AI Slowdown 2025: Why Data Center & Supply Chain Bottlenecks Threaten Top 5 AI Applications

AI Adoption Slowdown 2025: How Infrastructure Risk Stalls Commercial Scale Projects

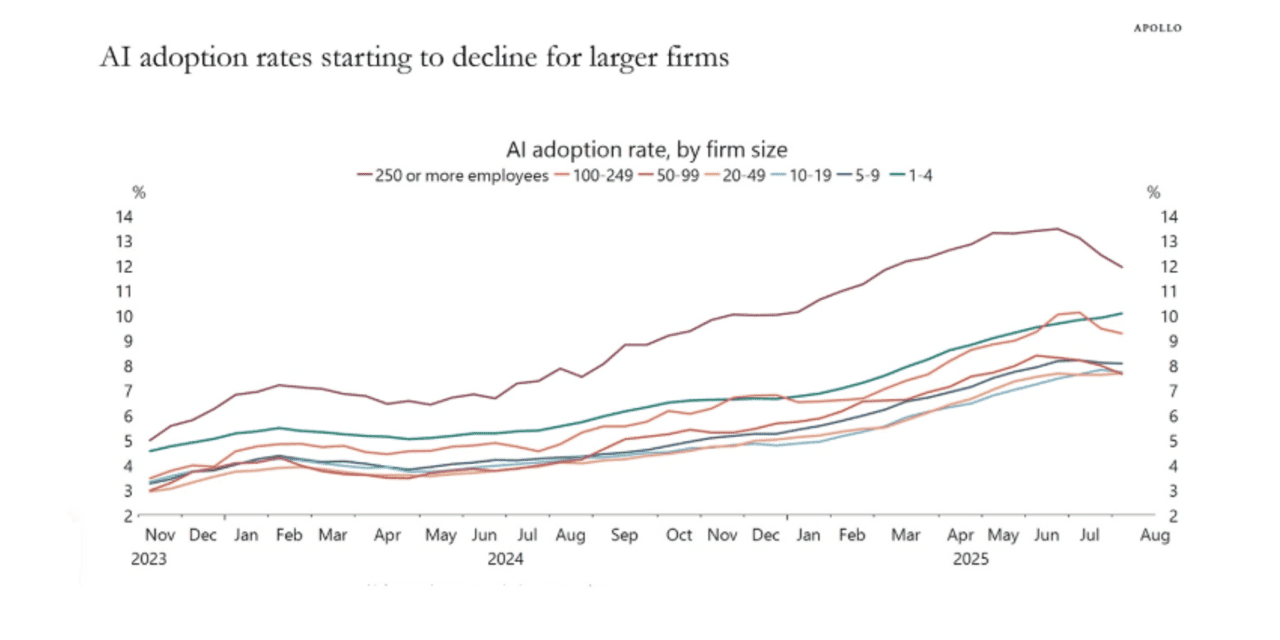

Enterprise AI adoption is fragmenting as infrastructure bottlenecks disproportionately stall large-scale projects, reversing the trend of widespread adoption seen in larger firms prior to 2025.

- Between 2021 and 2024, enterprise AI adoption grew across the board, with a Mc Kinsey survey in 2024 showing 67% of organizations using Gen AI, particularly in supply chain and inventory management. This period was characterized by broad experimentation and initial deployments focused on realizing benefits like cost reduction and efficiency gains.

- Starting in 2025, this trend reversed for large firms. Data shows AI adoption rates for companies with 250 or more employees began declining in mid-2025, while smaller firms continued a slower, steady adoption curve, indicating that the burdens of scaling infrastructure are hitting larger, more ambitious projects first.

- The primary reason for this shift is the failure to scale from pilot to production, with only 54% of AI projects making the transition in 2025. A Flexential report from 2025 identifies IT infrastructure as the top barrier for 44% of firms, a problem that became acute as the hardware and power shortages of 2025 and 2026 intensified.

- Consequently, many enterprises are stuck in “pilot purgatory.” Forrester projects that 25% of planned enterprise AI spending will be delayed until 2027 as companies struggle to prove ROI amid rising infrastructure costs and deployment delays, a stark contrast to the optimistic expansion phase of previous years.

AI Adoption Rate Declines For Large Firms in 2025

This chart directly illustrates the section’s core argument that the trend of widespread AI adoption reversed in 2025, with adoption rates for the largest firms specifically beginning to decline.

(Source: MarketWatch)

The $5 Trillion Infrastructure Bill: Analyzing AI’s Skyrocketing Investment and Risk in 2025

The AI industry requires an unprecedented wave of capital investment in data center infrastructure, but hardware shortages and power constraints create significant financial risk for these multi-trillion-dollar projects.

Big Tech Capex Skyrockets Toward $400B

This chart visualizes the dramatic ramp-up in capital expenditure by major tech players like Meta, Oracle, and Google through 2024, which the section text cites as the precursor to the multi-trillion-dollar future need.

(Source: Understanding AI)

- The scale of required investment is massive, with Mc Kinsey projecting a need for $5.2 trillion in cumulative capital for AI-specific data centers by 2030. This follows a period from 2021-2024 where major tech players like Meta, Oracle, and Google dramatically ramped up capital expenditures to build initial capacity.

- By 2025, the financial risks of these investments became clear. Moody’s noted that over $2 trillion in total data center investment is planned between 2025 and 2028, but these projects face severe execution risk due to power constraints and construction delays.

- The high capital expenditure, with some AI data centers facing $40 billion in annual depreciation, means that hardware delivery delays directly threaten project viability, a risk that was less pronounced before the 2025-2026 memory and GPU supply crisis.

- An EY Survey in October 2025 found that most companies deploying AI suffer some form of risk-related financial loss, totaling a combined $4.4 billion, highlighting the immediate financial consequences of failing to navigate infrastructure barriers.

Table: AI Data Center Investment and Demand Projections

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Mc Kinsey & Company | By 2030 | Projects a $5.2 Trillion capital expenditure requirement for AI-specific data centers to meet the computational demands of advanced models. | The cost of compute: A $7 trillion race to scale data centers |

| Moody’s | 2025-2028 | Forecasts over $2 Trillion in total data center investment, while highlighting significant risks related to power and construction boom management. | Data centers: managing risk amid a market boom |

| Forrester | Delayed until 2027 | Projects enterprises will delay 25% of planned AI spending due to the difficulty of proving ROI amid infrastructure challenges and elusive benefits. | AI spending may slow down as ROI remains elusive – CIO |

| EY Survey | 2025 | Reports a combined financial loss of $4.4 Billion from various rollout risks experienced by companies deploying AI, underscoring the financial stakes of execution. | Most companies suffer some risk-related financial loss … |

Strategic Alliances in AI 2025: How Partnerships Shape Supply Chain Access and Widen Competitive Gaps

Strategic partnerships have become a critical mechanism for securing access to constrained hardware and infrastructure, allowing established AI leaders to fortify their position while challengers struggle to acquire necessary resources.

- Before 2025, partnerships focused broadly on technology development and market access, such as collaborations between AI startups and cloud providers for compute credits.

- In October 2025, the nature of these deals shifted toward securing the physical supply chain, exemplified by the strategic collaboration between Open AI and Broadcom. This partnership aims to ensure Open AI has access to custom silicon and other critical components, mitigating its exposure to the supply chain crisis.

- This trend builds on existing deep relationships, like Open AI’s long-standing partnership with Microsoft, which provides the massive-scale data center infrastructure needed to train models like GPT-4. These alliances create a significant competitive advantage by locking in access to power and compute.

- The effect is a widening gap between industry leaders and others. While companies like Open AI secure their infrastructure through these deals, other firms face significant delays and higher costs, a dynamic that intensified in 2025 as hardware scarcity became the primary bottleneck.

Table: Key Strategic Partnerships for AI Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Open AI & Broadcom | Oct 2025 | Announced a strategic collaboration to accelerate the development of advanced AI infrastructure. This move is designed to secure Open AI’s supply of essential semiconductor components. | Open AI and Broadcom announce strategic collaboration to … |

| ORNL, AMD, & HPE | Oct 2025 | Partnered to deliver new AI supercomputers for the Department of Energy. This project highlights the competition for HPC resources between public scientific research and commercial AI. | ORNL, AMD and HPE to deliver DOE’s newest AI … |

| Open AI & Microsoft | Ongoing | A long-term, multi-billion dollar partnership where Microsoft provides the large-scale cloud infrastructure required for Open AI’s foundational model training and inference workloads. | The cost of compute: A $7 trillion race to scale data centers |

Regional Disparities in AI Infrastructure: Why North American Power Constraints Create Global Bottlenecks in 2025

While data center supply is expanding globally, the most acute bottlenecks are emerging in North America due to power grid limitations, creating a geographic mismatch that directly impacts the training of frontier AI models.

Power and Grid Capacity are Top Data Center Challenges

This chart perfectly aligns with the section’s focus on regional bottlenecks by identifying ‘Power and grid capacity constraints’ as the number one challenge for data center development.

(Source: Insights2Action – Deloitte)

- Between 2021 and 2024, data center construction was a global race, with significant investment across North America, Europe, and Asia to support cloud growth and initial AI workloads.

- By 2025, a clear divergence emerged. Data shows that while overall supply is accelerating, driven by the most significant growth in APAC and EMEA, North America’s growth is the slowest. This is creating uneven pockets of capacity and constraint.

- This slowdown in North America is critical because it is the hub for many frontier AI model developers. The region’s power constraints are a primary driver, with U.S. data center electricity demand projected by Bain & Company to double to 409 TWh by 2030.

- The consequence is that AI firms face severe challenges in securing sites with sufficient power. This geographic constraint in a key innovation hub creates a ripple effect, slowing down the most computationally demanding AI research and development globally.

Technology Maturity at Risk: How 2025 Hardware Shortages Threaten a Decade of AI Progress

The most advanced AI application categories, which appeared to be on a clear path to commercial scale between 2021 and 2024, are now seeing their development timelines stall due to a direct dependency on cutting-edge hardware that is in critically short supply.

- From 2021 to 2024, progress in AI was primarily gated by algorithms and data, leading to rapid advancements in foundational models and autonomous systems. Companies competed on model performance and innovation.

- In 2025, the primary gate shifted to physical infrastructure. The development of next-generation models and systems now depends on hardware like NVIDIA’s GPUs and high-bandwidth memory (HBM), which are facing an acute global supply crisis.

- This crisis is severe. SK Hynix predicts the memory shortage will last well into 2026, with AI data centers projected to consume 70% of all DRAM production in that year. This directly stalls innovation in foundational model training.

- Similarly, progress in Level 4/5 autonomous vehicles, which require massive “data factory” processing, is at risk. A January 2026 report notes chip suppliers are prioritizing higher-margin data center clients over the automotive sector, delaying the iteration cycle for improving vehicle safety and capability.

SWOT Analysis: Navigating AI’s Infrastructure Bottlenecks in 2025

The AI industry’s core strength in driving productivity is now directly challenged by the weakness of its infrastructure dependency, creating opportunities for infrastructure players but threatening the viability of compute-heavy applications.

- The analysis reveals a shift from algorithm-driven progress to infrastructure-gated development, a fundamental change from the 2021-2024 period.

- Strengths in AI’s proven value, such as cost reductions in logistics, are offset by weaknesses in its extreme resource consumption and exposure to supply chain volatility.

- Opportunities are concentrating in infrastructure, hardware, and power generation, while threats are escalating for application-layer companies that cannot secure the necessary resources.

Table: SWOT Analysis for AI’s Infrastructure-Gated Slowdown

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Demonstrated value in specific applications (e.g., supply chain optimization with 15% cost reduction, 35% inventory improvement). Widespread enterprise interest in AI adoption. | Highly efficient new hardware like NVIDIA’s B 200 offers up to a 25 x reduction in inference cost and energy, proving a path to greater efficiency exists. | The value of AI was validated, but the focus shifted from model capability to the efficiency and availability of the underlying hardware as the key strength. |

| Weaknesses | High cost and complexity of AI implementation. A growing, but manageable, demand for specialized chips like the NVIDIA H 100. | Extreme dependency on a fragile supply chain. AI data centers are set to consume 70% of DRAM by 2026. Power availability is now the top constraint. | The weakness shifted from being a business case challenge (ROI) to a physical limitation (power, hardware). The scale of AI demand created its own systemic weakness. |

| Opportunities | Broad opportunity for software and model developers to create new applications. Cloud providers benefited from rising compute demand. | Massive investment opportunity in data center infrastructure ($5.2 T by 2030) and for hardware manufacturers (NVIDIA, AMD). Strategic partnerships (Open AI/Broadcom) create moats. | The primary economic opportunity shifted from the application layer to the infrastructure layer. Companies that build the “picks and shovels” now hold the most strategic value. |

| Threats | Talent shortages and data privacy concerns. Initial signs of chip shortages in late 2023 were a concern but not a crisis. | A full-blown hardware supply chain crisis for GPUs and HBM. Power grid constraints and construction delays stall multi-billion dollar projects. Enterprise adoption for large firms is declining in 2025. | The threat moved from manageable business risks to systemic, physical bottlenecks that threaten to halt progress at the frontier and stall broad economic adoption. |

2026 Outlook: Expect AI Market Fragmentation as Infrastructure ‘Haves’ and ‘Have-Nots’ Emerge

If current infrastructure constraints persist, the primary trend to watch in the coming year is the fragmentation of the AI market, where a few vertically integrated players accelerate their lead while the majority of enterprises are forced to delay large-scale AI deployment.

- If these bottlenecks continue, watch for more strategic partnerships between AI leaders and hardware manufacturers, similar to the October 2025 Open AI–Broadcom deal. This would confirm that securing the supply chain is the top strategic priority for staying competitive.

- Monitor the capex announcements from hyperscalers like Microsoft, Google, and Meta. A continued surge in spending, despite supply constraints, would indicate they are successfully capturing the limited available hardware, widening their moat and validating this fragmentation.

- Track the pilot-to-production rates for enterprise AI projects. If the 54% figure from 2025 fails to improve or worsens, this could be happening: mainstream businesses are unable to overcome the infrastructure and ROI hurdles, confirming the “pilot purgatory” scenario for the majority of the market.

- A key indicator of this fragmentation will be the performance gap between early adopters who have secured infrastructure and the 40% of businesses that, according to a December 2025 analysis, may remain stuck in the exploration phase, unable to access the necessary compute to compete.

Frequently Asked Questions

Why is enterprise AI adoption slowing down for large companies in 2025?

The slowdown is due to infrastructure bottlenecks that stall large-scale projects. After a period of growth from 2021-2024, large firms are struggling to transition AI projects from pilot to production, with only 54% making the leap in 2025. A Flexential report identifies IT infrastructure as the top barrier for 44% of firms, leading to what Forrester calls “pilot purgatory” and delayed spending.

What are the biggest infrastructure risks threatening AI development?

The primary risks are hardware shortages, power constraints, and financial risk. The article points to a global supply crisis for GPUs and high-bandwidth memory (HBM) lasting into 2026. Power grids, especially in North America, are unable to meet demand, which is projected to double by 2030. These issues create severe execution risk for the over $2 trillion in data center investments planned through 2028, leading to significant financial losses as seen in a 2025 EY Survey.

How are leading AI companies like OpenAI trying to overcome these supply chain issues?

Leading companies are forming strategic partnerships to secure access to the supply chain. For example, in October 2025, OpenAI announced a collaboration with Broadcom to ensure its supply of custom silicon and other semiconductor components. This builds on its long-standing partnership with Microsoft, which provides the massive-scale data center infrastructure needed for model training. These alliances create a competitive advantage by locking in access to compute and power.

Which specific AI applications are most at risk from these hardware shortages?

The most advanced and computationally demanding applications are at the greatest risk. The article highlights two key areas: 1) The development of next-generation foundational models, which is directly stalled by the shortage of GPUs and high-bandwidth memory. 2) The progress of Level 4/5 autonomous vehicles, which rely on massive ‘data factory’ processing, as chip suppliers are reportedly prioritizing higher-margin data center clients over the automotive sector in 2026.

What is the expected outlook for the AI market in 2026 if these constraints continue?

The outlook for 2026 is a fragmentation of the AI market, creating a divide between infrastructure ‘haves’ and ‘have-nots’. A few vertically integrated players who secure their supply chains through strategic partnerships and massive capital expenditure will accelerate their lead. Meanwhile, the majority of enterprises will likely remain stuck in the exploration phase or ‘pilot purgatory,’ unable to access the necessary compute to deploy large-scale projects and prove ROI.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.