Plug Power 2025: Gigawatt Deals and a High-Stakes Pivot to Profitability

Plug Power’s Commercial Scale Projects Signal a Shift from Logistics to Heavy Industry

Plug Power has fundamentally shifted its commercial strategy from dominating the niche material handling market to becoming a core technology provider for large-scale industrial decarbonization, a transition marked by its entry into gigawatt-scale electrolyzer projects and new high-value sectors in 2025.

- Between 2021 and 2024, Plug Power’s primary commercial application was deploying its hydrogen fuel cells in forklifts for logistics leaders like Amazon and Walmart. This changed dramatically in 2025, when the company secured multi-gigawatt electrolyzer deals, including a 2 GW agreement with Allied Green Ammonia for a $5.5 billion project and another 2 GW deal with Allied Biofuels for a landmark e-Sustainable Aviation Fuel (e SAF) project.

- The company’s application focus has diversified significantly. The 2024 launch of a Class 6 fuel cell truck for middle-mile logistics was a step beyond the warehouse, but 2025 saw a strategic pivot into entirely new industries, including a contract to supply liquid hydrogen to NASA and a collaboration to provide stationary power for AI data centers.

- This expansion in project scale demonstrates hydrogen’s broadening adoption. While earlier projects included an 8 MW fuel cell system for a PGE microgrid in 2023, by 2025, Plug Power was delivering 100 MW of electrolyzers to Galp’s Sines refinery, showing that the technology is now being integrated into core industrial processes like biofuel production, green ammonia synthesis, and grid stability.

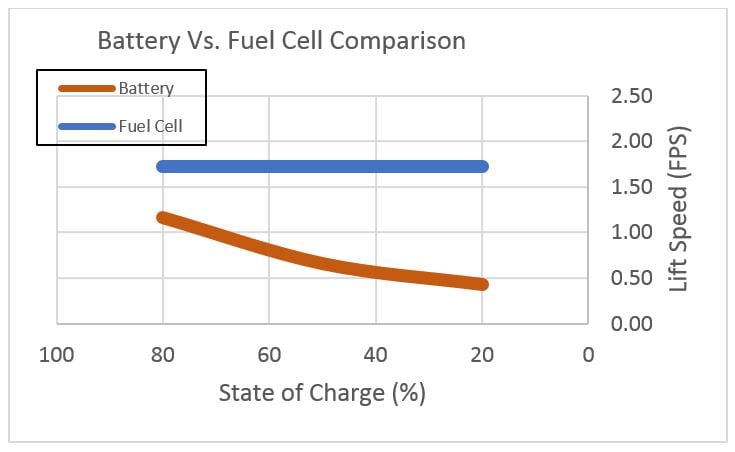

Fuel Cells Maintain Consistent Performance Over Batteries

This chart illustrates why Plug Power’s fuel cells dominated the logistics market, showing consistent performance versus the degrading output of batteries. This established the foundation for their later pivot to heavy industry.

(Source: Plug Power)

Plug Power’s Investment Analysis: From Foundational CAPEX to Aggressive Capital Raising in 2025

Plug Power’s investment strategy evolved from foundational capital expenditures between 2021-2024 to a massive, multi-front capital raise in 2025, driven by the need to fund its ambitious project pipeline and manage significant financial pressures.

- The 2021-2024 period was defined by strategic CAPEX to build a vertically integrated supply chain, including the $125 million investment in the Rochester Gigafactory and the $290 million for its New York green hydrogen plant, which laid the groundwork for future growth.

- Government backing became a cornerstone of its financing strategy, culminating in the finalization of a $1.66 billion conditional loan guarantee from the U.S. Department of Energy in January 2025. This loan is critical for de-risking the development of up to six new green hydrogen production facilities.

- In 2025, facing high cash burn, the company executed an aggressive and diverse fundraising strategy. This included a $1 billion at-the-market stock offering, a $525 million secured credit facility, and a $399 million convertible notes sale, highlighting a critical race for capital to fund operations and bridge the gap to profitability.

Plug Power Revenue Grows Amid Deepening Losses

By late 2025, Plug’s revenue grew to $676M while net losses widened to over $2.1B. This illustrates the significant financial pressure that necessitated the aggressive capital-raising strategy described in the section.

(Source: Finviz)

Table: Plug Power Key Investments and Funding (2021-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Vista Tech Campus Factory | January 2026 | A $125 million investment in a new factory in Slingerlands, NY, to manufacture fuel cells and electrolyzers, expected to reach full capacity by summer 2026. | Bethlehem IDA |

| Convertible Notes Sale | November 2025 | Successfully raised $399 million in cash to eliminate first-lien debt and fund its current business plan, strengthening its balance sheet. | Plug Power IR |

| U.S. DOE Loan Guarantee | January 2025 | Finalized a $1.66 billion conditional loan guarantee to fund the development, construction, and ownership of up to six green hydrogen production facilities across the U.S. | U.S. Department of Energy |

| Georgia Green Hydrogen Plant | January 2024 | Commenced operations at its 15 tons per day (TPD) liquid green hydrogen plant in Georgia, the largest of its kind in the U.S. market. | Hydrogen Tech World |

| New York Green Hydrogen Plant | October 2021 | Began construction on a $290 million, 45 TPD green liquid hydrogen production facility in Western New York, planned to be the largest in North America. | Governor of New York |

Plug Power’s Partnership Strategy: Securing Gigawatt Offtake Deals in 2025

Plug Power evolved its partnership model from securing strategic investors and shoring up its supply chain between 2021-2024 to establishing massive, multi-gigawatt offtake and supply agreements in 2025 that define its role as a core technology provider for the global hydrogen economy.

- Early partnerships between 2021 and 2024 were foundational, including the $1.6 billion strategic investment from South Korea’s SK Group to enter Asian markets and a 2023 alliance with Johnson Matthey to co-develop catalyst coated membrane (CCM) technology.

- The scale of partnerships shifted dramatically in 2025 with the announcement of gigawatt-level electrolyzer supply deals. These were headlined by binding agreements to supply up to 2 GW of electrolyzers to Allied Green Ammonia for a green ammonia facility and another 2 GW to Allied Biofuels for an e SAF project.

- In 2025, Plug Power also used partnerships to enter new high-value markets. Key among these were a liquid hydrogen supply contract with NASA, opening the aerospace sector, and a planned collaboration with a major U.S. data center developer to provide resilient backup power for the AI industry.

Plug Power Visualizes Its End-to-End Hydrogen Ecosystem

This infographic shows Plug Power’s vertically integrated hydrogen value chain, the strategic vision it aims to achieve. The large-scale partnerships mentioned in this section are key to building out this ecosystem.

(Source: Plug Power)

Table: Plug Power Strategic Partnerships (2022-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Data Center Developer | November 2025 | Announced a planned collaboration to explore using hydrogen fuel cells for backup and auxiliary power, targeting the high-growth data center market. | Reuters |

| Allied Biofuels | October 2025 | Expanded partnership with a binding agreement to deploy up to 2 GW of PEM electrolyzers for an e SAF project in Uzbekistan, with a final investment decision expected in Q 4 2026. | Plug Power IR |

| Allied Green Ammonia (AGA) | June 2025 | Signed a 2 GW electrolyzer supply agreement with AGA for a new $5.5 billion hydrogen-to-ammonia facility in Uzbekistan, building on a previous 3 GW collaboration. | Yahoo Finance |

| BASF | May 2025 | Signed a cooperation agreement to deploy advanced purification and catalyst solutions, aiming to improve the economic viability of liquid hydrogen production. | BASF |

| Nikola Corporation | December 2022 | A strategic collaboration where Plug will supply up to 125 TPD of green hydrogen to Nikola and purchase up to 75 Nikola Tre FCEV trucks for its own logistics. | PR Newswire |

Plug Power’s Global Expansion: From North America to Europe and Asia

Plug Power expanded its geographic focus from a primarily North American-centric build-out between 2021-2024 to a global deployment strategy in 2025, securing major projects across Europe, Australia, and Central Asia.

- Between 2021 and 2024, the company’s primary focus was building its production network in the United States, anchored by new plants in Georgia and New York and large domestic offtake agreements with Amazon and Walmart.

- The year 2025 marked an aggressive expansion into Europe. Plug Power secured contracts for major electrolyzer projects, including 55 MW for Carlton Power in the UK, 100 MW for Galp in Portugal, and announced plans to develop three green hydrogen production plants in Finland to serve European markets.

- The company also pushed into new strategic regions in 2025. This was highlighted by multi-gigawatt agreements in Uzbekistan with partners Allied Green Ammonia and Allied Biofuels, a 3 GW electrolyzer framework agreement in Australia, and the installation of its first fully integrated green hydrogen facility in Africa with Cleanergy Solutions Namibia.

Plug Power’s Technology: Achieving Industrial Scale and Material Innovation

Plug Power’s technology strategy matured from scaling its manufacturing capabilities between 2021-2024 to demonstrating commercial viability at industrial scale and achieving critical material innovations in 2025.

- From 2021-2024, the company focused on scaling production of its core Proton Exchange Membrane (PEM) technology, exemplified by the opening of the world’s first fuel cell Gigafactory in Rochester, NY. During this time, its technology was primarily validated in the controlled environment of material handling fleets.

- The year 2025 served as a validation point for the technology’s readiness for heavy industry. Large-scale deployments, such as the 100 MW electrolyzer system at Galp’s refinery, proved its application for producing industrial-scale green hydrogen, moving far beyond its origins in forklifts.

- A significant technological milestone was achieved in October 2025 through a collaboration with VSPARTICLE. The partnership yielded a breakthrough that improves iridium utilization in PEM electrolyzers by a factor of 10, directly addressing a critical cost and supply chain bottleneck for scaling green hydrogen production globally.

Plug Power’s SWOT Analysis: A High-Stakes Race for Profitable Scale

Plug Power’s strategic evolution reveals a shift from leveraging early-mover advantages and foundational partnerships to confronting the immense financial and operational pressures of executing its vertically integrated vision on a global scale.

- The company’s core strength has evolved from its established partnerships to a massive, multi-gigawatt project pipeline, but its persistent weakness remains its inability to achieve profitability, leading to significant cash burn and potential shareholder dilution.

- Opportunities have expanded from material handling into high-value markets like data centers and aerospace, while the primary threat has sharpened from general execution risk to the specific challenge of securing enough capital to survive until its projects become profitable.

Stock Price Plunge Highlights High-Stakes Financial Pressure

The company’s stock plummeted over 50% in one month, reflecting immense market pressure and investor concern. This visualizes the “high-stakes race for profitable scale” and the financial weaknesses discussed in the SWOT analysis.

(Source: CleanTechnica)

Table: SWOT Analysis for Plug Power

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Established leadership in the material handling market with key customers like Amazon and Walmart. Strategic investment from SK Group ($1.6 B) provided capital and market access. | A massive, multi-gigawatt project pipeline, including 2 GW deals with Allied Green Ammonia and Allied Biofuels. Vertically integrated from electrolyzer manufacturing to hydrogen production. | The company validated its ability to secure large-scale, industrial offtake agreements, moving from a component supplier to a full ecosystem provider. |

| Weaknesses | Consistently negative gross margins and significant net losses despite growing revenue. High cash burn and reliance on external financing. | Financial health remains precarious, with a $53 million gross loss in Q 2 2025. Seeking to double authorized shares, signaling risk of significant future shareholder dilution to fund operations. | The scale-up has exacerbated financial pressures. The core problem of unprofitability has not been resolved and has become more critical as capital needs have grown. |

| Opportunities | Expansion into e-mobility (Class 6 truck) and stationary power. Leveraging government incentives like the Inflation Reduction Act to support green hydrogen production. | Pivoting to high-margin markets like AI data centers for backup power and aerospace with a new NASA contract. Expanding into the e-fuels market (e SAF) with the Allied Biofuels deal. | The addressable market has expanded into more lucrative and technologically demanding sectors, validating the versatility of its hydrogen technology beyond logistics. |

| Threats | Execution risk in building out its ambitious green hydrogen production network on time and on budget. Competition from other hydrogen players and alternative clean technologies. | Intense capital needs and dependence on external funding, including the critical $1.66 billion DOE loan. Inability to reach positive margins quickly could lead to a liquidity crisis. | The primary threat has shifted from operational execution to financial survival. The company is now in a race against time to make its business model profitable before it runs out of funding options. |

2025 Forward-Looking Insights: The Pivot to Data Centers Is a Critical Test

Plug Power’s success in the next 12-18 months depends entirely on its ability to convert its massive project pipeline into profitable operations, with the pivot to the data center market serving as a critical test of its high-margin strategy.

- The central challenge for Plug Power is execution. It must successfully deliver on its multi-gigawatt electrolyzer commitments to partners like Allied Green Ammonia and finally achieve positive gross margins. Continued losses, such as the $53 million gross loss reported in Q 2 2025, are unsustainable and put immense pressure on the company’s financial stability.

- The strategic pivot to the data center market, highlighted by the November 2025 collaboration announcement, is a crucial and necessary move. This market offers the potential for higher-margin revenue that can help offset the high costs and low margins of its existing businesses and fund its capital-intensive expansion.

- The company’s financial survival is the dominant narrative. The recent $399 million financing round and the concurrent request to double authorized shares from 1.5 billion to 3 billion underscore that Plug Power is in a decisive race to achieve profitability before its financing needs overwhelm its market valuation.

Frequently Asked Questions

What was the biggest change in Plug Power’s business strategy in 2025?

In 2025, Plug Power fundamentally shifted its strategy from focusing on the material handling market (like forklifts for Amazon and Walmart) to becoming a core technology provider for large-scale industrial decarbonization. This pivot is demonstrated by its multi-gigawatt electrolyzer deals with partners like Allied Green Ammonia and Allied Biofuels, and its entry into new sectors like aerospace (NASA) and AI data centers.

How is Plug Power funding its massive expansion and new projects?

Plug Power executed an aggressive and diverse capital-raising strategy in 2025. Key funding sources include the finalization of a $1.66 billion loan guarantee from the U.S. Department of Energy, a $1 billion at-the-market stock offering, a $525 million secured credit facility, and a $399 million convertible notes sale to manage high cash burn and finance its project pipeline.

Has Plug Power become profitable with all these new large-scale deals?

No, the company has not yet achieved profitability. The article highlights that financial health remains a significant weakness, citing a $53 million gross loss in Q2 2025. Plug Power is currently in a high-stakes race to make its business model profitable before it runs out of funding options.

What are the most significant new partnerships Plug Power announced in 2025?

The most significant 2025 partnerships are the gigawatt-scale supply agreements, including a 2 GW deal with Allied Green Ammonia for a green ammonia facility and another 2 GW deal with Allied Biofuels for an e-SAF project. Other key collaborations include a liquid hydrogen supply contract with NASA and a planned partnership to provide backup power for a U.S. data center developer.

What is the biggest risk facing Plug Power right now?

The primary threat has shifted from operational execution to financial survival. The company’s intense need for capital to fund its vertically integrated strategy, combined with continued unprofitability and high cash burn, creates a significant risk. Its success depends on its ability to make its projects profitable before its financing options are exhausted.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.