Solid Oxide Fuel Cells 2025: SOFC Industry Analysis

Industry Activity Overview

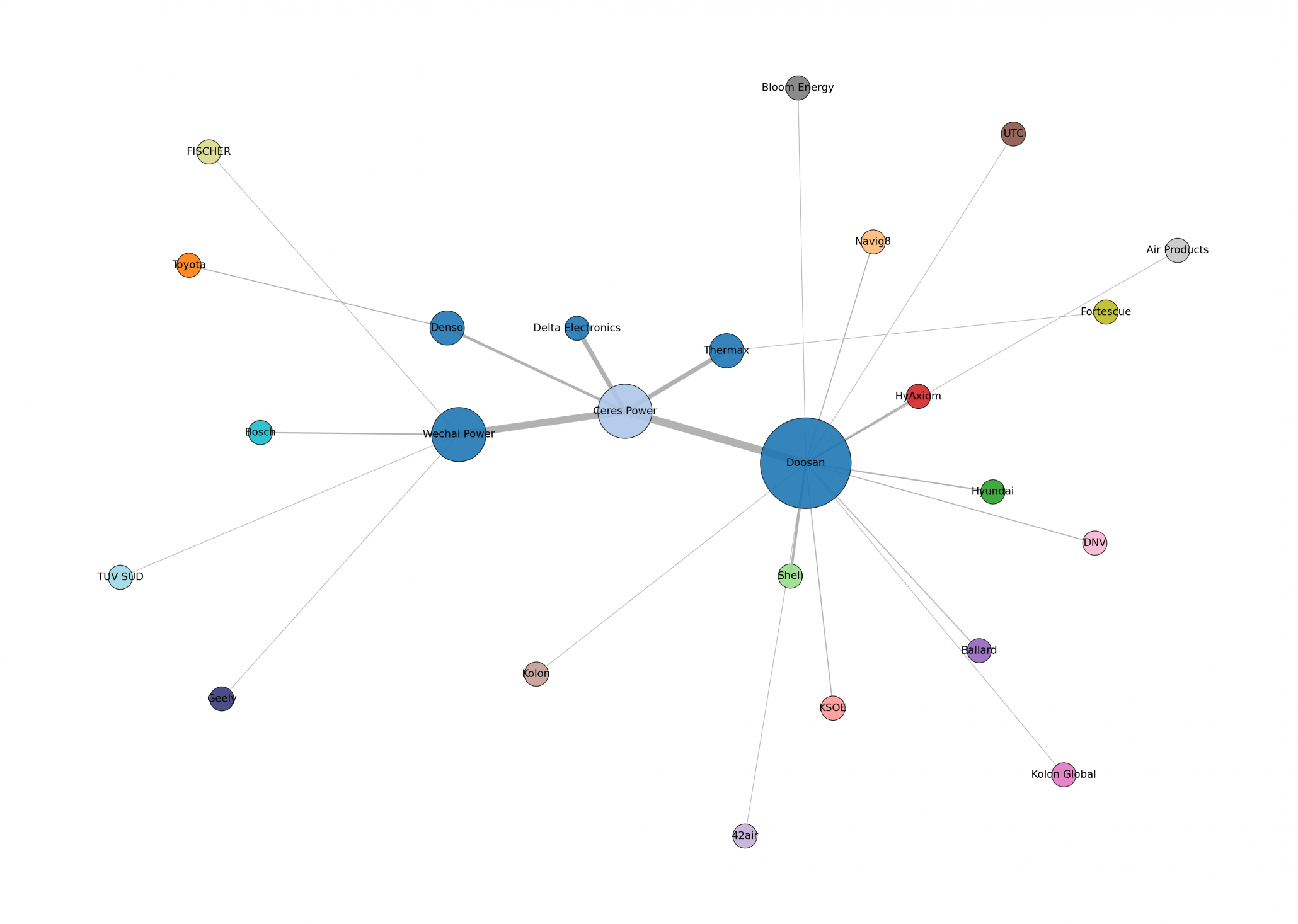

The following charts provide a comprehensive view of media signals and commercial activities across all companies in the Solid Oxide Fuel Cells sector.

🟦 Media Signal Volume

Counts the total number of articles mentioning a company within a specific clean tech vertical. Includes company announcements, media coverage, and third-party sources. May reflect repeated coverage or general PR activities. Indicates how actively a company signals interest in the space.

🟧 Commercial Signal Count

Captures unique, verified commercial events tied to a specific cleantech vertical. Each event is counted once and includes activities such as deals, deployments, partnerships, joint ventures, investments, and pilots. Reflects tangible market activity.

Solid Oxide Fuel Cells Industry Analysis 2025: Comprehensive Company Overview

This comprehensive analysis examines the leading companies in the Solid Oxide Fuel Cells sector, providing detailed insights into their strategies, technologies, and market activities throughout 2023-2025.

Thermax Green Hydrogen Strategy: 2025 Market Analysis →

Indian energy firm Thermax has executed a deliberate strategic pivot into the green hydrogen sector, transitioning from ambition to commercial readiness between 2023 and 2025. The company’s methodical build-up began in 2023 with foundational partnerships with Fortescue Future Industries and HydrogenPro. This was followed by a pivotal 2024 global license agreement with Ceres Power to manufacture their advanced Solid Oxide Electrolyser Cell (SOEC) technology, noted for being up to 25% more efficient. This dual-technology strategy was solidified in 2025 with an exclusive partnership with HydrogenPro for proven alkaline water electrolysers and the inauguration of a dedicated SOEC pilot facility in Pune. While early activity was announcement-driven, the period saw a significant shift toward tangible milestones, reinforcing strong market confidence. With a clear focus on indigenizing manufacturing for the Indian market, Thermax has de-risked its entry by licensing proven technologies and is now positioned for a new phase of commercial execution, aiming to capture a leadership role in the nation’s energy transition.

Doosan Fuel Cell SOFC 2025: Analysis, Risk & Outlook →

Doosan has strategically evolved from a regional developer into a commercial-scale manufacturer of hydrogen fuel cell solutions, with a primary focus on Solid Oxide Fuel Cell (SOFC) technology for the maritime and stationary power sectors. A significant achievement was the commencement of mass production at its new 50MW SOFC facility in South Korea in July 2025, built on technology from its partner Ceres. This manufacturing capability was reinforced by a key milestone in March 2024, when its SOFC stack became the world’s first to pass DNV‘s maritime environmental test, supporting collaborations with partners like Shell. Despite this progress and a successful $150 million private placement by its subsidiary HyAxiom in July 2023, the company’s trajectory was severely challenged in April 2025 by the cancellation of over $1 billion in deals with Air Products. This major setback has created significant commercial uncertainty, placing critical pressure on Doosan to secure firm sales contracts and validate its commercial-scale production model to restore market confidence.

Wechai Power SOFC Strategy: 2025 Analysis & Outlook →

Wechai Power has navigated a volatile period between 2023–2025, characterized by a major technological launch followed by a significant strategic pivot. The company’s activity peaked in 2023 with the much-publicized commercial launch of its world-first, high-power Solid Oxide Fuel Cell (SOFC) system, which boasts an impressive net power efficiency of over 60%. However, this momentum was severely curtailed in 2024 by the collapse of its planned SOFC manufacturing joint venture with partners Bosch and Ceres Power. In response, Wechai Power executed a swift strategic shift, forging a key partnership with Geely in 2024 to develop methanol-powered engines for heavy-duty vehicles using High-Pressure Direct Injection (HPDI) technology. Despite delivering pilot 25kW and 100kW SOFC systems in early 2025, all forward progress on the stationary power front has since stalled. This indicates a clear trend of de-emphasizing its SOFC business in favor of the more immediate market opportunity in alternative fuel transportation with Geely, leaving its once-central clean power generation strategy in an uncertain state.

Delta’s 2025 DAC & Hydrogen Strategy: Market Analysis →

Delta Electronics has rapidly emerged as an aggressive contender in the hydrogen energy sector, transitioning from a preparatory phase in 2023 to a period of decisive strategic action through 2025. The company solidified its technology foundation via a pivotal January 2024 licensing agreement with UK-based Ceres Power for approximately £43 million, fast-tracking its entry into high-efficiency Solid Oxide Fuel Cell (SOFC) and Solid Oxide Electrolyzer Cell (SOEC) systems. This was followed by significant infrastructure investments, including the development of a megawatt-grade R&D laboratory by December 2024 and the establishment of Taiwan’s first megawatt-class hydrogen testing platform in January 2025. A landmark NT$6.95 billion investment in July 2025 to acquire manufacturing facilities marked a critical shift from R&D toward scaling production. This calculated, high-impact market entry positions Delta Electronics to capitalize on industry consolidation, such as Bosch‘s 2025 exit from the SOFC market, despite facing cautious market sentiment. With these foundational moves, the company is on a clear trajectory to launch its first commercial products by its 2026 target and establish itself as a key manufacturer.

Denso’s 2025 SOEC Breakthrough: A Strategic Analysis →

Automotive components giant Denso is decisively executing a strategic pivot into the clean energy sector, concentrating its efforts on the hydrogen economy through the development of high-efficiency solid-oxide technologies. This carefully orchestrated progression saw the company advance from internal pilot programs for Solid Oxide Fuel Cell (SOFC) and Solid Oxide Electrolysis Cell (SOEC) systems in 2023 to establishing critical industrial partnerships in 2024, including a key manufacturing license with UK-based Ceres Power and a joint development project with Japan’s largest electricity producer, JERA. These strategic initiatives, backed by a significant €63 billion ten-year R&D investment plan, culminated in the landmark launch of Japan’s first 200kW SOEC demonstration project at a JERA power plant in Q3 2025. This event-driven market approach, with activity heavily concentrated in Japan around major partnership and project announcements, has successfully transitioned Denso from R&D to large-scale application, positioning it for commercialization from 2025 onward and potential expansion into new high-growth markets like data center power.

Industry Conclusion

### Conclusion: State of the Solid Oxide Fuel Cell Sector

The Solid Oxide Fuel Cells (SOFC) sector is undergoing a pivotal transition from research and development to industrial-scale commercialization, driven by the strategic entry of major global manufacturing conglomerates. A dominant trend is the widespread adoption of a technology-licensing model, which enables accelerated market entry by de-risking the substantial costs and timelines associated with proprietary technology development. This is most evident in the ecosystem forming around Ceres Power, whose SOFC and Solid Oxide Electrolyser Cell (SOEC) technology has been licensed by key regional players including Thermax in India, Weichai Power in China, Delta Electronics in Taiwan, and Denso in Japan. This strategy is complemented by innovation in applications, with companies targeting high-efficiency stationary power generation, where Weichai reports over 60% net efficiency, and green hydrogen production, where SOEC technology is noted for being up to 25% more efficient than incumbent alternatives. Furthermore, companies like Doosan are pioneering the use of SOFCs in the maritime sector, achieving a world-first with DNV environmental certification in March 2024, while others are exploring high-growth markets like power for data centers.

Collectively, the activities of these firms are forging a new industrial landscape for clean hydrogen and power generation, characterized by the emergence of regional manufacturing champions. The period between 2023 and 2025 marked a definitive shift from strategic announcements to tangible investment in physical infrastructure, including Doosan’s launch of a 50MW mass production facility in July 2025 and Delta Electronics’ NT$6.95 billion investment in manufacturing capabilities. This industrialization is creating regional supply chains and aligning with national decarbonization agendas, such as India’s “Make in India” initiative and Japan’s national hydrogen strategy. However, the market impact has been volatile. Strategic pivots, like Weichai Power’s 2024 partnership with Geely into methanol vehicles following the collapse of its SOFC joint venture, and market-shaking events, such as the April 2025 cancellation of Doosan’s deals worth over $1 billion, underscore a sector grappling with both rapid progress and significant commercial instability.

Looking forward, the sector faces a landscape of pronounced challenges and substantial opportunities. The most significant challenge is the inherent fragility of an ecosystem heavily reliant on a single core technology provider. The business transformation at Ceres Power and the collapse of the Weichai-Bosch-Ceres venture highlight the material impact of partnership risk. A second critical hurdle is the “commercial execution gap” observed across multiple companies, where manufacturing capacity and public relations activity are yet to be consistently matched by firm, bankable sales contracts. This “prove it” phase will be decisive in building investor confidence. Conversely, the opportunities are immense. The drive to decarbonize hard-to-abate industries like steel and fertilizers presents a massive addressable market for SOEC technology. The exit of competitors, such as Bosch, creates openings for committed players like Delta Electronics to capture market share. Ultimately, the sector’s success will be determined by its ability to convert its newly established manufacturing prowess into sustained commercial offtake while navigating the systemic risks of a highly interconnected, yet nascent, value chain.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.