📄 Download Full Report

Enter your email to receive this analysis as a PDF.

Ceres Power SOFC Commercialization: 2025 Data Center Strategy and Market Adoption

Ceres Power Commercial Projects Signal Shift to Mass Market Adoption in 2025

In 2025, Ceres Power transitioned from technology development and licensing agreements to commercial validation, marked by a key partner entering mass production for the high-demand data center market. This shift demonstrates the industrial maturity of its solid oxide platform and its strategic positioning to capitalize on urgent power needs driven by artificial intelligence.

- The period between 2021 and 2024 was characterized by the establishment of a licensing portfolio, including a significant £43 million agreement with Delta Electronics and manufacturing deals with DENSO and Thermax. This foundational work set the stage for the pivotal event in July 2025, when partner Doosan Fuel Cell began mass production of Solid Oxide Fuel Cell (SOFC) systems in South Korea.

- The application focus sharpened significantly in 2025. While earlier partnerships targeted broad industrial uses, Doosan’s mass production directly targets the power-intensive AI data center and commercial building sectors. This move aligns Ceres’ technology with a high-growth, high-margin market.

- The year also saw a dual-track validation of Ceres’ core technology. While SOFC for power generation reached mass production, the Solid Oxide Electrolyser Cell (SOEC) technology for green hydrogen achieved major milestones, including first hydrogen production at Shell’s megawatt-scale demonstrator in May 2025. This indicates broad market acceptance of the versatile solid oxide platform for both power and hydrogen applications.

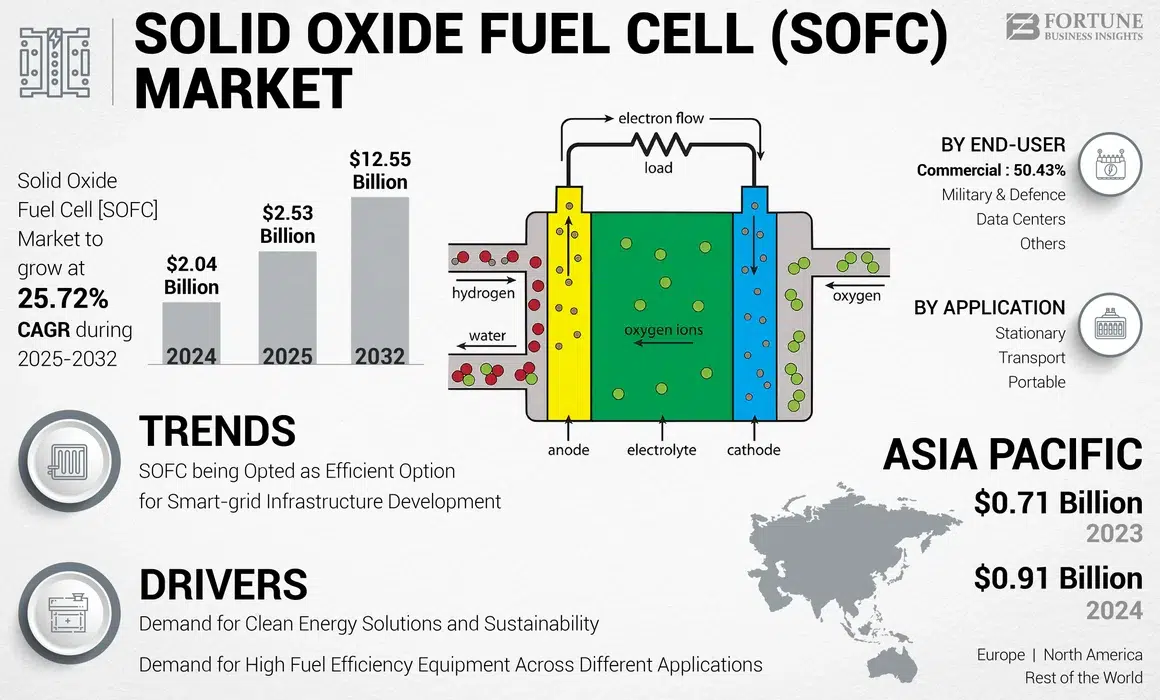

SOFC Market Primed for Growth

The section’s focus on a mass-market shift for data centers is perfectly contextualized by this chart, which forecasts strong SOFC market growth and explicitly names data centers as a key end-user.

(Source: Fortune Business Insights)

Investment Analysis: Ceres Power Navigates Pre-Commercial Finances Amid Market Scrutiny

Ceres Power’s financial performance in 2025 reflects the pre-commercial nature of its licensing model, with revenues declining due to the irregular timing of one-off fees, while significant earlier investments in technology development began to yield commercial results. Investor sentiment remains highly sensitive to commercial milestones over traditional financial metrics, rewarding tangible progress toward recurring revenue streams.

- Revenue in H 1 2025 fell to £21.1 million, a 26% decrease from the prior year. This highlights the company’s current reliance on large, infrequent licensing fees, such as the £43 million deal with Delta Electronics in 2024, rather than a steady flow of royalty income.

- The company continued to operate at a loss, reporting a £19.6 million post-tax loss for H 1 2025. This is consistent with its growth phase, which was funded by a £181 million equity raise in 2021 and a £100 million strategic investment in its SOEC technology.

- Investor reaction demonstrated a focus on commercial execution. The company’s stock surged 44% after Doosan’s mass production announcement in July 2025. This occurred despite underlying revenue weakness and a critical short-seller report from Grizzly Research in December 2025 that questioned the long-term viability of the business model.

Table: Ceres Power Key Investments and Financial Milestones

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Delta Electronics License | Jan 2024 | Technology transfer and licensing agreement for SOFC and SOEC stacks, valued at approximately £43 million. This provided significant non-dilutive capital and a manufacturing partner in Asia. | Ceres licences fuel cell technology to Delta |

| SOEC Technology Development | 2023 | A £100 million internal investment committed to developing its SOEC technology. This strategic allocation of capital aimed to capture a leading position in the high-efficiency green hydrogen production market. | Ceres collaborates with Bosch and Linde Engineering |

| Equity Fundraising | Mar 2021 | Successfully raised £181 million through a share placement, supported by strategic partners Bosch and Weichai. The funds were allocated to support technology development and operational activities. | Ceres Power set for a make-or-break year as it looks to China |

Partnership Strategy: Ceres Power Validates Licensing Model Amid Partner Risks in 2025

Ceres Power’s partner-dependent model experienced both its greatest validation and its most significant risk in 2025, as one key partner began mass production while another major collaboration was terminated. This highlighted the dual-edged nature of a strategy that offers scalability at the cost of direct control over commercial execution.

- The period from 2021 to 2024 was defined by building a portfolio of strategic alliances with industrial giants like Bosch, Weichai, Doosan, and Shell. The planned £30 million joint venture in China with Bosch and Weichai, however, failed to conclude in January 2024, an early indicator of execution risk.

- This risk materialized in February 2025 when the long-standing partnership with Bosch was officially concluded after Bosch shifted its strategic focus to PEM electrolyzer technology. This event underscored the vulnerability of the licensing model to partners’ internal strategic changes.

- Conversely, the model was strongly validated in July 2025 when Doosan Fuel Cell commenced mass production of SOFC systems. This success was followed by a new SOFC manufacturing license with Weichai Power in November 2025, demonstrating the strategy’s high potential when partners successfully execute their manufacturing roadmaps.

Table: Ceres Power Strategic Partnership Developments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Weichai Power | Nov 2025 | Signed a manufacturing license agreement for SOFC power systems, expanding Ceres’ manufacturing footprint into China and targeting the stationary power market. | Ceres signs manufacturing licence for SOFC power |

| Doosan Fuel Cell | Jul 2025 | Partner commenced mass production of fuel cell stacks and systems using Ceres’ technology. This milestone validated the licensing model and targets the AI data center market. | Doosan Fuel Cell begins mass production |

| Shell | May 2025 | A megawatt-scale SOEC demonstrator at Shell’s Bangalore technology center produced its first hydrogen. This project validates the technology for large-scale industrial green hydrogen production. | Shell – Ceres MW Scale Electrolyser Project |

| Bosch | Feb 2025 | The technology partnership was concluded after Bosch realigned its strategy to focus on PEM electrolyzers, highlighting the inherent risk of a partner-dependent model. | Bosch to ditch solid-oxide fuel cells |

| Delta Electronics | Jan 2024 | A long-term collaboration for technology transfer and licensing, securing a key manufacturing partner in Taiwan and providing £43 million in revenue. | Delta Secures License to Hydrogen Energy Technology |

Ceres Power Geographic Focus Sharpens on Asia for Manufacturing and Commercial Deployment

In 2025, Ceres Power’s geographical focus concentrated on Asia as the primary region for manufacturing and initial commercial deployment, a strategic refinement from its earlier, more distributed partnership base across Europe and Asia.

- Between 2021 and 2024, Ceres established a broad international footprint with partnerships in Europe, including Germany with Bosch and the UK with HORIBA MIRA for testing facilities. This was complemented by foundational agreements in Asia, such as with Doosan in South Korea and Thermax in India.

- The year 2025 marked Asia’s emergence as the commercial center of gravity for Ceres Power. Key operational milestones occurred in South Korea with Doosan’s start of mass production, India with Shell’s first hydrogen production, Japan with the DENSO/JERA SOEC demonstration, and China through the new Weichai license agreement.

- The inability to conclude the planned China joint venture with European partner Bosch in 2024 was quickly followed by a direct manufacturing license with Chinese industrial giant Weichai in 2025. This pivot reinforces the strategic necessity of a strong, direct manufacturing presence in the Chinese market.

Ceres Power Technology Maturity Reaches Commercial Scale in 2025

Ceres Power’s solid oxide technology crossed a critical threshold from pilot and demonstration to commercial-scale manufacturing in 2025, validating its readiness for mass-market applications like data centers and industrial hydrogen production.

- From 2021 to 2024, the technology was primarily in the evaluation and pilot phase. This was demonstrated by projects like the 1 MW SOEC demonstrator with Bosch and Linde, announced in 2023, and the internal launch of a 100 k W SOEC test module.

- The definitive inflection point was July 2025, when partner Doosan Fuel Cell moved the SOFC technology from pilot lines to mass production. This event signified that the technology is not only technically sound but also manufacturable at scale and cost-effectively.

- Simultaneously, the SOEC technology achieved megawatt-scale validation in 2025. Shell’s demonstrator in India produced its first hydrogen in May, providing real-world evidence that the technology can achieve its efficiency target of below 40 k Wh/kg, a key advantage over competing electrolyzer systems.

Ceres Tech Advantage Drives Viability

This chart supports the section’s theme of technology maturity by showing a core innovation—a thinner, less expensive ceramic layer—that is critical for achieving the commercial scale discussed in the text.

(Source: Ceres Power)

SWOT Analysis: Ceres Power Balances Validated Strengths with Exposed Risks

In 2025, Ceres Power’s strategic position was defined by the validation of its core strength in technology licensing, while simultaneously exposing its primary weakness of partner dependency and the external threat of market criticism of its business model.

- The analysis of 2025 events reveals that Ceres Power’s primary strengths, its asset-light IP model and high-efficiency technology, were validated by the commencement of mass production by Doosan and a new manufacturing agreement with Weichai.

- However, its key weaknesses, including revenue concentration from lumpy license fees and dependency on partners, were highlighted by the termination of the Bosch partnership and a subsequent revenue decline.

- The opportunities in high-growth markets like data centers were seized upon, but threats from competing technologies and negative market sentiment, exemplified by the Grizzly Research report, became more pronounced.

Fuel Cell Market Opportunity Nears $70B

This chart quantifies the massive market ‘Opportunity’ inherent in a SWOT analysis. It projects a $70.2 billion market and specifically calls out SOFC, Ceres’ core technology, validating the potential rewards discussed in the section.

(Source: Market.us)

Table: SWOT Analysis for Ceres Power

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | High-efficiency Steel Cell® technology and asset-light licensing model established through partnerships with Bosch, Weichai, and Doosan. | The model was validated by Doosan’s start of mass production in July 2025. A new manufacturing license was signed with Weichai in November 2025. | The theoretical strength of the licensing model was proven to be commercially executable by a major industrial partner. |

| Weakness | High dependency on partners for commercialization. Revenue was lumpy and dominated by one-off license and engineering fees. | The partnership with Bosch was terminated in February 2025. H 1 2025 revenue fell 26% due to the absence of large, one-off fees from the prior year. | The inherent risk of the partner-dependent model was realized, and the financial volatility of the pre-royalty phase became evident. |

| Opportunity | Growing demand for clean power in stationary applications and for green hydrogen production. | The Doosan partnership directly targeted the high-growth AI data center market. Shell and DENSO/JERA SOEC projects advanced to serve the industrial green hydrogen market. | The company successfully aligned its technology with two of the most urgent and high-value decarbonization markets. |

| Threat | Competition from other fuel cell and electrolyzer technologies (e.g., PEM). Geopolitical risks affecting partnerships, especially in China. | Bosch pivoted to focus on PEM technology, a direct competitive threat. A short-seller report in December 2025 attacked the viability of the business model. | Competitive and financial model threats moved from theoretical to tangible, impacting partnerships and market perception. |

Forward-Looking Insights: Focus Shifts to Royalty Revenue and Partner Execution

The central focus for Ceres Power moving forward is the conversion of its licensing agreements into a consistent and material stream of royalty revenue, with the Doosan Fuel Cell partnership serving as the primary test case.

- The most critical signal to watch is the sales volume and resulting royalty payments from Doosan’s mass production over the next 18-24 months. This will either validate or undermine the long-term financial premise of the licensing model, which was directly challenged by short-sellers in 2025.

- The progress of new manufacturing licensees, particularly Weichai in China and Delta Electronics in Taiwan, will determine if Ceres can replicate its commercial success and diversify its revenue base beyond a single partner.

- The performance data from the megawatt-scale SOEC projects with Shell and DENSO/JERA will be crucial for securing large-scale orders in the green hydrogen sector. This is the second major pillar of the company’s growth strategy and is essential for long-term value creation.

Frequently Asked Questions

What was the most significant event for Ceres Power in 2025 and why was it important?

The most significant event was in July 2025, when partner Doosan Fuel Cell began mass production of Solid Oxide Fuel Cell (SOFC) systems. This was crucial because it marked Ceres’s transition from technology development to commercial validation and specifically targeted the high-growth AI data center market, demonstrating the technology was ready for mass-market adoption.

Why did Ceres Power’s revenue decline in H1 2025 despite positive commercial news?

Revenue declined 26% because the company’s financial model is currently reliant on large, infrequent licensing fees. The prior year’s revenue was boosted by a £43 million deal with Delta Electronics, which was not repeated in H1 2025. This highlights the financial volatility of its pre-commercial phase before steady royalty income begins to flow.

What are the main risks to Ceres Power’s business model, as highlighted by events in 2025?

The events of 2025 highlighted two primary risks. First is partner dependency, which was realized when the long-standing collaboration with Bosch was terminated in February 2025 after Bosch changed its strategic focus. The second risk is market and financial scrutiny, as exemplified by a critical short-seller report in December 2025 that questioned the long-term viability of the licensing model.

Ceres has two core technologies, SOFC and SOEC. What progress was made on each in 2025?

For SOFC (for power generation), the key progress was its entry into mass production via partner Doosan, validating its readiness for commercial markets like data centers. For SOEC (for green hydrogen), a major milestone was reached in May 2025 when a megawatt-scale demonstrator with Shell produced its first hydrogen, proving its capability for large-scale industrial hydrogen production.

Looking forward, what is the most important factor for investors to watch?

The most critical factor is the conversion of licensing agreements into a consistent stream of royalty revenue. Specifically, investors should monitor the sales volume and resulting royalty payments from Doosan Fuel Cell’s mass production over the next 18-24 months. This will be the primary test of the long-term financial viability of Ceres’s licensing model.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.