Microsoft’s 2025 Renewable Energy Strategy: Securing Power for AI Growth

Microsoft Commercial Scale Projects Target AI Energy Demands in 2025

Microsoft has pivoted from general cloud expansion to a targeted strategy of securing massive renewable energy capacity, a direct response to the immense power requirements of its AI infrastructure growth in 2025.

- Between 2021 and 2024, Microsoft’s focus was on expanding its global cloud footprint to support broad enterprise adoption, with capital expenditures driven by standard data center growth.

- Starting in 2025, the company’s infrastructure strategy shifted to address the specific energy constraints of AI, as evidenced by its landmark agreement with Brookfield Asset Management to develop 10.5 gigawatts of new renewable energy.

- This shift is a reaction to AI server racks consuming over 40 kilowatts (k W) each, a sharp increase from the 7 k W used by traditional servers, making direct energy partnerships critical for scaling AI services.

- The variety of applications driving this demand, from enterprise generative AI on Azure to internal model development, indicates that securing power is now a core competitive requirement for all segments of the AI market.

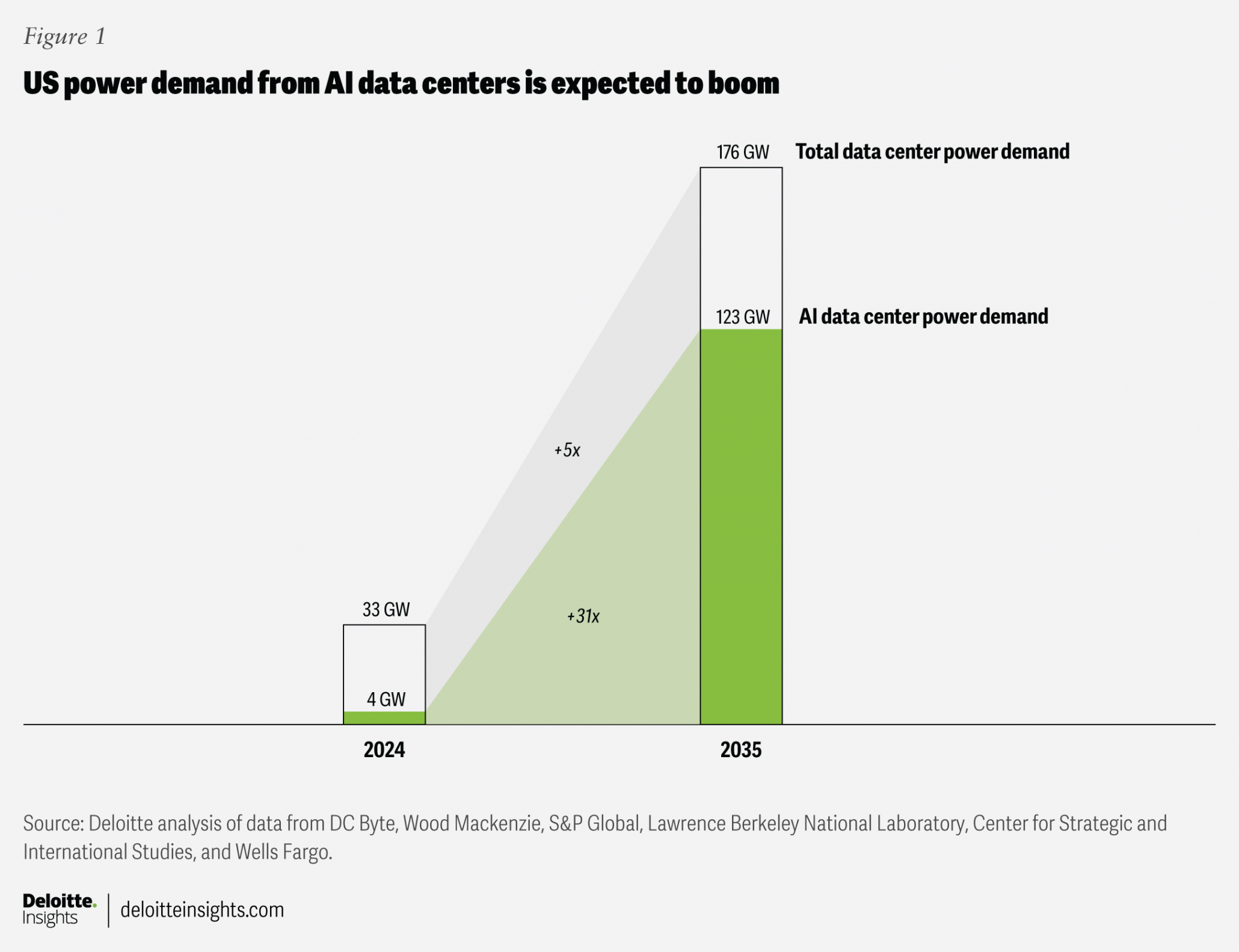

US AI Power Demand to Skyrocket

This chart quantifies the immense power demand from AI that is driving Microsoft’s strategic shift toward securing massive renewable energy capacity. It directly visualizes the core problem addressed in the section.

(Source: Deloitte)

Microsoft’s Strategic Partnerships and Investments Secure AI Supply Chain 2025

Microsoft is executing a multi-pronged partnership strategy, creating alliances with energy producers, AI technology firms, and hardware suppliers to secure its entire AI value chain from energy constraints and component bottlenecks.

AI Supply Chain Risks Drive Partnerships

This diagram highlights the supply chain vulnerabilities, like supplier dependency and bottlenecks, that motivate Microsoft’s strategic partnerships. It provides visual context for the risks Microsoft aims to mitigate.

(Source: ScienceDirect.com)

- The cornerstone of its energy strategy is the May 2024 agreement with Brookfield Asset Management, a deal to co-invest in and develop 10.5 GW of renewable energy, directly linking its data center power needs to new-build generation assets.

- To address AI demand at the source, Microsoft deepened its partnership with NVIDIA in November 2023 to integrate DGX Cloud and secure access to next-generation GPUs, which in turn drives the need for its energy partnerships.

- The company is also securing its global AI position through sovereign AI partnerships, exemplified by its $1.5 billion investment in UAE-based G 42 in April 2024 to build out regional AI infrastructure.

- To diversify its hardware supply chain, Microsoft confirmed in February 2024 that it will use Intel Foundry to manufacture a custom chip on its 18 A process, reducing reliance on single-source suppliers.

Table: Microsoft’s Key Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield Asset Management | May 2024 | Develop 10.5 GW of new renewable energy capacity between 2026 and 2030. This secures a direct power supply for Microsoft’s AI data centers in the U.S. and Europe. | WSJ |

| G 42 | April 2024 | $1.5 billion strategic investment in the UAE-based AI firm. This partnership secures Microsoft’s position in a key international AI market and builds out sovereign AI capabilities. | CNBC |

| Intel Foundry | February 2024 | Microsoft became a key customer for Intel’s 18 A process technology. The purpose is to diversify its custom silicon manufacturing away from a single foundry source. | Tom’s Hardware |

| NVIDIA | November 2023 | Expanded collaboration to offer NVIDIA DGX Cloud and latest GPUs on Azure. This partnership secures access to high-demand AI accelerators that drive Microsoft’s infrastructure needs. | NVIDIA News |

Microsoft’s Global Strategy Focuses on US and European Energy Security for AI

Microsoft’s geographic focus for AI infrastructure has transitioned from broad global expansion to targeted investments in the United States and Europe, where it is actively securing the energy infrastructure needed to power its AI ambitions.

US AI Infrastructure Market Shows Explosive Growth

This chart validates Microsoft’s strategic focus on the United States by showing the explosive growth projected for the U.S. AI infrastructure market. It provides a data-driven reason for the geographic concentration mentioned.

(Source: Grand View Research)

- In the period between 2021 and 2024, Microsoft’s geographic expansion was defined by opening new Azure cloud regions globally to serve a distributed customer base.

- From 2025, the strategy has become more concentrated, with the 10.5 GW Brookfield partnership specifically targeting new renewable projects in the U.S. and Europe to directly support data center clusters in those regions.

- This regional focus is a direct response to the AI Infrastructure Growth dynamic, where proximity to stable, renewable power grids in developed markets is becoming a primary site selection criterion over pure market-access expansion.

- Outside of its core energy focus, Microsoft is also making strategic geographic plays like its $1.5 billion investment in G 42 to establish a strong AI presence in the UAE, a key emerging technology hub.

Microsoft Deploys Commercial Scale Renewable Energy Solutions to Power AI

Microsoft is leveraging commercially mature renewable energy procurement models at an unprecedented scale, validating large-scale corporate power purchase agreements as the primary tool to de-risk the energy constraints of AI.

- Between 2021 and 2024, Microsoft was a leader in corporate PPAs, but these were typically smaller, individual project agreements supporting general sustainability goals.

- The 2025 strategy, highlighted by the 10.5 GW Brookfield deal, marks a fundamental shift to programmatic, portfolio-level energy development that is directly tied to the business case for AI infrastructure.

- This agreement moves beyond simple procurement to co-investment in new generation assets, demonstrating a new level of vertical integration into the energy supply chain and proving the commercial maturity of this approach.

- The shift validates that for the AI Infrastructure Growth sector, the technology for securing power is not experimental; it is the transactional and financial structuring of large-scale, commercially proven renewable energy projects.

SWOT Analysis: Microsoft’s Position in AI Infrastructure 2025

Microsoft’s dominant market position and financial strength are its greatest assets in the race for AI infrastructure, but this is counterbalanced by a profound dependency on fragile energy and hardware supply chains, creating both significant opportunities for integration and substantial external threats.

AI Infrastructure Market Explodes to $768B

This forecast illustrates the massive scale of the AI infrastructure market, providing context for Microsoft’s SWOT analysis. The market’s size highlights the opportunity and validates the need for Microsoft’s significant capital investment.

(Source: Research Nester)

- Strengths: Microsoft’s primary advantages are its massive capital base for investment (over $50 billion planned for FY 2025) and its ability to form strategic, large-scale partnerships like the one with Brookfield.

- Weaknesses: The core weakness is the insatiable power demand of its AI services, making it highly vulnerable to grid instability, power shortages, and shortages of physical components like transformers.

- Opportunities: The company has a clear opportunity to achieve a significant competitive advantage by securing long-term, low-cost renewable energy, effectively controlling a key bottleneck for the entire AI industry.

- Threats: The primary threats are physical, including delays in grid upgrades, shortages of critical electrical components, and geopolitical risks impacting the semiconductor supply chain that underpins its AI growth.

Table: SWOT Analysis for AI Infrastructure Growth

| SWOT Category | 2021 – 2024 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Financial strength and leadership in cloud computing. | Ability to execute record-breaking energy deals (Brookfield 10.5 GW) and secure hardware partners (Intel, NVIDIA). | Microsoft validated it can use its financial power to directly address physical infrastructure bottlenecks, not just software development. |

| Weaknesses | Growing energy consumption and carbon footprint of data centers. | Explicit dependence on the power grid and hardware supply chain as the primary constraint on AI growth. | The scale of AI has turned a background operational cost (energy) into a primary strategic vulnerability that requires direct intervention. |

| Opportunities | Procuring renewable energy (PPAs) to meet sustainability goals. | Vertically integrating with energy developers (Brookfield) to control both cost and supply of power for AI. | The energy constraint on AI creates an opportunity for Microsoft to build a competitive moat by becoming an integrated tech and energy player. |

| Threats | Geopolitical tensions affecting chip supply from Asia. General supply chain disruptions. | Acute shortages of physical grid components (transformers), power grid capacity limitations, and HBM memory bottlenecks. | The threat landscape has shifted from high-level geopolitical risk to tangible, near-term shortages of basic industrial and energy components. |

Outlook 2025: Microsoft to Deepen Energy Integration Beyond PPAs

Looking ahead, Microsoft’s next strategic move will be to deepen its integration into the energy sector, moving beyond power purchase agreements to direct investments in grid infrastructure, energy storage, and partnerships with 24/7 clean energy providers.

AI Infrastructure Market Nears $423B by 2029

As the outlook section discusses growth through 2030, this chart provides a concrete forecast for the AI infrastructure market. It quantifies the growth that necessitates Microsoft’s future strategy of deeper energy integration.

(Source: Data Bridge Market Research)

- The 10.5 GW Brookfield deal is a blueprint, and Microsoft will likely replicate this model to secure additional terawatt-hours of power required for its projected AI growth through 2030.

- Recent data highlights that power grids and components like transformers are the new bottlenecks. Expect Microsoft to form partnerships with utilities and manufacturers of grid equipment to secure its supply chain.

- The market has seen other tech leaders pursue 24/7 clean energy, such as Google’s partnership with geothermal firm Fervo Energy, signaling that Microsoft will also explore firm power sources to complement intermittent renewables.

- Ultimately, Microsoft’s success in the AI race is now directly tied to its effectiveness as an energy player, a trend that will accelerate throughout 2025 and beyond.

Frequently Asked Questions

Why is Microsoft focusing so heavily on renewable energy for 2025?

Microsoft is focusing on renewable energy because the power requirements for its AI infrastructure are massive and growing rapidly. AI server racks consume over 40 kW each, compared to 7 kW for traditional servers. This strategic shift ensures Microsoft can secure the vast amount of power needed to scale its AI services without being constrained by energy availability.

What is the significance of the partnership with Brookfield Asset Management?

The partnership with Brookfield Asset Management is a landmark deal for Microsoft to co-invest in and develop 10.5 gigawatts of new renewable energy capacity. This is significant because it moves Microsoft from simply purchasing power to directly investing in new energy generation, securing a dedicated, large-scale power supply specifically for its AI data centers in the U.S. and Europe.

How do partnerships with NVIDIA and Intel fit into this energy strategy?

These partnerships secure the hardware foundation of Microsoft’s AI ambitions, which in turn drives the need for more energy. The collaboration with NVIDIA ensures access to high-demand GPUs that power AI, while the agreement with Intel Foundry diversifies its custom chip manufacturing. By securing the core technology components, Microsoft can better forecast its future infrastructure needs and proactively secure the energy required to power them.

What are the biggest threats to Microsoft’s AI infrastructure plan?

The primary threats are physical and logistical bottlenecks in the energy and hardware supply chains. These include shortages of critical grid components like transformers, delays in grid upgrades to handle new capacity, and geopolitical risks impacting the semiconductor supply chain. Microsoft’s success is highly dependent on factors outside its direct control.

Is Microsoft’s strategy only about renewable energy?

No, it’s a multi-pronged strategy to secure the entire AI value chain. While the 10.5 GW Brookfield deal is the cornerstone for energy, Microsoft is also making strategic investments in hardware (Intel), AI technology access (NVIDIA), and global market position (G42 in the UAE). This holistic approach addresses potential bottlenecks from energy and component constraints to market access.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.