Grid Bottlenecks: Why Energy-First Data Center Strategy Dominates in 2026

From Grid Reliance to Grid Independence: How Data Center Decarbonization Strategy Shifted in 2025

The data center industry has fundamentally pivoted from a grid-dependent development model to a capital-intensive, “Energy-First” strategy where securing power is the foundational step. The previous approach, which involved procuring renewable energy through Power Purchase Agreements (PPAs) after a site was connected to the grid, has been rendered obsolete by severe, multi-year interconnection delays and insufficient grid capacity. This shift is not a choice but a necessity driven by the inability of public infrastructure to support the explosive power demands of artificial intelligence.

- Between 2021 and 2024, the primary strategy involved making data centers “grid-friendly” through partnerships like the one between Microsoft and Eaton to use UPS systems for grid stabilization. The focus was on optimizing interaction with the existing grid, a model that assumed the grid could eventually absorb new load.

- Starting in 2025, the strategy inverted to “Bring Your Own Power” (BYOP) in response to a quantitative crisis. Grid Strategies’ November 2025 report quantified data center demand at 90 GW of new load over five years, a figure the public grid cannot support. This forced developers to directly finance and build their own power sources.

- The consequences of this grid failure are now materializing, with utilities in the Southeast U.S. planning a significant buildout of natural gas plants specifically to serve data center demand, as detailed in a January 2025 IEEFA report. This confirms that relying on the grid now directly threatens decarbonization goals by locking in new fossil fuel infrastructure.

- The new model embraces co-locating data centers at former power plant sites to leverage existing interconnection infrastructure, a strategy that drastically reduces project timelines and has become a primary driver of site selection since 2025.

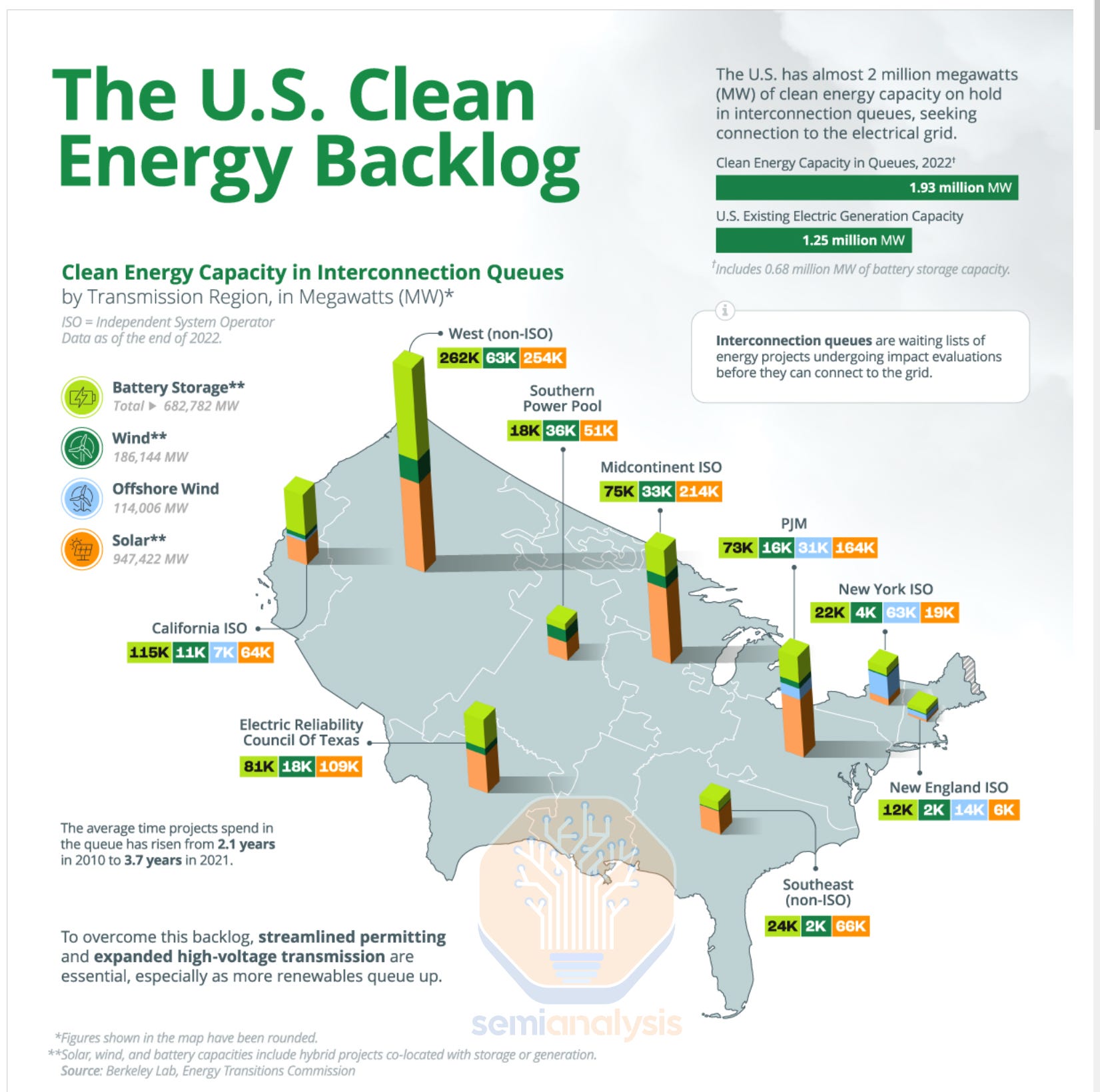

Grid Interconnection Backlog Forces Strategic Shift

This chart perfectly illustrates the ‘severe, multi-year interconnection delays’ mentioned in the text by showing the massive backlog of clean energy projects. This grid bottleneck is the primary driver forcing the industry’s pivot from grid reliance to energy independence.

(Source: SemiAnalysis)

Investment Surges in On-Site Power: The Trillion-Dollar Pivot to Energy-First Data Centers

Capital allocation has decisively shifted from a primary focus on data hall construction to massive upfront investment in dedicated power generation and infrastructure. This represents a strategic move from treating energy as a variable operating expense (OPEX) to a controlled capital expense (CAPEX). By internalizing power production, operators gain cost certainty, speed to market, and control over their carbon footprint, justifying the multi-trillion-dollar investment projections now defining the industry.

- The scale of this capital reallocation became clear in 2025, with data center M&A deals hitting a record $61 billion and Mc Kinsey projecting a global investment need of $6.7 trillion by 2030. A significant portion of this capital is now designated for power infrastructure.

- In contrast to the earlier 2021-2024 period focused on asset-level decarbonization, such as Digital Bridge‘s $300 million fund, the current era is defined by large-scale energy project finance. The final investment decision for Enbridge‘s $900 million Clear Fork natural gas pipeline project in July 2025 is a direct result of this trend, built specifically to serve new power demand driven by data centers.

- The financial logic is compelling. With electricity accounting for 20% or more of a data center’s total cost of ownership, building dedicated power sources insulates operators from grid price volatility and the rising costs associated with an overburdened system, as noted in a New York Times report from August 2025.

Table: Key Investments in Data Center Power Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Global Data Center Market | 2025 (Projected to 2030) | Projected investment of $3 trillion by 2030 to double global data center capacity to 200 GW. This highlights the massive capital influx, with a growing share dedicated to power generation to overcome grid constraints. | AI supercharge drives USD $3 trillion data centre boom |

| Enbridge (Clear Fork Project) | July 2025 | A final investment decision on a $900 million natural gas pipeline expansion to serve growing power demand. This project directly validates the use of natural gas as a commercial-scale bridge fuel for data centers awaiting clean alternatives. | Power Hungry: AI-Fueled Data Center Boom Sets Energy … |

| Digital Bridge & Climate Adaptive Infrastructure | May 2023 | A $300 million partnership to fund decarbonization projects across Digital Bridge‘s portfolio. This represents the earlier model of upgrading existing assets, which is now being superseded by building new, dedicated power ecosystems. | Climate Adaptive Infrastructure (CAI) and … |

New Alliances for Power: How Data Center Partnerships Redefine Energy-First Sustainability

The imperative to secure power has forged new strategic alliances, shifting partnerships away from software-level grid integration toward large-scale, physical energy development. Data center operators are no longer just technology partners; they are now key financiers and offtakers for new energy projects, collaborating directly with power developers, investment firms, and utilities to build private energy ecosystems from the ground up.

Google’s 24/7 Goal Drives New Energy Alliances

This infographic provides a perfect case study for the ‘new strategic alliances’ described in the section. Google’s journey toward 24/7 carbon-free energy necessitates the direct partnerships with energy developers that are redefining the industry.

(Source: Flexidao)

- The landmark partnership of the 2021-2024 period was the $20 billion initiative announced in December 2024 by Google, Intersect Power, and TPG. This collaboration to develop dispatchable clean power resources specifically for data centers marked the beginning of the shift from buying renewable energy credits to directly financing and building new generation assets.

- Prior to this, collaborations like the one between Microsoft and Eaton in 2021 focused on using data center technology to provide grid services. While innovative, this approach assumed a functional grid to partner with, a premise that no longer holds in constrained markets.

- By 2025, these collaborations have become more systemic. The Electric Power Research Institute (EPRI) launched the DCFlex initiative to formalize how data centers can act as grid resources, demonstrating a broader industry recognition that new operating models are required for grid stability.

- These partnerships are now essential for de-risking the development of next-generation power technologies. Hyperscalers are positioned to become the anchor customers for technologies like advanced geothermal and Small Modular Reactors (SMRs), providing the financial certainty needed for their commercialization.

Table: Evolution of Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| EPRI (DCFlex Initiative) | 2025 | An industry-wide initiative to demonstrate how data centers can support and stabilize the electric grid. This institutionalizes the shift from data centers as passive loads to active, flexible grid participants. | EPRI Home |

| Google, Intersect Power, & TPG | December 2024 | A $20 billion initiative to develop dispatchable clean power to support new data center growth. This was a foundational move, establishing the model of directly financing generation to bypass grid constraints. | Google, Intersect Power, TPG Launch $20 Billion Data … |

| Microsoft & Eaton | July 2021 | A research collaboration to enable data center UPS systems to act as distributed energy resources for grid stabilization. This represents the earlier “grid-interactive” paradigm, which has proven insufficient to solve the core power supply problem. | Grid-interactive data centers: enabling decarbonization … |

Beyond Virginia: How Energy-First Models Are Reshaping Data Center Geography

The Energy-First model has inverted traditional site selection criteria, elevating energy availability and interconnection capacity above network latency and proximity to established hubs. This is causing a geographic dispersal of data center development away from saturated markets like Northern Virginia and toward regions with untapped power resources, repurposed industrial sites, and supportive regulatory environments.

Power Constraints Reshape Data Center Geography

This chart directly supports the section’s theme of geographic dispersal by comparing power demand versus capacity in different regions, including Ireland (mentioned in the text). It shows why site selection is now driven by energy availability, pushing development beyond saturated hubs.

(Source: Nxtbook Media)

Data Centers Evolve into Active Grid Participants

This diagram visualizes the shift from a traditional grid to a modern, decentralized system. It directly illustrates the concept of data centers becoming ‘active, flexible grid participants’—the strategic purpose behind the partnerships listed in the section’s table.

(Source: Deloitte)

- The 2021-2024 period saw increasing strain on legacy markets. Ireland, for example, reported that data centers were consuming more electricity than all urban homes combined, signaling that the traditional model of concentrating development was becoming unsustainable.

- Since 2025, a clear trend has emerged toward co-locating data centers at former power plant sites. These locations offer access to robust transmission lines, water resources, and existing grid interconnection rights, providing a critical shortcut that bypasses years of delays.

- Regions are now competing based on their energy policy. In November 2025, the government of Alberta, Canada, announced new regulatory pathways specifically designed to attract data center investment by providing clear rules for grid connection and power procurement. Ontario followed with similar frameworks, indicating that proactive energy policy is becoming a key differentiator in attracting digital infrastructure investment.

- This geographic shift is also supported by federal policy, with a White House directive in July 2025 aiming to accelerate federal permitting for data center infrastructure, including the dedicated power generation and transmission required to support them.

From Pilots to Power Plants: The Technology Stack for Energy-First Data Centers

The technology stack supporting data centers is expanding from software and IT hardware to include physical, commercial-scale power generation. While earlier efforts focused on software-based grid interaction, the current reality demands on-site power plants. Natural gas turbines are being deployed today as a reliable, commercially available bridge solution, while the industry makes long-term plans for carbon-free technologies like Small Modular Reactors (SMRs) to provide 24/7 clean power.

On-Site Generation Becomes the New Tech Stack

This chart directly illustrates the section’s topic by forecasting the technology shift to on-site power generation. It shows the future mix of technologies, including the SMRs and fossil fuels mentioned in the text, that are expanding the data center ‘technology stack’.

(Source: ING Think)

- The 2021-2024 period was characterized by pilot projects and software-based solutions. The Microsoft and Eaton grid-interactive UPS pilot (2021) and the exploration of green hydrogen for backup power were promising but not yet at the scale required to solve the core supply issue.

- By 2025, the focus shifted to commercially proven, deployable generation. Companies like Mitsubishi Power are actively marketing gas turbines combined with carbon capture as a near-term solution for data centers needing reliable power now. Enbridge’s pipeline FID validates this as a bankable strategy.

- The industry is simultaneously planning for a post-gas future. Timelines for the first SMRs from companies like GE Hitachi and X-energy are now aligned with the medium-term power needs of hyperscalers, with commercial operation expected between 2029 and 2030. This indicates a clear technological roadmap from a fossil fuel bridge to a carbon-free destination.

- This technology transition reflects a pragmatic acceptance that decarbonization must be paired with reliability. On-site renewables and batteries are being co-located, but the need for firm, 24/7 power is driving investment in technologies that can provide baseload generation without relying on the public grid.

SWOT Analysis: Navigating the Energy-First Data Center Transition

The Energy-First paradigm provides a viable path for scalable growth and decarbonization but also introduces substantial new risks related to capital expenditure, technology adoption, and energy equity. This strategic shift solves the immediate grid bottleneck at the cost of taking on risks previously shouldered by the utility sector.

Grid Intermittency Poses a Strategic Threat

This chart visualizes a key ‘Threat’ that a SWOT analysis would cover: the intermittency of renewable energy on the grid. It illustrates the underlying challenge that the ‘Energy-First’ model, with its focus on 24/7 reliability, is designed to solve.

(Source: Reddit)

- Strengths have shifted from operational flexibility to strategic control over energy supply, cost, and carbon footprint.

- Weaknesses now center on massive upfront capital requirements and the long-term risk of stranded assets, particularly for gas-fired bridge solutions.

- Opportunities have expanded from earning grid services revenue to building entire private, clean energy ecosystems and becoming stabilizing grid assets.

- Threats have evolved from simple interconnection delays to complex regulatory hurdles for new generation and public backlash against perceived energy inequality.

Table: SWOT Analysis for Energy-First Data Center Decarbonization

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Operational flexibility through PPAs; ability to use data center assets for grid-interactive services (e.g., Microsoft/Eaton pilot). | Energy independence; control over power costs and reliability; faster speed-to-market by bypassing grid queues; direct alignment of clean energy investment with new load. | The grid bottleneck became so severe that grid dependence shifted from a strength (flexibility) to a critical liability, validating the need for an independent power strategy. |

| Weakness | High dependency on grid availability and transmission capacity; vulnerability to interconnection queue delays and volatile electricity prices. | Massive upfront CAPEX requirement ($3 T+ projections); risk of stranded assets (e.g., natural gas plants); long-term technology risk associated with SMRs and other unproven solutions. | The primary weakness shifted from external grid-related risks to internal financial and technology execution risks associated with becoming an energy producer. |

| Opportunity | Generate revenue from ancillary grid services; optimize energy procurement through sophisticated PPA structures. | Develop and own gigawatt-scale clean energy portfolios; become foundational customers for next-gen tech (SMRs); transform data centers into flexible grid assets that can enhance regional reliability (DCFlex initiative). | The opportunity expanded from optimizing within the existing energy system to building a new, parallel energy system at scale. |

| Threat | Multi-year grid interconnection delays stalling projects; risk of utilities retiring fossil plants without adequate replacement, threatening reliability. | Public and political backlash over creating a two-tiered energy system, driving up costs for residential customers (NYT report); regulatory hurdles for siting new generation; overbuilding fossil fuel bridge infrastructure. | The threat evolved from a logistical problem (delays) to a significant socio-political challenge concerning energy equity and the long-term carbon impact of bridge fuels. |

2026 Outlook: Will Data Centers Become Grid Assets or Energy Islands?

The critical uncertainty for 2026 is whether regulatory frameworks will evolve to integrate these privately-funded power systems as symbiotic grid assets or allow them to develop into isolated energy islands. The optimal outcome requires policies that harness the flexibility and new generation from data centers to benefit the entire grid, preventing the emergence of a two-tiered energy system where Big Tech has clean, reliable power while the public grid lags.

Explosive Demand Forces ‘Island vs. Asset’ Question

This chart’s forecast of exploding data center electricity demand provides the critical context for the ‘2026 Outlook’. The sheer scale of this growth is what forces the strategic question of whether new data centers will become ‘energy islands’ or integrated ‘grid assets’.

(Source: Trellis Group)

Past Strategy Relied on Grid-Based PPAs

This chart perfectly depicts the ‘2021 – 2024’ strategy described in the SWOT table, showing a past reliance on grid-based Power Purchase Agreements (PPAs). It provides a clear visual of the old model that has now been superseded.

(Source: Dgtl Infra)

- If integration succeeds, watch for the proliferation of “flexible interconnection agreements.” These contracts would allow data centers to draw a mix of firm and interruptible power, curtailing load during peak events in exchange for faster connection. This is the model being explored by groups like EPRI through its DCFlex initiative.

- Key signals of this trend include new rulemakings from federal regulators or state public utility commissions that standardize demand response participation for large loads and create tariff structures that reward flexibility. The policy work in Alberta and Ontario in 2025 provides a template.

- If integration fails, watch for an acceleration of fully off-grid data center campuses powered by dedicated natural gas plants. This trajectory would be confirmed by more projects like Enbridge‘s Clear Fork pipeline and a continued push by utilities in regions like the Southeast U.S. to build gas generation for specific data center clients.

- The risk is that this could be happening already. The pragmatic need for speed and reliability may lead developers to prioritize private generation over complex grid integration, potentially locking in fossil fuel emissions and exacerbating the divide between private and public infrastructure.

Frequently Asked Questions

Why are data centers moving away from relying on the public grid?

Data centers are moving away from the public grid because its infrastructure cannot support the explosive power demands driven by artificial intelligence. The article points to severe, multi-year interconnection delays and insufficient grid capacity as the primary reasons. A 2025 report quantified that data centers would require 90 GW of new power over five years, a load the public grid is unable to absorb, making grid reliance an obsolete and unworkable strategy.

What is the ‘Energy-First’ or ‘Bring Your Own Power’ (BYOP) strategy?

The ‘Energy-First’ strategy is a model where securing and building dedicated power generation is the foundational first step in developing a new data center. Instead of treating energy as a variable operating expense (OPEX) from the grid, operators are making massive upfront capital investments (CAPEX) to build their own power sources. This approach gives them control over costs, ensures reliability, accelerates speed-to-market by bypassing grid queues, and allows them to manage their carbon footprint directly.

Isn’t building new power plants, especially with natural gas, bad for environmental goals?

Yes, the article highlights this as a major threat. The immediate need for reliable power has forced the industry to invest in natural gas plants as a ‘bridge fuel,’ as evidenced by utilities in the Southeast U.S. and projects like Enbridge’s Clear Fork pipeline. The text explicitly states that relying on the grid now ‘directly threatens decarbonization goals by locking in new fossil fuel infrastructure.’ While the long-term plan is to shift to carbon-free sources like SMRs, this near-term reliance on gas presents a significant environmental challenge.

How is the ‘Energy-First’ model changing where data centers are located?

The model is causing a geographic dispersal away from traditional, saturated hubs like Northern Virginia. Site selection is now driven primarily by energy availability and interconnection capacity, not just network latency. A key trend is co-locating data centers at former power plant sites to leverage their existing robust transmission lines and grid connections. Furthermore, regions with supportive energy policies that provide clear pathways for power procurement, like Alberta and Ontario, are becoming the new prime locations for data center investment.

What is the difference between the data center strategies from 2021-2024 and the new strategy from 2025 onward?

Between 2021 and 2024, the strategy was to make data centers ‘grid-friendly’ by using their technology (like UPS systems in the Microsoft/Eaton partnership) to help stabilize the existing grid. This assumed the grid could eventually support them. Starting in 2025, the strategy inverted to ‘Bring Your Own Power’ (BYOP). This new model accepts that the grid is broken for their needs and focuses on building independent, dedicated power ecosystems, shifting from software-level grid interaction to financing and constructing physical power plants.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.