Ballard Power’s Commercial Scale Projects Define Heavy-Duty Mobility Fuel Cell Market in 2025

Ballard Power Systems has decisively shifted its commercial strategy from broad, small-scale pilot projects to securing high-volume, recurring orders in specific heavy-duty mobility sectors, validating its technology at a commercial scale.

- Between 2021 and 2024, Ballard’s activities centered on market validation through smaller, strategic deployments. This included partnerships for prototypes, such as with Ford Trucks for the F-MAX truck; pilot projects, like the one with Adani Group for a mining truck in India; and initial system installations, like the fuel cells for the world’s first hydrogen ferry, Hydra. These actions proved the technology’s viability in diverse, demanding applications.

- From January 2025, the company’s focus pivoted to securing large-scale supply agreements that underpin its manufacturing expansion. Landmark deals include the historic order for 1, 000 fuel cell engines for Solaris buses, a ~20 MW agreement with CPKC to power a fleet of North American locomotives, and a 6.4 MW marine order from e Cap Marine for Samskip container vessels. These agreements represent a transition from one-off projects to being an integral supplier for major vehicle OEMs.

- The variety of applications, spanning bus, rail, truck, and marine, demonstrates that Ballard’s core PEM fuel cell technology platform is mature and adaptable. The successful demonstration of a 1.5 MW backup power system for a Microsoft data center further expands its addressable market into stationary power for critical infrastructure, signaling broad industry adoption.

Ballard Power’s Investment Analysis 2025: Funding a North American Gigafactory

Ballard’s investment strategy has pivoted from general-purpose capital raises and a tentative China expansion to a focused, government-supported plan to build manufacturing scale in the United States.

- In the 2021–2024 period, Ballard secured a major $550 million “bought deal” financing to fund its growth strategy. However, market realities led to a strategic reassessment, including rethinking a planned $130 million investment in a Shanghai facility in 2023 and initiating a major corporate restructuring in September 2024 to cut operating expenses by over 30% (~$50 million annually) in response to a delayed market.

- Starting in 2025, the investment focus crystallized around North America with the announcement of a new integrated fuel cell production “Gigafactory” in Rockwall, Texas. The planned investment of approximately $160 million for phase one is significantly de-risked by substantial U.S. government support.

- This support, confirmed in 2024 and solidified in 2025, totals $94 million, composed of $40 million in grants from the Department of Energy (DOE) and an additional $54 million in investment tax credits from the IRS. This shift aligns Ballard’s capital expenditure with a politically favorable region that offers clear incentives for clean energy manufacturing.

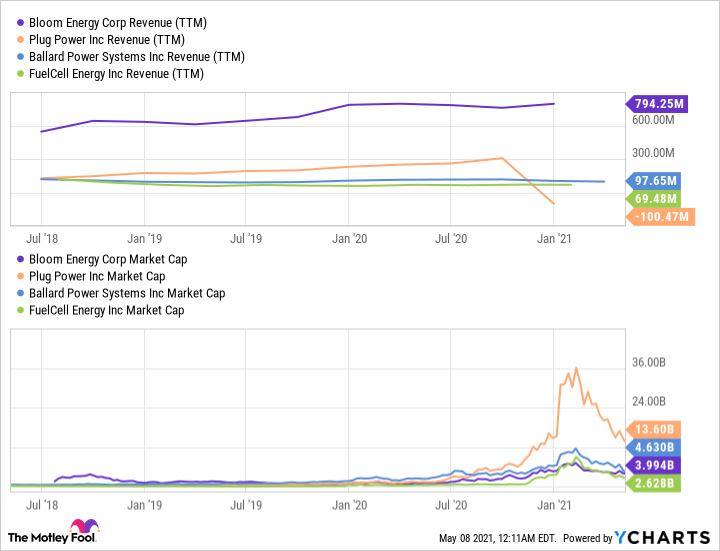

Ballard’s Financials at Start of Pivot

This chart provides financial context for the investment analysis by showing Ballard’s revenue and market capitalization in 2021, the beginning of the strategic period discussed.

(Source: The Motley Fool)

Table: Ballard Power Key Financial Events and Investments 2021-2025

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Texas Gigafactory Investment Hold | May 2025 | Paused the final investment decision on the Texas gigafactory as part of a cost-cutting program, despite securing $94 million in U.S. DOE grants. This reflects the company’s view of a “multi-year push-out” of the hydrogen industry. | ‘Multi-year push-out of the hydrogen industry’ | Ballard puts … |

| Corporate Restructuring | September 2024 | Announced restructuring to reduce total operating expenses by over 30%, yielding annual savings of ~$50 million to align with delayed market adoption and conserve capital. | Ballard announces restructuring to lower total operating … |

| Texas Gigafactory CAPEX Plan | April 2024 | Announced plan to invest ~$160 million (Phase 1) from 2024–2027 to build a new fuel cell production facility in Rockwall, Texas. | Ballard fortunes rise on record bus deal, U.S. gigafactory … |

| IRS Investment Tax Credit (48 C) | April 2024 | Awarded $54 million in U.S. tax credits to support the build-out of the Texas Gigafactory, bringing total federal support to $94 million. | Ballard announces $54 million of additional funding support … |

| U.S. DOE Grant | March 2024 | Awarded $40 million in grants from the U.S. Department of Energy (DOE) to support construction of the Texas Gigafactory. | Ballard announces $40 million in DOE grants to support build … |

| China Investment Reassessment | June 2023 | Re-evaluated a planned $130 million investment in a Shanghai MEA plant due to slower market ramp-up and geopolitical risks. | Ballard Power rethinking $130 M China investment plan … |

| Equity Investment in Quantron AG | September 2022 | Made a €5 million minority equity investment to deepen its strategic partnership for developing fuel cell trucks in Europe. | Ballard Power Systems Inc. Annual Information Form |

| Bought Deal Financing | February 2021 | Raised $550 million (up to $632.5 million) in a capital raise to fund corporate growth, R&D, and strategic initiatives. | Ballard Power Systems Announces Monster U.S. $550 … |

Ballard Power’s Strategic Partnerships Drive Commercial Dominance in 2025

Ballard’s partnership strategy has evolved from exploratory R&D collaborations to long-term supply agreements with major OEMs, cementing its role as a key technology supplier for the decarbonization of heavy-duty transport.

- From 2021 to 2024, partnerships were foundational, focusing on technology development and market entry. Collaborations with Eaton and the National Renewable Energy Laboratory (NREL) advanced R&D, while an alliance with ABB achieved a key marine certification. A strategic investment in Quantron AG provided an entry point into the European truck market.

- The period from 2025 onward is defined by scaled commercial relationships. This includes a long-term supply agreement with CPKC for a significant expansion of its hydrogen locomotive fleet, a major marine order with e Cap Marine for Samskip vessels, and a multi-year deal to supply 50 bus engines to MCV.

- Forward-looking partnerships aim to secure future growth and optimize the supply chain. A January 2026 Memorandum of Understanding (Mo U) with long-term partner Kolon Industries aims to scale production of key components to reduce costs, while a June 2025 Mo U with India’s Adani Group evaluates a joint venture for manufacturing in a key emerging market.

Table: Ballard Power Key Partnerships and Collaborations 2021-2026

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Kolon Industries | January 2026 | Signed an Mo U to strengthen collaboration on fuel cell components, scale production of bipolar plates, and reduce costs. | Ballard & Kolon aim to advance fuel cell excellence with new … |

| Adani Group | June 2025 | Entered an Mo U to evaluate a joint venture for manufacturing hydrogen fuel cells in India for mobility and industrial use. | Adani Group Announces Mo U with Ballard for Hydrogen … |

| CPKC | February 2025 | Announced a long-term supply agreement with an initial order for 98 engines (~20 MW) to power hydrogen locomotives in North America. | CPKC Places Follow-On Order for Ballard Fuel Cell Engines |

| Solaris | April 2024 | Announced its largest order in history: a long-term supply agreement for 1, 000 fuel cell engines for buses in Europe, with deliveries through 2027. | Ballard announces largest order in company history |

| Ford Trucks | August 2023 | Partnership to supply and develop a fuel cell system for a prototype heavy-duty F-MAX truck, including an initial order for two 120 k W FCmove™-XD engines. | Ballard announces partnership with Ford Trucks for fuel cell … |

| Quantron AG | September 2022 | Deepened a strategic partnership through a €5 million equity investment and an order for 140 FCmove™ modules for the European truck market. | Ballard Power Systems deepens strategic partnership with … |

| ABB | February 2022 | Received Approval in Principle from DNV for a high-power 3 MW marine fuel cell concept, a key step for marine transport decarbonization. | ABB and Ballard reach milestone toward fuel cell-powered … |

Ballard Power’s Geographic Focus Shifts to North America and Europe in 2025

Ballard has deliberately pivoted its commercial and investment focus away from a previously central China strategy to concentrate on the more mature and subsidy-rich markets of North America and Europe.

- Between 2021 and 2024, Ballard’s geographic strategy included a significant focus on China, highlighted by a plan to invest $130 million in a Shanghai manufacturing plant. However, by 2023, this plan was put under reassessment due to slower-than-expected market development and rising geopolitical risks.

- Starting in 2025, the company’s actions demonstrate a clear strategic shift. In North America, Ballard is advancing plans for its Texas Gigafactory, backed by $94 million in U.S. federal funding, and has secured a major rail agreement with CPKC. This pivot capitalizes on strong policy support in the U.S.

- In Europe, Ballard cemented its leadership with the historic 1, 000-engine order from Polish bus manufacturer Solaris and a 6.4 MW marine order for vessels operating in the region. This activity confirms Europe as a primary revenue-generating market.

- This realignment was explicitly confirmed in October 2025 when Ballard’s new CEO stated that new investments in China are “materially on pause” due to Beijing’s increasing preference for domestic suppliers. Concurrently, an Mo U with India’s Adani Group signals a strategic exploration of new high-growth Asian markets outside of China.

Ballard’s Fuel Cell Technology Achieves Commercial-Scale Validation in 2025

Ballard’s proton exchange membrane (PEM) fuel cell technology has successfully transitioned from a phase of advanced R&D and pilot-scale demonstrations to a commercially validated product platform ready for mass deployment in heavy-duty applications.

- The 2021–2024 period focused on maturing the technology and securing critical third-party validation. This included the launch of concepts for next-generation engines and achieving the world’s first DNV Type Approval for its FCwave™ marine module, a crucial certification for the maritime industry.

- From 2025 onward, the technology’s maturity is demonstrated through its deployment at scale in commercial products. Ballard launched its ninth-generation engine, the FCmove®-SC, specifically designed to lower lifecycle costs for transit buses and achieve parity with diesel.

- The ultimate validation of the technology’s readiness is its selection for large-scale, multi-year commercial agreements. The deployment of the FCwave™ in the 6.4 MW Samskip marine order, the FCmove®-XD in the ~20 MW CPKC locomotive order, and other engines in the 1, 000-unit Solaris bus deal confirm that Ballard’s products meet the demanding performance, reliability, and economic requirements of major OEMs.

Ballard’s Validated Fuel Cell Ecosystem

This infographic illustrates the end-use applications for Ballard’s technology, visually representing the ecosystem where its now commercially-validated fuel cells are being deployed.

(Source: Blog | Ballard Power Systems – Ballard’s fuel cell)

SWOT Analysis of Ballard Power’s Market Position in 2025

Ballard Power is capitalizing on its technological strengths and significant market opportunities by focusing on subsidized regions, but it faces persistent threats from a delayed hydrogen economy and internal financial pressures related to its long-term path to profitability.

- Strengths have evolved from deep R&D capabilities to a commercially proven product portfolio with a strong order backlog.

- Weaknesses remain centered on the company’s history of net losses, which continue to exert financial pressure despite impressive revenue growth.

- Opportunities are driven by strong government incentives for decarbonization, particularly in North America, and the clear value proposition of fuel cells in hard-to-abate sectors.

- Threats include the slower-than-expected build-out of the broader hydrogen economy and increasing competition from domestic suppliers in key markets like China.

Market Growth Projects Key Opportunity

This chart quantifies a key “Opportunity” from the SWOT analysis, showing the significant projected growth of the fuel cell component market that Ballard is positioned to capture.

(Source: Market.us)

Table: SWOT Analysis for Ballard Power

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Long-standing R&D leadership in PEM technology; key technology certifications like DNV approval for FCwave™. | Historic order backlog (1, 000 engines for Solaris); long-term supply agreements with major OEMs (CPKC); validated 9 th-gen product platform (FCmove®-SC/XD). | The company’s technological leadership has been validated by large-scale commercial orders, transitioning from potential to proven bankability. |

| Weaknesses | History of unprofitability ($1.3 billion net loss from 2000-2022); reliance on capital markets for funding. | Continued net losses ($119.8 million on $90.2 million revenue in a recent period) despite 120% Yo Y revenue growth in Q 3 2025; high cash burn. | The core weakness of unprofitability remains unresolved, although strong revenue growth and cost-cutting measures now provide a clearer path to positive cash flow. |

| Opportunities | Emerging government incentives for hydrogen; growing corporate decarbonization targets. | Massive, direct U.S. government support ($94 million for Texas Gigafactory); clear market leadership in heavy-duty bus, rail, and marine segments. | Vague policy tailwinds have materialized into concrete, company-specific financial incentives and large-scale orders in targeted, high-value markets. |

| Threats | Slower-than-expected hydrogen market development; geopolitical risks associated with China strategy. | Leadership acknowledges a “multi-year push-out” of the hydrogen industry; strategic pause on China investments due to preference for domestic suppliers. | The company has explicitly recognized and strategically pivoted away from key market and geopolitical threats by focusing on North America and Europe. |

Ballard Power’s Outlook 2025: Execution on a Path to Profitability

Ballard’s success in the next 18-24 months hinges on its ability to execute its cost-reduction strategy and flawlessly deliver on its large order backlog to finally convert strong revenue growth into positive cash flow and sustained profitability.

- The primary focus will be on the execution and impact of the strategic realignment announced in 2025. Investors will monitor quarterly results to see if the company can achieve its goal of positive cash flow, a key commitment from the new leadership.

- The final investment decision on the Rockwall, Texas Gigafactory remains a critical milestone. A go-ahead, backed by $94 million in U.S. grants, would signal long-term confidence, while further delays could indicate persistent market weakness.

- Market adoption of the new, lower-cost FCmove®-SC bus module will be a key indicator of Ballard’s ability to compete directly with diesel and battery-electric alternatives. Significant orders following its October 2025 launch would validate its economic proposition.

- The progression of Memoranda of Understanding, particularly the one with Adani Group for manufacturing in India, into definitive joint ventures and firm orders will be crucial for Ballard’s international growth strategy beyond its core North American and European markets.

Profitability Remains an Industry-Wide Challenge

By showing a competitor’s struggle to reach profitability, this chart provides critical context for the industry-wide challenges that inform Ballard’s own outlook and path to profitability.

(Source: CleanTechnica)

Frequently Asked Questions

What is the main change in Ballard Power’s business strategy in 2025?

In 2025, Ballard Power shifted its strategy from focusing on small-scale pilot projects and prototypes to securing large, high-volume commercial orders. This is demonstrated by landmark deals such as the 1,000-engine order for Solaris buses and a ~20 MW agreement with CPKC for locomotives, validating its technology at a commercial scale.

Why did Ballard pivot its investment focus from China to North America?

Ballard shifted its focus to North America due to significant U.S. government support and a more favorable policy environment. The company secured $94 million in U.S. federal grants and tax credits for a new Texas Gigafactory. Concurrently, it paused a planned $130 million investment in China because of a slower-than-expected market ramp-up and Beijing’s increasing preference for domestic suppliers.

Is Ballard’s fuel cell technology proven for heavy-duty use?

Yes, the technology is now commercially validated. Its maturity is demonstrated by its selection for large-scale, multi-year supply agreements with major OEMs across different sectors, including the 1,000-unit Solaris bus order, the ~20 MW CPKC rail order, and a 6.4 MW marine order for Samskip vessels. This confirms the products meet the performance and reliability demands of heavy-duty applications.

What is Ballard doing to address its history of financial losses and become profitable?

To improve its financial performance, Ballard initiated a major corporate restructuring in late 2024 to cut annual operating expenses by over 30% (~$50 million). The company’s strategy is to leverage its large order backlog and new, lower-cost products like the FCmove®-SC engine to drive revenue growth and execute on its new leadership’s commitment to achieving positive cash flow.

What is the status of Ballard’s planned Texas Gigafactory?

Ballard announced plans for a new fuel cell production ‘Gigafactory’ in Rockwall, Texas, with a planned phase-one investment of ~$160 million. The project is supported by $94 million in U.S. federal funding. However, as of May 2025, the company paused the final investment decision as part of a broader cost-cutting program, citing a delay in the overall hydrogen market adoption.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks- From Breakout Growth to Operational Crossroads

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.