What Commercial Signals Reveal About Clean Tech’s Next Moves

🧩 Problem

In clean tech, the signals are often mixed and confusing.

One day, solid oxide fuel cells (SOFCs) are “unstoppable.”

The next, Bosch announces it’s leaving the market.

For strategy, product, and market intelligence teams, this creates real challenges.

You’re expected to guide leadership and build partnerships—but how can you do that when headlines spin faster than actual moves?

🔦 The Signal That Matters

Headlines can mislead.

PR often outpaces reality.

And internal sources may only catch part of the picture.

So what’s the one signal you can trust?

Not one. But the combination.

Tracking commercial activities, sentiment, and inconsistencies between headlines and actual deployments gives you a truer picture. So you can surface what’s really happening—and what’s just noise.

🔍 Enki in Action: How We Identified the Bosch Exit vs. Bloom’s Rise

To help our client understand where to invest their time and relationship capital in the SOFC market, we used Enki to monitor three key indicators:

- Commercial Activities: Joint ventures, deployments, pilots, installations

- PR Signals: Public announcements, media exposure, product reveals

- Sentiment Analysis: Stakeholder tone shifts from analysts, media, and company statements

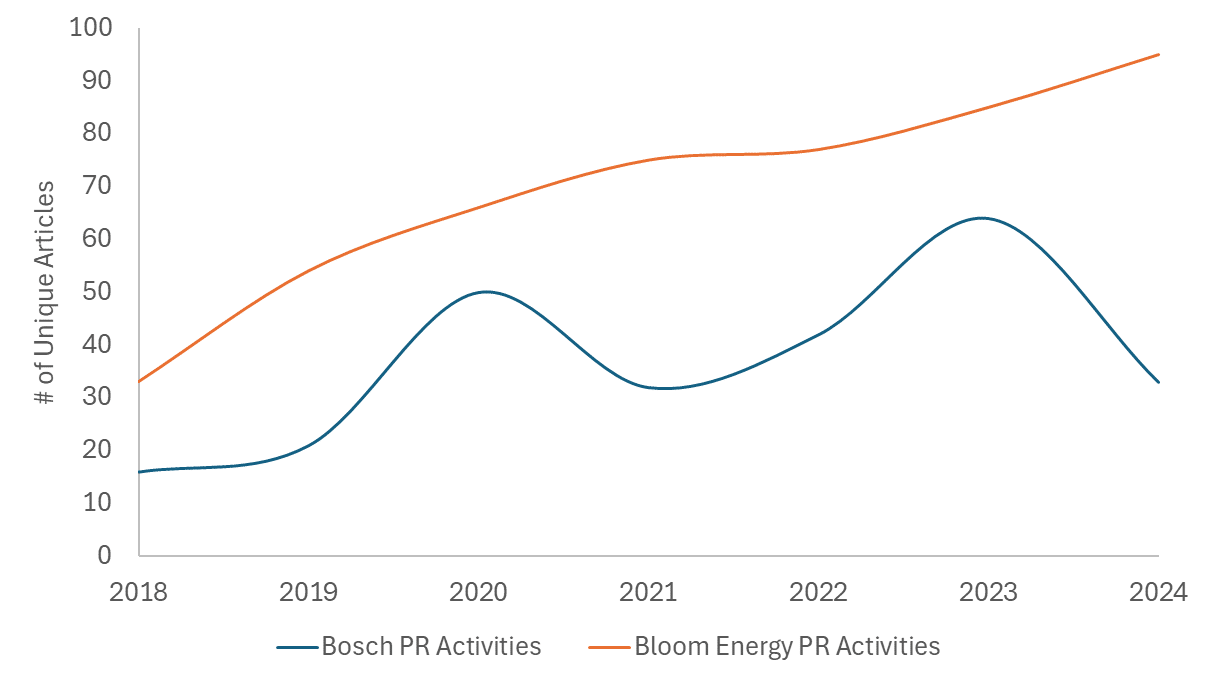

This chart tracks the unique commercial events for Bloom Energy and Bosch in the solid oxide fuel cell (SOFC) market. It includes deployments, pilots, JVs, partnerships, and installations.

🌱 Bloom Energy: A Signal of Strength

Commercial Trajectory

From the Figure 1:

- Strong, consistent growth since 2019

- Peak in 2021 followed by a renewed surge from 2022 to 2024

- Sustained commercial activity signals long-term strategic commitment

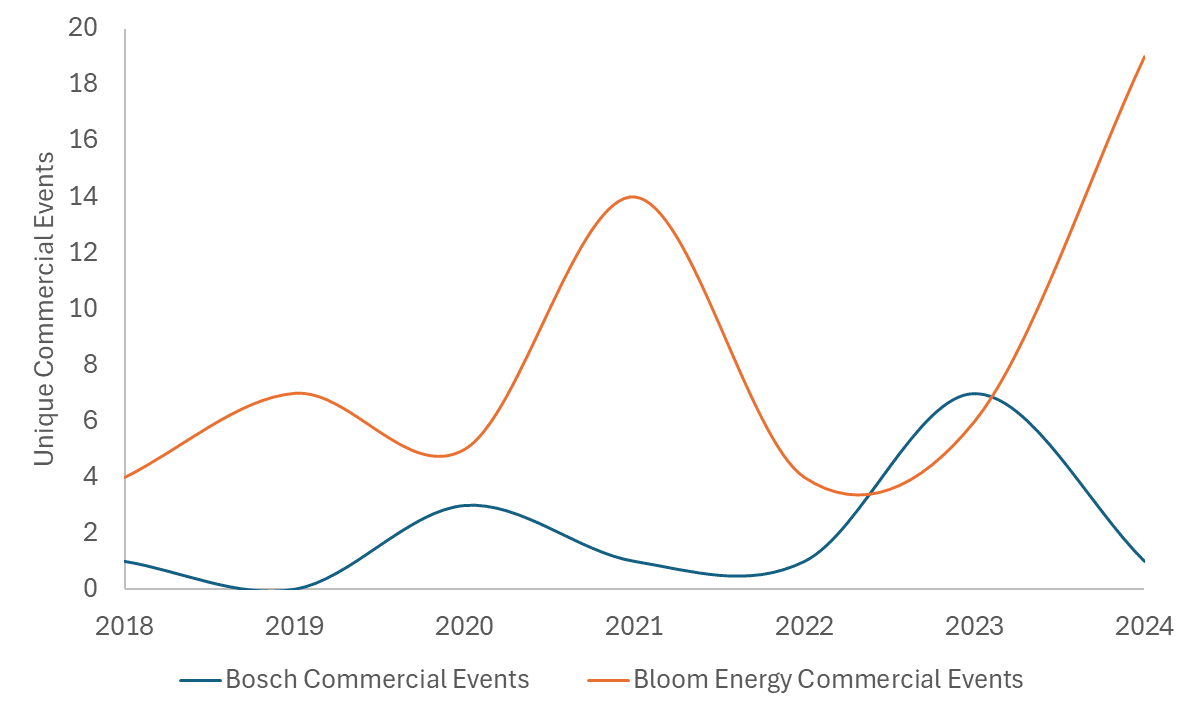

Figure 2: PR Mentions and Market Amplification. This figure compares total PR signals—including company press releases and external market amplification (e.g., media coverage, analyst mentions, third-party narratives) in solid oxide fuel cells.

From Figure 2. PR and Market Alignment

- PR engine amplifies Bloom’s real-world traction—not just marketing noise

- Announcements like the 100kW deployment in Korea (with SK ecoplant) and 80MW installation in 2024 align closely with commercial milestones

- Bloom’s innovation in load-following SOFCs and combined heat and power (CHP) solutions increase their credibility and market value

Sentiment Insights From Figure 3.

- Sentiment scores rise consistently after 2019, peak in early 2021, and trend upward again into 2024

- Reflects a growing base of trust from analysts, journalists, and partners

- Stakeholder confidence is reinforced by commercial reality

![Line graph showing the net sentiment scores [0–1] for Bosch and Bloom Energy from 2018 to 2024.](https://747c20b0.delivery.rocketcdn.me/wp-content/uploads/2025/05/bosch_bloom_picture_3.png)

This chart presents the net sentiment trajectory based on Enki’s signal analysis—evaluating media tone, company statements, and market signals.

🧊 Bosch: A Different Story Beneath the Surface

Headline vs. Reality

Yes, Bosch made waves at E-world 2024, showcasing its 100kW plug-and-play SOFC and prepping for full-scale production.

But Enki saw something else in the data.

Commercial Signal Decline From Figure 1

- Gradual ramp-up starting in 2020

- Activity peaks late 2022/early 2023

- Then drops off sharply—long before any public pivot

Sentiment Divergence From Figure 3

- Peaks in 2022, then tumbles

- Market confidence fades, mirroring the retreat in commercial activity

- Stakeholders become wary—even as headlines remain upbeat

PR Disconnect

- Bosch’s announcements create high expectations

- But the commercial follow-through isn’t there

- This mismatch points to strategic hesitation or internal recalibration

⚙️ Why Enki Is Different

Most traditional analysts rely on conversations, conferences, and press briefings.

But even insiders don’t always see the full picture.

Enki doesn’t guess.

It tracks hundreds of signals—PR, sentiment, commercial activity—and connects the dots in real time.

The result?

You catch turning points before they show up in public announcements.

📌 Final Recommendation (As of June 2024)

- ✅ Prioritize Bloom Energy: Their market behavior, sentiment, and PR are aligned. They’re scaling—and ready for partnership.

- ⚠️ Be cautious with Bosch: Strategic signals suggest retreat. PR is still strong, but commercial evidence says otherwise.

🔍 See the Signals Before the Headlines Do

By the time the market reacts, it’s already late.

Enki helps you track real moves—not just noise—so you can lead with clarity and confidence.

Don’t wait for the headlines to catch up.

Let Enki map your market in real time—so you can act before it’s obvious.

Start using Enki today.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.