Top 10 Nuclear Powered Data Center Projects in Europe in 2025

Europe’s AI Boom Ignites a Nuclear Renaissance: The Rise of SMR-Powered Data Centers

Introduction: A Strategic Pivot to Nuclear Power

In 2025, European data center operators are strategically pivoting to Small Modular Reactors (SMRs) as a dedicated, carbon-free baseload power source. This decisive shift is a direct response to the untenable grid-strain and exponential energy demand created by artificial intelligence. This trend is substantiated by a wave of high-stakes partnerships, including Equinix’s pre-order power purchase agreement (PPA) for up to 500 MWe of nuclear power with Stellaria Power and Data 4’s memorandum of understanding (Mo U) with Westinghouse to explore its 300 MWe AP 300 SMR. With European data center power demand projected to surge from 11 GW to 35 GW by 2030, the dominant theme of 2025 is the tech industry’s pursuit of energy sovereignty, moving from being passive consumers to active procurers of dedicated nuclear generation to guarantee operational uptime and meet net-zero goals.

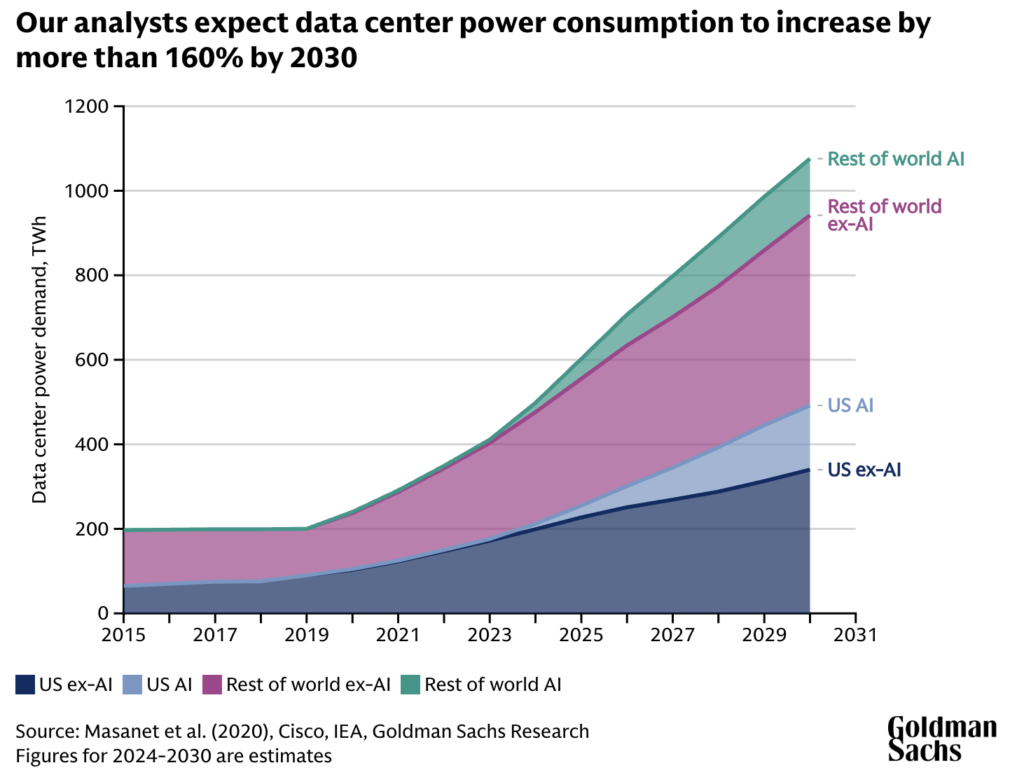

AI to Drive 160% Surge in Data Center Power Use

This chart establishes the core problem outlined in the introduction, showing how the exponential energy demand from AI is creating untenable grid strain and driving the strategic pivot to nuclear power.

(Source: National Security News)

2025 Key Installations and Initiatives: The Nuclear-Digital Nexus

The year has been defined by a series of landmark agreements coupling digital infrastructure providers with next-generation nuclear technology developers. These initiatives span direct power purchase agreements, co-location development projects, and national strategic programs.

1. Equinix & Stellaria Power Agreement

Company: Equinix & Stellaria Power

Installation Capacity: Up to 500 MWe

Applications: Powering Equinix’s data center portfolio across multiple European locations

Source: Equinix leans into nuclear power for its data centre empire

2. Equinix & ULC-Energy SMR Initiative (Netherlands)

Company: Equinix & ULC-Energy

Installation Capacity: Up to 250 MWe

Applications: Powering AI data centers in the grid-constrained Dutch market with Rolls-Royce SMRs

Source: Equinix and ULC-Energy Collaborate to Support …

3. Data 4 & Westinghouse AP 300 SMR Exploration

Company: Data 4 & Westinghouse Electric Company

Installation Capacity: 300 MWe (per unit)

Applications: Exploring the use of the AP 300 SMR to provide clean power for Data 4’s future data center campuses

Source: ROADMAPS TO NEW NUCLEAR 2025

4. Holtec/EDF SMR-Powered Data Center (UK)

Company: Holtec, EDF, and Tritax

Installation Capacity: SMR-300 (300 MWe)

Applications: Developing Europe’s first co-located SMR and data center campus on a 250-acre site

Source: UK and US firms outline plans for advanced nuclear development …

5. Swedish Nuclear Data Center Consortium

Company: Blykalla, Evroc, and Studsvik

Installation Capacity: Not specified

Applications: Exploring the construction of Sweden’s first nuclear-powered data center in Nyköping

Source: Swedish consortium to explore construction of Sweden’s first nuclear-powered …

6. Last Energy Microreactor Deployments

Company: Last Energy

Installation Capacity: 80+ units of 20 MWe each

Applications: A significant portion is designated for powering data centers with modular microreactors

Source: 4 tech companies eyeing nuclear power for AI energy

7. Poland SMR & Data Center Working Group

Company: ORLEN Synthos Green Energy (OSGE) & Polish Data Center Association (PLDCA)

Installation Capacity: Not specified

Applications: Creating a national roadmap for deploying SMRs to power Poland’s data center market

Source: Polish data centers to join forces with SMR sector

8. UK AI Data Center Plan

Company: UK Government & Vantage Data Centers

Installation Capacity: Not specified

Applications: Formally exploring dedicated nuclear energy for special data center districts, backed by a £12 billion investment from Vantage

Source: UK Will Explore Nuclear Power for New AI Data Center Plan

9. France’s Nuclear-Powered AI Initiative

Company: French Government

Installation Capacity: Not specified (leveraging existing national fleet)

Applications: Expanding national AI computing capacity, explicitly powered by its nuclear backbone, with an initial €10 billion investment

Source: ‘Plug, Baby, Plug’: France to Use Nuclear Power to Expand AI …

10. Brookfield AI Data Centre (Stockholm, Sweden)

Company: Brookfield

Installation Capacity: Not specified

Applications: A USD 1.2 billion AI data center project positioned to become a key offtaker for nuclear power in Sweden

Source: Top 7 Upcoming Data Centers in Europe (2025)

Table: 2025 European Nuclear-Data Center Initiatives

| Company / Initiative | Installation Capacity | Applications | Source |

|---|---|---|---|

| Equinix & Stellaria Power | Up to 500 MWe | Powering multi-site data center portfolio | totaltele.com |

| Equinix & ULC-Energy | Up to 250 MWe | Powering AI data centers in the Netherlands | equinix.com |

| Data 4 & Westinghouse | 300 MWe (per unit) | Powering future data center campuses | oecd-nea.org |

| Holtec, EDF, Tritax | 300 MWe (SMR-300) | Co-located SMR and data center campus | datacenterdynamics.com |

| Swedish Nuclear Data Center Consortium | Not specified | Exploring nuclear-powered data center construction | datacenterdynamics.com |

| Last Energy | 80+ units of 20 MWe each | Modular power for distributed data centers | techtarget.com |

| OSGE & PLDCA | Not specified | National roadmap for SMR-powered data centers | osge.com |

| UK AI Data Center Plan | Not specified | Dedicated nuclear for special data center districts | energyconnects.com |

| French Government | Not specified | Powering national AI capacity expansion | insidehpc.com |

| Brookfield | Not specified | USD 1.2 billion AI data center | blackridgeresearch.com |

From Power Consumers to Power Producers

The range of partnerships in 2025 signifies a fundamental shift in the data center industry’s relationship with energy. Operators are moving beyond opportunistic renewable PPAs to become anchor tenants and co-developers of new nuclear capacity. The singular application—powering high-density AI workloads—implies that this is not a diversification play but a critical-path strategy to ensure survival and growth. This is evident in the multiple partnership models being pursued:

- Direct Offtake: Equinix is leading this model, signing large-scale PPAs directly with SMR developers like Stellaria Power and ULC-Energy to secure hundreds of megawatts, effectively de-risking its power supply chain.

- Integrated Development: The Holtec/EDF/Tritax project in the UK is the blueprint for co-location, where the power source and the data center are planned and built as a single, integrated ecosystem. This optimizes land use and transmission infrastructure.

- National Ecosystem Building: In Poland and Sweden, consortia like the OSGE/PLDCA working group are creating national-level frameworks. This approach aligns industrial policy with digital infrastructure growth, treating data centers as strategic national assets.

Europe’s New Nuclear-Powered Data Corridors

European Nations Dominate Data Center Rankings

This chart supports the section’s focus on geographic trends by showing the high density of data centers in key European countries, providing context for the shift away from saturated legacy markets.

(Source: Brightlio)

Geographic trends in 2025 reveal a strategic migration of data center development, driven by energy availability. While legacy FLAP-D markets (Frankfurt, London, Amsterdam, Dublin) face severe grid saturation, new nuclear-powered corridors are emerging.

- United Kingdom: The UK is positioning itself as a leader in integrated development. The Holtec/EDF project in Nottinghamshire, combined with the government’s plan for special data center districts, signals a proactive national strategy to pair new nuclear with digital growth.

- France: Leveraging its unique position as a nuclear energy giant, France is using its existing fleet to power a €10 billion AI expansion. This provides a significant first-mover advantage, though it faces challenges in grid connection capacity.

- The Nordics & Eastern Europe: Sweden and Poland represent the next frontier. Initiatives like the Swedish Nuclear Data Center Consortium and Poland’s SMR working group are building new ecosystems from the ground up, attracting investment like Brookfield’s $1.2 billion AI campus in Stockholm. This “energy-first” approach is creating new digital hubs outside of traditional markets.

The SMR Blueprint: From MOUs to Megawatts

SMR Project Pipeline Shows Massive Growth

This chart perfectly illustrates the section’s theme of SMRs transitioning ‘From MOUs to Megawatts’ by showing the vast capacity in announced and permitting phases, confirming their commercial viability.

(Source: POWER Magazine)

The initiatives of 2025 demonstrate that SMRs are transitioning from a conceptual technology to a commercially viable solution for industrial-scale power needs. The current landscape is defined by foundational agreements—Mo Us, Lo Is, and pre-order PPAs—that pave the way for regulatory engagement and financing. Technology selection reveals a maturing market with differentiated offerings. Large-scale reactors like the Westinghouse AP 300 and Rolls-Royce SMR are being tapped for multi-hundred-megawatt campuses. In parallel, Last Energy’s deployment plans for over 80 of its 20 MWe microreactors highlight a complementary strategy for smaller, distributed, or faster-to-deploy power solutions. The involvement of established nuclear titans like Westinghouse and EDF provides the technical credibility and financial stability necessary to attract investment from risk-averse data center operators like Equinix and Data 4.

Energy-First Development: The New Data Center Paradigm

AI Power Demand to Exceed Entire State Grids

This chart provides a powerful concluding statement on the ‘insatiable power demands of AI’, reinforcing why an ‘energy-first’ development paradigm is now a critical necessity for the data center industry.

(Source: ai-supremacy.com)

The strategic moves of 2025 signal a permanent change in data center development, driven by the insatiable power demands of AI. The future is one of “energy-first” site selection, where developers secure a dedicated power source like an SMR before breaking ground on a data center campus. The UK’s Holtec/EDF project is the prime example of this new model. Furthermore, this trend marks the dawn of energy sovereignty for the tech industry. By directly procuring and co-developing nuclear power, hyperscalers and colocation providers are taking control of their energy supply to hedge against volatile grid prices and ensure the 24/7 reliability that AI workloads demand. While the first SMRs dedicated to data centers in Europe are unlikely to be operational before 2030, the agreements signed in 2025 are the critical first steps, locking in the technology, sites, and anchor customers for the next decade of digital infrastructure growth. The race is no longer just for land and fiber, but for clean, reliable megawatts.

Frequently Asked Questions

Why are European data centers turning to Small Modular Reactors (SMRs)?

Data centers are turning to SMRs as a direct response to the massive energy demand created by AI, which is causing significant strain on existing power grids. SMRs provide a dedicated, carbon-free, and reliable baseload power source, which guarantees the 24/7 operational uptime required for AI workloads and helps companies meet their net-zero carbon goals. This move allows them to achieve ‘energy sovereignty’ by securing their own power supply.

Are these nuclear-powered data centers already running?

No. According to the report, the first SMRs dedicated to powering data centers in Europe are not expected to be operational before 2030. The partnerships and agreements detailed for 2025 are the critical foundational steps, such as pre-order power purchase agreements (PPAs) and memorandums of understanding (MoUs), that lock in the technology, sites, and anchor customers for the next decade.

Which companies are leading this trend?

Several key players are pioneering this shift. Data center giant Equinix is a major leader, with large-scale power agreements with SMR developers like Stellaria Power (up to 500 MWe) and ULC-Energy (up to 250 MWe). Other notable initiatives include Data 4’s exploration with Westinghouse for its AP 300 SMR and a consortium in the UK (Holtec, EDF, Tritax) developing Europe’s first co-located SMR and data center campus.

What is the ‘energy-first’ development model?

The ‘energy-first’ model represents a fundamental change in how data centers are planned and built. It means that developers secure a dedicated, high-capacity power source, like an SMR, *before* breaking ground on a new data center campus. This contrasts with the traditional model of finding land with existing grid connectivity. It’s a strategic shift to prioritize energy availability above all else.

Which European countries are emerging as new hubs for these nuclear-powered data centers?

New ‘nuclear-powered data corridors’ are emerging outside of the traditional, grid-saturated markets. The United Kingdom is positioning itself as a leader with proactive government support and integrated projects. France is leveraging its vast existing nuclear fleet to power its AI ambitions. Furthermore, the Nordics (specifically Sweden) and Eastern Europe (specifically Poland) are becoming the next frontier, creating national frameworks to attract major investments for new nuclear-powered digital hubs.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.