Top 10 Wind Powered Data Center Projects in the US in 2025

The New Power Play: A 2025 Analysis of Wind-Powered Data Center Infrastructure

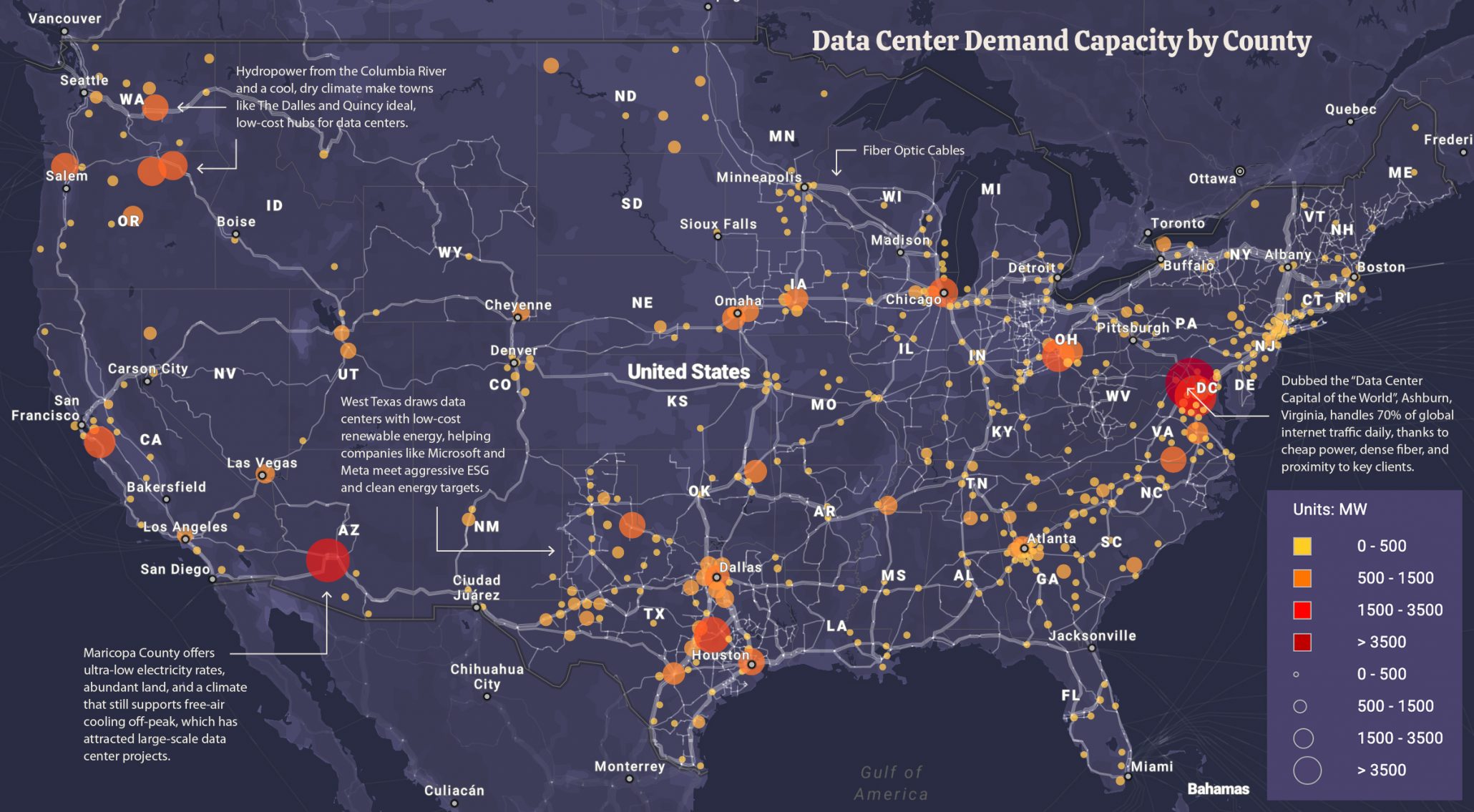

Map of US Data Center Power Hotspots

This map provides a geographical overview of data center power demand, highlighting the key clusters in Virginia and Texas that are central to the report’s analysis.

(Source: Visual Capitalist)

Introduction: An Executive Briefing on the Wind-Compute Nexus

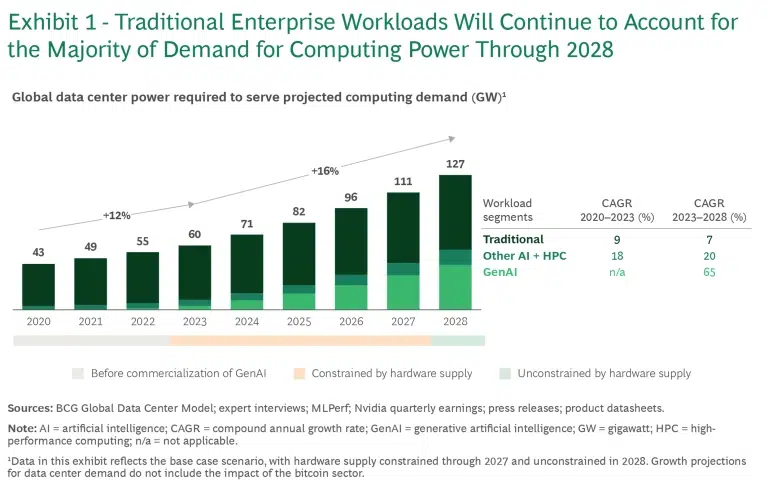

The convergence of exponential AI power demand and grid limitations is forcing a fundamental shift in data center strategy, establishing dedicated wind-powered infrastructure as the primary solution for securing reliable, gigawatt-scale energy. This move is no longer about sustainability credits but about operational certainty. Hyperscalers are underwriting new wind farms through massive, long-term Power Purchase Agreements (PPAs), exemplified by Meta’s deal with Invenergy for the 196 MW Seaway Wind Energy Center. Concurrently, specialized developers like Soluna Holdings are pioneering a co-location model, building over 598 MW of data center capacity directly connected to wind farms to monetize otherwise stranded energy. The dominant theme for 2025 is the strategic decoupling of data center development from the public grid, creating “energy-first” infrastructure where power availability, not just location, dictates site selection.

AI Workloads to Triple Power Demand by 2028

This chart directly supports the section’s opening statement about ‘exponential AI power demand’ by showing that Generative AI is the primary driver of future data center energy growth.

(Source: Boston Consulting Group)

2025 Installations: Top 10 Wind-Powered Data Center Projects

The following projects represent the leading edge of wind and data center integration, spanning large-scale PPAs, co-located facilities, and master-planned energy campuses.

1. Meta’s Seaway Wind Energy Center

Company: Meta, Invenergy

Capacity: 196 MW

Application: Powering U.S. data centers via PPA

Source: Invenergy to Provide Meta with Nearly 800 MW, Supporting …

2. Microsoft’s Virginia Clean Power Initiative

Company: Microsoft, AES

Capacity: Part of a 6.15 GW total renewable portfolio

Application: To achieve 100% clean power for Virginia data centers via PPA

Source: How solar energy is shaping the future of data centers

3. Microsoft’s Wyoming Direct Wind Farm

Company: Microsoft

Capacity: 237 MW

Application: Directly powering the Cheyenne, Wyoming, data center

Source: How to Make Data Centers More Sustainable

4. Apple’s Diversified Nevada Data Center

Company: Apple

Capacity: 32% of facility supply

Application: Powering the Reno data center with a mix of renewables, including wind

Source: Apple data centers consumed more than 2.5 billion k Wh …

5. Clearway’s Elbow Creek Co-Located Data Center

Company: Clearway Energy Group

Capacity: 122 MW (wind farm)

Application: Co-located high-performance computing (HPC) data center powered directly by the wind project

Source: Clearway Announces New High-Performance Computing …

6. Soluna’s Project Hedy

Company: Soluna Holdings

Capacity: 120 MW data center co-located with a 200 MW wind farm

Application: Monetizing curtailed wind energy for batchable computing services

Source: Data center signs PPA with 200-MW South Texas wind farm

7. Soluna’s Project Gladys

Company: Soluna Holdings

Capacity: 150 MW data center co-located with a 226 MW wind farm

Application: Converting surplus wind power into revenue-generating computing

Source: O’Melveny Advises Soluna on Launch of Two Green Data …

8. Minnesota’s Integrated Energy & Data Campus

Company: Unnamed Developer

Capacity: $4 billion master-planned development

Application: Large-scale data center campus powered by an integrated network of new wind and solar

Source: In Minnesota farm country, a plan for a $4 billion data …

9. Soluna & Metrobloks’ Project Kati AI Hub

Company: Soluna, Metrobloks

Capacity: 100+ MW

Application: Specialized AI and HPC data hub drawing dedicated power from a co-located wind farm

Source: Soluna, Metrobloks plan 100+ MW AI data hub in Texas

10. Dominion’s Coastal Virginia Offshore Wind (CVOW) Project

Company: Dominion Energy

Capacity: 176 turbines

Application: Supplying massive, consistent power to the Northern Virginia data center market

Source: Court allows Dominion Energy to resume offshore wind …

Table: 2025 US Wind-Powered Data Center Projects

| Company | Capacity | Application | Source |

|---|---|---|---|

| Meta, Invenergy | 196 MW | Powering U.S. data centers via PPA | Invenergy to Provide Meta with Nearly 800 MW, Supporting … |

| Microsoft, AES | Part of a 6.15 GW total renewable portfolio | To achieve 100% clean power for Virginia data centers via PPA | How solar energy is shaping the future of data centers |

| Microsoft | 237 MW | Directly powering the Cheyenne, Wyoming, data center | How to Make Data Centers More Sustainable |

| Apple | 32% of facility supply | Powering the Reno data center with a mix of renewables, including wind | Apple data centers consumed more than 2.5 billion k Wh … |

| Clearway Energy Group | 122 MW (wind farm) | Co-located high-performance computing (HPC) data center powered directly by the wind project | Clearway Announces New High-Performance Computing … |

| Soluna Holdings | 120 MW data center co-located with a 200 MW wind farm | Monetizing curtailed wind energy for batchable computing services | Data center signs PPA with 200-MW South Texas wind farm |

| Soluna Holdings | 150 MW data center co-located with a 226 MW wind farm | Converting surplus wind power into revenue-generating computing | O’Melveny Advises Soluna on Launch of Two Green Data … |

| Unnamed Developer | $4 billion master-planned development | Large-scale data center campus powered by an integrated network of new wind and solar | In Minnesota farm country, a plan for a $4 billion data … |

| Soluna, Metrobloks | 100+ MW | Specialized AI and HPC data hub drawing dedicated power from a co-located wind farm | Soluna, Metrobloks plan 100+ MW AI data hub in Texas |

| Dominion Energy | 176 turbines | Supplying massive, consistent power to the Northern Virginia data center market | Court allows Dominion Energy to resume offshore wind … |

From PPAs to Power Plants: Wind Becomes a Core Data Center Asset

The applications for wind power have evolved from a simple procurement tool into a foundational element of data center design and strategy. The diversity of these projects signals broad adoption across different operational needs. On one end, hyperscalers like Microsoft and Meta use massive, portfolio-wide PPAs to secure terawatt-hours of energy, effectively underwriting the development of new wind farms like the 196 MW Seaway project. This is a strategy of scale, aimed at ensuring long-term, cost-predictable power for sprawling, mission-critical campuses. On the other end, the “behind-the-meter” model pioneered by Soluna Holdings and adopted by Clearway represents a more symbiotic application. By co-locating data centers with wind farms, as seen in Project Hedy (120 MW) and Project Gladys (150 MW), these companies create an on-site, flexible buyer for energy that would otherwise be curtailed due to grid congestion. This turns a liability (wasted power) into a valuable asset (low-cost computing), perfect for the batchable, interruptible workloads common in AI training and HPC.

Leading US Wind Power Developers of 2024

This chart identifies the top wind developers, including Invenergy and AES, who are mentioned in the article as the key energy partners enabling hyperscale data center PPAs.

(Source: Cleanview)

Texas and Virginia: The New Wind-AI Corridors

A clear geographic pattern is emerging, with two states leading the integration of wind and data infrastructure for different strategic reasons. Texas has become the undisputed epicenter of the co-location model. The state’s vast wind resources, combined with significant grid interconnection challenges, create the perfect conditions for this strategy. Projects like Soluna’s Project Kati AI hub and Clearway’s Elbow Creek facility are clustered here to capitalize on the availability of low-cost, stranded wind power. This trend is creating a “Wind-AI Belt” where energy generation and high-density computing are being developed in tandem. Meanwhile, on the East Coast, Virginia represents the next major frontier. Dominion Energy’s massive Coastal Virginia Offshore Wind (CVOW) project is explicitly designed to serve the voracious power demands of Northern Virginia’s data center alley, the largest and densest market in the world. This strategy leverages the consistent and powerful generation of offshore wind to energize an established, high-value compute region, demonstrating a different path to scale than the Texas model.

Virginia and Texas Lead Future Demand

This chart directly visualizes the section’s core argument by projecting that Virginia and Texas will account for the majority of new data center power demand.

(Source: Rystad Energy)

Beyond the PPA: Maturing Models for Direct Wind Integration

These installations reveal a clear maturation curve for wind-powered data center models. The traditional hyperscale PPA, used by Microsoft and Meta to contract for gigawatts of power, is a fully commercial and scaled strategy. It is the established standard for large corporations to meet renewable energy goals and secure bulk power. The co-location model, however, has rapidly moved from a niche concept to a proven, scaling business strategy. The repeated success of Soluna’s multi-hundred-megawatt projects in Texas demonstrates that this model is commercially viable and replicable, effectively solving the dual problems of renewable intermittency and data center power demand. Looking forward, the most advanced but still emerging models are the fully integrated energy-and-data campuses. Minnesota’s proposed $4 billion project and Dominion Energy’s ambitious CVOW project represent the next technological and financial frontier. These are not just power agreements; they are master-planned infrastructure ecosystems that treat energy and data as a single, inseparable asset class, signaling the ultimate destination of the market.

GenAI Workloads Concentrated in Colocation Facilities

This data validates the section’s claim about the maturity of the co-location model by showing it is already a primary venue for running advanced AI workloads.

(Source: Comarch)

The Future is Integrated: Wind as the Bedrock of AI Expansion

The projects of 2025 signal a clear and irreversible trend: the future of large-scale computing, particularly for AI, is inextricably linked to the direct development of dedicated renewable energy. The primary market catalyst is the projected 165% increase in data center power demand by 2030, which is colliding with multi-year grid interconnection queues. This forces operators to build their own power solutions to energize multi-billion dollar GPU clusters on time. We are moving beyond PPAs toward more integrated partnerships, including direct equity investments by tech companies in new wind projects. The co-location model, championed by specialists like Soluna, will become a mainstream development strategy, providing an elegant solution to grid constraints and renewable intermittency. The ultimate test for the next decade will be the success of pioneering offshore-to-onshore projects like CVOW. If successful, they will unlock coastal data center markets for unprecedented growth, cementing wind power not merely as a sustainable choice, but as the fundamental enabler of the AI revolution.

Data Center Electricity Use to Skyrocket by 2030

This forecast visually represents the massive growth in power demand discussed in the section, with its projection closely matching the cited ‘165% increase by 2030’.

(Source: POWER Magazine)

Frequently Asked Questions

Why are data centers suddenly so focused on wind power?

It’s no longer just about sustainability. The massive power demand from AI is outstripping the capacity of public grids, leading to long delays for new connections. Data center operators are now building or contracting dedicated wind power to secure the reliable, large-scale energy they need for operational certainty and to power their infrastructure on time.

What are the main strategies for integrating wind power with data centers?

The article highlights three main models: 1) Power Purchase Agreements (PPAs), where companies like Meta and Microsoft buy power long-term from a wind farm; 2) Co-location, where companies like Soluna build data centers directly at wind farms to use surplus power; and 3) Integrated Energy Campuses, which are master-planned developments that combine data centers with dedicated renewable power sources from the start.

What is the difference between the PPA model and the co-location model?

A PPA is a financial contract where a data center company agrees to buy power, often delivered via the public grid, to meet renewable energy goals and secure stable pricing. Co-location is a physical and operational strategy where a data center is built ‘behind-the-meter’ at the wind farm itself. This allows it to directly consume low-cost, surplus energy that might otherwise be wasted, making it ideal for flexible computing workloads.

Which US regions are becoming hotspots for this trend?

Two main regions are leading the way. Texas has become the epicenter for the co-location model, creating a ‘Wind-AI Belt’ where developers capitalize on the state’s vast wind resources and grid congestion. Meanwhile, Virginia is a major frontier for large-scale supply, with projects like the Coastal Virginia Offshore Wind (CVOW) project being developed specifically to serve the massive power needs of the Northern Virginia data center alley.

Who are the key companies mentioned in the article?

The key players include: Hyperscalers like Meta, Microsoft, and Apple, who use large-scale PPAs; Co-location Specialists like Soluna Holdings and Clearway Energy Group, who build data centers directly at wind farms; and Energy Providers like Invenergy and Dominion Energy, who are developing the large onshore and offshore wind projects to supply this power.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.