Phillips 66 AI Strategy 2025: How Analytics Cut Emissions and Drive ROI

Phillips 66 Commercial Scale AI Projects Cut Emissions Across Operations 2025

Phillips 66 has transitioned its artificial intelligence strategy from isolated pilot projects to commercially scaled, enterprise-wide deployments focused on reducing emissions and improving operational efficiency. The company’s approach leverages proven AI applications to generate quantifiable financial returns and achieve environmental, social, and governance (ESG) targets, shifting from validation to value realization.

- Between 2021 and 2024, the company focused on demonstrating the value of AI in specific operational contexts, such as using Seeq software to optimize heat exchanger performance at its Sweeny Hub for $1.5 million in annual savings and deploying an AI model to provide a 45-day warning for compressor failures. These initiatives served as critical proofs of concept, validating the business case for AI within core refining and chemical operations.

- Starting in 2025, the strategy pivoted to scaling these proven solutions across the enterprise, a move validated by the realization of over $100 million in value from the enterprise-wide deployment of the C 3 AI suite. AI is now a core component of the company’s plan to achieve its 2025 sustainability goals and is an enabling technology for its broader $1.5 billion business transformation savings target.

- The variety of applications, from monitoring flare gas systems to prevent emissions to optimizing crude oil selection, shows that AI is being adopted as a versatile tool across the value chain. This indicates a broad internal acceptance of data-driven decision-making and a move to embed analytics into standard operating procedures rather than treating it as a specialized function.

Phillips 66 Investment Analysis: Capital Budgets and AI-Driven Savings Targets

Phillips 66‘s financial strategy directly connects capital allocation to the measurable returns generated by its AI and digital initiatives. The company’s budgets and savings targets reflect a disciplined, ROI-driven approach where technology investments are expected to produce specific cost reductions and efficiency gains.

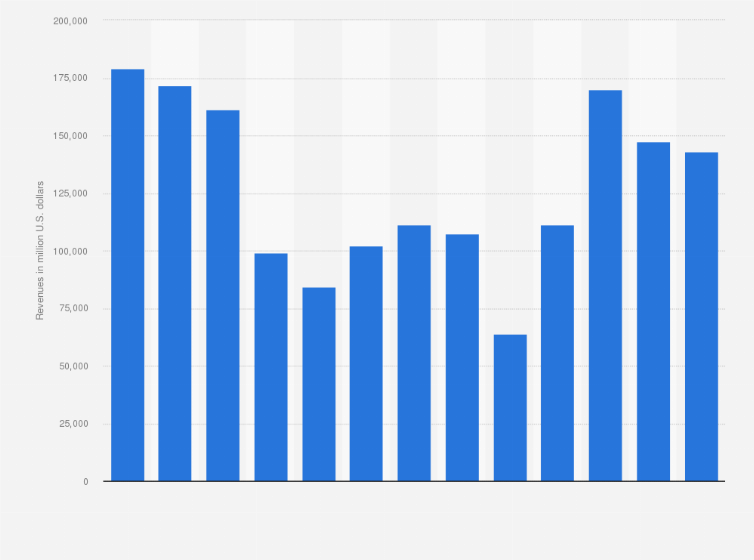

Phillips 66 Annual Operating Revenue Performance

This chart displays the annual operating revenue for Phillips 66, providing a high-level view of the company’s financial scale and performance over time.

(Source: Statista)

- The company’s $2.4 billion capital budget for 2026, which allocates $1.3 billion for growth and $1.1 billion for sustaining projects, provides the financial capacity to both fund new AI deployments and maintain the digital infrastructure required to support them. A significant portion of sustaining capital is essential for the data platforms that underpin its analytics capabilities.

- A primary financial driver for AI adoption is the company’s aggressive business transformation goal of achieving $1.5 billion in run-rate savings. AI-powered projects in predictive maintenance and process optimization are critical enablers for reaching this target, which is composed of $1.2 billion in cost reductions and $300 million in capital efficiencies.

- The financial viability of this strategy is validated by the specific returns from individual AI projects. The C 3 AI suite has already generated over $100 million in value, while the implementation of Seeq software yields approximately $50, 000 in annual savings, demonstrating a clear and positive return on investment that justifies continued and expanded funding.

Table: Phillips 66 AI Initiative Investments and Returns

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Corporate Capital Budget | 2026 | $2.4 billion budget ($1.3 B growth, $1.1 B sustaining) to fund technology deployments and digital infrastructure upgrades. | Phillips 66 announces $2.4 billion capital budget for 2026 |

| Business Transformation Savings | 2025 | Target of $1.5 billion in run-rate savings ($1.2 B cost, $0.3 B capex), with AI and analytics as critical enablers. | 2025 Sustainability and People Report by Phillips 66 Co |

| Enterprise Predictive Maintenance (C 3 AI) | By 2025 | Realized over $100 million in value by deploying the C 3 AI suite for enterprise-scale predictive maintenance, validating the business case for AI. | Phillips 66 AI Strategy 2025: How Analytics Cut Emissions |

| Advanced Analytics Software (Seeq) | 2025 | Generated $50, 000 in annual savings by using Seeq to empower process engineers, reducing dependency on third-party tools. | Driving Operational Excellence with Advanced Analytics in … |

Phillips 66 Partnership Ecosystem: AI Technology Alliances Driving Efficiency Gains

Phillips 66 executes its AI strategy through a curated ecosystem of technology partners, enabling the company to deploy specialized, best-in-class solutions for operational efficiency and emissions reduction without bearing the full cost and risk of in-house development.

- The cornerstone of its operational AI is the partnership with C 3 AI, which provided the enterprise platform for predictive maintenance and reliability applications. This long-term collaboration, expanded in October 2020, has been scaled across the company’s global operations to deliver significant, documented value.

- For process-specific analytics, Phillips 66 leverages Seeq‘s advanced software to empower its subject matter experts. This partnership enables engineers at facilities like the Sweeny Hub to directly analyze time-series data to optimize processes and identify efficiency gains, such as the $1.5 million annual savings from improved heat exchanger monitoring.

- The company partners with established technology leaders like Intel to enhance its underlying AI capabilities. The collaboration on gasoline blending models, which used Intel Xeon processors and AI libraries, resulted in a 400 x performance improvement in model training and a 250% increase in prediction accuracy.

- To explore novel applications of machine learning, Phillips 66 collaborates with academic institutions like the National Center for Supercomputing Applications (NCSA). This partnership provides access to expertise in data mining and geospatial analysis, helping unlock new insights from complex operational datasets.

Table: Phillips 66 Strategic Technology Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| C 3 AI | 2017 – Present | Deployment of the C 3 AI Suite for enterprise-wide predictive maintenance and process optimization, delivering over $150 million in annual economic value as of 2020. | Phillips 66 Deploys C 3 AI Suite as its Enterprise AI Platform |

| Seeq | Customer | Use of advanced analytics software to empower engineers, leading to $1.5 million in annual savings from heat exchanger optimization at the Sweeny Hub. | Phillips 66 Optimizes Heat Exchanger Performance at the Sweeny Hub |

| Intel | 2019 | Collaboration to use Intel hardware and software to accelerate machine learning models for gasoline blending, improving training time by 400 x. | Phillips 66 Uses Intel AI to Help Optimize Gasoline Production |

| NCSA | Ongoing | Partnership with the National Center for Supercomputing Applications to utilize advanced data mining and machine learning on time series and geospatial data. | Data Analytics – NCSA – University of Illinois |

| Cognite | Customer | Deployed Cognite Data Fusion® at the Bayway Refinery to contextualize data, reducing the time engineers spend searching for data by 75%. | Phillips 66 Bayway Refinery |

Phillips 66 Geographical Focus: U.S. Refineries Serve as AI Proving Grounds

The company’s adoption of AI for emissions reduction and operational efficiency is geographically concentrated in its United States-based refineries and processing hubs, which serve as strategic centers for piloting, proving, and scaling these advanced technologies.

- Between 2021 and 2024, Phillips 66 focused its AI deployments on key U.S. facilities to generate validated use cases. The Sweeny Complex in Texas was a primary site for optimizing heat exchanger performance with Seeq and deploying AI to monitor the flare gas recovery system, while the Bayway Refinery in New Jersey implemented Cognite‘s data platform to build a foundation for digital twin applications.

- The Borger refinery in Texas also served as a testbed, with an AI-powered system analyzing over 400 variables to optimize a fluid catalytic cracker unit. The quantifiable success at these specific locations provided the business case for the broader, enterprise-wide AI rollouts that began in 2025.

- The company’s strategic collaboration with the National Center for Supercomputing Applications (NCSA) at the University of Illinois further anchors its advanced analytics development within the U.S. This partnership leverages top-tier domestic research talent to tackle complex data challenges, reinforcing the United States as the central geography for its AI innovation.

AI for Emissions Reduction: Phillips 66 Technology Reaches Commercial Scale

Phillips 66 has successfully matured its use of artificial intelligence for emissions control and operational efficiency from pilot programs to commercially scaled, enterprise-wide solutions that deliver quantifiable business value.

- In the 2021–2024 period, the company’s focus was on technology validation in controlled settings. This included targeted deployments like using Seeq at the Sweeny Hub, which saved $1.5 million annually, and a collaboration with Intel that improved model accuracy by 250%. These projects proved the technical feasibility and financial return of specific AI applications.

- Beginning in 2025, the strategy has shifted to enterprise-wide commercialization of these proven technologies. The deployment of the C 3 AI suite for predictive maintenance is no longer a pilot but a fully scaled solution that has generated over $100 million in value, confirming its status as a commercially mature and impactful technology.

- The establishment of an internal AI Governance Board and a formal Generative Artificial Intelligence policy in 2024 further confirms this maturity. These organizational structures demonstrate that AI is now managed as a core business function with standardized processes and risk controls, not as an experimental technology.

SWOT Analysis: Phillips 66’s AI-Driven Efficiency Strategy

Phillips 66‘s AI strategy is strengthened by its demonstrated success in generating returns from operational deployments, yet its business-unit-led approach creates potential weaknesses in integration and a unified vision. The company’s opportunity lies in leveraging its financial resources to build a cohesive, enterprise-wide platform, a necessity driven by threats from activist investors and advancing competitors.

- The company’s core strength is its proven ability to generate tangible ROI from AI, which has evolved from project-specific savings to over $100 million in enterprise-level value.

- A key weakness is the fragmented, business-unit-led adoption of AI, which risks creating data silos and preventing the realization of network effects from an integrated platform.

- The primary opportunity is to use its $2.4 billion 2026 capital budget to unify these disparate initiatives into a cohesive strategy that can achieve its $1.5 billion corporate savings target.

- Threats have become more acute with direct pressure from activist investor Elliott Management demanding improved returns and competitors making significant investments in AI-related infrastructure.

Table: SWOT Analysis for Phillips 66

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Demonstrated ROI in pilots, such as $1.5 M/yr savings with Seeq and $12-18 M projected savings from C 3 AI at Sweeny. Strong partnerships with tech leaders like Intel and C 3 AI. | Proven enterprise-scale ROI with over $100 M in value from the C 3 AI suite. Established an AI Governance Board and formal AI policies. | The value of AI was validated at an enterprise level, moving beyond pilot projects to become a core, governed part of business operations with significant, measured financial impact. |

| Weaknesses | Dependence on multiple, potentially disconnected, third-party platforms (C 3 AI, Seeq, Cognite) creating integration challenges. | Strategy appears fragmented and business-unit-led rather than a unified, top-down digital transformation. Lacks a cohesive, single platform approach. | The challenge evolved from selecting the right partners to integrating a collection of successful but separate technology solutions into a coherent enterprise data strategy. |

| Opportunities | Explore AI applications in Emerging Energy R&D, including battery materials and carbon capture optimization. | Leverage the $2.4 B 2026 capex to fund a more integrated AI platform. Systematically apply AI to help achieve the $1.5 B corporate savings target. | The opportunity matured from exploratory R&D to deploying AI as a key lever to achieve major, publicly stated corporate financial targets. |

| Threats | General execution risk on digital projects and keeping pace with industry technology adoption. | Direct pressure from activist investor Elliott Management demanding improved operational efficiency and shareholder returns. Competitors like Kinder Morgan are making large investments in AI-enabling infrastructure. | External threats intensified from general market competition to specific, high-profile investor pressure and visible strategic moves by direct competitors in the AI space. |

Future Outlook: Integrating AI to Meet 2026 Financial and ESG Targets

The forward-looking priority for Phillips 66 is to consolidate its proven yet fragmented AI initiatives into a unified enterprise strategy capable of achieving its ambitious $1.5 billion cost-saving and 2026 capital efficiency goals. Success will depend on moving beyond isolated, business-unit-led projects to build a cohesive data and analytics platform that drives value across the entire organization, satisfying both internal objectives and external investor demands for measurable returns.

- The realization of over $100 million in value from the C 3 AI deployment serves as a powerful internal validation that justifies deeper investment and drives the business case for a more integrated, enterprise-wide data infrastructure.

- With its $2.4 billion capital budget for 2026, Phillips 66 possesses the financial resources to fund this strategic integration. The critical task is to allocate this capital not just to more siloed projects but to foundational platforms that connect insights from refining, midstream, and commercial operations.

- Intensifying pressure from activist investors like Elliott Management will compel the company to explicitly link its technology spending to bottom-line results. This reinforces the focus on ROI-centric AI applications in predictive maintenance, process optimization, and emissions reduction, as these projects deliver the clear, quantifiable improvements in operational efficiency that investors demand.

Frequently Asked Questions

What is the main shift in Phillips 66’s AI strategy starting in 2025?

Starting in 2025, Phillips 66 shifted its AI strategy from running isolated pilot projects to implementing commercially scaled, enterprise-wide deployments. The focus has moved from validating the technology’s potential to realizing quantifiable financial value and achieving sustainability goals across the entire organization.

What are some specific, quantifiable results of Phillips 66’s AI initiatives?

The company has realized over $100 million in value from its enterprise-wide deployment of the C3 AI suite for predictive maintenance. Additionally, a project using Seeq software to optimize heat exchanger performance at the Sweeny Hub generated $1.5 million in annual savings. A collaboration with Intel also accelerated machine learning model training times by 400x.

Who are Phillips 66’s main technology partners in its AI strategy?

Phillips 66 partners with a curated group of technology leaders. Key partners include C3 AI for its enterprise-wide predictive maintenance platform, Seeq for advanced process analytics software used by engineers, Intel for accelerating machine learning models, Cognite for data contextualization, and the National Center for Supercomputing Applications (NCSA) for academic expertise.

How is Phillips 66’s AI strategy linked to its overall financial targets?

The AI strategy is a critical enabler for the company’s goal to achieve $1.5 billion in run-rate savings. AI-driven projects in predictive maintenance and process optimization are expected to contribute significantly to this target. The company’s $2.4 billion capital budget for 2026 is allocated to fund these technology deployments, which have already demonstrated a clear return on investment.

What is a key weakness or challenge in Phillips 66’s current approach to AI?

According to the SWOT analysis, a key weakness is that the AI strategy has been fragmented and led by individual business units. This approach risks creating data silos and prevents the company from realizing the full benefits of a unified, integrated data platform, a challenge the company aims to address by consolidating its initiatives.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.