AI’s Power Demand: Will Transformer Supply Chain Bottlenecks Stall Grid Expansion in 2026?

Grid Modernization Projects vs. AI Data Center Demand: The Growing Risk of Delays

The fundamental misalignment between the rapid deployment cycle of AI data centers and the decade-long timeline for utility grid upgrades has evolved from a future planning concern into a present-day crisis. This mismatch now represents the single greatest constraint on the growth of the AI economy, with utilities’ reactive planning posture creating a high probability of widespread project delays and power shortages. The core strategy of massive, long-term capital investment in grid modernization, while necessary, is too slow to address the immediate power crunch.

- Between 2021 and 2024, utility planning treated the rise in data center demand as a significant but manageable load growth, focusing on forecasting and integrating renewables. From 2025 onward, the surge became exponential, forcing utilities into reactive, stopgap measures such as delaying coal plant retirements and planning new natural gas capacity to ensure near-term reliability, directly conflicting with decarbonization goals.

- The critical timeline disparity, a theoretical issue before 2025, is now a tangible bottleneck. Data centers can be built in 1-2 years, yet they face a grid infrastructure upgrade cycle that takes a minimum of 10 years for new high-voltage transmission, creating significant customer dissatisfaction and delaying revenue for technology companies.

- The risk profile has shifted dramatically. Before 2025, the main risk was forecasting inaccuracy. Today, the primary threats are tangible supply chain failures, particularly for high-voltage transformers, and a workforce shortage of skilled engineers, which create physical limits on how fast the grid can be expanded regardless of investment levels.

Data Center Surge Drives Electrification

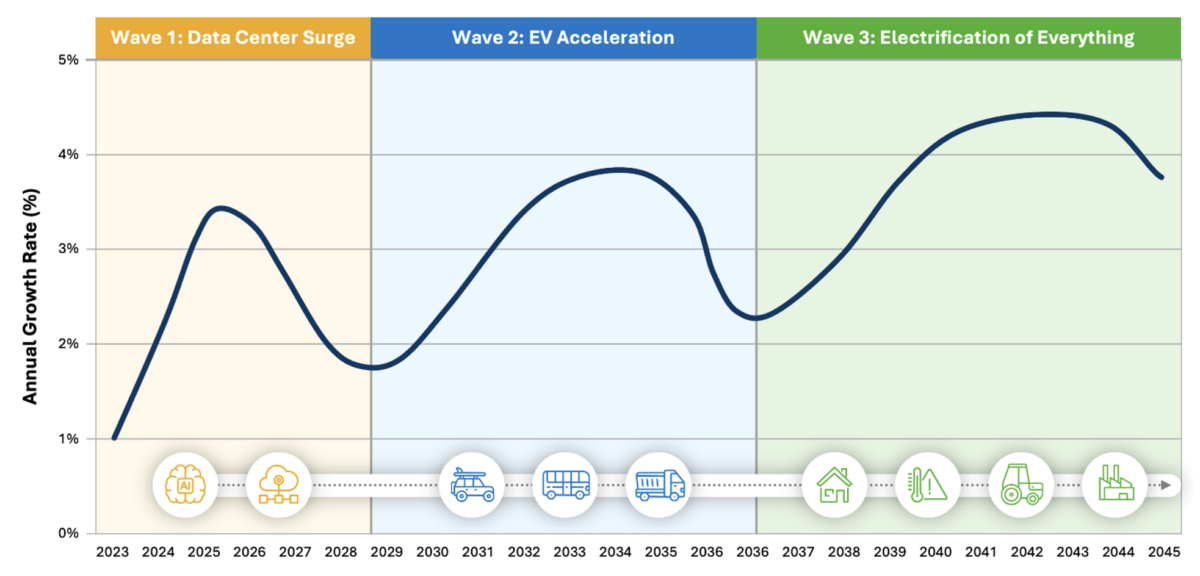

This chart illustrates the immediate ‘Data Center Surge,’ visually representing the rapid deployment cycle that is creating a present-day crisis for grid planners, as discussed in the section.

(Source: Energy and Environmental Economics, Inc.)

Capital Outlay for AI Grid Support: Investment Analysis for 2026

Utilities are earmarking historic levels of capital to address the AI-driven demand surge, but the scale and timeline of these investments are poorly synchronized with the immediate needs of the technology sector. The data reveals a significant disconnect between utility capital planning and the tech industry’s actual demand projections, creating a risk of misallocating billions toward infrastructure that could become stranded assets.

- U.S. utilities are planning an aggregate investment of $1.1 trillion by 2030 to modernize the grid for AI data centers and broader electrification, a figure that reflects the system-level scale of the challenge.

- A substantial portion of this capital, estimated between $36 billion and $60 billion, is required by 2030 specifically to build out the utility infrastructure needed to connect and power new data center facilities.

- A critical planning failure has emerged post-2025, with reports indicating the utility industry is planning for approximately 50% more data center demand than the tech industry itself projects. This discrepancy risks significant overbuilding of fossil fuel infrastructure and undermines efficient capital deployment.

Table: Grid Modernization and Data Center Support Investment Projections

| Source/Entity | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| US Utilities (Aggregate) | By 2030 | $1.1 Trillion allocated for grid modernization and electrification to support AI data center demand and other new loads. | US Utilities Invest $1.1 T by 2030 for AI & Electrification |

| US Utilities (Data Center Specific) | By 2030 | $36–$60 Billion in dedicated utility investments required to directly support data center expansion requirements. | US Power Question: Can the U.S. Grid Handle AI’s Energy … |

Geographic Hotspots: How AI Power Demand is Reshaping Regional Utility Planning in the US

The intense, geographically concentrated nature of AI data center power demand is creating acute regional stress on grids, making power availability the primary factor in site selection and forcing a re-evaluation of utility planning at a local level. What was once a national forecast has become a series of regional crises, with the potential to reshape the digital economy’s physical footprint.

- Between 2021 and 2024, data center siting was influenced by a mix of factors including connectivity, land costs, and tax incentives, with load growth being a consideration but not an absolute constraint. From 2025, power availability and the speed of grid connection have become the dominant, non-negotiable siting criteria.

- The United States is the clear epicenter of this challenge, with forecasts from Deloitte projecting U.S. AI data center power demand could reach 123 GW by 2035. This has triggered massive investment plans and revealed deep-seated infrastructure deficits, particularly in established data center hubs.

- The problem is not confined to the U.S. In Canada, for example, the AI-driven demand surge is forcing a direct evolution of electricity grid connection policies, signaling a broader North American trend where specific provinces and states must overhaul regulations to cope with localized demand.

- This regional pressure is forcing direct, high-stakes relationships between tech giants and local utilities. For instance, Oracle’s goal to build 10 GW of data center capacity by the end of 2025 places immense strain on its utility partners, such as Duke Energy, to accelerate specific grid modernization projects to serve a single customer.

Grid Technology vs. AI Demand: Assessing the Maturity of Utility Solutions

Utilities are primarily deploying mature, conventional grid technologies to meet the AI power challenge, but the deployment speed of these solutions is fatally slow. The critical path is constrained by manufacturing and regulatory bottlenecks, while more agile technologies like on-site generation and demand response remain too nascent to provide a systemic solution.

- The primary utility strategy is foundational grid modernization, involving new transmission lines, substations, and transformers. While the technology is proven, the implementation is not. Post-2025 analysis confirms that these projects require a minimum of a decade to complete due to permitting and right-of-way battles, making them ineffective for the immediate crisis.

- A crucial technology component, the high-voltage transformer, has emerged as a severe bottleneck. Though a mature technology, its manufacturing supply chain is now facing lead times of 2-4 years due to the global surge in orders, creating a hard physical limit on the pace of both grid expansion and new data center connections.

- Between 2021-2024, discussions centered on the potential of flexible loads and advanced reactors. Since 2025, the lack of grid capacity has forced AI firms to act independently, building their own on-site power plants, often using natural gas. This signals a market failure, where proven but slow utility solutions are being bypassed in favor of faster, less integrated, and often carbon-intensive alternatives.

SWOT Analysis: Utility Planning for AI-Driven Power Demand

The utility sector’s response to the AI power demand surge is defined by a deep conflict between its inherent strengths in capital and infrastructure and its crippling weaknesses in speed and agility. This dynamic creates an opportunity for unprecedented growth but also carries the threat of derailing both grid reliability and national decarbonization targets.

- Strengths: Access to massive capital and an incumbent role as the primary energy provider.

- Weaknesses: Systemic sluggishness due to decade-long project timelines and acute supply chain bottlenecks for critical components.

- Opportunities: A massive new revenue stream from a permanent, high-growth customer class.

- Threats: The risk of widespread power shortages and being bypassed by customers who opt for on-site generation.

Table: SWOT Analysis for Utility Planning for AI-Driven Data Center Demand

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Established infrastructure and regional monopolies. Consistent, regulated revenue streams. | Ability to marshal massive capital ($1.1 trillion by 2030). Critical enabler of the AI economy. | The sector’s strength has shifted from passive incumbency to being an active, funded agent of national economic expansion, with AI as the primary justification for investment. |

| Weaknesses | Aging grid infrastructure. Slow, bureaucratic planning and regulatory approval cycles. | Fatal timeline mismatch (10+ year grid projects vs. 1-2 year data center builds). Critical supply chain bottlenecks (2-4 year transformer lead times). Shortage of skilled engineers. | Abstract, long-term weaknesses have become acute, tangible constraints that are actively impeding economic growth and creating immediate operational risk. |

| Opportunities | Anticipated load growth from general electrification and early data centers. | Unprecedented, exponential load growth from AI (Global demand projected to rise 165% by 2030). Justification for major rate-based grid modernization projects. | The opportunity has scaled from incremental revenue to a system-defining demand driver that could reshape the entire utility business model for decades. |

| Threats | Pressure from decarbonization mandates. Risk of flat or declining load growth in some areas. | Widespread power shortages. Derailing climate goals by building new gas plants. Data centers building their own power, bypassing the utility. Stranded assets from overbuilding. | Threats have escalated from financial and regulatory pressures to existential risks to both grid reliability and long-term climate commitments. The AI boom itself has become a threat. |

Forward Outlook: Key Signals for Utility Grid Strategy in 2026

If utilities and regulators fail to radically accelerate permitting and resolve supply chain blockages for critical grid components, the primary signal to watch in 2026 will be a proliferation of on-site, fossil-fueled power generation by data centers. This trend would signal a fragmentation of the grid and an irreversible blow to decarbonization goals.

AI to Dominate Power Consumption

This chart provides critical context for the forward outlook by projecting AI workloads as the overwhelming driver of future data center power demand, substantiating the section’s strategic focus.

(Source: Visual Capitalist)

- If this happens: The 10-year timeline for new transmission projects remains the status quo and the U.S. Department of Energy’s initiative to fast-track projects shows no material progress.

- Watch this: A marked increase in announcements from data center developers and hyperscalers detailing plans for their own dedicated, on-site natural gas power plants to ensure power certainty, bypassing the utility grid connection queue entirely.

- These could be happening: More utilities, especially in the Southeast and Midwest, may be forced to publicly announce delays to planned coal plant retirements or file for new gas peaker plants, explicitly citing data center demand as the cause and directly contradicting their corporate ESG commitments.

- Watch this: The lead times for high-voltage transformers. If lead times remain at 2-4 years or lengthen, it is a definitive signal that the physical supply chain, not capital or planning, is the ultimate cap on growth.

Frequently Asked Questions

What is the single biggest bottleneck stalling grid expansion for AI data centers?

The primary bottleneck is the severe timeline mismatch. AI data centers can be built in 1-2 years, but essential grid upgrades like new high-voltage transmission lines take a minimum of 10 years. This is made worse by a critical supply chain failure for high-voltage transformers, which now have lead times of 2-4 years, creating a physical limit on how fast the grid can expand.

How much are U.S. utilities investing to meet the power demand from AI?

U.S. utilities are planning an aggregate investment of $1.1 trillion by 2030 for overall grid modernization and electrification. A specific portion of this, estimated between $36 billion and $60 billion, is required by 2030 for the dedicated utility infrastructure needed to directly connect and power new data center facilities.

What is the main risk if utilities cannot meet the AI power demand in time?

The main threat is that data center companies will bypass the utility grid and build their own on-site power plants, often using natural gas, to ensure power certainty. This would lead to a fragmentation of the power grid, widespread power shortages, and would be a significant blow to national decarbonization goals as utilities may also be forced to delay coal plant retirements.

Are utility investment plans aligned with the tech industry’s actual needs?

No, the article highlights a significant disconnect. Reports indicate that the utility industry is planning for approximately 50% more data center demand than the tech industry itself projects. This creates a major risk of misallocating billions, overbuilding infrastructure (particularly fossil fuel plants), and creating stranded assets.

What is the key indicator to watch for in 2026 to see if this problem is getting worse?

The key signal to watch for in 2026 is an increase in announcements from data center developers planning their own on-site natural gas power plants. Another definitive indicator is the lead time for high-voltage transformers; if these times remain at 2-4 years or get longer, it confirms that physical supply chain constraints are the ultimate cap on growth, regardless of investment.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.