Total Energies’ USA AI Power Play: How Data Center PPAs Define its 2025-2026 Strategy

Total Energies is executing a highly strategic pivot from primarily using Artificial Intelligence for internal operational efficiency to becoming a premier commercial energy provider for the power-intensive data center industry. This shift is designed to capture the exponential growth in energy demand from the global AI boom, creating a new, high-margin revenue stream that directly links its renewables portfolio to the tech sector’s expansion. The company is capitalizing on this opportunity by signing massive, long-term Power Purchase Agreements (PPAs) with technology giants, positioning itself not merely as an adopter of AI but as a critical enabler of the AI revolution.

Total Energies’ Commercial Scale Projects Shift from Internal AI Tools to Powering the AI Industry 2026

Total Energies has fundamentally evolved its AI strategy from developing internal optimization tools to establishing a major commercial business line supplying renewable energy directly to the AI sector.

- Between 2021 and 2024, the company’s AI initiatives were focused on internal efficiency and operational safety. Key projects from this period included the development of the AUSEA drone-based system for methane detection, the ARGOS autonomous robot project for offshore platforms, and partnerships with Cerebras and Google Cloud to enhance subsurface analysis for oil and gas exploration.

- Beginning in 2025, the strategy pivoted decisively toward external commercialization, targeting the immense energy demand of AI data centers. This is demonstrated by a series of major Power Purchase Agreements (PPAs), most notably the landmark deal in February 2026 to supply 1 GW of solar capacity to Google‘s Texas data centers, its largest US renewable PPA to date.

- This strategic shift transforms the challenge of the energy transition into a lucrative opportunity. While earlier projects like AI-powered plastic sorting and deploying Microsoft Copilot internally built foundational capabilities, the recent wave of PPAs in the USA and Asia signifies a move to a scalable, revenue-generating business model that positions Total Energies as an indispensable energy partner for Big Tech.

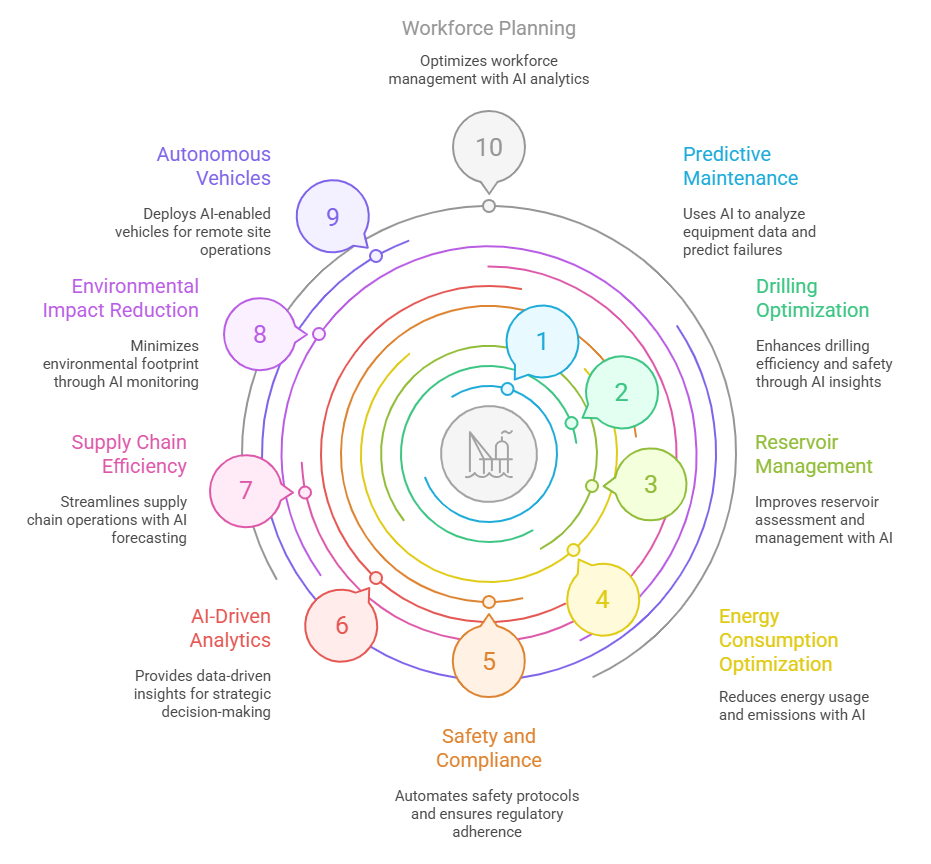

AI Applications Transforming Oil & Gas Operations

This chart illustrates the internal AI tools for operational efficiency, such as predictive maintenance and autonomous vehicles, that formed the first phase of Total Energies’ strategy before its commercial pivot.

(Source: Intelegain)

Total Energies’ Investment Analysis: Over $1 Billion Earmarked for AI-Driven Energy Strategy

Total Energies is allocating significant capital to both enhance its internal AI capabilities and build the renewable energy infrastructure required to service the AI industry, underscoring a firm financial commitment to its dual-pronged strategy.

- The company has explicitly planned a US$1 billion investment in its AI strategy between 2026 and 2028, which is aimed at increasing plant uptime and improving operational efficiency across its asset base. This investment creates the financial and operational capacity to support its expansion into new energy markets.

- This is complemented by a broader US$5 billion investment allocated for low-carbon energy in 2025. This capital provides the direct funding for constructing the large-scale solar and wind farms needed to fulfill its long-term PPA commitments to data centers.

- Earlier strategic moves, such as the acquisition of Swiss AI startup Predictive Layer in December 2023, demonstrate a forward-thinking approach to internalizing key technologies. This acquisition was specifically aimed at bolstering its electricity trading operations, a critical function for managing and profiting from its growing portfolio of renewable generation assets.

TotalEnergies Details $15 Billion 2026 Capex Plan

The chart shows the company’s 2026 capital expenditure plan, providing the financial context for the investments in low-carbon energy required to service the AI industry as described in the text.

(Source: Seeking Alpha)

Table: Total Energies Strategic AI & Data Center Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| AI Strategy Investment | 2026-2028 | US$1 Billion investment to use AI to increase plant uptime and operational efficiency, funding the company’s broader strategic initiatives. | Wood Mackenzie |

| Low-Carbon Energy CAPEX | 2025 | US$5 Billion in capital allocated to low-carbon energy, providing the financial foundation for renewable projects that power AI data centers. | enkiai.com |

| Data Platforms in Refineries | 2025-2028 | $300 Million investment in data platforms within refineries to leverage data for operational optimization, freeing up capital for growth areas. | Hydrocarbon Processing |

| Acquisition of Predictive Layer | December 2023 | Acquisition of a Swiss AI startup to internalize machine learning solutions and enhance the performance of electricity trading operations. | startupticker.ch |

Total Energies’ Partnership Strategy: Securing Long-Term PPA Dominance with Tech Giants

Total Energies has built a robust ecosystem of partnerships that solidifies its role as a key energy provider for the AI revolution, locking in long-term revenue through strategic alliances with technology leaders and data center operators.

- The cornerstone of this strategy is the series of large-scale, long-term PPAs with Google. The agreements announced between November 2025 and February 2026 cover data centers in Texas (1 GW, 15 years), Ohio (15 years), and Malaysia (21 years), making Total Energies a primary supplier for Google‘s global AI infrastructure.

- Beyond a single partner, Total Energies is diversifying its customer base within the data center sector. The 10-year agreement with European operator Data 4 in November 2025 to power its Spanish sites demonstrates a broader market strategy targeting both hyperscalers and regional data center players.

- These commercial agreements are supported by a foundation of technology partnerships. Collaborations with industrial AI firms like Cognite and Emerson are standardizing data platforms across assets to make them “AI-ready, ” while the partnership with French startup Mistral AI is developing bespoke generative AI tools to optimize its multi-energy business, creating a virtuous cycle of efficiency and growth.

TotalEnergies Details Data Center Partnerships with Tech Giants

This infographic directly supports the section by visualizing the large-scale Power Purchase Agreements (PPAs) that TotalEnergies has secured with tech giants like Google to power their data centers.

(Source: Seeking Alpha)

Table: Total Energies AI and Data Center Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| February 2026 | A 15-year PPA to supply 1 GW of solar capacity for Google‘s Texas data centers, representing the company’s largest US renewable PPA. | Houston Chronicle | |

| December 2025 | A 21-year PPA to supply 1 TWh of renewable energy for Google‘s data centers in Malaysia, securing a foothold in the growing Asian market. | Reuters | |

| Honeywell | November 2025 | Pilot program to deploy Honeywell‘s AI-assisted Experion Operations Assistant at the Port Arthur Refinery to improve control room decisions and safety. | Total Energies US |

| Data 4 | November 2025 | A 10-year agreement to supply renewable electricity to Data 4‘s data center sites in Spain, diversifying its European customer base. | Reuters |

| Cognite | September 2025 | Expanded partnership to scale Cognite‘s industrial AI platform across all upstream assets, making complex operational data “AI-ready.” | Data Center Dynamics |

| Mistral AI | June 2025 | Collaboration to develop bespoke generative AI tools to optimize its multi-energy business, with a focus on renewables and emissions reduction. | Reuters |

Total Energies’ Global Expansion: A Geographic Pivot to US and Asian Data Center Hubs

Total Energies has executed a clear geographic pivot, leveraging its foundational AI capabilities developed primarily in Europe to aggressively capture high-growth data center power markets in the United States and Asia.

- Between 2021 and 2024, the company’s AI-related activities were concentrated in Europe, focusing on building internal capacity. This included strategic partnerships with French firms like Microsoft, collaborations at its Pau research hub, and the pivotal acquisition of the Swiss AI startup Predictive Layer to enhance its trading operations.

- Starting in 2025, the geographic focus has shifted dramatically to align with the global distribution of major data center hubs. The United States has become the primary target for large-scale commercial deployment, evidenced by major PPAs with Google in Texas and Ohio.

- Simultaneously, Total Energies is establishing a strong presence in Asia’s burgeoning digital economy, highlighted by the 21-year PPA to power Google‘s data centers in Malaysia. This move, combined with its continued presence in European markets like Spain via the Data 4 deal, demonstrates a targeted global strategy to supply power wherever AI demand is surging.

TotalEnergies’ Strategic Shift Towards Renewable Electricity by 2030

This chart shows the planned increase in renewable electricity’s share of the sales mix, which is the core product enabling the company’s geographic pivot to US and Asian data center markets.

(Source: CarbonCredits.com)

Total Energies Technology Maturity: From Internal Pilots to Commercially Validated AI Power Solutions

Total Energies has rapidly advanced its application of AI from internal R&D and pilot programs to a fully commercialized, scalable business model centered on long-term, high-value energy contracts for the AI industry.

- The period from 2021 to 2024 was characterized by the development and deployment of proprietary technologies aimed at internal optimization. These included the AUSEA drone for emissions monitoring, the ARGOS robotics project for offshore safety (targeting 2030), and the use of specialized AI supercomputers like the Cerebras CS-2 for complex geological modeling. These initiatives represented pilot-to-deployment stage technologies.

- Since 2025, the company’s AI-related activity has reached full commercial validation. The landmark 1 GW PPA with Google is not an experiment but a large-scale, bankable commercial agreement that establishes a new revenue stream. This model is expected to generate over $250 million in annual earnings.

- This progression shows that Total Energies has successfully translated its internal AI expertise into an external, market-facing product. The ability to secure a reported ~10% premium on power sales to data centers confirms that the market values the reliable, large-scale renewable energy solutions that Total Energies can now provide, marking a definitive shift from R&D to commercial dominance.

Total Energies SWOT Analysis: Leveraging AI to Capture the Data Center Power Market

Total Energies has effectively utilized its strengths in digital innovation and project execution to seize the opportunity presented by the AI-driven surge in energy demand, though this dual-focus strategy introduces new competitive pressures and operational complexities.

- This SWOT analysis reveals a clear strategic progression. The company transitioned from building internal AI capabilities in the 2021-2023 period to actively monetizing those capabilities by serving a massive new market from 2024 onward. The core change is the validation of “powering AI” as a profitable, standalone business line.

TotalEnergies Balances 2030 Energy Growth and Emissions Goals

This chart visualizes the high-level strategic goals discussed in the SWOT analysis, balancing increased energy production with significant targeted emissions reductions.

(Source: CarbonCredits.com)

Table: SWOT Analysis for Total Energies’ AI and Data Center Strategy

| SWOT Category | 2021 – 2023 | 2024 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Early adoption of AI for internal efficiency (e.g., Cerebras CS-2 for research, subsurface analysis tools). Building a digital foundation. | Dual-pronged strategy (O&G optimization funding renewables). Integrated power business model. Proven ability to sign large, multi-year PPAs with tech giants like Google. | The company successfully transitioned its digital strength from an internal cost-saver to an external revenue-generator. |

| Weaknesses | Reliance on third-party partners (Microsoft, SLB) for core technology. Focus remained on optimizing legacy assets. | High CAPEX required to build out renewable capacity for PPAs ($5 billion in 2025). Execution risk on massive projects. Complexity of managing a global, multi-energy portfolio. | The strategy’s success is now dependent on large-scale project execution and delivery, a more complex challenge than internal software pilots. |

| Opportunities | Improving operational efficiency in oil and gas. Using AI for emissions reduction and safety on platforms (AUSEA, ARGOS). | Exponential growth in energy demand from AI data centers. Ability to command a ~10% premium on PPAs. Securing long-term revenue (over $250 M/year) insulated from commodity volatility. | A massive, high-margin market (power for AI) emerged and was validated as a core business opportunity, shifting the strategic focus. |

| Threats | Competition from other energy majors (e.g., Shell, Equinor) also investing in digitalization and AI. Pace of technological change. | Direct competition for high-value data center PPAs. Grid constraints in key regions (e.g., Texas). Potential for regulatory shifts impacting renewable project timelines and costs. | Competition is no longer just about digital leadership but about securing specific, high-value contracts with a limited pool of hyperscale customers. |

Forward-Looking Insights: Total Energies Must Execute on PPA Pipeline to Realize AI Power Profits

The most critical action for Total Energies in the year ahead is the successful execution of its extensive pipeline of renewable energy projects to transform its massive contractual PPA victories into operational, revenue-generating assets.

- The primary focus will be on the financial performance of the Integrated Power segment, as investors and the market watch to see if the company can deliver on its projection of over $250 million in annual earnings from its data center deals once the associated solar projects are fully operational.

- Progress on the $1 billion AI investment plan (2026-2028) will be a key indicator to monitor. Stakeholders will look for quantified efficiency gains and cost improvements that demonstrate the investment is strengthening the core business and funding further growth in the renewables-for-AI sector.

- Watch for the announcement of new large-scale PPAs, potentially with other tech giants beyond Google. Securing contracts with companies like Amazon, Microsoft, or Meta would further validate this business model and solidify Total Energies‘ market-leading position.

- The outcomes of the collaboration with Mistral AI should be closely followed. The development of bespoke generative AI tools for managing complex, intermittent renewable energy systems could provide a significant competitive advantage in optimizing the delivery of power to its data center clients.

Frequently Asked Questions

What is the main change in Total Energies’ AI strategy for 2025-2026?

The primary change is a strategic pivot from using AI for internal operational efficiency to a major commercial business focused on selling renewable energy to the power-intensive AI data center industry. Instead of just using AI, Total Energies is now focused on powering the AI revolution through large-scale Power Purchase Agreements (PPAs).

How is Total Energies funding its new strategy to power data centers?

The company is using a dual-investment approach. It has allocated US$5 billion for low-carbon energy in 2025 to build the required solar and wind farms. This is supported by a separate US$1 billion investment planned for 2026-2028 to use AI to enhance its own operational efficiency, which frees up capital and capacity for this new commercial venture.

Who are Total Energies’ main partners in this data center power play?

The cornerstone partner is Google. Total Energies has signed several massive, long-term PPAs to supply Google’s data centers in Texas (1 GW), Ohio, and Malaysia. The company is also diversifying its customer base with deals like the 10-year agreement to power European operator Data 4’s sites in Spain.

Why are Power Purchase Agreements (PPAs) so important to this strategy?

PPAs are critical because they are long-term contracts (often 10-21 years) that lock in a stable, high-margin revenue stream for Total Energies. These agreements, such as the 1 GW deal with Google, validate the business model and position the company as an indispensable energy partner for Big Tech, insulating it from the volatility of traditional energy markets.

How does this new strategy benefit Total Energies financially?

This strategy creates a new, profitable business line. The company can reportedly command a ~10% price premium on power sold to data centers. Once the renewable projects are operational, these PPA deals are expected to generate over $250 million in annual earnings, providing a significant and stable new source of revenue.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.