Elcogen’s 2025 Solid Oxide Fuel Cell Surge: New 360 MW Factory Signals Shift to Mass Production

Elcogen’s Commercial Scale Projects Show 2025 Shift From R&D to Industrial SOFC/SOEC Deployment

In 2025, Elcogen decisively transitioned from a technology developer focused on pilot validations to an industrial-scale component supplier targeting the decarbonization of hard-to-abate sectors.

- Between 2021 and 2024, Elcogen focused on demonstrating its technology’s viability through partnerships, such as supplying solid oxide fuel cells (SOFC) to Watt Any Where for off-grid EV charging solutions and validating its electrolyzer efficiency with Convion. These projects proved the core technology’s high performance in controlled, smaller-scale applications.

- The strategic inflection point occurred in 2025 with the launch of large-scale industrial projects. The company became a key technology provider for the SYRIUS project, which will deploy a 4.2 MWel solid oxide electrolyzer cell (SOEC) system to produce green hydrogen for the steel industry in Italy.

- This shift towards heavy industry was further solidified by a Memorandum of Understanding signed in May 2025 with Casale SA, a leader in chemical plant design. This collaboration aims to integrate Elcogen’s high-efficiency SOEC technology into green ammonia production processes, opening a new, large-scale market vertical.

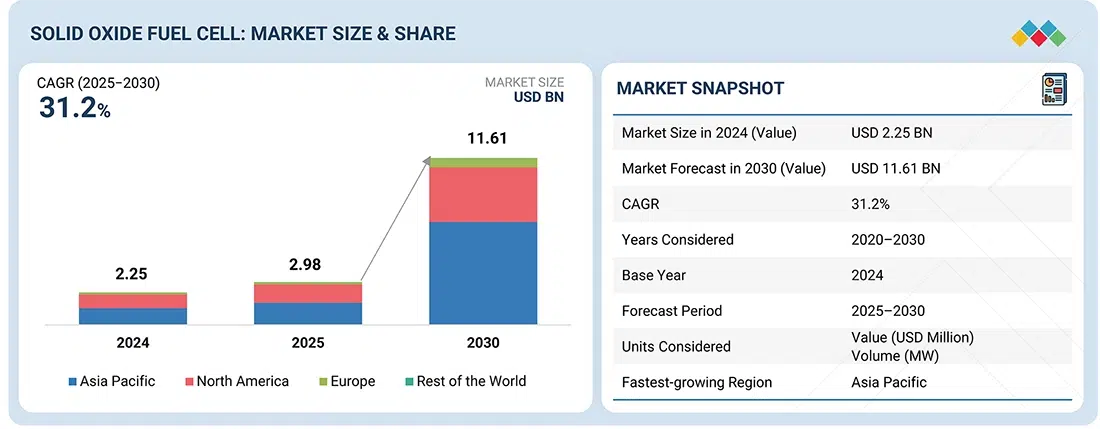

SOFC Market to Skyrocket Past $11B

This forecast shows the massive market opportunity driving Elcogen’s 2025 industrial scale-up. The market is projected to grow over 5x by 2030, validating the company’s strategic shift to commercial deployment.

(Source: MarketsandMarkets)

Elcogen Investment Analysis: Strategic Funding Fuels 2025 Manufacturing Expansion

Elcogen successfully leveraged strategic corporate investments and public funding to finance its pivotal transition from a research-oriented firm to a mass-production powerhouse in 2025.

- The period between 2022 and 2024 was defined by securing strategic capital from key industry players, which validated its technology and growth plan. This included a €24 million investment from Hydrogen One Capital in 2022 and a crucial €45 million investment from South Korean industrial giant HD Hyundai in 2023.

- In 2025, the investment focus shifted to directly funding industrial scale-up. This was demonstrated by a €24.9 million grant from the EU Innovation Fund and a €5 million equity investment from Estonian venture fund Smart Cap, both earmarked to support the construction and operation of its new factory.

- These financial injections culminated in the September 17, 2025, inauguration of the €50 million ELCO I factory in Tallinn. This facility represents the materialization of its investment strategy, built upon the foundation of over €140 million raised by early 2024 from stakeholders including Baker Hughes and HD Hyundai.

Table: Elcogen Strategic Investments and Grants

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| ELCO I Factory Stakeholders | Sep 2025 | The €50 million factory was financed by key investors including Baker Hughes, HD Hyundai, and Smart Cap, confirming strong industry and financial backing for the company’s manufacturing scale-up. | Invest in Estonia |

| EU Innovation Fund | Apr 2025 | Awarded a €24.9 million grant to support the construction and expansion of the ELCO I factory, aligning Elcogen’s expansion with Europe’s strategic goals for green hydrogen production. | Elcogen |

| Smart Cap | Jan 2025 | Secured a €5 million equity investment to accelerate growth, expand operations, and support the development of the new high-volume production facility in Tallinn. | Elcogen |

| Baker Hughes & Others | Apr 2024 | Closed a funding round totaling over €140 million, including a strategic investment from Baker Hughes, to provide the capital base for accelerating commercialization and scaling manufacturing. | Elcogen |

| HD Hyundai | Oct 2023 | Received a €45 million strategic investment to expand manufacturing and deepen collaboration on developing SOFC/SOEC systems for marine and stationary power applications. | Elcogen |

| Hydrogen One Capital | May 2022 | Secured a €24 million investment to scale up manufacturing capabilities, providing early-stage growth capital to drive its commercialization strategy forward. | Elcogen |

Elcogen’s Partnership Ecosystem: Driving SOFC/SOEC Market Entry and Scale

Elcogen’s commercial strategy hinges on a partner-centric model, which matured from technology validation alliances before 2025 to large-scale industrial integration partnerships in 2025 to secure market access.

- In the 2021-2024 period, partnerships with companies like Convion and Watt Any Where were instrumental in proving system viability and demonstrating the real-world performance of Elcogen’s core technology in operational settings.

- A significant strategic evolution occurred with the HD Hyundai partnership, which began as a strategic investment in 2023 and deepened into a collaborative effort to develop power systems for the marine and stationary power markets, establishing a strong foothold in a key industrial sector.

- The year 2025 saw the formation of high-impact industrial partnerships, including the Mo U with Casale SA for green ammonia and participation as a technology supplier in the SYRIUS project for steel decarbonization, directly linking Elcogen’s technology to major end-markets.

Partnerships Powering Green E-Fuel Production

This diagram illustrates how Elcogen’s partnership with Convion combines high-temperature electrolysis with captured CO2. This collaboration is key to producing e-fuels and demonstrates their partner-centric market strategy.

(Source: Elcogen)

Table: Elcogen Strategic Partnerships and Collaborations

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Casale SA | May 2025 | Signed an Mo U to integrate Elcogen’s high-efficiency SOEC technology with Casale’s ammonia synthesis processes, creating a cost-effective pathway for green ammonia production. | Elcogen |

| SYRIUS Project | Mar 2025 | Became a key technology provider, supplying the core SOEC technology for a 4.2 MWel electrolyzer aimed at decarbonizing the steel industry through on-site green hydrogen production. | Elcogen |

| AVL List Gmb H | Jul 2024 | Initiated a development collaboration to create megawatt-scale SOEC stack modules, a crucial step in preparing the technology for large industrial hydrogen plants. | Elcogen |

| Bumhan Fuel Cell Co. | Oct 2023 | Signed an Mo U to supply SOFC and SOEC technology for green hydrogen production and power generation, targeting the marine and stationary power markets in South Korea. | Elcogen |

| Convion | Jan 2024 | Successfully concluded a 2, 000-hour test of an industrial-scale SOE system, validating the technology’s high efficiency and durability in a commercial-like setting. | Elcogen |

Elcogen’s Geographic Strategy: Estonia as a European Hub with Asian Market Penetration

Elcogen established a strong manufacturing and R&D footprint in Europe, centered in Estonia, while simultaneously executing a targeted strategy to penetrate high-growth Asian markets through key industrial partnerships.

- Between 2021 and 2024, Elcogen’s activities were primarily concentrated in Europe. This included R&D and manufacturing development in Estonia and Finland (with Convion) and pilot projects in markets like Switzerland (with Watt Any Where), building a solid regional foundation.

- The company’s strategic pivot toward Asia became evident in 2023 with the €45 million investment from South Korea’s HD Hyundai and an Mo U with Bumhan Fuel Cell. These moves provided a direct channel into the competitive South Korean marine and industrial sectors.

- The year 2025 solidified this dual-continent strategy. The launch of the ELCO I factory in Tallinn, Estonia, establishes a European manufacturing hub, while the Asian partnerships provide market access to a region with significant demand for clean energy solutions, a strategy confirmed by the January 2026 appointment of a Business Development Director for India and the APAC region.

Asia-Pacific Region to Lead SOFC Growth

Global SOFC market growth is forecast at 24.5% annually, with the Asia-Pacific region offering significant opportunities. This data supports Elcogen’s geographic strategy of penetrating high-growth Asian markets from its European hub.

(Source: Research Nester)

Elcogen SOFC/SOEC Technology Maturity: From Pilot Validation to Commercial Scale in 2025

Elcogen’s solid oxide technology has progressed from a prototype validated in pilots during the 2021-2024 period to a commercially manufactured component ready for mass-market adoption in 2025.

- In the years leading up to 2025, the technology’s maturity was proven through successful, long-duration tests and pilot projects. A key validation point was the 2, 000-hour field test with partner Convion, which demonstrated over 85% electrical efficiency and confirmed the technology’s durability and high performance.

- The definitive shift to commercial maturity occurred in September 2025 with the launch of the ELCO I factory. This move signaled a transition from proving performance to focusing on mass production, automated manufacturing processes, and achieving a targeted cost reduction of over 60%.

- The company’s marketing in 2025 also reflects this maturity. It now promotes specific, commercial-ready performance metrics, such as producing 1 kg of hydrogen with as little as 33 k Wh of electricity and achieving system-level SOFC electrical efficiencies of over 60%.

Elcogen Stack Performance Validated by Testing

This chart validates the performance and stability of Elcogen’s solid oxide stack technology. The linear power increase and stable voltage confirm the technology is mature and ready for commercial deployment, as stated in the section.

(Source: EnkiAI)

Elcogen SWOT Analysis: A 2025 Strategic Review of Solid Oxide Leadership

In 2025, Elcogen leveraged its technological strengths and key partnerships to convert its primary weakness, limited production capacity, into a core competitive advantage, effectively addressing market threats.

- Elcogen’s consistent strength has been its market-leading cell and stack efficiency, which was validated through partner projects before 2025 and became a key commercial differentiator.

- The company’s main weakness, a lack of at-scale manufacturing, was directly resolved with the launch of the 360 MW ELCO I factory, enabling it to meet growing global demand.

- By securing strategic investments and a significant grant from the EU Innovation Fund, Elcogen capitalized on the immense market opportunity for green hydrogen, mitigating the threat from larger, more established competitors.

Elcogen’s Core Technology: Efficient and Flexible

Elcogen’s core strength, as highlighted in its SWOT analysis, is its efficient technology. This diagram shows how the ‘elcoStack’ converts various fuels into electricity and heat, a key commercial differentiator.

(Source: Elcogen)

Table: SWOT Analysis for Elcogen

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High-efficiency SOFC/SOEC technology demonstrated in pilots (e.g., with Convion). Strong R&D capabilities. | Market-leading, commercially validated efficiency (33 k Wh/kg H 2). Reversible dual-use technology for both power and hydrogen. Strong investor backing from industry leaders. | The technology’s efficiency was validated and transformed from an R&D metric into a core commercial selling point in 2025. |

| Weaknesses | Limited manufacturing capacity (10 MW annually). Dependent on partners for system integration and market access. High unit costs due to low-volume production. | Scaling production to meet demand from the new 360 MW factory. Managing complex supply chains for mass manufacturing. | The primary weakness of limited production capacity was directly resolved by the launch of the ELCO I factory, increasing capacity 36-fold. |

| Opportunities | Growing global demand for green hydrogen. Access to EU funding and strategic investors. Emerging markets in hard-to-abate sectors (marine, steel). | Penetrate industrial markets (steel, ammonia) with partners like Casale SA. Expand into Asian markets with HD Hyundai. Leverage EU policy support for energy independence. | Elcogen fully capitalized on the funding opportunity by securing a €24.9 million EU grant and over €140 million in private investment to build its factory. |

| Threats | Competition from established SOFC players (e.g., Bloom Energy) and other electrolysis technologies (e.g., PEM). High CAPEX barrier for market adoption. | Maintaining technological lead as competitors also scale. Commodity price fluctuations impacting manufacturing costs. Execution risk in ramping up new factory production. | The threat of high CAPEX was mitigated by a projected 60% cost reduction from the new factory, making its technology more competitive. |

Forward-Looking Insights: Elcogen’s 2026 Focus on Production Ramp-Up and Global Market Penetration

Moving into 2026, Elcogen’s critical challenge will be to translate its newly established manufacturing capacity into tangible market share by successfully ramping up production and securing large-volume supply agreements.

- The primary signal to monitor will be production milestones from the ELCO I factory. Achieving the targeted 60% cost reduction will be essential for competing against incumbents and influencing the final price of green hydrogen, making it a critical indicator of long-term success.

- Watch for the announcement of new supply agreements and partnerships in Asia, which will validate the success of its global expansion strategy following the January 2026 appointment of a dedicated Business Development Director for the region.

- Progress on collaborations with AVL to develop megawatt-scale modules and with HD Hyundai for marine applications will demonstrate the company’s ability to move beyond selling individual components and into supplying integrated solutions for high-value industrial markets.

📄 Download Full Report

Enter your email to download this analysis as PDF.

Frequently Asked Questions

What was the biggest change for Elcogen in 2025?

In 2025, Elcogen made a decisive shift from being a research and development-focused company to an industrial-scale manufacturer. This was highlighted by the inauguration of its new 360 MW ELCO I factory in Tallinn, Estonia, enabling mass production of its solid oxide cells for large industrial markets.

How did Elcogen fund its new factory and expansion?

The expansion was financed through a mix of private investments and public grants. Key funding included a €45 million investment from HD Hyundai (2023), a total of over €140 million raised from investors like Baker Hughes by 2024, a €24.9 million grant from the EU Innovation Fund (2025), and a €5 million equity investment from Smart Cap (2025).

What is the capacity of the new ELCO I factory?

The new ELCO I factory, which opened in September 2025, has an annual manufacturing capacity of 360 megawatts (MW). This is a significant scale-up from its previous capacity and is intended to meet growing global demand for solid oxide technology.

Who are some of Elcogen’s key industrial partners?

Elcogen collaborates with several major industrial players. These include HD Hyundai for developing power systems for marine and stationary applications, Casale SA for integrating SOEC technology into green ammonia production, and participation in the SYRIUS project to help decarbonize the steel industry.

How efficient is Elcogen’s solid oxide technology?

Elcogen’s technology is recognized for its high efficiency. For green hydrogen production (SOEC), it can produce one kilogram of hydrogen with as little as 33 kWh of electricity. When used for power generation (SOFC), its systems can achieve electrical efficiencies of over 60%. A long-duration test with partner Convion demonstrated an electrical efficiency of over 85%.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Elcogen's 2025 SOFC & Solid Oxide Fuel Cells Analysis

- Ceres Power SOFC 2025: Fuel Cell & Hydrogen Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.