Top 10 Solar Powered Data Center Projects in the US in 2025

AI’s Power Play: How Utility-Scale Solar Became the Backbone of Data Center Expansion

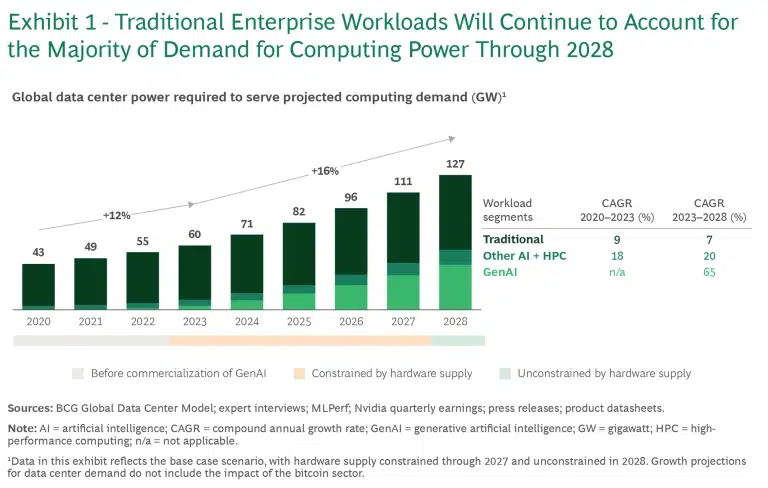

AI Drives Explosive Data Center Power Demand

This chart shows how AI workloads are projected to nearly triple global data center power demand by 2028, establishing the core energy challenge driving the turn to solar.

(Source: Boston Consulting Group)

Introduction: The Strategic Pivot to Solar-Powered AI

The explosive growth of Artificial Intelligence is forcing a fundamental realignment of the U.S. energy sector, establishing hyperscale tech companies as de facto energy developers. The core insight is that utility-scale solar, once a tool for corporate sustainability, is now a mission-critical strategic asset required to power AI’s gigawatt-scale energy needs, as the existing grid cannot keep pace. This transition is evidenced by projections that data centers will consume 130 GW, or nearly 12% of U.S. electricity, by 2030, and by massive procurement deals like Amazon‘s 13.6 GW solar development pipeline. The dominant theme for 2025 is this strategic necessity: tech giants are no longer just buying clean energy; they are building entire energy ecosystems, from off-site power plants to integrated solar-plus-storage campuses, to ensure their AI operations can grow without constraint.

Top Solar-Powered Data Center Installations and Strategies

The following projects represent the leading edge of how tech companies are securing power for AI. They are categorized by the primary business model, moving from large-scale procurement to fully integrated, co-located power generation facilities.

1. Amazon Solar Development Pipeline

Company: Amazon Web Services (AWS)

Installation Capacity: 13, 600 MW

Applications: Powering a nationwide portfolio of data centers through a massive pipeline of off-site solar projects.

Source: Tech Giants Rush to Solar Amid Data Center Grid Strain

2. Google & Intersect Power Partnership

Company: Google, Intersect Power

Installation Capacity: Not Specified (part of a $20 billion partnership)

Applications: Development of renewable energy projects, primarily solar, to supply power to Google‘s U.S. data centers.

Source: AI Leaders are Pumping Billions into Solar + Storage – SEIA

3. Meta’s Clear Fork Solar Project

Company: Meta, Enbridge, ENGIE

Installation Capacity: 600 MW

Applications: A $900 million solar farm developed to supply power to Meta‘s data centers in Texas, part of a larger 1.3 GW PPA.

Source: A $900 M Texas solar mega-farm will power Meta’s data …

4. Google’s First Solar Module Deal

Company: Google, First Solar

Installation Capacity: 875 MW

Applications: Powering Google‘s data centers using 1.3 million solar modules manufactured by First Solar in Ohio.

Source: First Made-in-USA Solar Plant Set to Power Google Data …

5. Microsoft Renewable Portfolio Expansion

Company: Microsoft

Installation Capacity: 475 MW

Applications: An addition to its existing 6.15 GW renewable portfolio to meet the growing energy demands of its AI data centers.

Source: Solar notches another win as Microsoft adds 475 MW to …

6. AES Bellefield Project

Company: AES

Installation Capacity: 2, 000 MW Solar + Storage

Applications: A massive solar-plus-storage campus in Southern California designed to provide reliable, clean power to key data center hubs.

Source: Renewable Hyperscale Data Center Energy Solutions | AES

7. SB Energy “Stargate” AI Campus

Company: SB Energy, Open AI, Soft Bank

Installation Capacity: 1, 200 MW

Applications: A $1 billion investment to build a 1.2 GW AI data center campus in Texas with fully integrated solar and energy storage.

Source: SB Energy secures $1 billion from Open AI and Soft Bank for …

8. Google’s Operational Storage

Company: Google

Installation Capacity: 312 MW (Battery Storage)

Applications: An operational fleet of battery storage systems paired with renewable energy projects to enhance grid stability and reliability for its data centers.

Source: AI Leaders are Pumping Billions into Solar + Storage – SEIA

9. Fermi America Hybrid Energy Campus

Company: Fermi America, Texas Tech

Installation Capacity: 11, 000 MW (11 GW)

Applications: An ambitious hybrid energy campus in Texas designed for AI data centers, integrating nuclear, natural gas, and solar generation.

Source: Fermi America: Gigawatt Scale Power for Next-Gen AI

10. Ameren Missouri Solar Facility

Company: Ameren

Installation Capacity: 250 MW

Applications: A large solar facility planned in Missouri, partly driven by anticipated power demand from new data centers in the region.

Source: Ameren plans large solar facility in Missouri, in part for data …

11. Soluna Project Annie

Company: Soluna

Installation Capacity: 75 MW

Applications: A data center for high-performance computing powered by a co-located solar farm in Northeast Texas.

Source: Soluna to build first solar powered data center in northeast …

Table: Summary of Key Solar and Data Center Projects (2025)

| Company / Key Players | Installation Capacity | Applications | Source |

|---|---|---|---|

| Amazon Web Services (AWS) | 13, 600 MW | Powering nationwide data centers | datacenterknowledge.com |

| Google, Intersect Power | $20 billion partnership | Developing renewable projects for data centers | seia.org |

| Meta, Enbridge, ENGIE | 600 MW | Powering Texas data centers | electrek.co |

| Google, First Solar | 875 MW | Powering data centers with U.S.-made modules | energy.gov |

| Microsoft | 475 MW | Expanding renewable portfolio for AI | techcrunch.com |

| AES | 2, 000 MW Solar + Storage | Reliable power for California data centers | aes.com |

| SB Energy, Open AI, Soft Bank | 1, 200 MW | Integrated solar campus for AI data center | pv-magazine-usa.com |

| 312 MW (Storage) | Enhancing renewable reliability for data centers | seia.org | |

| Fermi America | 11, 000 MW | Hybrid (nuclear, gas, solar) campus for AI | fermiamerica.com |

| Ameren | 250 MW | Serving anticipated data center demand | stlpr.org |

| Soluna | 75 MW | Co-located solar for HPC data center | datacenterdynamics.com |

Beyond PPAs: The Evolving Models of Energy Adoption

The singular application—powering energy-intensive data centers—is driving a rapid diversification in adoption models. This implies that the market is moving past simple procurement towards sophisticated, integrated energy infrastructure development. We see a clear progression:

1. Massive Off-Site Procurement: The dominant model, exemplified by Amazon‘s 13.6 GW pipeline and Meta‘s 600 MW project in Texas, involves long-term Power Purchase Agreements (PPAs). This allows hyperscalers to secure vast quantities of renewable energy at scale without being limited by land availability at individual data center sites.

2. Integrated Solar + Storage Campuses: The next evolution addresses solar’s intermittency. Projects like the 2, 000 MW AES Bellefield facility and SB Energy‘s $1 billion “Stargate” AI campus integrate multi-gigawatt-hour battery systems. This model is critical for providing the 24/7 carbon-free energy that mission-critical data centers require.

3. Co-located & Dedicated Generation: The most advanced model involves developing power plants and data centers as a single, integrated project. This approach, seen with Soluna‘s 75 MW project and the ambitious 11 GW Fermi America hybrid campus, bypasses grid interconnection bottlenecks entirely, ensuring a dedicated and resilient power supply for gigawatt-scale AI deployments.

The Sun Belt and Beyond: Mapping AI’s Energy Hotspots

Geographic trends highlight a strategic focus on regions with abundant land and solar resources, but the need is national. Texas has clearly emerged as the epicenter for these developments, hosting major projects like Meta‘s Clear Fork Solar, SB Energy‘s “Stargate” campus, and the planned Fermi America hybrid facility. This concentration is driven by favorable regulations, vast land availability, and high solar irradiance. However, the trend is not exclusively Texan. AES‘s massive 2, 000 MW solar-plus-storage project in Southern California is strategically located to serve West Coast data center hubs. Furthermore, Ameren‘s plan for a 250 MW solar facility in Missouri to serve data centers indicates that this demand is pushing large-scale solar development into new regions. Finally, the nationwide scope of procurement by giants like Amazon and Microsoft demonstrates this is a continental strategy, with localized manufacturing benefits underscored by Google‘s deal for Ohio-made modules from First Solar.

Mapping America’s Data Center Energy Hotspots

This map visualizes data center power demand by county, directly illustrating the geographic concentrations in Texas, Virginia, and other key hubs discussed in this section.

(Source: Visual Capitalist)

From Procurement to Power Plant: The Maturation of Data Center Energy

These installations reveal a rapid maturation of energy strategy, moving from simple purchasing to direct infrastructure development. Utility-scale solar PPAs, as deployed by Amazon and Microsoft in multi-gigawatt volumes, are now a fully commercial and scaled solution. They represent the foundational, de-risked approach. The technology is now advancing to solve solar’s core weakness: intermittency. Solar-plus-storage is quickly moving from demonstration to the new commercial standard for reliable renewables, with projects like AES Bellefield proving the model at the gigawatt scale necessary for data center hubs. The most forward-looking, though still emerging, stage is the co-located hybrid power campus. The Fermi America project, which plans to integrate solar with firm power sources like nuclear and natural gas, represents the future state: a private, grid-independent, multi-technology utility built for the sole purpose of powering AI.

Power Plant Pipeline Surges for Future Demand

Supporting the theme of maturation, this chart reveals the massive spike in new power plant projects scheduled for 2024-2025 to meet growing energy needs.

(Source: Enverus)

The Future is Integrated: What’s Next for AI and Clean Energy

The projects of 2025 signal an irreversible trend: the convergence of technology and energy infrastructure. The future of powering AI is not just more solar, but more integrated and resilient energy systems. Solar serves as the fast, cost-effective anchor, but it is increasingly being paired with other technologies to ensure 24/7 uptime. The next wave of development will be defined by hybrid solutions. This includes the massive scaling of solar-plus-battery projects and, as evidenced by Meta‘s backing of Terra Power and the Fermi America proposal, a strategic inclusion of firm power sources like advanced nuclear. This profound shift is transforming hyperscale companies into some of the most influential players in the energy market, creating immense new opportunities for utilities, technology providers, and developers capable of delivering reliable, gigawatt-scale power at the speed AI demands.

Solar and Storage to Dominate Grid Expansion

This forecast shows solar and batteries accounting for over 80% of new U.S. capacity in 2025, validating the article’s conclusion that the future is integrated.

(Source: pv magazine USA)

Frequently Asked Questions

Why are tech companies building their own solar farms instead of just buying power from the grid?

The explosive growth of AI is creating energy demands that the existing U.S. power grid cannot meet. Data centers are projected to consume nearly 12% of U.S. electricity by 2030. To avoid grid constraints and secure the massive, reliable power needed for expansion, tech companies are proactively developing their own energy ecosystems, with utility-scale solar as a foundational component.

What are the main strategies tech companies are using to power their data centers with solar?

The article identifies three evolving models: 1) Massive Off-Site Procurement through large Power Purchase Agreements (PPAs), like Amazon’s 13.6 GW pipeline. 2) Integrated Solar + Storage Campuses, which pair solar farms with large batteries for 24/7 power, such as the 2,000 MW AES Bellefield project. 3) Co-located & Dedicated Generation, where power plants are built as part of the data center campus to bypass the grid entirely, like the Soluna and Fermi America projects.

Which companies are leading this move into solar energy development?

Amazon is at the forefront with a massive 13,600 MW (13.6 GW) solar development pipeline. Other major players include Google, with its $20 billion partnership with Intersect Power and large module deals; Meta, which is powering its Texas data centers with projects like the 600 MW Clear Fork Solar farm; and Microsoft, which is adding hundreds of megawatts to its large renewable portfolio.

Is solar power alone enough to run an AI data center 24/7?

No, solar alone is not enough due to its intermittency. That’s why the trend is moving toward hybrid solutions. Projects like AES Bellefield and SB Energy’s ‘Stargate’ are integrating multi-gigawatt-hour battery storage systems. The most advanced concepts, like the Fermi America campus, plan to combine solar with firm power sources like advanced nuclear and natural gas to guarantee a completely reliable, 24/7 power supply.

Is this trend only happening in sunny states like Texas and California?

While Texas and California are epicenters for these projects due to high solar irradiance and available land, the trend is national. The article highlights that procurement by giants like Amazon and Microsoft is continent-wide. Furthermore, it points to a 250 MW solar facility planned in Missouri by Ameren, partly driven by anticipated data center demand, indicating that the need for power is pushing large-scale solar development into new regions.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.