Doosan SOFC Commercial Projects Signal High-Growth, High-Risk Market 2025

Doosan Fuel Cell is executing a high-stakes pivot from its established Phosphoric Acid Fuel Cell (PAFC) technology to high-efficiency Solid Oxide Fuel Cells (SOFC), targeting the maritime and data center markets. The strategy shifted from foundational development between 2021 and 2024 to aggressive commercial execution in 2025, marked by both significant manufacturing milestones and extreme market volatility.

- In July 2025, Doosan Fuel Cell began mass production at its new 50 MW SOFC factory, a culmination of its partnership with Ceres Power and a KRW 155.8 billion investment. This contrasts with the 2021-2024 period, which was defined by forming partnerships, such as with Shell and KSOE, to develop the technology for maritime use.

- The commercial pipeline in 2025 reveals a volatile market. The company secured major long-term agreements, including a 20-year, $308 million service deal, but also suffered a stunning setback in April 2025 with the cancellation of three supply contracts worth a combined $560 million.

- Application focus has sharpened in 2025. New partnerships with SK ecoplant and Hyosung Heavy Industries directly target the burgeoning AI data center market, a segment not explicitly pursued in the earlier period. This complements the ongoing maritime focus, where its SOFC stack became the first to pass DNV environmental tests in March 2024.

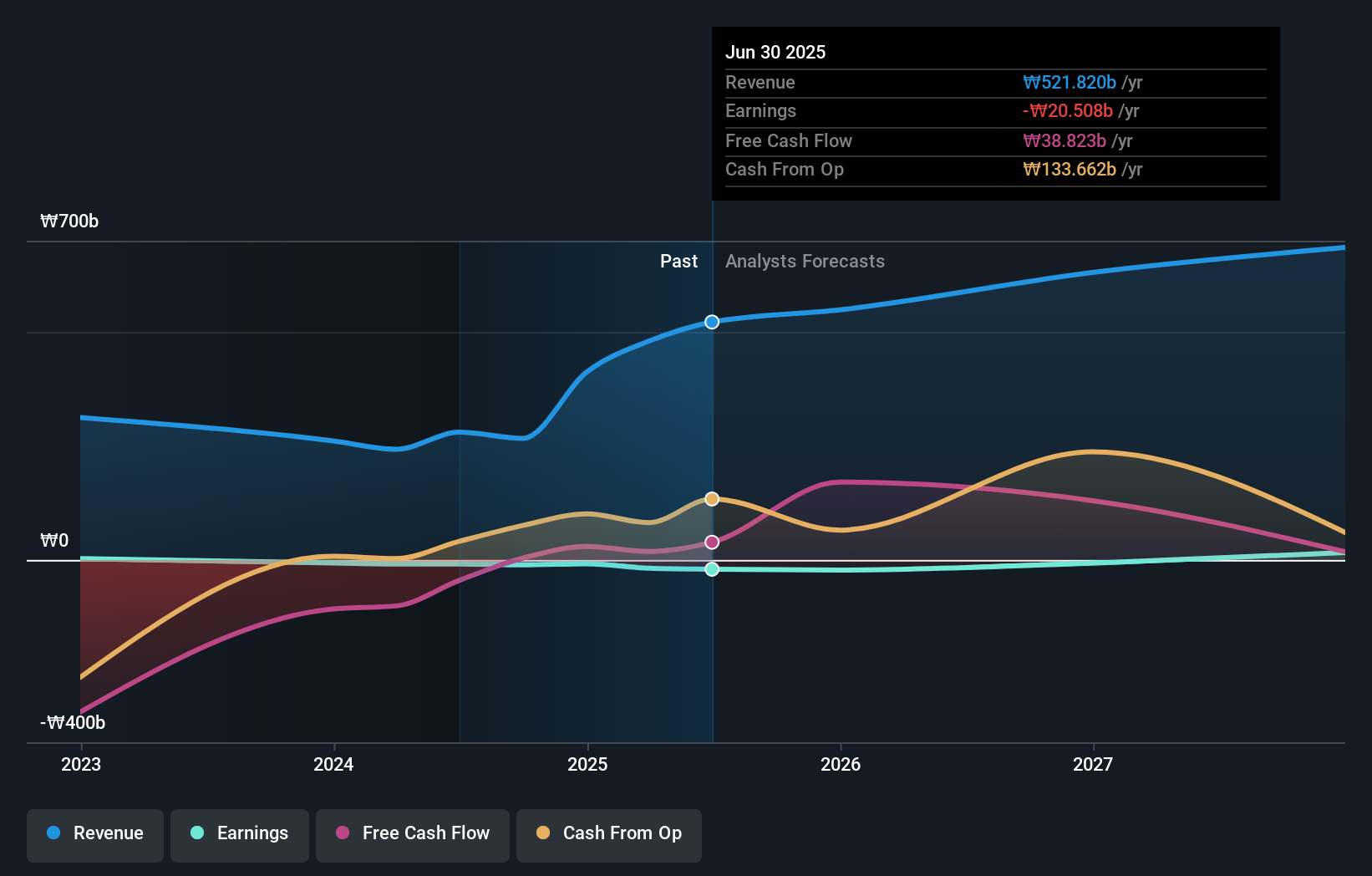

Doosan Projects Revenue Surge Post-SOFC Pivot

This chart directly supports the section’s focus on the 2025 commercial pivot by showing the strong revenue growth analysts forecast from that point forward, validating the high-growth strategy.

(Source: Simply Wall St)

Investment Analysis: Doosan Fuel Cell’s Capital-Intensive SOFC Scale-Up

Doosan‘s investment strategy shows a concentrated and capital-intensive push to build out its SOFC and hydrogen mobility capabilities. The funding is focused on constructing manufacturing infrastructure and scaling production to support its strategic pivot, highlighting the high-cost barrier to entry in advanced fuel cell markets.

- The most significant capital outlay is the KRW 155.8 billion (approx. $115 million) investment in the Saemangeum SOFC factory, which was completed in September 2025. This facility is the physical manifestation of its strategic technology shift initiated in prior years.

- To fund U.S. expansion and further SOFC development, its subsidiary Hy Axiom launched a pre-IPO funding round in June 2025, targeting $200 million at a $1.4 billion valuation. This follows a successful $150 million private placement in July 2023.

- In parallel, Doosan Mobility Innovation (DMI) raised KRW 27 billion (approx. $22.4 million) to advance its hydrogen drone business, showing a commitment to capturing niche, high-value mobility markets alongside its large-scale stationary and maritime goals.

Table: Doosan Fuel Cell Strategic Investments (2022-2025)

| Project / Entity | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Hy Axiom Pre-IPO Funding | June 2025 | Targeted $200 million at a $1.4 billion valuation to fund U.S. expansion and SOFC/mobility development. | Hy Axiom’s 2025 Fuel Cell Strategy |

| Doosan Mobility Innovation (DMI) Funding | August 2025 | Raised KRW 27 billion (~$22.4 million) to develop hydrogen fuel cell-powered logistics drones, expanding into the high-endurance mobility market. | Doosan Fuel Cell 2025 |

| SOFC Factory Investment | 2023 – 2025 | Completed a total investment of KRW 155.8 billion (~$115 million) in the Saemangeum SOFC factory for mass production. | Saemangeum National Industrial Complex |

| Hy Axiom Private Placement | July 2023 | Completed a $150 million private placement to scale production and R&D for its stationary fuel cell business in the U.S. | Hy Axiom, Inc. Announces Completion of $150 Million |

Partnership Strategy: Doosan’s Alliances Drive SOFC Market Penetration

Doosan Fuel Cell‘s partnership strategy is the engine of its SOFC pivot, creating an ecosystem for technology licensing, supply chain security, and market access. These alliances are not isolated but form an interconnected web designed to de-risk its entry into new, high-growth sectors like maritime and data centers.

- The cornerstone alliance is the licensing partnership with UK-based Ceres Power, which provides the core SOFC technology. This partnership moved from a development phase to full-scale commercialization with the start of mass production in July 2025.

- To secure its manufacturing scale-up, Doosan established a critical supply agreement with Alleima in January 2025 for SEK 160 million (~$15 million) worth of essential SOFC components, mitigating supply chain risks.

- In November 2025, Doosan formed a strategic alliance with SK ecoplant and Hyosung Heavy Industries to develop power solutions for data centers, demonstrating a targeted approach to capture new end markets created by the AI boom.

- The long-standing collaboration with HD Hyundai and KSOE continues to drive the maritime strategy, aiming to commercialize SOFC systems as auxiliary power units for ships and capitalize on the industry’s decarbonization mandates.

Table: Doosan Fuel Cell Strategic Partnerships (2022-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| SK ecoplant & Hyosung Heavy Industries | November 2025 | Strategic cooperation to supply hydrogen-based power to data centers, combining Doosan‘s SOFC for baseload with gas engines for backup. | Doosan Fuel Cell joins SK, Hyosung |

| Alleima | January 2025 | SEK 160 million (~$15 million) supply agreement for critical components to support the mass production of SOFC stacks. | Alleima receives an order for mass production |

| Ceres Power | Ongoing since 2022 | Cornerstone technology licensing partner for SOFC. The partnership reached a major milestone with the start of mass production in July 2025. | Doosan Fuel Cell starts mass market production |

| Shell, KSOE, DNV | October 2022 | Consortium to develop and demonstrate a 600 k W SOFC Auxiliary Power Unit on a vessel, targeting the maritime decarbonization market. | Doosan teams with Shell and KSOE |

Geographic Focus: Doosan’s South Korean Base as a Global SOFC Launchpad

Doosan‘s geographic strategy is centered on leveraging South Korea as a manufacturing and commercial hub to support both domestic demand and future global exports. The period from 2021-2024 saw international groundwork, while 2025 has been about solidifying its domestic production and sales pipeline.

- The strategic center of gravity is the new 50 MW SOFC factory in Jeollabuk-do, South Korea, which came online in 2025. This facility serves as the industrial backbone for Doosan‘s entire SOFC strategy, localizing production of licensed Ceres Power technology.

- In 2025, commercial activity has been heavily concentrated in South Korea. Key deals include a 20-year Power Purchase Agreement with KEPCO, a $308 million service agreement for a plant in Ulsan, and domestic partnerships for data centers, all validating the strength of the home market.

- The 2021-2024 period involved laying the groundwork for international expansion, notably with an agreement in November 2022 for its U.S. subsidiary Hy Axiom to supply 105 MW of fuel cells to China. However, the cancellation of a 50 MW portion of this deal in April 2025 highlights the execution challenges in overseas markets.

Technology Maturity: Doosan’s SOFC Moves from Licensed R&D to Commercial Scale

Doosan has successfully advanced its SOFC technology from a licensed, pre-commercial stage to full-scale mass production within three years. The period from 2021-2024 focused on technology adaptation and validation, while 2025 marks the beginning of its commercial life, defined by the launch of tangible products and the pursuit of revenue-generating projects.

- The primary shift occurred in July 2025, when Doosan began mass production of its SOFC S 300 NG system. This model, boasting 54.3% electrical efficiency, is now a commercial product targeting data centers and commercial buildings, a significant step up from the development and demonstration phase of previous years.

- Prior to 2025, a key milestone was the successful maritime environmental testing of its SOFC stack in March 2024, certified by DNV. This was a critical validation point that de-risked the technology for one of its primary target markets.

- While SOFC is now at commercial scale, Doosan continues to operate with a multi-technology portfolio. It still secures contracts for its mature PAFC systems (Pure Cell® Model 400) and develops PEMFC technology through its subsidiary Doosan Mobility Innovation for the drone market.

SOFCs Meet Dynamic Power Demand

This chart illustrates the technology’s maturity by showing how a fuel cell’s output can precisely track a facility’s fluctuating power needs, a key capability for commercial applications like data centers.

(Source: Doosan Fuel Cell)

SWOT Analysis: Assessing Doosan’s High-Risk, High-Reward SOFC Strategy

Doosan Fuel Cell‘s strategic pivot to SOFC technology positions it for high-growth markets but also exposes it to significant financial and execution risks. The company’s strengths in diversification are balanced by the challenges of achieving profitability and navigating a volatile emerging market.

- Strengths: A diversified technology portfolio (PAFC, SOFC, PEMFC) allows it to target multiple sectors, while its manufacturing scale-up provides a competitive asset.

- Weaknesses: Continued net losses despite revenue growth and a heavy reliance on licensed technology from Ceres Power for its flagship growth initiative.

- Opportunities: First-mover potential in the massive maritime decarbonization market and the ability to capture surging energy demand from AI data centers.

- Threats: Intense competition from established SOFC players like Bloom Energy and the demonstrated fragility of its project pipeline, highlighted by the $560 million in contract cancellations.

High-Growth Market Underpins SOFC Strategy

This forecast validates the ‘Opportunity’ identified in the SWOT analysis, quantifying the significant growth potential in the fuel cell market that Doosan’s high-risk strategy aims to capture.

(Source: Grand View Research)

Table: SWOT Analysis for Doosan’s Fuel Cell Business

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Established PAFC business and strong domestic market presence. Began diversification through partnerships (Ceres, Ballard). | Launched mass production of high-efficiency SOFC systems. Secured long-term service contracts, demonstrating a stable recurring revenue model. | The strategic pivot to SOFC was validated with the factory launch, moving from a plan to a tangible manufacturing capability. |

| Weaknesses | Technology portfolio was heavily weighted toward legacy PAFC. Profitability was a persistent challenge. | Net losses continue despite revenue growth. High capital expenditure on the new factory strains financials. Extreme commercial volatility. | The financial pressures of a major technology transition became evident, and the risk of customer-side project failures was validated. |

| Opportunities | Identified maritime and international expansion (China) as key growth areas. Formed consortium with Shell and KSOE. | Targeted the high-growth AI data center market with new partnerships (SK ecoplant). Secured a 20-year PPA with KEPCO. | The addressable market expanded from general stationary power to specific, high-value niches like data centers, validating a more focused go-to-market strategy. |

| Threats | Competition from established global players like Bloom Energy. Execution risk on large-scale international projects. | Staggering $560 million in contract cancellations in April 2025, including a 110 MW deal, exposed pipeline fragility and market instability. | The theoretical threat of project failure became a material reality, raising significant questions about revenue forecasting and market stability. |

Forward-Looking Insights: Doosan’s 2026 Success Hinges on Pipeline Conversion

The critical factor for Doosan Fuel Cell‘s success in 2026 will be its ability to convert its new 50 MW of SOFC manufacturing capacity into a stable and profitable project pipeline. The company must demonstrate it can overcome the market volatility that led to the April 2025 contract cancellations and build a reliable revenue stream from its new technology.

- Watch for the first commercial sales and deployments of the SOFC S 300 NG systems in late 2025 and early 2026. These initial projects, particularly in the data center and maritime sectors, will serve as crucial proof points for the market.

- Doosan‘s showcase at CES 2026 will be a key event to gauge market interest and potentially announce new projects or partnerships for its AI-focused energy solutions, signaling the strength of its commercial pipeline.

- Financial reports in the coming quarters will be heavily scrutinized for signs of improved margins and evidence that new, high-value SOFC contracts are replacing the lost revenue from the cancelled deals.

- Progress on the maritime front with partners HD Hyundai and Shell remains a long-term catalyst. Any new milestones from the 600 k W auxiliary power unit demonstration will be a significant indicator of future growth.

Frequently Asked Questions

What is Doosan Fuel Cell’s main strategic change in 2025?

In 2025, Doosan Fuel Cell is executing a major pivot from its established Phosphoric Acid Fuel Cell (PAFC) technology to high-efficiency Solid Oxide Fuel Cells (SOFC). This strategy shifts from the development phase (2021-2024) to aggressive commercial execution, targeting the maritime and AI data center markets with its new 50 MW SOFC factory.

What are the biggest risks associated with Doosan’s SOFC strategy?

The primary risks are high market volatility and financial pressure. This was starkly illustrated in April 2025 when the company suffered the cancellation of supply contracts worth $560 million, exposing the fragility of its project pipeline. The SWOT analysis also highlights continued net losses and intense competition as significant threats.

What specific new markets is Doosan targeting with its SOFC technology?

Doosan is focusing on two key high-growth sectors. The first is the maritime industry, where it is developing SOFCs as auxiliary power units for ships to meet decarbonization goals. The second, a new focus in 2025, is the AI data center market, where its high-efficiency SOFCs are positioned to provide reliable baseload power.

Who are Doosan’s key partners in its shift to SOFC?

Doosan’s strategy is built on a web of alliances. The cornerstone partner is UK-based Ceres Power, which licenses the core SOFC technology. Other critical partners include Alleima for supplying manufacturing components, a consortium with Shell and KSOE for maritime applications, and a new alliance with SK ecoplant and Hyosung Heavy Industries to target the data center market.

How is Doosan funding this expensive transition to SOFC?

Doosan’s capital-intensive push is funded through several channels. The largest single outlay was the KRW 155.8 billion (~$115 million) investment in its Saemangeum SOFC factory. Additionally, its U.S. subsidiary, Hy Axiom, has been raising capital, including a $150 million private placement in 2023 and a targeted $200 million pre-IPO round in June 2025 to fund U.S. expansion and SOFC development.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Ceres Power SOFC 2025: Fuel Cell & Hydrogen Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Doosan SOFC 2025: Solid Oxide Fuel Cell Market Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.