Bosch Quietly Exits the SOFC Market – The Signals Were There All Along

🚗 Ever looked in a car’s side mirror and seen the warning: “Objects in mirror are closer than they appear”? Similarly, Bosch’s SOFC ambitions appeared closer to success than they truly were.

That’s how PR works—but in reverse. Instead of making things seem closer, it makes companies look bigger, stronger, and more dominant than they actually are.

For years, Bosch positioned itself as a major force in the Solid Oxide Fuel Cell (SOFC) market. It invested heavily, formed strategic partnerships, and announced ambitious plans for commercialization.

Then, seemingly out of nowhere, Bosch announced it would discontinue its SOFC business, end its partnership with Ceres Power, and shift focus to hydrogen electrolysis.

🔹 Could this exit have been predicted earlier?

🔹 Were there warning signs hidden in Bosch’s commercial activities?

For Enki customers, this was no surprise. The data told the story long before the headlines did.

Tracking Bosch’s SOFC Journey – The Signals Were Clear

Tracking Bosch’s SOFC Journey – The Signals Were Clear Strategic withdrawals don’t happen overnight—they leave a trail of signals that Enki can detect early, providing key insights into market shifts before they become public knowledge. 🚀

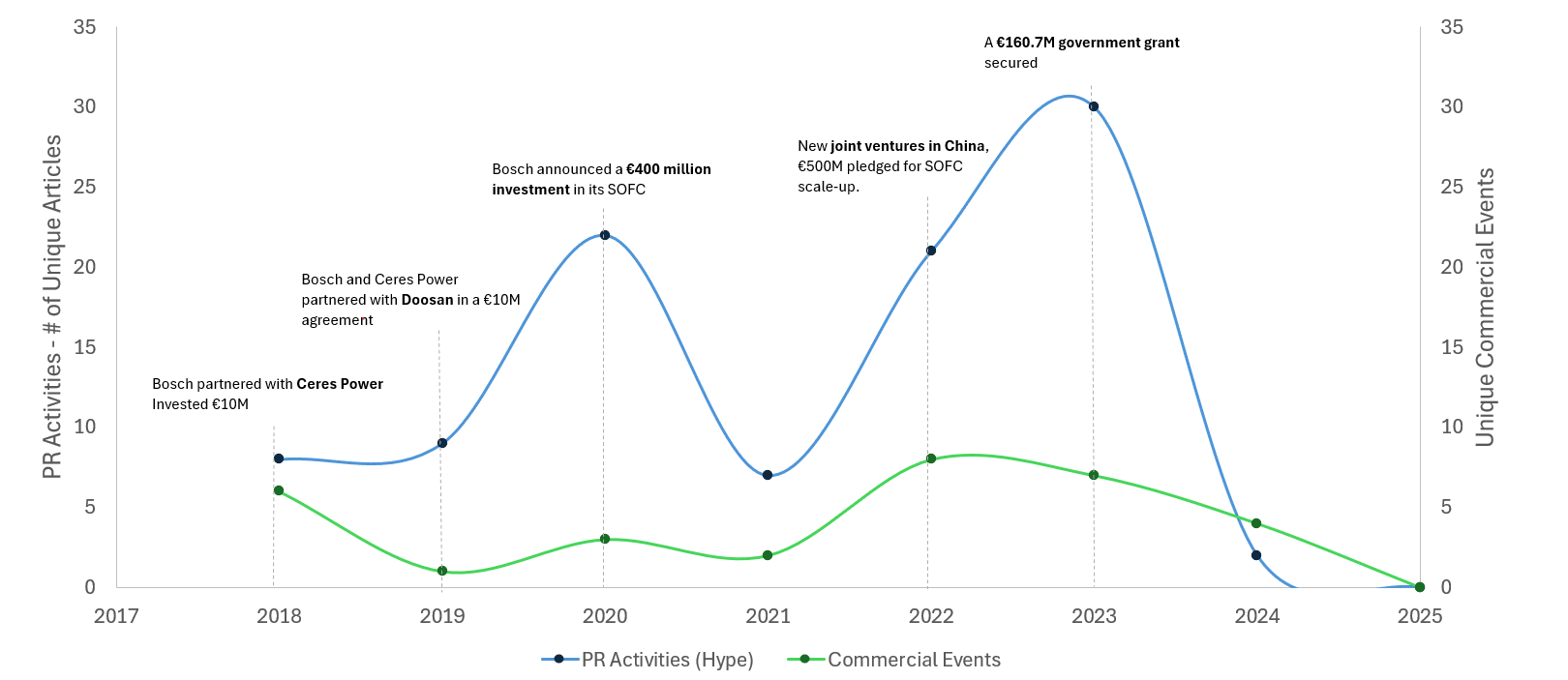

In 2018, Bosch made a grand entrance into the SOFC market (see Figure 1). Here’s what happened next:

✅ 2018: Bosch partnered with Ceres Power, investing £9M (€10M) in SOFC development.

✅ 2019: Expanded into Korea, signing an £8M agreement with Doosan.

🟢 2020: Announced a €400M SOFC investment, increasing its stake in Ceres Power to 18%.

✅ 2022: Established joint ventures in China, pledging €500M for SOFC scale-up.

✅ 2023: Secured a €160.7M government grant—but no major commercial expansion followed.

🚨 2024: No updates on production capacity. PR silence.

🚨 2025: Bosch exits the SOFC market, shifting focus to hydrogen electrolysis.

Unveiling the Gap: PR Hype vs. Commercial Progress in Bosch’s SOFC Ambitions

At first glance, this timeline suggests momentum. But the real story is in the gap between PR hype and actual commercial execution.

Figure 1. Trends in PR Activities and Commercial Events in the Solid Oxide Fuel Cell for Bosch (2017-2025)

📊 Left Y-Axis (PR Activities – Hype): Represents the number of unique media articles covering Bosch’s SOFC technology, reflecting the amplification of corporate PR efforts across multiple channels. 📊 Right Y-Axis (Unique Commercial Events): Tracks real business activities such as partnerships, funding announcements, and product launches—key indicators of actual market traction. This data comes directly from Enki’s AI engine, ensuring a precise mapping of commercial momentum and early detection of strategic shifts. 🚀

🔵 Blue Line (PR Hype): Shows media coverage fluctuations, with peaks following major announcements. This includes both original corporate PR and media amplification, where third-party outlets pick up and expand on Bosch’s news.

🟢 Green Line (Commercial Events): Represents tangible commercial milestones—partnerships, investments, and deployments. Unlike PR, these events follow a more measured and organic trajectory. The chart contrasts PR-driven hype cycles with actual commercial progress, revealing how Bosch’s media strategy inflated perception while commercial traction remained inconsistent.

PR Hype vs. Commercial Action in Bosch’s SOFC Ambitions—The Mismatch

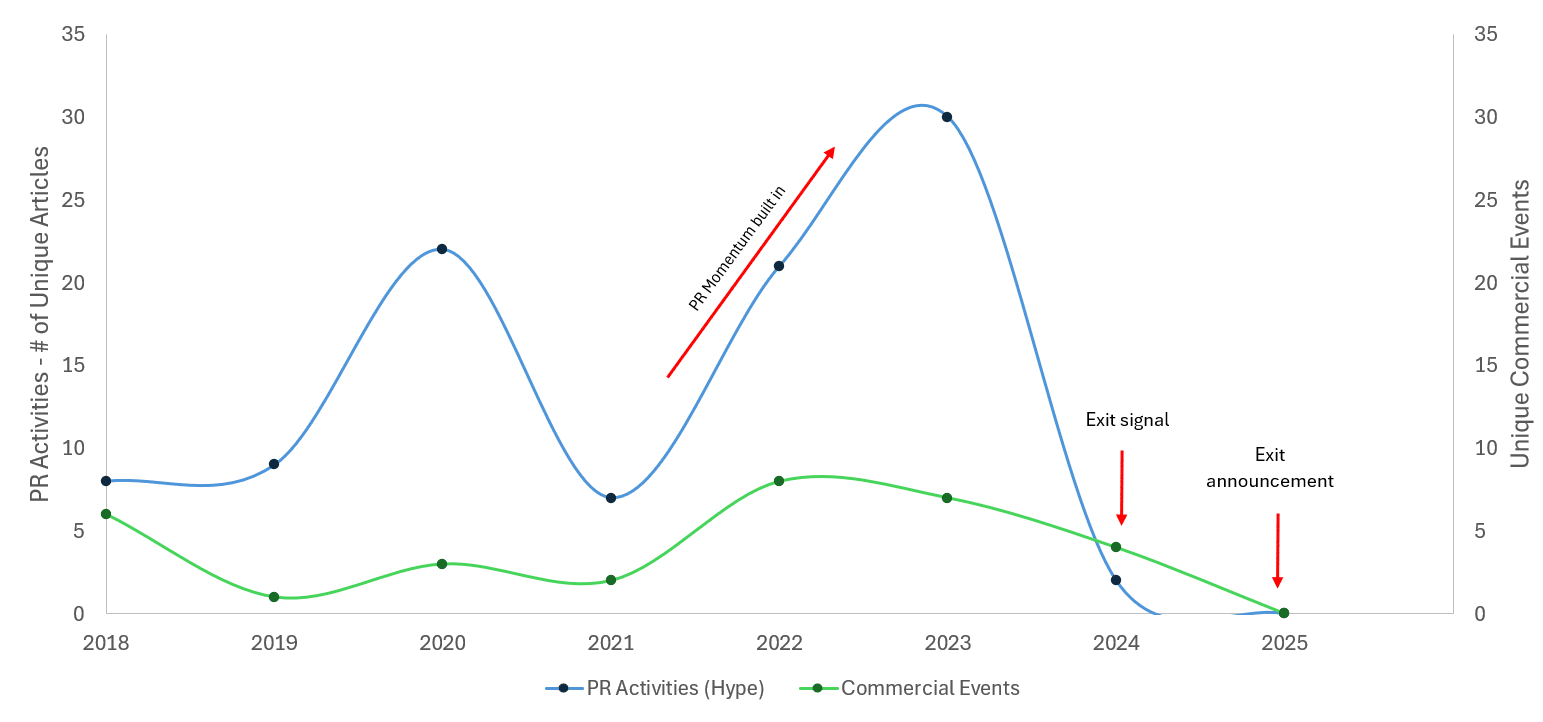

Bosch’s media coverage peaked twice—first in 2020, then again in 2023 (see Figure 2). These spikes aligned with major investment announcements:

📣 €400M investment in 2020

✅ €500M commitment in 2022

📣 €160.7M government grant in 2023

But while PR activity (blue line) surged, actual business execution—real partnerships, product launches, large-scale deployments—followed a slower trajectory (green line).

“Supplying the country with hydrogen from renewable energies will be indispensable in the future in order to achieve the climate goals.”

– Winfried Kretschmann, Minister-President of Baden-Württemberg (2023)

The announcements were grand. But the real question was: ❌ Where was the execution?

But while the PR team was busy, commercial activities—partnerships, large-scale deployments, and product launches—remained inconsistent. The mismatch suggests more storytelling than substance, likely to maintain public perception rather than drive real growth.

By 2022, Bosch had peak commercial events but failed to sustain momentum. Despite securing a €160.7M grant in 2023, business activity declined instead of expanding.

📌 This is a textbook warning sign of an impending strategic retreat.

Figure 2. PR Hype vs. Commercial Reality – Bosch’s SOFC exit followed a predictable pattern

🚨 The Warning Signs Were There – Here’s What They Meant

📉 PR Spikes Hint at Internal Struggles

Big PR pushes without sustained business action often signal trouble—a need to attract partners, justify spending, or mask stagnation. The lack of follow-through suggests Bosch struggled to convert hype into results.

📉 Unique Events Peaked in 2022, Then Declined Despite heavy PR in 2023, real business activity dropped after 2022. Instead of expansion, Bosch slowed investment and hesitated—classic signs of a strategic retreat.

📉 Last-Resort’ PR Surge in 2023 A final media push without matching business expansion is a classic sign of an impending strategic retreat—a red flag Enki detected early. 📉 PR Collapse in 2024 = Imminent Exit

Bosch’s PR flatlined in 2024, a typical precursor to market withdrawal. A gradual decline in PR and real events might suggest a winding-down phase, but a sharp drop to near-zero in 2024 implies a sudden decision—possibly triggered by an external factor

Enki’s real-time commercial intelligence spotted Bosch’s exit trajectory long before it became public. By tracking early warning signals, Enki provides foresight into clean tech market movements—before the headlines confirm them.

What This Means for the Clean Tech Market

Bosch’s SOFC exit is a case study in how not all clean tech investments translate into long-term market success.

It also highlights a critical insight for investors and industry watchers:

📌 PR and funding announcements aren’t enough. Real business activity**—commercial deals, JVs, and large-scale deployments—are what matter.**

Enki has seen this pattern before.

✅ It flagged Cummins’ SOFC exit.

📣 It captured Bloom Energy’s rise based on early commercial momentum.

✅ It predicted Bosch’s SOFC exit based on declining real activity.

Understanding market signals, not just media narratives, is the key to seeing where the clean tech industry is really headed.

Final Thoughts

Bosch’s SOFC ambitions may have ended, but the broader clean energy transition continues.

The big question now is: Will Bosch’s hydrogen strategy succeed where SOFC failed?

Tracking commercial signals—not just announcements—will be crucial in predicting the answer.

What other clean tech market moves do you want Enki to analyze? Drop your thoughts below.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.