Top 10 Wind Powered Data Center Projects in Europe in 2025

Europe’s Wind-Powered Data Centers: A Market Deep Dive

Introduction: The New Energy Imperative for Digital Infrastructure

The strategic integration of dedicated wind power is now the primary driver of data center site selection and operational viability in Europe, a direct response to the collision of AI’s massive energy demands and strained national grids. This shift is no longer about sustainability alone but about securing the gigawatt-scale power necessary for growth. Hyperscalers like Amazon, Google, Microsoft, and Meta have become Europe’s largest corporate energy buyers, contracting 9.3 GW of wind power in 2025 to fuel their expansion. This trend is reinforced by Europe’s burgeoning 20 GW data center development pipeline, which is forcing operators to bypass traditional grid-connected locations in favor of regions with abundant renewable resources. The dominant theme for 2025 is the pivot from opportunistic Power Purchase Agreements (PPAs) to the intentional development of integrated “AI Factories” and energy parks, where data center location is dictated by direct access to reliable, large-scale wind power.

Data Center Power Demand to Skyrocket

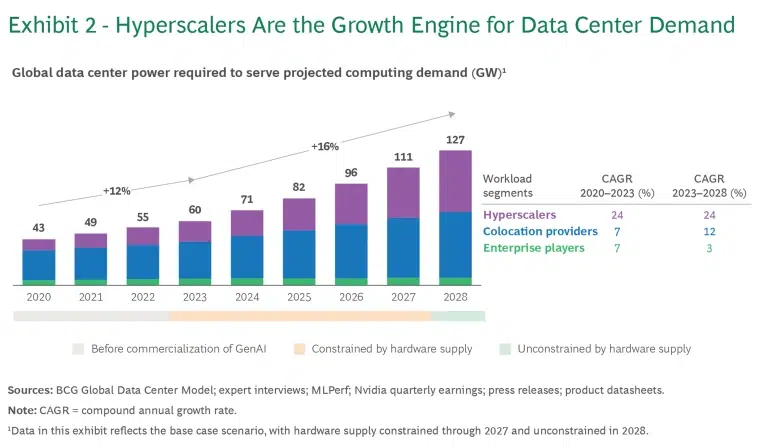

This chart quantifies the article’s central problem: the massive growth in data center energy demand driven by AI, which necessitates the gigawatt-scale wind power solutions discussed.

(Source: Boston Consulting Group)

Key Wind-Powered Data Center Installations and Initiatives

The European market is defined by a range of strategies, from massive hyperscale procurement to deeply integrated, co-located energy parks. The following projects represent the leading edge of this transformation.

1. Pan-European Hyperscaler Procurement

Company: Amazon, Google, Microsoft, and Meta

Installation Capacity: 9.3 GW of wind power via PPAs

Applications: Powering existing and future data centers across Europe to meet corporate sustainability goals and secure large-scale energy.

Source: Analysis: Data centre boom presents opportunities and …

2. Google’s Spanish Wind Power Deal

Company: Google, Exus Renewables

Installation Capacity: 33 MW

Applications: A 10-year PPA to power Google’s Spanish data center operations with carbon-free energy and support new renewable capacity in Spain.

Source: The Global Data Center Power Market Report

3. Meta’s U.S. Blueprint for Europe

Company: Meta, Invenergy

Installation Capacity: Nearly 800 MW (wind and solar)

Applications: A large-scale, multi-technology procurement model in the U.S. that is being replicated to underpin Meta’s European data center expansion.

Source: Meta Powers U.S. Data Centers with Nearly 800 MW …

4. VIRTUS Data Centres’ UK Wind Agreement

Company: VIRTUS Data Centres, Inspired, LID windfarms

Installation Capacity: 31 MW

Applications: A tri-party Corporate PPA directly linking VIRTUS’s data center portfolio to specific wind assets to achieve 100% renewable energy goals.

Source: VIRTUS Secures Wind Power Deal for Net Zero Data Centres

5. Telehouse UK’s Offshore Wind PPA

Company: Telehouse International Corporation of Europe, RWE

Installation Capacity: Sourcing from the 630 MW Sofia Offshore Wind Farm

Applications: A 10-year PPA to supply Telehouse’s London data centers with reliable, large-scale renewable power from offshore wind.

Source: RWE Signs PPA to Power Data Center Hub with Offshore …

6. LCL Data Centers’ Direct Turbine Investment

Company: LCL Data Centers

Installation Capacity: 6.9 MW

Applications: Powering its Belgian data centers with three dedicated, company-owned wind turbines to gain energy independence and achieve carbon neutrality.

Source: LCL powers up three wind turbines to support carbon …

7. Eurowind & Edora’s Integrated Energy Park

Company: Eurowind, Edora

Installation Capacity: 2 MW to 10 MW data center

Applications: A data center developed within a renewable energy park in Denmark, using a Battery Energy Storage System (BESS) as the primary backup power source.

Source: Eurowind, Edora to develop data center within renewable …

8. Innova’s 4.4 GW UK Proposal

Company: Innova

Installation Capacity: Proposed 4.4 GW of data center capacity

Applications: Ten proposed data center projects, with five co-located with BESS to create integrated energy hubs powered by the UK’s wind resources.

Source: UK renewable firm Innova submits proposals for ten …

9. Finland’s National Wind-Powered Strategy

Company: National Initiative (involving grid operator Fingrid)

Installation Capacity: National-scale wind power build-out

Applications: Attracting data center investment by creating a national energy ecosystem based on abundant and low-cost wind power.

Source: How Wind-Powered Finland Became Europe’s New Data …

10. Green Mountain’s Nordic Expansion

Company: Green Mountain

Installation Capacity: Portfolio-wide expansion

Applications: Expanding data center capacity in Norway, explicitly backed by the country’s vast hydro and wind power portfolio to offer sustainable and competitive services.

Source: Europe Hyperscale Data Center Market Size & Share …

Table: Europe’s Top Wind-Powered Data Center Projects & Initiatives (2025)

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| Amazon, Google, Microsoft, Meta | 9.3 GW (wind PPAs) | Powering pan-European data centers | Analysis: Data centre boom presents opportunities and … |

| Google, Exus Renewables | 33 MW | Powering Spanish data center operations | The Global Data Center Power Market Report |

| Meta, Invenergy | Nearly 800 MW | Blueprint for European data center energy strategy | Meta Powers U.S. Data Centers with Nearly 800 MW … |

| VIRTUS Data Centres | 31 MW | Powering UK data center portfolio | VIRTUS Secures Wind Power Deal for Net Zero Data Centres |

| Telehouse, RWE | From 630 MW offshore farm | Powering London data centers with offshore wind | RWE Signs PPA to Power Data Center Hub with Offshore … |

| LCL Data Centers | 6.9 MW | Dedicated turbines for energy independence | LCL powers up three wind turbines to support carbon … |

| Eurowind, Edora | 2 MW-10 MW (data center) | Integrated renewable park with BESS backup | Eurowind, Edora to develop data center within renewable … |

| Innova | 4.4 GW (proposed) | Co-located data centers with BESS | UK renewable firm Innova submits proposals for ten … |

| National Initiative (Finland) | National wind build-out | Attracting data centers via national energy strategy | How Wind-Powered Finland Became Europe’s New Data … |

| Green Mountain | Portfolio expansion | Nordic expansion backed by hydro and wind | Europe Hyperscale Data Center Market Size & Share … |

From PPAs to Power Plants: Data Centers Evolve into Energy Players

The methods of wind power integration reveal a maturing market with distinct strategies for different players. At one end, hyperscalers like Google and Meta use their immense balance sheets to underwrite new, large-scale wind farms through PPAs, as seen in their collective 9.3 GW procurement. This is the brute-force approach to securing power and ensuring “additionality.” In the middle, colocation providers like VIRTUS and Telehouse leverage PPAs to offer green hosting as a competitive differentiator. The Telehouse deal to source power from RWE’s 630 MW offshore wind farm signifies a crucial trend: tapping into more reliable, utility-scale renewable sources to power dense urban data center hubs. At the most advanced end of the spectrum is direct ownership and deep integration. LCL Data Centers’ €7.5 million investment in its own 6.9 MW turbine cluster and the Eurowind/Edora project in Denmark showcase a move toward energy independence, displacing diesel generators with BESS and creating a truly symbiotic relationship between power generation and consumption.

European Wind Investment Surges to Record Highs

This chart provides the financial context for the article’s theme, showing the surge in wind investment that enables the large-scale PPAs used by data centers.

(Source: EnkiAI)

The Nordic Nexus: How Abundant Wind is Redrawing Europe’s Data Map

Geography is becoming the single most critical factor in data center strategy, with a clear geographic shift toward regions with abundant renewable energy. The Nordic countries are the undisputed leaders. Finland has been dubbed “Europe’s new data centre darling” precisely because its massive investment in wind power offers a solution to the energy crunch plaguing established markets. Similarly, operators like Green Mountain are expanding rapidly in Norway by leveraging the nation’s vast hydro and wind resources to offer sustainable and cost-effective services, creating a powerful competitive advantage. While traditional hubs are not disappearing, they are forced to adapt. The UK, for example, is seeing ambitious proposals like Innova’s plan for 4.4 GW of data centers co-located with renewables and storage, an attempt to build new, integrated energy ecosystems. Meanwhile, Google’s 33 MW deal in Spain demonstrates how hyperscalers are actively developing renewable capacity in secondary markets to support regional deployments.

Map Shows New Data Center Hotspots

This map perfectly illustrates the section’s core argument, visually confirming the geographic shift of data center development towards renewable-rich regions like Northern Europe.

(Source: Aegir Insights)

Beyond the PPA: Integrated Energy Systems Reach Commercial Scale

The installations of 2025 reveal a clear progression in technological and commercial maturity across different integration models. Corporate PPAs are a fully mature, commercialized instrument, now being deployed at a multi-gigawatt scale by hyperscalers. The key innovation here is the sheer size of the deals, which are now large enough to single-handedly finance new offshore wind farms. The next level, direct integration by colocation providers, is rapidly scaling and moving from a niche offering to a mainstream strategy. When a provider like Telehouse signs a 10-year PPA tied to a major offshore wind project, it signals that this model is bankable and ready for prime time. The most forward-looking model—the fully integrated renewable energy park with co-located data centers and battery storage—is transitioning from demonstration to commercial reality. The Eurowind/Edora project is a critical proof-of-concept, while Innova’s proposal to deploy this at a 4.4 GW scale indicates powerful commercial confidence in the model’s viability for overcoming grid constraints and achieving 24/7 carbon-free operations.

Europe’s Data Center Power Market Booms

This chart’s forecast directly reflects the theme of ‘commercial scale,’ quantifying the significant growth and market value of the power solutions being deployed.

(Source: Market Data Forecast)

The Future is Integrated: Gigawatt-Scale AI Factories Powered by Wind

The clear signal from the 2025 market is a structural unbundling of data centers from legacy power grids and a rebundling with dedicated renewable generation. The future of digital infrastructure in Europe is not just green; it is deeply integrated with the energy sector. We are moving toward a model where gigawatt-scale “AI Factories” are developed as part of larger energy campuses, complete with dedicated wind farms, solar arrays, and battery storage. Projects like those proposed by Innova are the blueprint for this future. In this new paradigm, data centers will not just be passive consumers of energy but active participants in the energy system, using their flexible loads and storage assets to provide grid services. The competitive landscape is being redrawn around access to power, and companies that master the integration of wind and other renewables, like the Nordic pioneers, will lead the next decade of digital growth in Europe.

Future Scenarios Point to Wind Power Dominance

This long-term forecast provides a powerful concluding visual, validating the article’s thesis that the future of large-scale computing is inextricably linked to wind energy.

(Source: RFF.org)

Frequently Asked Questions

Why is wind power suddenly so critical for European data centers?

The massive energy demand from AI is colliding with Europe’s already strained national power grids. As a result, securing a dedicated, gigawatt-scale power source is no longer just about sustainability but has become essential for operational viability and growth. Data center operators are turning to wind power to bypass grid limitations and secure the energy they need.

Who are the biggest players driving the demand for wind power?

Hyperscalers are the primary drivers. The article states that Amazon, Google, Microsoft, and Meta have become Europe’s largest corporate energy buyers, collectively contracting 9.3 GW of wind power in 2025 to fuel their expansion and meet sustainability goals.

What are the different strategies for integrating wind power with data centers?

Companies are using a range of strategies. The most common is signing large-scale Power Purchase Agreements (PPAs) to fund new wind farms. Other methods include direct investment, where companies like LCL Data Centers buy their own turbines, and the most advanced model, which involves developing fully integrated energy parks where data centers are co-located with wind farms and battery storage (BESS).

How is this trend affecting the location of new data centers in Europe?

It’s causing a significant geographic shift towards regions with abundant renewable energy. The Nordic countries, especially Finland and Norway, are becoming prime locations due to their vast, low-cost wind and hydro resources. This is redrawing Europe’s data map, as new developments prioritize direct access to power over proximity to traditional city hubs.

What is an integrated ‘AI Factory’ or ‘energy park’?

This is the most advanced model where a data center is not just a consumer of power but part of a larger, integrated energy system. These ‘AI Factories’ or ‘energy parks’ are campuses that include dedicated wind farms, battery storage (BESS), and the data center itself. This allows for energy independence, greater reliability, and enables the data center to act as an active participant in the energy grid.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.