Brookfield’s $100 Billion AI Power Play: How Onsite Generation Dominates Data Center Strategy in 2025

Brookfield’s Commercial Scale Power Projects Redefine AI Data Center Viability 2025

Brookfield has strategically pivoted to integrate onsite power generation as a core component of its AI infrastructure investments, directly addressing the industry’s most critical bottleneck and establishing a new model for de-risking data center development.

- Between 2021 and 2024, the industry approach to data center power was largely reactive, focusing on securing connections to a progressively strained public grid and facing significant project delays.

- The launch of Brookfield‘s $100 billion AI Infrastructure Program in November 2025 marked a fundamental shift, moving power generation from an external dependency to a vertically integrated part of the investment thesis.

- The $5 billion framework agreement with Bloom Energy, announced in October 2025, moved onsite power from a backup or pilot solution to a commercial-scale, primary power source for new AI data centers. This demonstrates a clear strategy to bypass grid-related constraints.

- This model provides a template for the broader market, showcasing how to build resilient AI infrastructure in an environment where 88% of U.S. enterprises believe grid limitations could restrict AI scaling.

Brookfield’s 2025 Capital Deployment: A $100 Billion Fund for AI Infrastructure

Brookfield’s capital allocation in 2025 confirms a decisive strategy to control the foundational assets of the AI ecosystem, with an explicit focus on solving the power deficit that threatens the projected $3 trillion market.

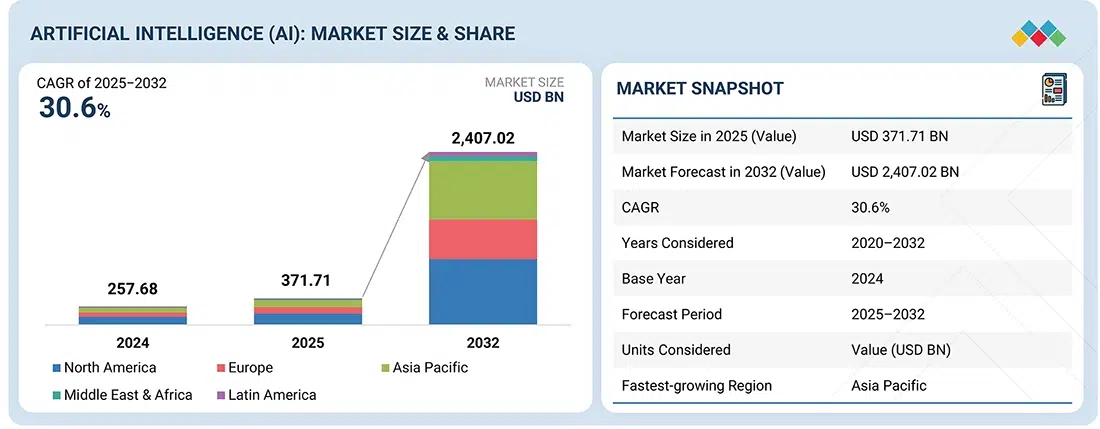

AI Market Growth Validates $100B Fund

This chart shows the AI market approaching $2.4 trillion, providing the macroeconomic context for why Brookfield is deploying a massive $100 billion fund into the AI ecosystem.

(Source: MarketsandMarkets)

- The company launched its $100 billion AI Infrastructure Program to deploy capital across the entire value chain, directly targeting the physical inputs like power and data centers that have become the new chokepoints.

- A cornerstone of this program is the $5 billion strategic agreement with Bloom Energy to provide dedicated, onsite power solutions, earmarking significant capital specifically to mitigate energy supply risk.

- This investment approach contrasts with the pre-2025 period by actively acquiring and developing power assets alongside data centers, rather than treating them as separate investment classes.

Table: Brookfield AI Infrastructure Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| AI Infrastructure Program | November 2025 | Launch of a $100 billion investment fund to deploy capital across the AI value chain, from power generation to data centers, to build a resilient and controlled infrastructure portfolio. | Brookfield Launches $100 Billion AI Infrastructure Program |

| Bloom Energy | October 2025 | A $5 billion framework agreement to provide onsite power solutions for Brookfield‘s data centers, securing a reliable energy supply independent of grid constraints. | Brookfield and Bloom Energy Announce $5 Billion … |

Brookfield and Bloom Energy: A Strategic Partnership to Solve AI’s Power Crisis in 2025

Brookfield’s partnership with Bloom Energy is a calculated response to the primary physical constraint in the AI infrastructure arms race, establishing a replicable model for securing power and ensuring project timelines.

Surging Power Demand Drives Onsite Solutions

The chart’s projection of a 31x surge in AI data center power demand directly illustrates the ‘power crisis’ that the Brookfield-Bloom Energy partnership is designed to solve.

(Source: Deloitte)

- The alliance directly addresses the reality that AI data centers require more than double the power density of traditional facilities, a demand that aging public grids cannot reliably meet.

- By integrating Bloom Energy‘s fuel cell technology at the development stage, Brookfield mitigates the risk of multi-year lead times for high-voltage transformers and other grid components that delay projects.

- This partnership exemplifies the cross-sector collaboration required to solve systemic bottlenecks, combining Brookfield‘s capital and real asset expertise with Bloom Energy‘s specialized energy technology.

- This move positions Brookfield to offer a premium, resilient data center product to hyperscalers and AI companies who prioritize speed to market and operational uptime over reliance on the public grid.

Table: Brookfield’s Key Energy Partnership

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Bloom Energy | October 2025 | A $5 billion agreement for onsite, clean-energy power solutions. The strategic purpose is to create a reliable and scalable power supply for data centers, bypassing public grid constraints and accelerating development timelines for AI infrastructure assets. | Brookfield and Bloom Energy Announce $5 Billion … |

Brookfield’s Global AI Infrastructure Strategy Targets Power-Constrained Regions in 2025

As a global asset manager, Brookfield is deploying its integrated power-and-data-center model in key geographic markets where high AI demand collides with insufficient grid capacity, turning a regional liability into a competitive advantage.

US Market Growth Justifies Regional Focus

This chart validates Brookfield’s strategy to target North America by quantifying the strong growth in the U.S. AI infrastructure market, the primary region mentioned in the text.

(Source: Grand View Research)

- While data center development from 2021 to 2024 centered on established hubs with existing infrastructure, the AI boom is creating intense demand in new regions where power is a significant constraint.

- North America, particularly the U.S., is the initial and primary target for this strategy, as confirmed by reports that 88% of U.S. telecom and enterprise firms see infrastructure limits as a direct threat to AI scaling.

- The $100 billion fund’s global mandate suggests that after validating the model in North America, Brookfield will expand its strategy to high-growth markets in Europe and Asia-Pacific where similar grid challenges exist.

- By solving the power problem, Brookfield can enter and dominate markets that are otherwise inaccessible to competitors who rely solely on traditional grid connections.

Onsite Power Generation for AI Data Centers Reaches Commercial Scale in 2025

The Brookfield and Bloom Energy partnership validates that onsite power generation has matured from a niche or backup solution into a commercially scalable and strategically essential technology for the AI infrastructure industry.

Infrastructure Market Boom Demands New Solutions

The forecast for explosive AI infrastructure market growth demonstrates why new, scalable solutions like onsite power generation are reaching commercial scale, as the section states.

(Source: Research Nester)

- Prior to 2025, onsite power for data centers was primarily used for emergency backup, with few examples of it serving as the primary, baseload power source at a significant scale.

- The $5 billion commitment announced in October 2025 signals a definitive market shift, proving that technologies like fuel cells are now considered reliable and economically viable for powering mission-critical, power-dense AI workloads.

- This technological maturation was accelerated by the market’s failure to solve the problem through conventional means, as the strain on power grids and extended lead times for electrical components made the status quo untenable for AI’s growth trajectory.

- Brookfield‘s adoption provides a critical validation point for the entire onsite generation sector, signaling that the technology is ready for widespread deployment in the most demanding industrial applications.

SWOT Analysis: Brookfield’s AI Infrastructure and Onsite Power Strategy

Brookfield’s strategy to integrate power solutions within its AI infrastructure fund establishes a powerful competitive advantage by controlling a critical bottleneck, but it also introduces dependencies and execution risks that must be managed.

Risk Framework Highlights Strategic Bottlenecks

This diagram visually represents the core risks of ‘Limited capacity bottlenecks’ and ‘Dependency on key supplier’ that Brookfield’s SWOT analysis and integrated power strategy directly address.

(Source: ScienceDirect.com)

- The key strength is the ability to offer a complete, de-risked infrastructure solution to AI clients, bypassing the grid-related delays that plague competitors.

- The primary opportunity is to capture market share and command premium pricing in power-constrained, high-demand geographic regions.

- The main threat comes from competing energy technologies or significant public grid upgrades that could diminish the value proposition of onsite generation.

Table: SWOT Analysis for AI Infrastructure Growth

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Strong capital base and experience in real asset management. | Control over both capital ($100 B fund) and a critical input (power via the Bloom Energy deal). | Validated a model for vertical integration that directly addresses the AI industry’s primary physical bottleneck, moving beyond pure financial investment. |

| Weakness | Exposure to general data center market risks, including grid connection delays. | Dependency on a single technology partner (Bloom Energy) for a core part of the strategy. Execution risk in deploying a novel, large-scale energy infrastructure model. | The strategy shifted the risk from external grid dependency to internal partnership and execution dependency. |

| Opportunity | Participate in the general growth of the data center market. | Become the go-to developer in power-constrained regions. Offer “power-as-a-service” with data centers, capturing a premium. | The AI power crisis created a specific, high-value opportunity that Brookfield‘s integrated model is uniquely positioned to capture. |

| Threat | Rising interest rates and general economic slowdown affecting real asset investments. | Advances in grid-scale energy storage or small modular reactors (SMRs) could offer alternative solutions. Geopolitical risks impacting the supply chain for fuel cell components. | The threat evolved from broad economic factors to specific technological and supply chain risks associated with the chosen energy solution. |

Future Outlook: Brookfield’s Onsite Power Model as the New Standard for AI Infrastructure in 2026

The central strategic question for 2026 is whether Brookfield can successfully execute its integrated power-and-data-center model at scale, a development that would establish a new industry standard for AI infrastructure investment.

AI Infrastructure Growth Defines Future Standard

By projecting the AI infrastructure market to exceed $422 billion, this chart highlights the massive scale of the future market for which a ‘new standard’ will be critical.

(Source: Data Bridge Market Research)

- The performance of the first projects deployed under the $5 billion Bloom Energy agreement will be the most critical validation point for the market, proving whether the model is both technically and financially replicable.

- Competitors, including other large asset managers and data center REITs, will likely move to replicate this strategy, leading to a wave of similar partnerships between infrastructure investors and energy technology firms.

- The focus of supply chain risk will broaden, with the ability to secure a stable supply of fuel cells and their underlying critical minerals becoming as strategically important as securing GPUs from NVIDIA.

- Monitoring these strategic partnerships and their project milestones is essential for understanding which players will lead the next phase of AI infrastructure development. Use a dedicated research platform to track these corporate energy strategies and capital deployments in real-time.

Frequently Asked Questions

What is the main change in Brookfield’s data center strategy in 2025?

In 2025, Brookfield shifted its strategy from relying on the public grid to vertically integrating onsite power generation as a core part of its data center investments. This was marked by the launch of a $100 billion AI Infrastructure Program and a $5 billion partnership with Bloom Energy to build dedicated power sources for its AI data centers.

Why is onsite power generation so critical for AI data centers?

Onsite power is critical because AI data centers require more than double the power density of traditional facilities, and public grids are often too strained or slow to upgrade to meet this demand. According to the text, 88% of U.S. enterprises believe grid limitations could restrict AI scaling. Onsite generation allows developers like Brookfield to bypass these grid constraints and avoid multi-year project delays.

What is the significance of the $5 billion Brookfield and Bloom Energy partnership?

The $5 billion agreement, announced in October 2025, is significant because it elevates onsite power from a backup or pilot solution to a primary, commercial-scale power source for new AI data centers. It validates that technologies like Bloom Energy’s fuel cells are now considered reliable and economically viable for powering mission-critical, power-dense AI workloads, setting a new industry precedent.

How does this new strategy give Brookfield a competitive advantage?

This strategy gives Brookfield a competitive advantage by allowing it to offer a complete, de-risked infrastructure solution (power and data center) to AI clients. It can enter and dominate power-constrained, high-demand markets that are inaccessible to competitors who rely on traditional grid connections, potentially commanding premium pricing for its resilient data center product that prioritizes speed to market and operational uptime.

What are the primary risks associated with Brookfield’s onsite power strategy?

According to the provided SWOT analysis, the main risks include a dependency on a single technology partner (Bloom Energy) and the execution risk of deploying a novel, large-scale energy model. Additionally, there is a future threat from competing energy technologies like small modular reactors (SMRs) or significant public grid upgrades that could diminish the value of their onsite generation model.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.