Bloom Energy’s AI Power Dominance: How 2025 Fuel Cell Deals Captured the Data Center Market

Bloom Energy Commercial Projects: The Pivot to AI Data Center Power in 2025

Bloom Energy has decisively shifted its commercial strategy from serving a broad range of industries to dominating the high-value AI data center power market, a move validated by a series of landmark agreements in 2025.

- Between 2021 and 2024, Bloom Energy established its technology across various sectors, including a 100 MW expansion with data center operator Equinix and deployments in industrial settings with companies like Perenco and Conagra Brands.

- The strategic inflection point occurred in 2025, when the company secured multi-billion-dollar agreements specifically to address the power crisis in the AI sector, including a massive $2.7 billion deal with American Electric Power (AEP) for 100 MW of fuel cells.

- This focus on AI was further solidified through collaborations with tech giants like Oracle, for whom Bloom committed to a rapid 90-day deployment timeline to power Oracle Cloud Infrastructure, directly addressing the speed-to-market needs of AI workloads.

- The variety of applications in 2025, from direct data center power with Oracle to utility-scale infrastructure support with AEP, demonstrates that Bloom’s solid-oxide fuel cell (SOFC) technology is now viewed as a primary, scalable solution for the AI industry’s critical power bottleneck.

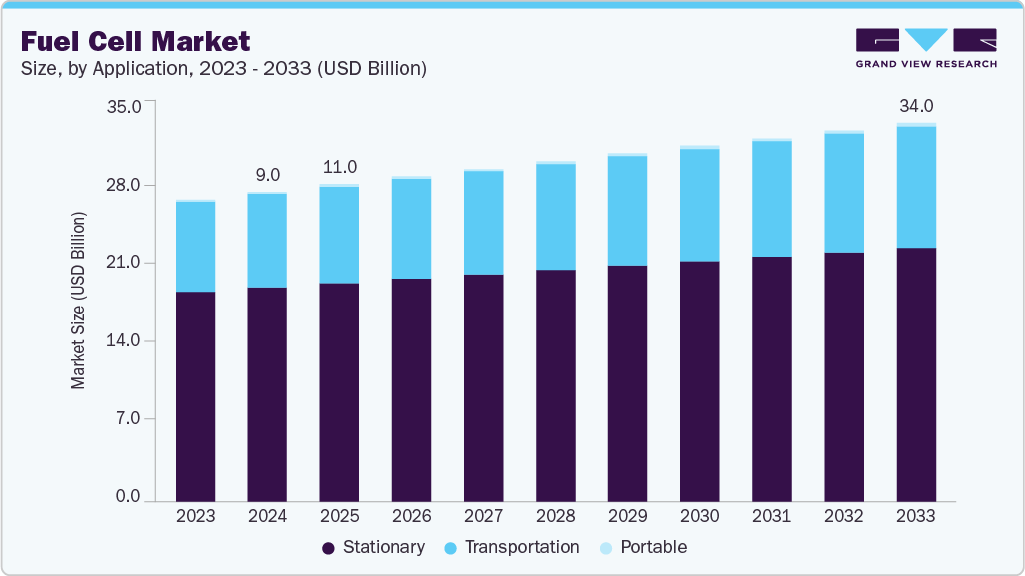

Stationary Fuel Cells Dominate Market Growth

This chart shows the fuel cell market segmented by application, forecasting that stationary power will remain the largest segment, growing to over $21 billion by 2033. This highlights the market opportunity in sectors like data centers.

(Source: Grand View Research)

Bloom Energy Investment Analysis: Funding a 2 GW Production Expansion

Bloom Energy’s capital allocation strategy in 2025 pivoted toward aggressive manufacturing expansion, funded by strategic partnerships and government support, to meet a surge in secured demand from the AI sector.

- In August 2025, Bloom Energy committed approximately $100 million to double its manufacturing capacity from 1 GW to 2 GW by the end of 2026, a direct response to the massive order backlog created by new AI-related deals.

- This expansion is financially de-risked by a landmark October 2025 agreement where Brookfield Asset Management committed to invest up to $5 billion to deploy Bloom’s fuel cells at AI data centers, providing a dedicated customer base and capital for growth.

- Prior to this, the company built its foundation with over $1.2 billion in cumulative R&D spending and a $973 million historical funding total as of July 2025, which developed the core technology now being commercialized at scale.

Table: Bloom Energy Key Investments and Capital Allocation

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Cumulative R&D Spend (Non-GAAP) | Through Q 3 2025 | Over $1.2 Billion invested since inception to refine SOFC technology and achieve cost reductions, laying the groundwork for the 2025 commercial surge. | Investor Presentation |

| Production Capacity Expansion | 2025 – 2026 | Investment of ~$100 Million announced in August 2025 to double manufacturing capacity to 2 GW by the end of 2026 to meet AI-driven demand. | Bloom Energy Expands Fuel Cell Manufacturing Amid AI … |

| Total Historical Funding | Through Q 2 2025 | $973 Million in total funding raised since inception to support R&D and initial commercial scale-up activities. | Bloom Energy – 2026 Company Profile & Team |

Bloom Energy Partnership Strategy: Securing Multi-Billion Dollar AI Alliances

In 2025, Bloom Energy transformed its partnership model from broad technology collaborations to focused, multi-billion-dollar strategic alliances with capital partners and anchor customers, cementing its role as a critical infrastructure provider for the AI industry.

- The period between 2021 and 2024 was characterized by foundational partnerships aimed at technology integration and market exploration, such as collaborations with Baker Hughes and Shell to explore hydrogen solutions.

- 2025 marked a strategic shift with two monumental deals: a $5 billion partnership with Brookfield to build and operate AI data centers and a $2.7 billion agreement to supply 100 MW of fuel cells to AEP, both announced in late 2025.

- These partnerships provide more than just revenue; they offer powerful market validation and de-risk future growth by creating a captive customer base for Bloom’s planned 2 GW manufacturing expansion.

- The company also secured key technology players as clients, including Oracle and an expanded agreement with Equinix, proving its value proposition of rapid, reliable, grid-independent power directly to the end-users fueling the AI boom.

Table: Bloom Energy Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| American Electric Power (AEP) | 2025 – Present | A $2.7 billion agreement for 100 MW of solid oxide fuel cells to power data centers, announced in late 2025. This deal establishes Bloom Energy as a utility-scale power provider. | Bloom Energy Stock Jumps on $2.7 Billion Fuel Cell Deal. … |

| Brookfield Asset Management | 2025 – Present | A strategic partnership valued at up to $5 billion for Brookfield to finance and develop AI data centers powered by Bloom’s technology, securing a long-term demand pipeline. | Brookfield and Bloom Energy Announce $5 Billion … |

| Oracle | 2025 – Present | Collaboration to deploy fuel cells at Oracle Cloud Infrastructure data centers. This partnership validates Bloom’s ability to deliver power solutions within a 90-day timeline. | Oracle and Bloom Energy Collaborate to Deliver Power … |

| SK ecoplant | 2021 – 2024 | An expanded partnership included a $4.5 billion revenue commitment for a minimum of 500 MW of Energy Servers, establishing a strong foothold in the South Korean market before the major AI pivot. | Bloom Energy & SK ecoplant Expand Power Generation … |

Bloom Energy’s Geographic Focus: US Market Dominance Driven by AI

Bloom Energy’s geographic strategy has consolidated around the United States, driven by the intense power demands of the domestic AI data center boom, while leveraging its established international presence in key markets like South Korea as a secondary growth engine.

North America Fuel Cell Market Growth Trajectory

The North American fuel cell market is projected to grow steadily, expanding from USD 1.79 billion to USD 3.47 billion by 2033. The chart indicates a compound annual growth rate (CAGR) of 8.64% for the 2025-2033 period.

(Source: Market Data Forecast)

- Between 2021 and 2024, Bloom pursued a diversified international expansion, entering European markets through partnerships in the UK with Perenco and Northern Europe with Elugie, alongside deepening its significant partnership with SK ecoplant in South Korea.

- In 2025, the company’s focus sharpened dramatically on the U.S. market, where landmark deals with AEP and Brookfield, along with deployments for Silicon Valley giants like Oracle and Intel, are concentrated.

- This geographic consolidation is a direct response to where the AI power demand is most acute and where grid constraints create the largest market opportunity for Bloom’s on-site power solutions.

Bloom Energy Technology Maturity: From Viable Alternative to Mission-Critical Infrastructure

Bloom Energy’s solid-oxide fuel cell technology transitioned from a commercially proven clean energy solution to an indispensable infrastructure component for the AI industry in 2025, validated by its adoption for mission-critical, utility-scale deployments.

- In the 2021-2024 period, the technology’s maturity was demonstrated through steady efficiency gains, achieving record-setting hydrogen production efficiency with its electrolyzer and securing large commercial orders, such as the 80 MW project with SK Eternix.

- The year 2025 provided definitive validation, as the technology was selected for multi-billion-dollar projects by sophisticated customers like AEP and Brookfield specifically because it solved the AI industry’s primary bottleneck: power availability.

- Key proof points of its advanced maturity include its “five nines” reliability (99.999% uptime) and the ability to deploy complex power systems for customers like Oracle in under 90 days, capabilities that are essential for the fast-moving AI sector.

- The technology’s recognition as one of TIME’s Best Inventions of 2025 underscores its market relevance and readiness for large-scale commercial application.

SWOT Analysis of Bloom Energy’s AI Pivot

Bloom Energy’s strategic pivot to the AI power market in 2025 successfully converted a market opportunity into a core strength, but in doing so, shifted its primary business risk from demand creation to operational execution and rapid scaling.

- Strengths were solidified as its technology was validated by major financial and utility partners, establishing it as a leader in the AI infrastructure space.

- Weaknesses evolved from the historical challenge of achieving profitability to the new challenge of scaling manufacturing fast enough to meet a massive, secured backlog.

- Opportunities were crystallized, moving from a general clean energy transition to a specific, addressable $50 billion market for AI power.

- Threats became more internal, focusing on execution risk rather than external market acceptance or competition.

Table: SWOT Analysis for Bloom Energy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Proven SOFC technology with fuel flexibility; strong partnership with SK ecoplant in South Korea. | Market leadership in on-site data center power; multi-billion-dollar partnerships with Brookfield and AEP; “five nines” reliability. | The AI power crisis validated Bloom’s technology as a mission-critical solution, moving it from a niche product to a mainstream infrastructure component. |

| Weaknesses | Inconsistent profitability; high capital costs for customers; reliance on natural gas. | Production capacity constraints (pre-expansion); execution risk on massive backlog; operating margins improving but still under scrutiny. | The challenge shifted from convincing the market to buy the product to physically producing enough of it to meet secured orders. Profitability is improving with scale. |

| Opportunities | Broad decarbonization trends; hydrogen economy development; expansion into new geographic markets like Europe. | Targeting a $50 billion AI power market; grid-independent deployments for rapid data center build-outs; hydrogen transition pathway. | The broad opportunity for clean energy was refined into a specific, high-value, and urgent market need created by AI, which Bloom is uniquely positioned to capture. |

| Threats | Competition from other fuel cell and clean energy technologies; fluctuating policy support (e.g., tax credits). | Failure to scale manufacturing to 2 GW by 2026; supply chain disruptions impacting production; margin erosion from rapid scaling. | The primary threat is now internal execution. Failure to deliver on its 2 GW promise would damage credibility and cede market share in the fast-moving AI sector. |

Future Outlook for Bloom Energy: Execution of 2 GW Expansion is Critical

The single most critical factor for Bloom Energy’s continued success is its ability to execute the planned doubling of its manufacturing capacity to 2 GW by the end of 2026, as its entire growth trajectory now depends on fulfilling its massive, secured order backlog.

Fuel Cell Market to Exceed $112 Billion by 2035

This bar chart illustrates a strong growth forecast for the global fuel cell market, projecting an increase from $11.87 billion in 2025 to $112.07 billion in 2035. This long-term outlook underscores the significant market potential for leading companies.

(Source: Precedence Research)

- The market will be scrutinizing Bloom’s ability to meet the hardware delivery schedules for the initial phases of the AEP and Brookfield partnerships, as these projects are the primary drivers of its projected revenue growth.

- Maintaining and improving gross margins, guided at approximately 29% for full-year 2025, will be a key indicator of whether the company can scale production profitably.

- Progress on the hydrogen transition remains a key watchpoint. While the AI pivot is currently fueled by natural gas, any large-scale project announcements involving green hydrogen would significantly improve the company’s long-term environmental, social, and governance profile and unlock new markets.

Frequently Asked Questions

What caused Bloom Energy to shift its focus specifically to AI data centers in 2025?

Bloom Energy shifted its focus in 2025 to address the significant power crisis in the AI sector. The massive and urgent power demands of AI workloads, combined with existing grid constraints, created a high-value market opportunity that Bloom’s on-site, reliable fuel cell technology was uniquely positioned to solve, as validated by multi-billion-dollar deals with AEP and Brookfield.

How is Bloom Energy planning to meet the massive demand from its new AI-related deals?

To meet the surge in secured demand from the AI sector, Bloom Energy announced in August 2025 an investment of approximately $100 million to double its manufacturing capacity from 1 gigawatt (GW) to 2 GW. This expansion is scheduled to be completed by the end of 2026.

What are the most significant partnerships Bloom Energy secured in 2025?

In 2025, Bloom Energy secured two monumental partnerships: a $2.7 billion agreement with American Electric Power (AEP) to supply 100 MW of fuel cells, and a strategic partnership with Brookfield Asset Management, valued at up to $5 billion, to finance and develop AI data centers powered by Bloom’s technology. These deals provide both a massive revenue backlog and a long-term demand pipeline.

What makes Bloom Energy’s technology suitable for powering AI data centers?

Bloom Energy’s solid-oxide fuel cell (SOFC) technology is ideal for AI data centers due to its high reliability (offering 99.999% uptime), scalability, and ability to be deployed rapidly. For example, the company committed to a 90-day deployment for Oracle, addressing the critical speed-to-market needs of the AI industry and bypassing traditional grid constraints.

According to the analysis, what is the biggest risk facing Bloom Energy now?

The primary risk for Bloom Energy has shifted from creating market demand to execution. Its biggest challenge is successfully scaling its manufacturing to 2 GW by the end of 2026 and delivering on its massive, secured order backlog. Failure to meet these production and deployment schedules for partners like AEP and Brookfield is its most significant threat.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.