Memory Manufacturing Shift 2026: Why AI Is Causing a PC & Smartphone Supply Crisis

AI’s HBM Demand Triggers 2026 Memory Supply Chain Risks for Consumer Electronics

The strategic pivot by major semiconductor manufacturers to prioritize high-margin High-Bandwidth Memory (HBM) for the artificial intelligence sector is directly causing a supply crisis for the conventional memory used in PCs and smartphones. This manufacturing reallocation is creating a structural shortage and historic price inflation for consumer electronics, a stark reversal from the market dynamics of previous years.

- Between 2021 and 2024, the memory market experienced a cyclical downturn, leading to oversupply, excess inventory for PC and smartphone OEMs, and significant price declines. In contrast, the period from 2025 to today is defined by an extreme demand shock for HBM, with manufacturers like SK Hynix reporting their HBM supply is sold out for 2024 and most of 2025.

- Memory producers Samsung, SK Hynix, and Micron are actively diverting wafer production capacity away from conventional DRAM and NAND flash to the more profitable HBM. This shift is so significant that AI-centric memory is projected to consume 70% of global memory hardware production in 2026, leaving the consumer electronics sector to compete for the remaining supply.

- The direct consequence is an unprecedented surge in component costs for OEMs. After prices rose as much as 50% in Q 4 2025, forecasts from Trend Force project conventional DRAM contract prices will increase by 90–95% and NAND flash prices by 55-60% quarter-over-quarter in Q 1 2026.

- This supply constraint directly impacts consumer markets, with global smartphone shipments forecast to shrink by 2.1% and the PC market by at least 4.9% in 2026. The higher Bill of Materials (BOM) costs are forcing device makers to increase average selling prices, which is expected to dampen consumer demand.

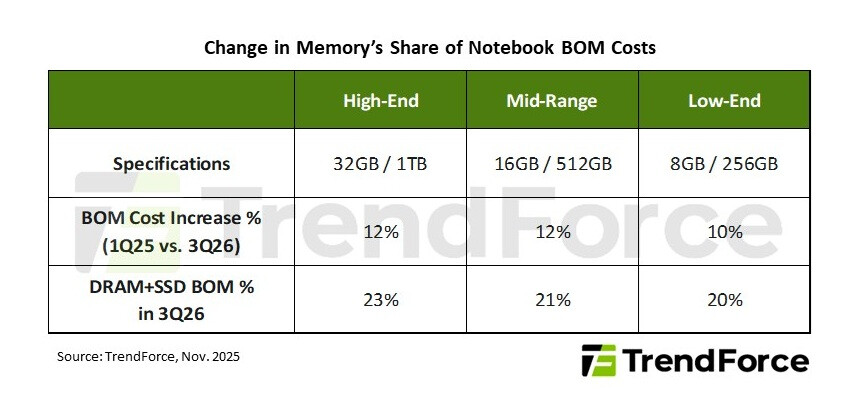

Memory to Exceed 20% of Notebook BOM

This chart quantifies the supply chain risk for consumer electronics, showing that memory is forecast to comprise 20-23% of a notebook’s bill of materials cost by 2026, a direct result of the price inflation mentioned in the section.

(Source: EnkiAI)

Memory Sector Cap Ex 2026: Investment Pivots to High-Bandwidth Memory

Memory producers are executing disciplined but substantial capital expenditures, channeling investment almost exclusively into expanding HBM capacity to meet AI demand, rather than bolstering the supply of conventional memory for consumer devices. This focused investment strategy reinforces the production bottleneck for the PC and smartphone markets.

- Memory manufacturers, wary of past boom-bust cycles, are avoiding broad capacity expansion. Instead, total DRAM sector Cap Ex is expected to grow by 14% year-over-year, from $53.7 billion in 2025 to $61.3 billion in 2026, with these funds specifically targeted at advanced HBM production lines.

- This investment shift creates a significant opportunity for semiconductor equipment suppliers. Companies like ASML are key beneficiaries, as memory producers require advanced lithography and packaging tools to build the more complex, layered HBM chips.

- The capital is not just for building new fabs but also for re-tooling existing lines for HBM. This process effectively reduces overall memory unit output, as a single HBM wafer yields fewer, albeit more valuable, chips than a conventional DRAM wafer, exacerbating the unit shortage for consumer electronics.

Strategic Alliances in the 2026 Memory Crisis: Producers Collaborate to Manage Supply

The severity of the supply-demand imbalance has driven top memory producers into an unusual collaboration to manage supply and prevent customer hoarding, consolidating their market power and fundamentally altering their relationships with both AI leaders and consumer electronics OEMs.

Top Suppliers See Explosive Revenue Growth

This chart shows the financial outcome of strategic alliances, with the top three suppliers’ combined revenue projected for 108% year-over-year growth, demonstrating the consolidated market power gained through collaboration.

(Source: EnkiAI)

- In a significant departure from the competitive landscape of 2021-2024, the three dominant memory makers, Samsung, SK Hynix, and Micron, are reportedly collaborating to block memory hoarding by customers. This move aims to stabilize supply chains but is also likely to accelerate price increases in the short term by controlling inventory.

- The production agenda is now heavily influenced by AI hardware leaders, particularly NVIDIA, whose massive procurement orders for HBM effectively underwrite the capacity expansion at producers like SK Hynix. This de-facto partnership prioritizes the needs of the AI data center market above all others.

- This realignment leaves major OEMs like Apple, Dell, HP, and Lenovo in a much weaker negotiating position. They must now compete for a shrinking pool of conventional memory, facing higher prices and the risk of supply shortfalls for their core products.

Table: Key Strategic Alliances Shaping the 2026 Memory Market

| Partners / Alliance | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Samsung, SK Hynix, Micron | 2026 | A reported collaboration to block memory hoarding by customers. This strategy intends to prevent inventory buildups that distort demand signals and aims to maintain pricing power by controlling supply flow, a significant shift from prior competitive behavior. | Tom’s Hardware |

| NVIDIA and SK Hynix | 2024 – 2026 | A deep technology and supply partnership where SK Hynix is the primary supplier of HBM for NVIDIA’s AI GPUs. NVIDIA’s demand forecasts and procurement power effectively dictate SK Hynix’s production priorities, securing HBM capacity at the expense of conventional DRAM. | Reuters |

| NVIDIA and TSMC | 2025 – 2026 | While not a memory alliance, this partnership is critical. TSMC’s ability to scale its advanced packaging (Co Wo S) capacity is a key bottleneck for HBM integration. NVIDIA CEO Jensen Huang has stated TSMC may need to double its capacity to meet demand, linking foundry output directly to memory availability. | EENews Europe |

Geographic Shifts in the Global Memory Shortage: Asia Dominates as US Ramps Up

While Asia-Pacific remains the undisputed center of memory production and the origin of the current supply crisis, geopolitical factors and government incentives are driving long-term plans for geographic diversification, although these efforts will not resolve the immediate shortage in 2026.

- From 2021 to 2024, the memory supply chain was almost entirely concentrated in Asia, with South Korean firms Samsung and SK Hynix controlling over 60% of the DRAM market. The current crisis is a direct result of their collective decision to pivot this vast manufacturing base towards HBM.

- Starting in 2025, government initiatives like the U.S. CHIPS and Science Act have catalyzed investment announcements for new domestic fabrication plants. However, the long lead times for construction mean these fabs will not contribute meaningful volume until well after the 2026-2027 shortage period.

- Geopolitical friction between the U.S. and China introduces significant risk. U.S. export controls on advanced semiconductor technology limit the capabilities of Chinese competitors like CXMT, while potential retaliatory measures from China could disrupt the supply chains of global companies, adding cost and uncertainty.

HBM at Scale: How Mature High-Bandwidth Memory Production is Constraining 2026 Electronics Markets

High-Bandwidth Memory has rapidly matured from a niche, specialized component to a commercially scaled product driving the entire memory sector, but its complex manufacturing process is the primary technological constraint creating a severe downstream shortage of conventional memory.

HBM Forecasted to Dominate AI Chip Market

Illustrating HBM’s maturation to a scaled product, this chart forecasts its overwhelming dominance in the AI chip market, which is the primary technological driver of the memory supply constraint on electronics.

(Source: EnkiAI)

- During the 2021-2024 timeframe, HBM was a high-cost component used in limited supercomputing and networking applications. By 2025-2026, it has become a mainstream requirement for the booming AI industry, with demand from NVIDIA, AMD, and Google turning it into a high-volume product whose supply is sold out for years in advance.

- The technological maturity of conventional memory like DDR 4 is now a liability. Because it is a commoditized product with lower margins than HBM, its production is being deprioritized. Data shows a growing undersupply of DDR 4 is expected to persist through 2026 as wafer capacity is reallocated.

- While the transition to next-generation conventional memory like DDR 5 continues, its rollout and availability are being hampered by the industry’s singular focus on maximizing HBM output. The higher profitability of HBM provides a powerful financial disincentive to invest in scaling DDR 5 capacity for the consumer market.

- Emerging memory technologies such as MRAM and RRAM exist in R&D but are not commercially mature enough to offer any relief to the 2026 supply crisis. The market is entirely dependent on the production decisions of the three dominant DRAM manufacturers.

SWOT Analysis: Navigating the 2026 Memory Market Realignment

The memory market’s structural shift presents immense strength and opportunity for memory producers through unprecedented pricing power, while simultaneously creating significant weaknesses and threats for the consumer electronics ecosystem, which faces margin compression and demand destruction.

Price Surge Validates Memory Producer Strength

This chart shows the dramatic price surge for memory components, directly visualizing the “unprecedented pricing power” that is identified as a key strength for producers in the SWOT analysis.

(Source: EnkiAI)

- Strengths for memory producers have shifted from volume production to high-margin specialization, giving them control over a critical AI component.

- Weaknesses emerge from the complexity of HBM manufacturing, which carries high execution risk, and the cannibalization of the high-volume consumer market.

- Opportunities are vast, driven by the structural, long-term demand from the AI sector, which is less cyclical than consumer electronics.

- Threats include potential demand destruction in the PC and smartphone markets due to high prices and the ever-present risk of geopolitical trade disruptions.

Table: SWOT Analysis for the Global Memory Market Shift

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | High-volume production efficiency for conventional DRAM/NAND. Market share dominance by the top three producers (Samsung, SK Hynix, Micron). | Unprecedented pricing power driven by HBM scarcity. High-margin HBM products boosting profitability. Supply for HBM sold out years in advance. | The market has shifted from valuing volume to valuing specialized, high-margin technology. Producer pricing power is validated by record price hike forecasts for Q 1 2026. |

| Weaknesses | High cyclicality leading to periods of oversupply and price collapse (e.g., 2023). Dependence on the PC and smartphone replacement cycles. | HBM production is more complex, with lower yields and longer manufacturing times than DRAM. Cannibalization of conventional memory capacity alienates large-volume OEM customers. | The weakness has shifted from market cyclicality to production complexity. The pivot to HBM has been validated as a strategic priority, but it creates a structural weakness in serving the broader market. |

| Opportunities | Growth tied to PC, smartphone, and traditional data center expansion. Introduction of new memory standards like DDR 5. | Explosive, structural demand from the AI sector (NVIDIA, AMD, Google). Ability to secure long-term, high-value contracts with AI hardware leaders. | The primary growth driver is no longer consumer electronics but the capital-intensive AI infrastructure build-out, which offers more predictable, long-term demand. |

| Threats | Inventory gluts at PC/smartphone OEMs leading to sharp price corrections. Geopolitical tensions impacting the global supply chain. | Extreme price hikes causing demand destruction in the PC and smartphone markets (shipments forecast to shrink in 2026). Risk of an “AI bubble” that could cause a sharp drop in HBM demand. | The threat of a cyclical downturn has been replaced by the threat of a structural bifurcation, where the high-volume consumer market is permanently damaged by the prioritization of the AI sector. |

Forward Outlook 2026: Navigating a Bifurcated Memory Market

If the extreme demand for AI infrastructure continues as projected, the memory market will remain bifurcated, forcing PC and smartphone OEMs to contend with a prolonged period of high prices and constrained supply, leading to difficult choices between raising prices, absorbing costs, or reducing device specifications.

DDR4 Memory Faces Persistent Undersupply by 2026

This chart perfectly illustrates the forward outlook of “constrained supply,” showing a forecast where demand for conventional DDR4 memory consistently outstrips supply through 2026.

(Source: EnkiAI)

- If this happens: Continued voracious demand for HBM by AI companies through 2026. Watch this: The quarterly contract price negotiations for conventional DRAM and NAND. A sustained Qo Q increase above 20% in the second half of 2026 would confirm that the supply crisis is deepening, not easing.

- If this happens: Memory producers continue to allocate the majority of their capital expenditure to HBM capacity. Watch this: The forward guidance on Cap Ex allocation in the quarterly earnings calls of Samsung, SK Hynix, and Micron. Any statement signaling a shift back toward conventional memory would be a key, but unlikely, de-escalation signal.

- This could be happening: Consumer electronics OEMs like Dell, Lenovo, and Xiaomi begin announcing product delays or reduced memory configurations in their mid-range and even high-end devices to manage BOM costs. Qualcomm’s disappointing sales forecast is an early signal of this trend.

- This could be happening: In response to the high cost of memory, there could be an accelerated push for more efficient on-device AI processing that relies less on massive memory footprints. This would create a strategic opportunity for companies specializing in low-power AI accelerators and optimized software models.

Frequently Asked Questions

Why are PCs and smartphones expected to get more expensive in 2026?

PCs and smartphones are expected to become more expensive because the memory they use (conventional DRAM and NAND flash) is in short supply. Major manufacturers like Samsung, SK Hynix, and Micron are shifting production to more profitable High-Bandwidth Memory (HBM) for the AI industry. This has led to a forecasted price increase of up to 95% for conventional memory, which directly raises the manufacturing cost for device makers, who are then likely to pass these costs on to consumers.

What is High-Bandwidth Memory (HBM) and why is it causing this problem?

High-Bandwidth Memory (HBM) is a specialized, high-performance memory essential for AI accelerators, like those made by NVIDIA. The booming AI sector has created massive, high-margin demand for HBM. Because HBM is much more profitable than the conventional memory used in PCs and smartphones, memory producers are reallocating their manufacturing capacity to prioritize HBM. This strategic pivot is directly causing the supply shortage and price crisis for consumer electronics.

Are companies not building more factories to increase the supply of all types of memory?

While memory producers are increasing their capital expenditure (CapEx), the investment is almost exclusively targeted at expanding HBM production capacity to meet AI demand. They are not significantly expanding capacity for conventional DRAM and NAND used in consumer devices. In fact, by re-tooling existing production lines for HBM, they are effectively reducing the overall output of conventional memory units, worsening the shortage for the PC and smartphone markets.

How does this memory crisis affect different tech companies like NVIDIA, Apple, and Dell?

The crisis creates a divided market. AI leaders like NVIDIA are in a strong position, forming deep partnerships with memory makers to secure the HBM supply they need. In contrast, consumer electronics OEMs like Apple, Dell, HP, and Lenovo are in a much weaker negotiating position. They face a shrinking pool of conventional memory, leading to extreme price hikes and the risk of supply shortfalls for their core products.

When is this memory supply crisis expected to end?

The article suggests the supply crisis and high prices will persist through at least 2026. New factories being built, such as those in the U.S. under the CHIPS Act, will not come online in time to resolve the immediate shortage. An end to the crisis would depend on a slowdown in AI demand or a significant strategic shift by memory producers back to prioritizing conventional memory, neither of which is expected in the short term.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Memory Shortage 2026: How AI Will Cause a Supply Crisis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.