Toyota’s AI Strategy for Electric Mobility 2025-2026: A Deep Dive into Commercial Projects and Investments

Toyota’s artificial intelligence strategy has matured from foundational research into a full-spectrum commercial offensive, directly impacting its electric vehicle development, manufacturing efficiency, and long-term mobility platforms. By channeling record profits into targeted AI initiatives, the company is systematically integrating intelligent automation across its entire value chain. This analysis details the commercial projects, investments, and partnerships that define Toyota’s AI-driven position in the energy and automotive markets, providing critical intelligence for executives and investors tracking the transition to electrified and autonomous mobility.

Toyota’s AI Projects Advance from Pilots to Commercial Scale

Toyota’s application of artificial intelligence has decisively shifted from exploratory pilots between 2021 and 2024 to large-scale commercial deployments and mass production in 2025 and 2026, validating its strategy to automate both manufacturing and mobility services.

- In the earlier period, Toyota focused on foundational improvements, such as deploying Invisible AI’s computer vision platform in its North American factories to enhance quality control and partnering with Google Cloud for in-car voice services.

- The period from 2025 to today shows a significant escalation, marked by the commercial Robots-as-a-Service (Raa S) agreement with Agility Robotics in February 2026 to deploy seven Digit humanoid robots for logistics tasks at its Woodstock, Ontario plant.

- This move to physical automation is mirrored in its autonomous vehicle strategy, where the joint venture with Pony.ai transitioned to mass production of b Z 4 X-based robotaxis in February 2026, targeting over 1, 000 units for commercial service in China.

- Internally, Toyota launched its own generative AI tools, such as the Gear Pal assistant in November 2025 to reduce factory downtime and a design tool from the Toyota Research Institute (TRI) that integrates engineering constraints into early-stage creative work.

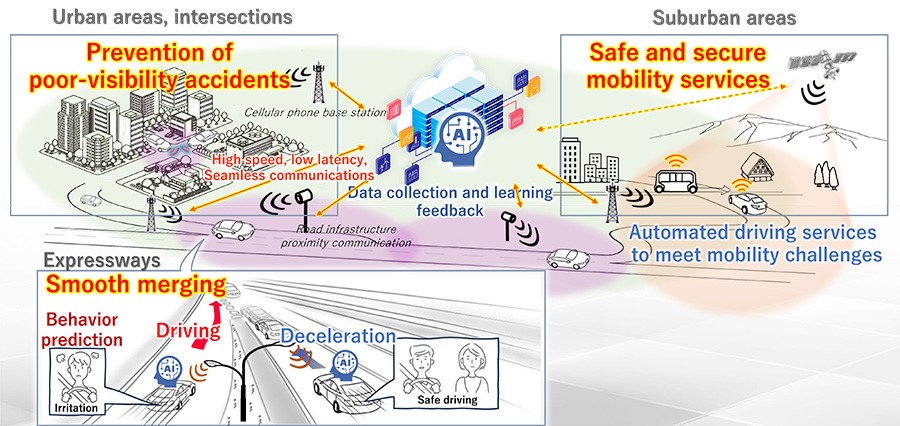

Toyota’s Vision for AI-Powered Mobility

This diagram illustrates Toyota’s long-term vision for AI-powered mobility, which aligns with the section’s theme of advancing projects from pilot phases to large-scale commercial deployment.

(Source: TechDogs)

Toyota’s AI Investment Data Analysis

Toyota has aggressively escalated its financial commitment to AI, moving from broad R&D spending to multi-billion-dollar strategic investments aimed at securing leadership in next-generation mobility and automation.

- In September 2025, the company launched a major investment initiative, establishing two new funds totaling $1.5 billion: the $670 million Toyota Invention Partners (TIP) for early-stage startups and the $800 million Woven Capital Fund II for growth-stage companies in AI and automation.

- This was followed by a planned $10 billion investment over five years into its U.S. operations announced in November 2025, with a stated focus on energy and artificial intelligence initiatives.

- These specific funds complement a broader $11.2 billion investment plan for “growth” technologies, including AI and EVs, announced in May 2024 after the company posted record profits.

Table: Toyota’s Key AI and Technology Investments (2024-2026)

| Entity / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Operations | Nov 2025 | A $10 Billion investment plan over five years with a significant focus on advancing AI and energy-related initiatives within its U.S. manufacturing and R&D footprint. | LA Times |

| Woven Capital Fund II | Sep 2025 | An $800 Million growth-stage fund targeting 20-25 investments in companies specializing in AI, automation, and future mobility solutions. | Tech Crunch |

| Toyota Invention Partners (TIP) | Sep 2025 | A new $670 Million strategic investment subsidiary created to fund and collaborate with early-stage technology startups. | Toyota Global |

| Joby Aviation | May 2025 | A $250 Million follow-on investment to deepen its stake in the electric air taxi startup, reinforcing a previous $1 billion pledge and its role in manufacturing. | Zag Daily |

| Joint R&D Investment with NTT | Oct 2024 | A $3.3 Billion joint investment by 2030 to develop a “Mobility AI Platform” for autonomous driving and smart city infrastructure. | Reuters |

Toyota’s Strategic AI Partnership Analysis

Toyota’s partnership strategy creates a web of specialized alliances designed to accelerate development in core areas, from foundational data platforms and quantum computing to the commercial deployment of autonomous systems and humanoid robots.

- In 2025-2026, partnerships shifted toward execution, exemplified by the collaboration with Deloitte and AWS to deploy “agentic AI” for supply chain modernization and the adoption of the Databricks platform to create a unified data and AI infrastructure across the company.

- The company is building the technical foundation for its next generation of vehicles through a partnership with NVIDIA, announced in January 2025, to use the NVIDIA DRIVE AGX Orin™ platform.

- Long-term research continues with a formal collaboration between TRI and Boston Dynamics, announced in August 2025, to develop Large Behavior Models for advanced humanoid robots like Atlas.

- To capture the autonomous vehicle market, Toyota is pursuing a dual strategy, partnering with Waymo to explore personally owned autonomous vehicles and advancing its joint venture with Pony.ai to mass-produce robotaxis.

Toyota and NTT’s Joint AI Platform

This chart details the architecture of the joint AI platform with NTT, providing a concrete example of the strategic partnerships discussed in the section.

(Source: AI Business)

Table: Toyota’s Critical AI Partnerships (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Pony.ai | Feb 2026 | Advanced a long-term joint venture to the mass-production phase for driverless robotaxis, aiming to scale commercial autonomous mobility services in China. | PR Newswire |

| Agility Robotics | Feb 2026 | Signed a commercial Raa S agreement to deploy humanoid robots in a Canadian assembly plant for logistics tasks, moving robotics from pilot to production. | Agility Robotics |

| Deloitte & AWS | Dec 2025 | Collaborating to move from AI pilots to production-scale “agentic AI” to modernize supply chain planning and other core operational processes. | Silicon ANGLE |

| Boston Dynamics | Aug 2025 | Engaged in a joint research effort with TRI to accelerate the development of general-purpose humanoid robots using Large Behavior Models. | Toyota Pressroom |

| Waymo (Alphabet) | Apr 2025 | Entered a preliminary agreement to explore collaboration on a new platform for next-generation, personally owned autonomous vehicles. | Bloomberg |

| NVIDIA | Jan 2025 | Announced it will build its next-generation vehicles on the NVIDIA DRIVE AGX Orin™ platform, securing a core technology supplier for future autonomous capabilities. | NVIDIA |

Toyota’s Geographic Focus on North America and Asia

Toyota’s AI activities are strategically concentrated in North America and Asia, aligning its technology development and deployment with its largest manufacturing hubs and key growth markets.

- Between 2021-2024, North America was a key site for foundational AI deployment, with Invisible AI’s computer vision platform being rolled out in factories across the region, including the plant in Princeton, Indiana.

- From 2025 onward, North America became a center for commercial-scale automation, highlighted by the $10 billion U.S. investment plan and the deployment of Agility Robotics’ humanoids at the Canadian manufacturing plant in Woodstock, Ontario.

- Asia, particularly Japan and China, serves as the hub for both long-term R&D and large-scale market deployment. The $3.3 billion “Mobility AI Platform” with NTT is based in Japan, as is the Woven City testbed.

- China is the primary market for Toyota’s robotaxi ambitions, where its joint venture with Pony.ai began mass production in 2026 for deployment in Tier-1 cities, and a partnership with Tencent was formed to integrate local AI services.

US Dominates Global AI Investment

This chart provides crucial context for Toyota’s strategic focus on North America, showing the region’s dominance in private AI investment.

(Source: Stanford HAI – Stanford University)

Toyota’s AI Technology Maturity Moves to Commercial Scale

The maturity of Toyota’s AI portfolio has advanced from research and limited pilots to commercially scaled applications, particularly in manufacturing automation and autonomous mobility services.

- The 2021-2024 period was characterized by R&D and controlled deployments. This included TRI’s work on generative AI for design, research into autonomous drifting with Stanford, and the initial rollout of 500 AI devices from Invisible AI in factories.

- In 2025-2026, the technology reached commercial validation. The agreement with Agility Robotics is a formal Robots-as-a-Service contract, not a pilot, and the joint venture with Pony.ai is now focused on mass production, signifying readiness for market deployment.

- Enterprise-level AI also matured, with the 2026 adoption of the Databricks Data Intelligence Platform to serve as a unified AI backbone for the entire company, moving beyond siloed projects.

- While advanced research continues in areas like quantum computing and general-purpose robotics, core applications in factory logistics, quality control, and autonomous ride-hailing are now in the commercialization or scaling phase.

AI Optimizes Car Aerodynamics

This chart provides a direct example of how AI is used in the design process, illustrating the technology’s maturity from R&D to practical application as described in the text.

(Source: Fox News)

SWOT Analysis of Toyota’s AI Strategy

Toyota’s AI strategy capitalizes on its immense financial strength and manufacturing prowess but faces threats from agile, tech-native competitors as it navigates the transition to software-defined mobility.

- This analysis evaluates Toyota’s strategic position by examining its strengths, weaknesses, opportunities, and threats, with a focus on how its position has evolved from the foundational period of 2021-2024 to the commercial scaling phase of 2025-2026.

Industrial AI Market Growth Forecast

This forecast illustrates the significant market opportunity in industrial AI, providing context for the ‘Opportunities’ aspect of the SWOT analysis introduced in this section.

(Source: IoT Analytics)

Table: SWOT Analysis for Toyota’s AI Initiatives

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong R&D foundation via TRI; renowned manufacturing efficiency (Kaizen); significant R&D spending. | Record net income ($32.7 B); massive capital allocation ($1.5 B new funds, $11.2 B growth tech plan); leading IP portfolio (3, 000+ AI patents). | Financial strength was validated and weaponized through massive, targeted AI funds, moving from general R&D spending to strategic capital deployment. |

| Weaknesses | Perceived as a laggard in pure EVs and software-defined vehicles compared to rivals like Tesla. | Heavy reliance on a complex network of partners (Waymo, Pony.ai, NVIDIA) can introduce integration risk and slow decision-making. | The shift to a partnership-heavy model to catch up in software and autonomy introduces new operational complexities, which remain an unresolved variable. |

| Opportunities | Leverage AI to improve existing manufacturing processes (e.g., with Invisible AI); explore autonomous driving concepts. | Dominate factory automation with humanoid robots (Agility Robotics); build new revenue streams from mobility platforms (NTT partnership); use Gen AI to shorten vehicle design cycles. | Opportunities have become more concrete and commercial, moving from process improvement to creating entirely new business lines (robotaxis, robotics-as-a-service). |

| Threats | Competition from established automakers and tech companies entering the automotive space. | Intensified competition from Chinese rivals in AI and EVs (prompting partnerships with Tencent); rapid pace of AI innovation risks making current technology obsolete. | The threat from Chinese automakers was explicitly acknowledged and addressed via partnerships, validating the competitive pressure in that key market. |

Forward-Looking Insights and Summary

Toyota’s primary strategic objective for the coming year is to successfully scale its commercial AI deployments in manufacturing and autonomous mobility to generate tangible returns on its multi-billion-dollar investments.

- The most critical signal to monitor is the performance and expansion of the Agility Robotics deployment. Success with the initial seven Digit robots will likely trigger a large-scale rollout across Toyota’s global manufacturing footprint, fundamentally changing factory logistics.

- Progress in the Pony.ai joint venture is another key indicator. The ability to deploy and operate a large fleet of robotaxis commercially in China will validate Toyota’s strategy of using partnerships to penetrate new mobility markets.

- The investment activity from the new $1.5 billion funds (TIP and Woven Capital Fund II) will reveal which emerging AI technologies Toyota prioritizes for its next wave of innovation, offering a roadmap to its future strategic interests.

- Finally, developments from the Woven City project will provide the first real-world validation of how Toyota’s various AI, robotics, and autonomous systems integrate into a cohesive mobility ecosystem, informing future product and service development.

Frequently Asked Questions

What is the main change in Toyota’s AI strategy between the 2021-2024 period and 2025-2026?

The primary change is a shift from foundational research and pilot projects to large-scale commercial deployments. For instance, Toyota moved from initial factory pilots with Invisible AI to a full commercial agreement with Agility Robotics for humanoid robots and advanced its joint venture with Pony.ai from development to mass production of robotaxis.

How much money is Toyota investing in AI according to the report?

Toyota has announced several major investments, including two new funds totaling $1.5 billion for startups (Woven Capital Fund II and Toyota Invention Partners), a planned $10 billion investment over five years into its U.S. operations focused on AI and energy, and a broader $11.2 billion investment plan for growth technologies like AI and EVs.

What are some real-world examples of Toyota using AI in its commercial operations in 2026?

In 2026, Toyota began deploying ‘Digit’ humanoid robots from Agility Robotics for logistics tasks in its Canadian manufacturing plant. Additionally, its joint venture with Pony.ai started the mass production of bZ4X-based driverless robotaxis, targeting a fleet of over 1,000 units for commercial service in China.

Who are Toyota’s most important AI partners mentioned for 2025-2026?

Key partners include Agility Robotics for humanoid factory robots, Pony.ai for robotaxi mass production, NVIDIA for the DRIVE AGX Orin™ autonomous vehicle platform, and Deloitte & AWS for modernizing its supply chain with ‘agentic AI’. Toyota is also partnering with Waymo to explore personally owned autonomous vehicles.

What are the biggest weaknesses or threats to Toyota’s AI strategy?

The main weakness identified is a heavy reliance on a complex network of external partners, which can introduce integration risks. The primary threats include intensified competition from Chinese rivals in the EV and AI space and the rapid pace of AI innovation, which could make Toyota’s current technology obsolete.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.