🚀 Why Bloom Energy is Crushing the Hydrogen Market (And What You Can Learn From It)?

The hydrogen market is undergoing a massive transformation, and Bloom Energy is leading the charge. Over the past year, its stock has surged +160.92% YoY, leaving key hydrogen benchmarks like Global X Hydrogen ETF (-21.84%) and Defiance Next Gen Hydrogen ETF (-23.67%) in the dust.

So, what’s their secret? 🤔

🟢 The Hidden Drivers of Hydrogen Market Success

In early-stage technology, revenue is a backward indicator—it grows when you get everything right. But relying on revenue alone is like driving while only looking in the rearview mirror. Instead, focus on the commercial activities that drive future growth:

- Product launches & pilots

- Strategic partnerships & joint ventures

- Investments & licensing deals

These are the real drivers of long-term success.

Tracking all that manually is a headache though—so we use Enki to monitor who’s investing, who’s partnering, and who’s quietly making moves behind the scenes.

Early commercial momentum often signals who will dominate later. If a company is racking up deals, forging alliances, and focusing on the right niches, chances are they’ll be leading the pack when the market matures.

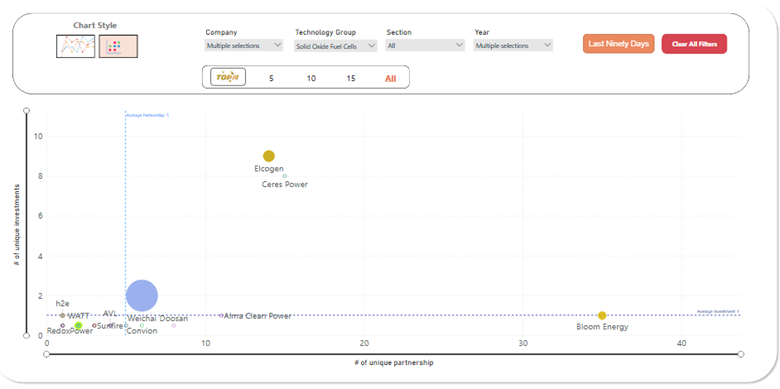

📊 Who’s Leading the SOFC Game?

Enki analyzed five years of commercial activities, analyzing and structing over 6,000 news articles to uncover key trends in the solid oxide fuel cell (SOFC) market. Bloom Energy has been steadily accelerating its commercial partnerships year over year, while Elcogen has emerged as a rising player with a € 140 million fundraise. Ceres Power is also making strides, securing a £43 million licensing deal with Delta Electronics. Early-stage commercial activities often indicate future market leaders, making these developments worth watching.

Figure 2. Partnership and Investment Landscape in Solid Oxide Fuel Cells (SOFC) Industry

This chart visualizes the number of unique partnerships (X-axis) and unique investments (Y-axis) among key players in the SOFC industry over the last 5 years. Larger bubble sizes indicate monetary activities.

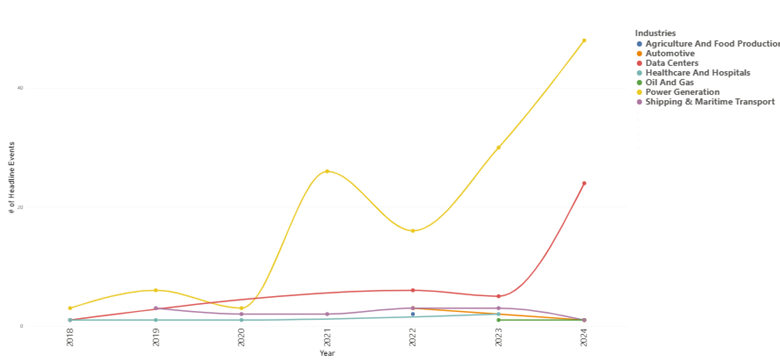

Powering the AI Boom: How Bloom Energy’s SOFC Microgrids Are Reshaping Data Centers

The key question is where these partnerships are focused. Combined Heat and Power (CHP) applications and data centers are driving most of these deals. Since 2023, Bloom Energy has positioned itself to capitalize on the growing demand for data center power solutions. SOFC technology could be a breakthrough for power-hungry data centers due to its dual-fuel capability, CHP integration, and efficiency. Recognizing this potential, Bloom Energy has tailored products specifically for the data center market.

Figure 3. Growth of Unique Industry Applications in the Solid Oxide Fuel Cell (SOFC) Market Over Time

This chart illustrates the expansion of unique applications for Solid Oxide Fuel Cells (SOFCs) across various industries over time. The Y-axis represents the number of distinct applications, while the X-axis represents the timeline from earlier years to the present.

During its partnership agreement with Quanta, Aman Joshi, Bloom Energy’s Global Chief Commercial Officer, underscored the urgency of AI infrastructure, stating, “Leaders in the AI industry like Quanta simply do not enjoy the luxury of being able to wait for traditional grid infrastructure, because the marketplace won’t wait for them.” He further emphasized Bloom’s advantage, saying, “Bloom’s SOFC microgrids provide AI customers with a flexible, pay-as-you-grow solution that is ready to scale and avoids additional transmission or distribution upgrades. This effectively shortens interconnection permitting associated with traditional infrastructures.”

Key Partnerships and Expanding Market Influence

Beyond its technology, Bloom Energy has built a dedicated sales and technical support team to expand its reach in the data center sector, reinforcing its strategic focus on this high-growth market.

Let’s have a deeper look at Bloom Energy’s recent deals:

🚀 80 MW fuel cell project in South Korea – the world’s largest single-site SOFC installation.

✅ 1 GW partnership with American Electric Power (AEP) for data centers.

✅ Quanta expansion: Boosting their existing SOFC installation by 150%.

🌱 20 MW deal with FPM Development for fuel cell-powered energy servers.

✅ $125M funding secured for 19 MW of Energy Server deployments.

South Korea’s 80 MW project is not just about capacity—it cements Bloom’s dominance in a government-backed clean energy initiative. Korea has aggressive decarbonization targets, and this deal positions Bloom as the de facto SOFC supplier for future expansions.

1 GW with AEP for data centers is a major inflection point. The data center industry is under pressure to meet ESG goals, and fuel cells are seen as a bridge between carbon-heavy grids and full renewable integration. If successful, this could set a precedent for hyperscalers like Google, Microsoft, and AWS to follow suit.

Quanta’s expansion signals an interesting trend: repeat customers scaling up SOFC deployments. The key takeaway here is customer stickiness and economic viability—a clear indicator that SOFC technology is delivering real-world ROI beyond just pilot phases.

The $125M funding for 19 MW of Energy Servers signals a shift towards project finance-backed fuel cell deployments. Rather than companies purchasing SOFCs outright, third-party financiers are betting on SOFCs as bankable assets, enabling Energy-as-a-Service (EaaS) models.

Is Bloom Energy Moving to Its Hyper-Scaling Moment?

Bloom Energy and the Hydrogen Market are no longer in an experimental phase—they are actively reshaping the SOFC industry at scale. But is this the tipping point for mass adoption? Here’s what to watch:

🔁 Repeat Customers Signal a Breakout Moment

✅ Quanta and FPM are expanding their SOFC investments – Will we see even more customers doubling down on Bloom’s tech?

⚡ Data Centers and Utilities Are Becoming Bloom’s Power Play

✅ 1 GW deal with AEP is a major milestone – Will AWS, Google, and Microsoft follow suit to power their data centers with SOFCs?

💰 SOFC Financing is Taking Shape—Will It Unlock Massive Growth?

✅ $125M in structured financing for Energy Servers – Is this the beginning of an energy subscription model for fuel cells?

✅ Capital barriers are coming down – Will we see more third-party financiers backing SOFC projects like solar PPAs?

🌊 SOFC adoption in shipping & maritime surges as regulations tighten – Will SOFC make its move into new sectors?

Want to learn more? Get in touch with us.

Let us know what you think below.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.