The Great Realignment: How AI-Driven Demand Created Systemic Semiconductor Scarcity in 2025

Industry Risks: AI Demand Creates a New Hierarchy of Semiconductor Scarcity

The global semiconductor shortage has returned not as a temporary disruption but as a structural realignment of the supply chain, driven by the insatiable, high-margin demand of the Artificial Intelligence sector. This demand shock is creating a clear hierarchy of industries, where AI data centers command priority for advanced logic and memory, pushing automotive and consumer electronics manufacturers to the back of the line and triggering unprecedented price volatility.

- Between 2021 and 2024, the market contended with broad-based shortages driven by pandemic-related demand for consumer goods and logistical failures. In contrast, the scarcity crisis that began in 2025 is targeted and structural, originating from the AI sector’s willingness to pay premium prices for high-performance components, which has fundamentally altered production priorities.

- Major memory producers like Samsung, SK Hynix, and Micron have been forced to shift production capacity away from conventional DRAM, such as DDR 4 and DDR 5, toward more lucrative High-Bandwidth Memory (HBM). This pivot is a direct response to the AI sector’s staggering appetite for memory, with data centers projected to consume up to 70% of the world’s high-end memory production in 2026.

- The ripple effects are severe for other industries. Automakers, who were at the center of the previous chip crisis, are again facing production cuts because they cannot compete with the purchasing power of AI firms. Similarly, prices for smartphones and PCs are set to surge as the memory shortage is expected to persist until at least late 2027.

- The most acute technological bottleneck has shifted from raw wafer supply to advanced packaging and assembly. Capacity for technologies like TSMC’s Chip-on-Wafer-on-Substrate (Co Wo S), which is essential for integrating HBM with processors, is now the primary constraint limiting the production of AI accelerators and creating ripple effects across the entire technology ecosystem.

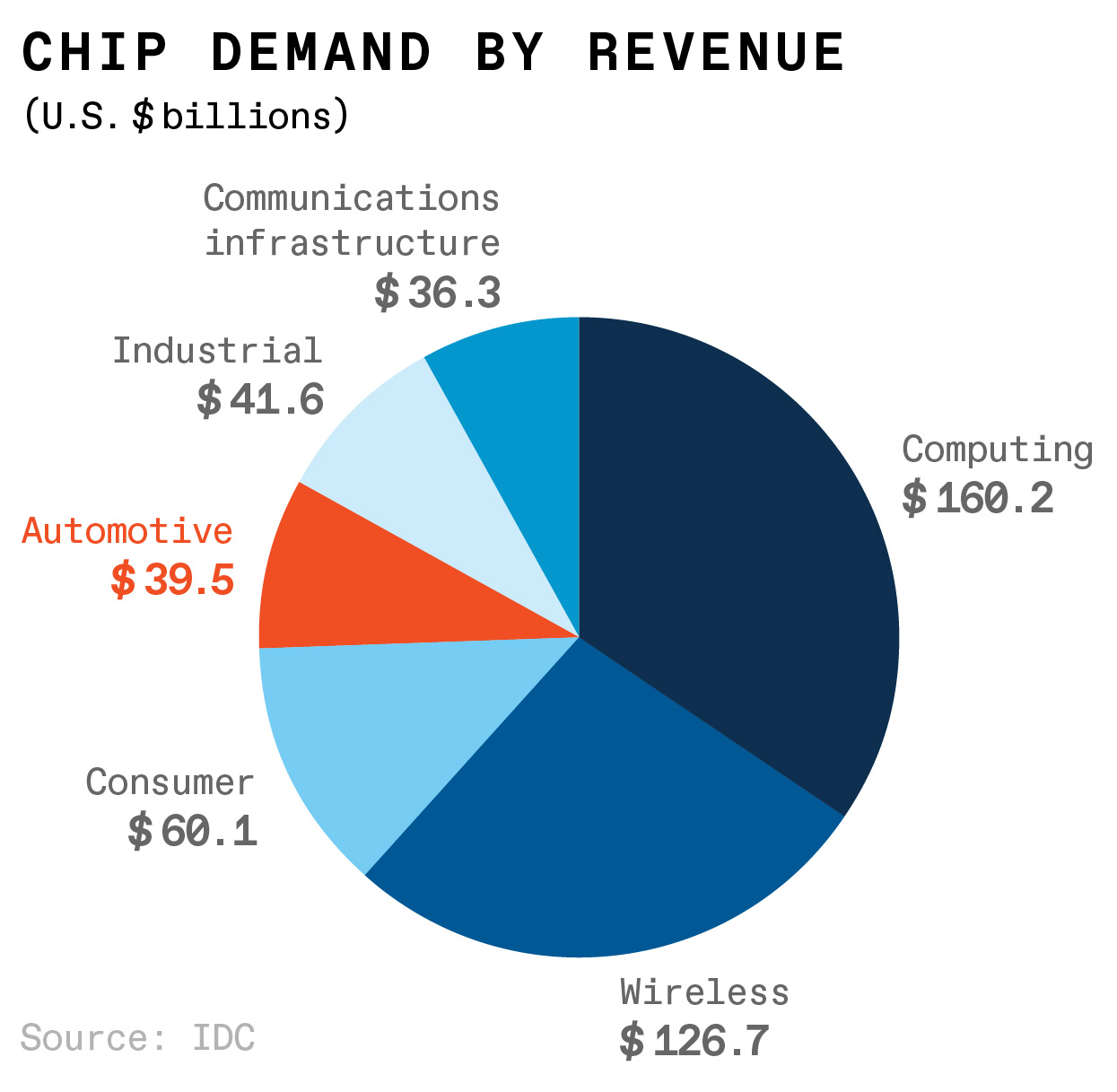

Computing Sector Dominates Chip Demand

This chart quantifies the hierarchy of demand discussed in the section, showing the computing sector’s revenue share dwarfing that of the automotive and consumer electronics industries.

(Source: IEEE Spectrum)

Investment Analysis: Unprecedented Capital Deployment Meets Systemic Barriers

In response to the scarcity crisis and government incentives like the CHIPS Act, the semiconductor industry has initiated a historic wave of investment to expand and diversify manufacturing, but this capital deployment faces significant headwinds. This investment paradox is exacerbating short-term resource constraints in the race to build long-term resilience, with the potential to create future market volatility.

- The scale of investment is massive, with global semiconductor companies planning to invest approximately $1 trillion in new facilities through 2030. In the U.S. alone, private-sector companies had announced over half-a-trillion dollars in investments across the ecosystem as of July 2025.

- A critical barrier to this expansion is the lack of skilled labor, which investment alone cannot solve. The U.S. semiconductor workforce is projected to need 460, 000 jobs, a 33% increase from the current 345, 000, creating a significant talent gap that threatens to delay new fab operations.

- This investment cycle signals a strategic shift from an efficiency-focused “just-in-time” model, prevalent before 2024, to a resilience-focused “just-in-case” strategy. Companies are now focused on diversifying suppliers, regionalizing supply chains, and using digital twins to anticipate future disruptions.

Table: Major Semiconductor Manufacturing Investment Announcements

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| TSMC | March 2025 (Expanded Plans) | Expanded its U.S. investment to over $100 Billion for three new fabs, two advanced packaging facilities, and an R&D center in Arizona to establish advanced node manufacturing in the U.S. | TSMC Intends to Expand Its Investment in the United States … |

| Texas Instruments | June 2025 | Announced plans to invest over $60 Billion in seven U.S. semiconductor fabs across three mega-sites in Texas and Utah, focusing on foundational chips for industrial and automotive sectors. | Texas Instruments plans to invest more than $60 billion … |

| Global Foundries | June 2025 | Announced a $16 Billion U.S. investment to reshore essential chip manufacturing for the AI, aerospace, and automotive sectors, expanding capacity at its existing fabs. | Global Foundries Announces $16 B U.S. Investment to … |

| SK hynix | April 2024 | Announced a nearly $4 Billion investment to build an advanced packaging fabrication and R&D facility in Indiana, USA, specifically for AI memory chips like HBM. | SK hynix announces semiconductor advanced packaging … |

| Intel | Ongoing (post-2022) | Investing over $100 Billion across Arizona, New Mexico, Ohio, and Oregon to increase domestic chip manufacturing capacity, supported by the CHIPS Act. | US Semiconductor Manufacturing | CHIPS and Science Act |

Geography: Geopolitical Fragmentation Creates New Supply Chain Risks

Geopolitical tensions and strategic reshoring initiatives are fundamentally fragmenting the once-globalized semiconductor supply chain, concentrating both new investments and systemic risks in a few key regions. While the 2021-2024 period highlighted vulnerabilities in the hyper-efficient global model, the post-2025 era is defined by a costly and complex race to build redundant, regionalized manufacturing capabilities.

Semiconductor Power Consolidated in Asia Pre-Shortage

This chart provides critical context for the section’s discussion on geopolitical risk by visualizing the significant consolidation of semiconductor industry power in Taiwan and South Korea leading up to the shortage era.

(Source: GEP)

- The world’s reliance on Taiwan for advanced semiconductors remains a critical vulnerability, with a potential conflict projected to cause a 10% drop in global GDP. This single point of failure has become a primary driver of geographic diversification efforts in the U.S. and Europe.

- The U.S. has become the epicenter of new fab investment, with the CHIPS Act catalyzing major projects by Intel (Ohio, Arizona), TSMC (Arizona), and Texas Instruments (Texas). This marks a significant shift from the pre-2025 period, where the majority of advanced manufacturing investment was concentrated in Asia.

- The ongoing “chip war” between the U.S. and China has forced companies to create bifurcated supply chains, adding complexity and cost. Further disruption is threatened by disputes in Europe, such as the ownership conflict over Dutch chipmaker Nexperia, which supplies crucial mature-node chips to the automotive industry.

- Beyond geopolitics, climate and environmental risks are becoming a major geographic factor. By 2035, an estimated 32% of global semiconductor production will depend on copper supplies at risk from climate events, while water scarcity poses a direct threat to manufacturing hubs in Asia and the American Southwest.

Technology Maturity: Advanced Packaging Emerges as the Critical Bottleneck

The primary technological bottleneck constraining the semiconductor supply chain has decisively shifted from front-end wafer fabrication to back-end advanced packaging. While the 2021-2024 shortages were largely defined by insufficient capacity for mature-node wafers, the current crisis is a function of limited capacity for the complex technologies required to assemble high-performance AI systems.

Mature Technologies Dominate Chip Market Volume

This chart directly supports the section’s thesis by showing that while advanced nodes are critical, mature nodes still make up the vast majority of the market, explaining the shift in bottlenecks.

(Source: IEEE Spectrum)

- As Moore’s Law slows, performance gains increasingly depend on advanced packaging techniques like 3 D stacking and chiplets, making the assembly, testing, and packaging (ATP) phase the new innovation frontier. This is a marked change from the pre-2025 focus on scaling process nodes.

- High-Bandwidth Memory (HBM) has become a commercially critical technology, with demand from AI accelerators driving its production. The process of integrating HBM stacks with logic processors using technologies like Co Wo S is now the most significant chokepoint, with demand far outstripping the available supply from leaders like TSMC.

- The maturity of these advanced packaging technologies is limited by the availability of specialized manufacturing equipment. The long lead times for these complex tools, which were a known factor before 2024, now represent a hard cap on how quickly the industry can respond to the AI-driven demand shock.

SWOT Analysis: Semiconductor Supply Chain Risks 2025

The semiconductor industry’s strength in the high-margin AI market has created a systemic weakness in supplying traditional sectors, while massive government investment opportunities are threatened by geopolitical instability and a severe talent shortage. This SWOT analysis reveals an industry in a state of structural transformation, where today’s opportunities are seeding tomorrow’s risks.

Semiconductor Industry Faces Severe Talent Shortfall

This chart directly quantifies a key threat mentioned in the SWOT analysis, projecting that nearly 60% of new semiconductor jobs could be unfilled by 2030 due to a talent shortage.

(Source: TechRepublic)

Table: SWOT Analysis for Semiconductor and Memory Scarcity

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Recovery from pandemic-driven shortages and broad-based demand across multiple sectors. | Explosive, high-margin AI demand drives record revenue ($793 billion in 2025). Memory producers (Samsung, SK Hynix) pivot to highly profitable HBM. | AI was validated as the new, dominant center of gravity for profitability, replacing the more balanced demand from consumer electronics and automotive. |

| Weaknesses | Shortages of mature-node chips for automotive; widespread logistical bottlenecks. | Structural scarcity of conventional DRAM and NAND due to HBM production shift. Advanced packaging (Co Wo S) is the new critical bottleneck. A severe talent gap emerges (460, 000 job shortfall in the U.S.). | The supply chain bottleneck shifted from generic chips to specific, high-value advanced packaging and memory, creating a new hierarchy of access. |

| Opportunities | Government incentive programs like the U.S. CHIPS Act are proposed and enacted to encourage domestic production. | An unprecedented investment cycle begins, with over $1 trillion planned through 2030. Companies like Intel, TSMC, and TI announce massive U.S. fab projects. | Government policy transformed into massive capital deployment, creating a greenfield opportunity to build resilient, regional supply chains. |

| Threats | Geopolitical tensions between the U.S. and China begin to impact the supply chain. | Heightened geopolitical risk around Taiwan (potential 10% global GDP loss). Trade disputes like the Nexperia case threaten mature-node supply. Climate risks are quantified (32% of copper supply at risk). | Geopolitical and environmental risks have shifted from being hypothetical concerns to active, quantifiable threats to the new investment cycle. |

Forward Outlook: Navigating Scarcity and Volatility in 2025 and Beyond

The critical path forward for technology-dependent industries involves navigating a bifurcated market where scarcity in advanced components will persist through at least 2027. This forces sectors outside of AI to re-architect their products and supply chains for greater efficiency and resilience in the face of sustained price volatility and limited access to cutting-edge manufacturing capacity.

AI Drives Semiconductor Memory Market Growth

This forecast aligns with the forward outlook by projecting massive growth in the semiconductor memory market, explicitly identifying AI as the primary driver, which supports the text’s reference to HBM demand.

(Source: Research Nester)

- If this happens: AI-related demand for HBM and advanced packaging continues its exponential growth, consuming an even larger share of manufacturing capacity.

- Watch this: The price indexes for both HBM and conventional DRAM, lead times for advanced packaging services from TSMC and its competitors, and quarterly production forecasts from major automotive and consumer electronics companies.

- These could be happening: Industries unable to compete with the AI sector’s purchasing power will be forced to accelerate the design of products that are less dependent on the most constrained components. Expect to see announcements from automotive and PC makers about new, more efficient chip architectures or long-term, high-price supply contracts for memory to guarantee availability.

Frequently Asked Questions

Why is there another semiconductor shortage in 2025, and how is it different from the previous one?

The 2025 shortage is a structural crisis driven by the AI sector’s massive, high-margin demand for advanced components like High-Bandwidth Memory (HBM). Unlike the broad, pandemic-driven shortage of 2021-2024, this scarcity is targeted. AI companies are paying premium prices, causing manufacturers to prioritize them and creating a shortage of components for other industries like automotive and consumer electronics.

Which industries are most negatively impacted by the 2025 AI-driven chip shortage?

The automotive and consumer electronics (PCs, smartphones) sectors are the most affected. According to the report, they cannot compete with the purchasing power of AI firms for advanced logic and memory. As a result, they are pushed to the back of the supply line, facing production cuts and expected price surges for their products.

What is the main technological bottleneck causing the current semiconductor supply chain issues?

The primary bottleneck has shifted from raw wafer supply to advanced packaging and assembly. Specifically, there is a critical lack of capacity for technologies like TSMC’s Chip-on-Wafer-on-Substrate (CoWoS), which is essential for integrating High-Bandwidth Memory (HBM) with processors for AI accelerators. This packaging technology is now the main constraint on production.

If companies are investing over a trillion dollars in new chip fabs, why is the shortage expected to last until at least 2027?

The massive investment faces two major barriers that prevent a quick resolution. First, there is a critical shortage of skilled labor needed to operate the new facilities, with the U.S. alone projecting a need for 460,000 jobs. Second, the long lead times for building new fabs and acquiring specialized advanced packaging equipment mean that new capacity cannot come online fast enough to meet the exponential growth in AI-driven demand.

What is HBM, and why is it so important in the current supply chain crisis?

HBM stands for High-Bandwidth Memory, a type of high-performance memory essential for AI accelerators. The AI sector’s insatiable demand for HBM has made it extremely profitable, causing major producers like Samsung and SK Hynix to pivot their production capacity away from conventional memory (like DDR4 and DDR5). This strategic shift to prioritize HBM is a primary driver of the current scarcity and price volatility for other industries.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.