Grid Constraints 2025: Why These 5 AI Applications Face a Power-Driven Downturn

Industry Risks: How Grid Constraints Became the Top Threat to AI Scalability in 2025

The primary constraint on Artificial Intelligence scalability has fundamentally shifted from semiconductor availability to the structural limitations of global power grids. Before 2025, the central challenge was securing compute hardware. Now, the inability of energy infrastructure to meet exponential demand dictates the pace of AI deployment, creating severe operational and financial risks for the most power-intensive applications. This pivot forces a re-evaluation of project viability, ROI, and geographic strategy across the AI sector.

- In the period from 2021 to 2024, the industry focused on acquiring GPUs and scaling model size, exemplified by the massive compute required for models like GPT-3. Since January 1, 2025, the defining challenge has become securing power, with interconnection queues of 4-8 years and transformer shortages becoming the primary project timeline drivers.

- Applications with long-duration, inflexible workloads, such as foundational model training and scientific research, are now the most exposed. An outage can corrupt a multi-week training run, resulting in sunk costs of millions of dollars, a risk that has transitioned from theoretical to a material threat impacting the ROI of multi-billion dollar AI investments.

- A paradoxical vulnerability has emerged for AI systems designed to manage the grid itself. These systems require perfect power stability to function, but as demonstrated by the fictionalized “San Francisco blackout of 2026, ” they fail precisely when they are needed most, potentially exacerbating the outages they are meant to prevent.

- The risk profile for autonomous mobility and industrial automation has also changed. The focus has expanded from cloud availability to include the quality and stability of local power grids, where even brief voltage sags can halt production lines, leading to downtime costs exceeding $1 million per hour in automotive manufacturing.

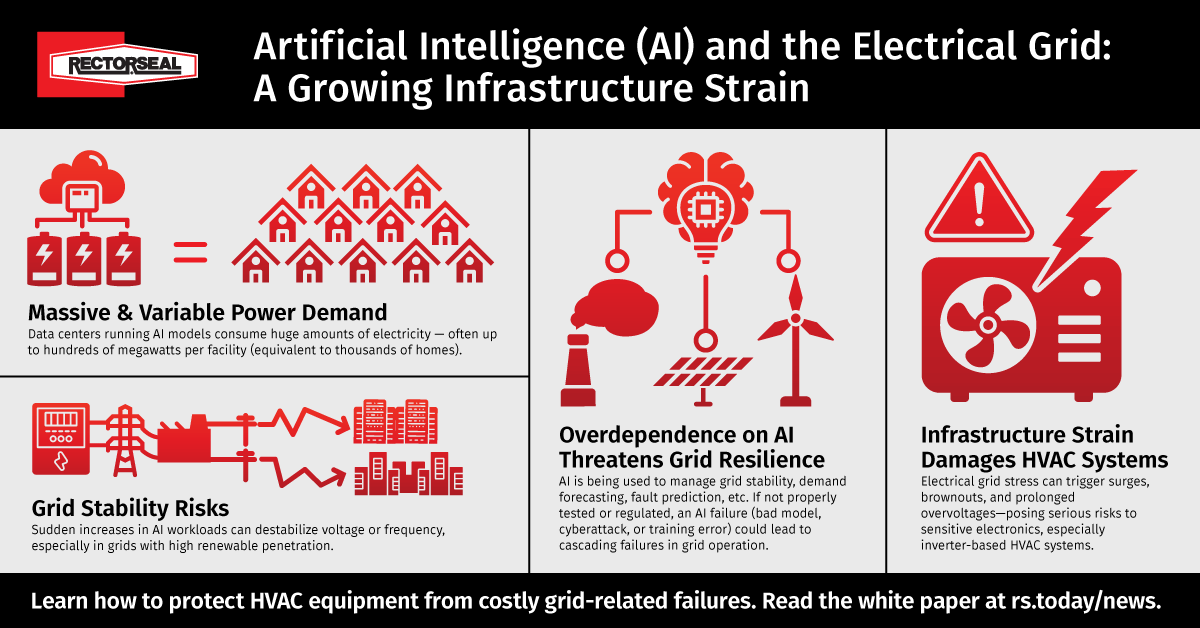

AI Power Demand Creates Growing Grid Strain

This infographic directly illustrates the core risk outlined in the section: that massive AI power demand is creating significant grid stability risks and threatening infrastructure.

(Source: RectorSeal)

Investment Analysis: Capital Redirects from Compute to On-Site Power Generation

Investment in the AI ecosystem is bifurcating, with a significant and growing portion of capital now allocated to energy infrastructure to mitigate grid-related operational risks. This strategic redirection of funds away from pure-play compute hardware and toward on-site power generation, microgrids, and long-term energy contracts is a direct response to the inadequacy of public grid infrastructure. Investors now price in energy security as a critical component of an AI project’s valuation and long-term viability.

- The scale of this pivot is evident in massive, energy-inclusive infrastructure programs. Brookfield’s $100 Billion Global AI Infrastructure Program, announced in late 2025, explicitly targets the entire value chain, including the energy generation required to power new data centers.

- The formation of direct partnerships between infrastructure funds and energy technology providers signals a clear move to bypass grid constraints. The $5 billion strategic partnership between Brookfield and Bloom Energy in October 2025 aims to establish fuel cells as a primary, on-site power source for data centers, reducing reliance on strained local utilities.

- This trend is validated by major technology projects that now incorporate power generation from their inception. The planned Open AI–Oracle “Stargate” project, with its multi-gigawatt power requirement, necessitates the construction of dedicated natural gas power plants to ensure operational stability.

- Even traditional energy companies are targeting this new market. GE Vernova’s announcement of a $15 billion investment in AI energy infrastructure in November 2025 confirms that powering AI is now a distinct and highly lucrative market segment for the energy industry.

Table: Key Investments in AI and Energy Infrastructure (2025 – Today)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield / NVIDIA / KIA | 2025 onwards | A $100 billion program to fund a global build-out of the AI ecosystem, with a specified focus on the energy infrastructure required to support it. This represents a systemic shift to funding power and compute together. | Brookfield Launches $100 Billion AI Infrastructure Program |

| GE Vernova | 2025 | A $15 billion investment dedicated to energy infrastructure specifically for powering AI data centers. This move establishes AI power provision as a core business line for a major energy technology firm. | GE Vernova’s AI Power Play: 2025 Energy Dominance … |

| 2025 | A $75 billion capital expenditure plan for AI infrastructure. While primarily for compute, the massive scale of this investment directly contributes to the power demand crisis, forcing such companies to also become major energy strategists. | We did the math on AI’s energy footprint. Here’s the story … | |

| Brookfield / Bloom Energy | 2025 onwards | A $5 billion partnership to deploy Bloom Energy’s on-site fuel cells as a primary power source for data centers. This alliance is designed to circumvent grid interconnection delays and ensure power reliability. | Brookfield and Bloom Energy Announce $5 Billion … |

Geography: AI Growth Follows Power Availability, Not Just Talent or Fiber

The geography of AI infrastructure development is undergoing a fundamental realignment, with site selection now primarily dictated by power availability and grid stability rather than proximity to established tech hubs. Regions with surplus energy capacity, modern grid infrastructure, and favorable regulatory environments for private power generation are attracting the next wave of large-scale AI investment. This marks a departure from the 2021-2024 period, when development was concentrated in areas with rich fiber connectivity and talent pools.

Blueprint for an AI-Integrated Power Grid

As site selection follows power availability, this diagram shows the conceptual grid infrastructure—connecting diverse regional power sources—that enables the new geography of AI.

(Source: ScienceDirect.com)

- From 2021 to 2024, data center growth focused on established markets like Northern Virginia and Silicon Valley, leading to severe grid strain in those regions. Since 2025, developers are actively seeking new locations where utilities can accommodate loads of 100 MW to 500 MW without causing local instability or requiring multi-year upgrades.

- The risk of operating in constrained regions was highlighted by the fictional “San Francisco blackout of 2026, ” which illustrated the vulnerability of concentrated tech ecosystems to grid failures. This is causing a strategic de-risking through geographic diversification.

- The need to build dedicated power generation, such as the natural gas plants required for the “Stargate” project, shows that AI developers are expanding their geographic footprint to locations where they can co-locate compute and power generation, effectively becoming their own utilities.

- The market for Agentic AI in Energy and Utilities, projected to grow to USD 3.14 billion by 2030, indicates a focus on deploying AI to optimize grid operations in specific utility territories like PJM, as seen in the Constellation and Grid Beyond partnership. This creates regional opportunities for both AI and energy firms.

Technology Maturity: AI Model Capability Outpaces Essential Power Infrastructure

The technological maturity of large-scale AI is now gated by the comparatively slow development of energy infrastructure, creating a significant gap between what AI models can do and where they can be deployed reliably. While AI algorithms and hardware advanced rapidly between 2021 and 2024, the underlying grid technology did not. Since 2025, an AI project’s feasibility is no longer just a measure of its computational performance but its ability to secure a stable, long-term power supply.

Utilities Show Limited AI Adoption for Grid

This chart provides direct evidence for the section’s claim that power infrastructure is lagging, showing that a significant portion of utilities report no AI use for grid development.

(Source: Medium)

- Between 2021 and 2024, technology maturity was defined by model scale and capability, such as training a 175-billion parameter model like GPT-3. The key challenge was hardware supply. Post-2025, the critical metric is the “Levelized Cost of Compute, ” which is now dominated by the cost and reliability of electricity.

- The emergence of on-site power solutions like fuel cells from Bloom Energy as a preferred technology for data centers is a direct technological response to the grid’s immaturity. This represents a shift in the tech stack, where energy hardware is now as critical as compute hardware.

- The vulnerability of AI-driven grid management tools to the very power disruptions they are designed to solve demonstrates a critical weakness in their real-world maturity. The technology works in stable conditions but lacks the resilience needed for mission-critical operations during grid stress events.

- The economic case for AI in applications like predictive maintenance, which can cut downtime by up to 50%, is being undermined. The technology is mature, but its value is nullified if the monitoring system itself fails due to a power outage, indicating a dependency that vendors have not fully solved.

SWOT Analysis: Grid Constraints Reshape AI’s Strategic Outlook in 2025

The strategic landscape for AI is now defined by a central tension: while AI’s internal capabilities for optimization and discovery are a major strength, its external dependence on an aging and constrained power grid has become a critical weakness. This dynamic has reshaped the sector’s opportunities and threats, moving the focus from algorithmic competition to a race for energy security.

High Energy Use Is Top AI Concern

This chart quantifies the grid-related “Weakness” discussed in the SWOT analysis by showing that high energy use is the number one concern, validating its strategic importance.

(Source: The Information)

- Strengths: AI’s proven economic value, such as its ability to reduce industrial maintenance costs by up to 40% and unplanned downtime by 50%, continues to drive demand and justify large-scale investment.

- Weaknesses: The core vulnerability is the trifecta of massive, sustained, and inflexible power demand. A single hyperscale training campus can require up to 500 MW continuously, a profile that public grids are ill-equipped to serve.

- Opportunities: The primary opportunity has shifted to developing and deploying solutions that mitigate grid risk. This includes on-site power generation (fuel cells, microgrids), investments in energy-efficient AI hardware, and software for smart demand management.

- Threats: The most significant threats are long interconnection queues, volatile energy prices, and the risk of multi-billion dollar data centers becoming stranded assets in regions with deteriorating grid stability.

Table: SWOT Analysis for AI Applications Facing Grid Constraints

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Focus on rapid model improvement and performance gains (e.g., training GPT-3). AI’s value was primarily in its computational power and accuracy. | Demonstrated ROI in physical operations, such as predictive maintenance reducing costs by 10-40% and extending asset life by 20-40%. | The value proposition of AI was validated, shifting from theoretical performance to tangible economic benefits in industrial and scientific applications. |

| Weaknesses | High energy consumption was known but treated as an operational cost (OPEX). The main weakness was seen as the high cost of GPUs. | Extreme power intensity (100-500 MW) and workload inflexibility are now recognized as a strategic liability. A power outage during a training run results in millions of dollars in irrecoverable sunk costs. | The weakness shifted from a manageable OPEX line item to a critical single point of failure that threatens the entire investment in an AI cluster. |

| Opportunities | Opportunities were centered on developing larger, more capable models and expanding cloud AI services. | Massive investment in on-site power generation (Brookfield/Bloom partnership) and vertically integrated AI infrastructure (Brookfield’s $100 B program). | The market opportunity expanded from selling AI services to building the underlying energy infrastructure, creating a new multi-billion dollar sub-sector. |

| Threats | The primary threat was semiconductor supply chain disruptions and competition for limited GPU capacity. | Grid constraints, including interconnection delays of 4-8 years and insufficient firm capacity, are now the primary bottleneck. The risk of stranded assets due to power issues is a major concern. | The existential threat to AI scalability was confirmed to be energy infrastructure, not silicon. This was validated by the strategic shift of major investors and developers toward securing power. |

Scenario Modeling: Watching for the Decoupling of AI from the Public Grid

If grid constraints continue to be the primary limiting factor for AI growth, the most critical strategic development to monitor is the rate at which AI infrastructure decouples from the public grid through private power generation. The acceleration of this trend will signal a permanent fragmentation of the energy landscape, where access to private, reliable power becomes the key determinant of who can compete in the large-scale AI market. The pace and success of this decoupling will define the next phase of AI development.

AI Applications to Optimize Power Grids

This table complements the article’s SWOT by detailing specific applications that represent AI’s “Strengths” in improving grid stability, forecasting, and efficiency.

(Source: FischerJordan)

- If more data center developers announce large-scale partnerships with on-site power providers, similar to the $5 billion Brookfield-Bloom Energy deal, watch the stock performance and order backlogs of those energy tech companies. This could be happening: a validation that the public grid is no longer viewed as a viable primary power source for serious AI deployments.

- If utility commissions in key regions like Virginia, Texas, or Arizona begin denying or significantly delaying connection requests for new data centers, watch for a subsequent wave of AI infrastructure investments in new, energy-rich geographies. This could be happening: a forced geographic redistribution of the AI industry.

- If the operational costs for AI applications with high real-time sensitivity, like autonomous vehicle fleet management, begin to rise sharply due to power-related downtime, watch for a slowdown in their commercial expansion. This could be happening: an indication that the business model for these services is not viable without dedicated, resilient power infrastructure.

Frequently Asked Questions

Why has the power grid suddenly become a bigger problem for AI scalability than acquiring chips like GPUs?

According to the analysis, the period from 2021-2024 focused on securing compute hardware. Since 2025, the exponential growth in AI’s power demand has overwhelmed the structural capacity of global power grids. The primary bottlenecks are no longer semiconductor supply but rather energy infrastructure limitations, such as interconnection queues lasting 4-8 years and shortages of critical components like transformers.

Which types of AI applications are most at risk from these grid constraints?

The article identifies applications with long-duration, inflexible workloads as the most exposed. These include: 1) Foundational model training, where an outage can corrupt a multi-week run and cost millions. 2) Scientific research with similar long-compute needs. 3) Industrial automation, where brief voltage sags can halt production lines. 4) Autonomous mobility, which depends on stable local power. 5) AI systems for grid management, which can fail precisely when they are needed most during a grid event.

How is the industry responding to this power-driven challenge?

The industry is shifting investment from purely acquiring compute hardware to securing reliable power. Key strategies include investing in on-site power generation like fuel cells (evidenced by the $5 billion Brookfield/Bloom Energy deal), creating vertically integrated infrastructure funds that bundle power with data centers (like Brookfield’s $100 billion program), and planning for dedicated power plants, such as the natural gas plants needed for the ‘Stargate’ project.

The article mentions AI’s value is being ‘undermined.’ How can that be if the technology works?

The issue is dependency. While an AI application like predictive maintenance is technologically mature and can reduce costs, its value is entirely dependent on the reliability of its own power supply. If the monitoring system itself fails due to a power outage or voltage sag, its ability to prevent downtime becomes zero. Therefore, the unreliability of the grid undermines the economic case for the AI application running on it.

What does the article mean by the ‘decoupling of AI from the public grid’?

This refers to the strategic trend of AI developers building their own private, dedicated power generation facilities (like fuel cell arrays or natural gas plants) instead of relying on the public utility grid. The article suggests watching this trend as a key indicator. Its acceleration would signal that the public grid is no longer considered a viable option for serious AI deployments, potentially creating a future where access to private power determines who can compete in the large-scale AI market.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.