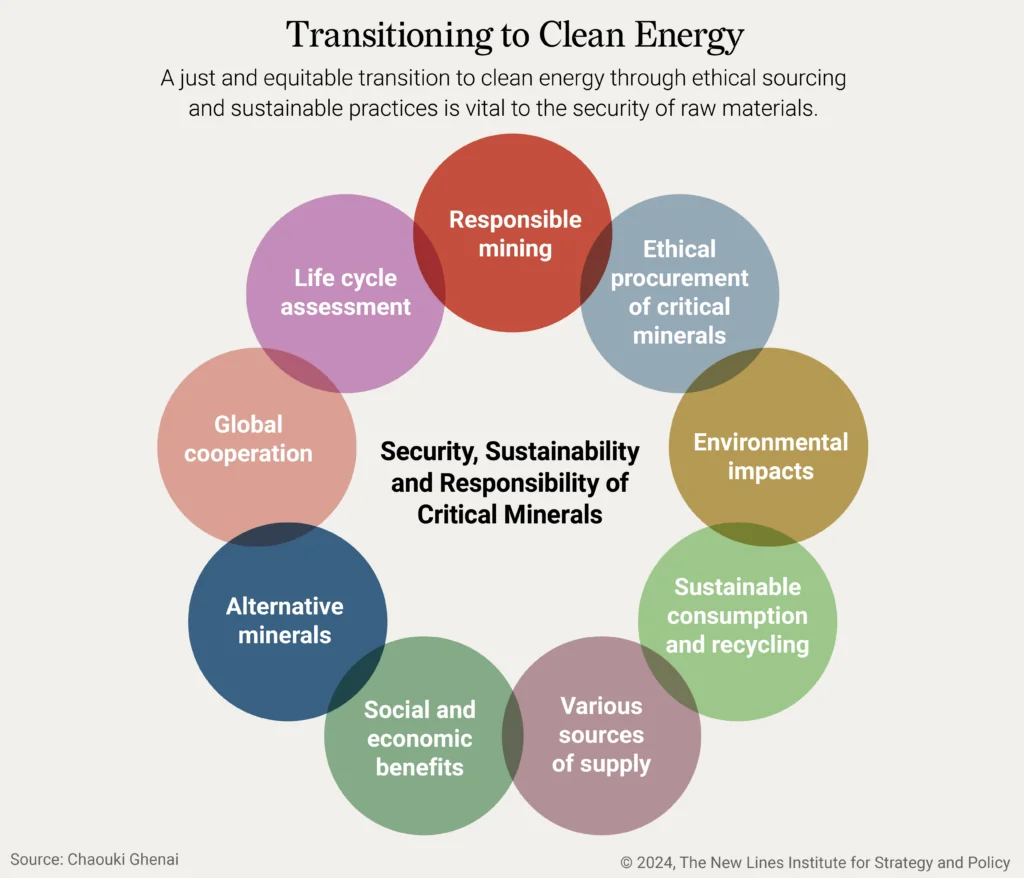

A Strategic Framework for Securing Mineral Supplies

This diagram outlines the holistic strategies required to de-risk supply chains, from recycling to global cooperation. It visually represents the pivot to strategic capital deployment discussed in the section.

(Source: New Lines Institute)

- The most significant shift is the scale and specificity of capital. While the 2021-2024 period saw foundational policy like Canada’s Critical Minerals Strategy, 2025 brought high-value actions, exemplified by the $1.4 billion partnership between Vulcan Elements and Re Element Technologies to establish a secure, U.S.-based rare earth supply chain.

- Government intervention has become more direct and substantial. The proposed plan to deploy nearly US$12 billion to create a U.S. strategic reserve of rare earth elements signals a move to buffer against supply shocks, a direct countermeasure to China’s market dominance.

- Investment is also flowing into creating a circular economy for critical minerals to reduce reliance on primary extraction. The USD 25 million investment in Cyclic Materials’ recycling facility in June 2025 marks the launch of North America’s first commercial-scale rare earth recycling center, a key step in building a resilient secondary supply source.

Table: Key Investments in Critical Mineral Supply Chain De-Risking (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Government (Trump Administration Plan) | Feb 2026 | A plan to deploy nearly US$12 billion to create a strategic national reserve of rare earth elements, aiming to counter China’s market control and mitigate supply shocks. | BNN Bloomberg |

| Vulcan Elements & Re Element Technologies | Nov 2025 | A $1.4 billion partnership to establish a vertically integrated, U.S.-based rare earth supply chain by refining materials from both waste and mined sources. | Vulcan Elements |

| Export Development Canada / Canada Infrastructure Bank | Oct 2025 | Announced a $165 million loan package to support the development of a domestic rare earths project, reinforcing Canada’s national strategy to build its own supply chain. | National Observer |

| Cyclic Materials | Jun 2025 | A USD 25 million private investment to launch North America’s first commercial-scale rare earth recycling facility, creating a circular supply to reduce reliance on primary mining. | Recycling Product News |

| Rio Tinto & Imperial College London | Dec 2024 | A $150 million partnership to establish a center for decarbonization and research into sourcing and recycling critical materials, a foundational move to address future supply challenges. | Rio Tinto |

Partnership Dynamics: Forging Alliances to Counteract Geopolitical Threats to Mineral Supplies

The nature of partnerships has evolved from research-focused collaborations before 2025 to strategic, multi-billion dollar alliances between governments, corporations, and international blocs. These new coalitions are explicitly designed to build resilient, parallel supply chains for critical minerals in response to weaponized trade dependencies.

Geopolitical Competition Drives Formation of New Alliances

This diagram illustrates the competitive dynamic between global blocs over clean technology materials. It provides the geopolitical context for why strategic, multi-billion dollar alliances are being forged.

(Source: Real Instituto Elcano)

- The $1.4 billion deal between Vulcan Elements and Re Element Technologies in November 2025 exemplifies the new model of public-private partnerships. It moves beyond research to create a vertically integrated industrial capacity within the U.S., a direct reaction to geopolitical risk.

- Multilateral groups like the Quad (U.S., India, Japan, Australia) have shifted from dialogue to action. In late 2025, these alliances are being leveraged to coordinate investment and offtake agreements, creating a bloc of allied nations to reduce collective dependence on single-source suppliers.

- Public financing is now being used to de-risk private investment in strategic sectors. The Canadian government’s $165 million loan to a domestic rare earths project in October 2025 is a clear example of state-directed industrial policy aimed at fostering a non-Chinese supply chain.

Table: Key Strategic Partnerships for Critical Mineral Supply Chains

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Quad Alliance (U.S., India, Japan, Australia) | Dec 2025 | Leveraging the multilateral group to coordinate efforts, pool resources, and create diversified supply chains through joint ventures and offtake agreements, reducing collective dependence. | Lexology |

| Vulcan Elements & Re Element Technologies | Nov 2025 | A $1.4 billion public-private partnership aimed at establishing a secure, vertically integrated U.S.-based rare earth supply chain. | Vulcan Elements |

| Export Development Canada / Canada Infrastructure Bank | Oct 2025 | A $165 million government loan to support a domestic rare earths project, signaling direct state financial backing to build an independent Canadian supply chain. | National Observer |

| Rio Tinto & Imperial College London | Dec 2024 | A $150 million R&D partnership to research decarbonization and critical materials, building foundational knowledge for future supply chain strategies. | Rio Tinto |

Geographic Hotspots: How Mineral Nationalism in China, Africa, and Latin America Threatens Data Center Growth

The geographic landscape of risk has intensified, shifting from a singular focus on China’s established dominance before 2025 to a multi-polar environment where emerging resource nationalism in Africa and Latin America now poses additional and more unpredictable supply chain threats. In response, North America is becoming the primary geography for de-risking and investment.

- China remains the central geographic risk, controlling approximately 90% of global rare-earth refining capacity. This provides Beijing with a powerful chokepoint over materials essential for magnets in data center cooling systems and wind turbines.

- A key shift in 2025 is the rise of active resource nationalism in other regions. Nations in Africa and Latin America are moving beyond rhetoric to renegotiate mining contracts and demand local processing, creating new layers of cost and timeline uncertainty for mineral projects that supply the global market.

- This escalating risk abroad has turned North America into a strategic geography for building alternative supply chains. The U.S. and Canada are now focal points for major investments in domestic processing and recycling, evidenced by projects from Vulcan Elements in the U.S. and Cyclic Materials in Ontario, Canada.

Supply Chain Maturity: From Raw Material Extraction to At-Risk Commercial Scale Processing

While extraction technologies for critical minerals are mature, the crucial mid-stream processing and refining stage has become the primary point of failure. This segment of the supply chain has moved from a recognized dependency before 2025 to a commercially weaponized chokepoint today that threatens the entire digital infrastructure ecosystem.

- In the 2021-2024 period, the technological focus was on improving the efficiency of mature extraction methods and the end-use applications in EVs or renewables. The mid-stream processing gap was a known vulnerability but not yet a source of acute commercial disruption.

- Since 2025, the strategic focus has shifted decisively to the “technology” of processing, refining, and recycling critical minerals within Western nations. The immaturity of this capacity in North America is precisely why it is attracting billions in state-directed and private investment.

- China’s advantage is not merely in physical capacity but in the operational expertise and intellectual property of mineral processing. The flurry of investment in companies like Vulcan Elements and Cyclic Materials is a direct attempt to fast-track the development of this missing industrial capability and close the maturity gap.

SWOT Analysis: Critical Mineral Supply Chain Risks for Data Center Expansion

The strategic landscape for critical minerals has become substantially more volatile, with soaring demand from AI colliding with severe geopolitical concentration. This dynamic has spurred reactive diversification investments under the immediate threat of supply weaponization, fundamentally reshaping risk calculations for data center developers.

How Geopolitical Shocks Constrict Supply, Raise Prices

This supply and demand chart conceptually illustrates the primary ‘Threat’ outlined in the SWOT analysis. It shows how a geopolitical risk shock directly leads to higher costs and lower availability, the core of the commercial threat.

(Source: ScienceDirect.com)

- Strengths are now driven by the massive, non-negotiable demand from AI and the energy transition, which justifies large-scale, long-term capital investment.

- Weaknesses remain rooted in the extreme geographic concentration of mineral processing, but this has been activated as a live threat.

- Opportunities have crystallized in the form of building alternative supply chains, developing recycling technologies, and forming strategic alliances.

- Threats are no longer hypothetical, with active resource nationalism and the potential for export controls representing clear and present dangers to project timelines.

Table: SWOT Analysis for Critical Mineral Supply Chains and Data Centers

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Growing demand for critical minerals was projected by the IEA, driven by EV and renewable energy growth. | AI-driven data center expansion creates a $7 trillion demand shock, adding a massive new buyer and accelerating demand forecasts from entities like Goldman Sachs. | The scale and urgency of demand have been validated and amplified, creating an even stronger business case for new supply investment. |

| Weaknesses | Awareness of China’s dominance in mineral processing (e.g., 73% of cobalt) was a known strategic vulnerability noted by think tanks like CSIS. | China’s processing chokehold (90% of REEs) is now viewed as an active commercial and political weapon. A lack of Western processing capacity is identified as an acute failure point. | The weakness has been validated as a critical, immediate threat, shifting from a passive risk to an active constraint on industrial and digital expansion. |

| Opportunities | Policy initiatives like the Canadian Critical Minerals Strategy were being developed. R&D partnerships (e.g., Rio Tinto) were forming. | Massive, targeted investments are being made to build alternative supply chains ($1.4 B Vulcan Elements deal) and recycling capacity ($25 M Cyclic Materials facility). | Opportunities have moved from policy to practice. Capital is now being deployed to build the physical infrastructure needed to mitigate the core weakness. |

| Threats | The potential for supply disruption due to geopolitical tension was a theoretical risk. Resource nationalism was an emerging concept. | Active resource nationalism is occurring in Africa and Latin America. The U.S. government is planning a $12 billion strategic reserve in direct response to the threat of supply weaponization. | The threats have been validated and are now occurring. Geopolitical risk is no longer a future scenario but a present-day operational reality impacting market behavior. |

2026 Outlook: Navigating the Collision of AI Demand and Geopolitical Supply Constraints

If data center operators continue to rely on traditional procurement and spot markets, they will face significant project delays and cost overruns in 2026 as geopolitical supply constraints tighten. Watch for leading hyperscalers to pursue aggressive vertical integration and direct resource acquisition as the primary mitigation strategy to secure their multi-trillion dollar expansion plans.

Modeling the Price Impact of Geopolitical Risk

This chart directly supports the 2026 outlook by showing the statistical effect of geopolitical risk on mineral prices. It quantifies the ‘cost overruns’ predicted in the section, adding analytical depth to the forecast.

(Source: Energy RESEARCH LETTERS – Scholastica)

- If this happens: Geopolitical actors continue to use mineral supply as a political tool. Watch this: An increase in announcements of long-term offtake agreements from hyperscalers, bypassing intermediaries to lock in supply directly from miners and refiners in allied nations. The 2025 government-backed projects in Canada will be prime targets.

- If this happens: The cost and risk of sourcing from dominant or unstable regions continue to rise. Watch this: A price premium develops for “de-risked” materials sourced from North American or allied supply chains, creating a two-tiered market. This will validate the business case for investments like the Vulcan Elements partnership.

- These could be happening: Leading tech companies may begin acquiring stakes in, or forming exclusive joint ventures with, mining and processing companies. This would represent a fundamental strategic shift from being a consumer of materials to a direct participant in the supply chain, moving beyond the partnership models seen to date.

Frequently Asked Questions

Why has the risk from critical mineral supply chains for data centers intensified since 2025?

According to the analysis, the risk shifted from a theoretical vulnerability to an immediate commercial threat. This is driven by the ‘weaponization’ of mineral processing dominance by countries like China, a new wave of resource nationalism in Africa and Latin America leading to export restrictions, and a massive demand surge from the AI-driven data center boom, all converging in 2025.

What specific critical minerals are mentioned, and why do data centers need them?

The article highlights rare earth elements like neodymium and cobalt. Neodymium is crucial for high-efficiency magnets used in data center cooling systems, while cobalt is a key component for the battery backup systems that ensure uninterrupted power.

What are Western countries and companies doing to solve this supply chain problem?

They are shifting from policy initiatives to large-scale, targeted investments. Key actions mentioned include the $1.4 billion Vulcan Elements partnership to build a U.S.-based rare earth supply chain, a proposed $12 billion U.S. plan to create a strategic mineral reserve, and a $25 million investment in Cyclic Materials to launch North America’s first commercial-scale rare earth recycling facility.

The article mentions a supply chain ‘chokepoint’. What part of the supply chain is the biggest problem?

The primary chokepoint is not the initial mining of raw materials but the crucial mid-stream stage of processing and refining. The article notes that while extraction technology is mature, the West lacks the industrial capacity and operational expertise for processing, a segment where China controls approximately 90% of global rare-earth refining.

As a data center operator, what is the key strategic takeaway for 2026?

The 2026 outlook warns that relying on traditional procurement will lead to significant project delays and cost overruns. The primary mitigation strategy will be to secure supply chains more directly. This could involve pursuing long-term offtake agreements with miners in allied nations, paying a premium for ‘de-risked’ materials, or even acquiring stakes in mining and processing companies to ensure supply for multi-trillion-dollar expansion plans.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.