Chevron’s 2025 CCUS Strategy: A High-Risk Pivot to Service Hubs Amidst Gorgon’s Failures

Chevron’s CCUS Projects in 2025: Shifting from In-House Abatement to Commercial Service Hubs

In 2025, Chevron pivoted its Carbon Capture, Utilization, and Storage (CCUS) strategy from primarily decarbonizing its own assets to building a commercial service model, creating new markets for carbon storage. This represents a significant strategic shift from the 2021-2024 period, which was defined by developing projects to manage internal emissions and establishing foundational joint ventures.

- The most significant change in 2025 is a market-creation partnership with Engine No. 1 and GE Vernova to develop up to 4 GW of natural gas power for data centers, with CCUS integrated by design. This move manufactures demand for both its natural gas and carbon storage services, a stark contrast to the earlier focus on abating emissions from existing facilities like the San Joaquin Valley project.

- The Bayou Bend CCS project has evolved from a joint venture formation in 2022 with Talos Energy to the cornerstone of Chevron’s third-party service offering in 2025. Now a partnership with energy majors Equinor and Total Energies, the project aims to be a large-scale CO₂ storage hub for industrial clients on the U.S. Gulf Coast.

- While the Gorgon project in Australia was intended as a large-scale operational asset, its persistent failures, culminating in its weakest performance to date in 2025, highlight the execution risk in Chevron’s strategy. It captured only 30% of reservoir CO 2, operating at less than half its designed capacity.

- In August 2025, Chevron broadened its commercial focus by joining a consortium with BHP, Mitsui & Co., and major Asian steelmakers. This collaboration to study CCUS hubs for hard-to-abate sectors signals an expansion of its service model into new industries and geographies beyond its traditional operations.

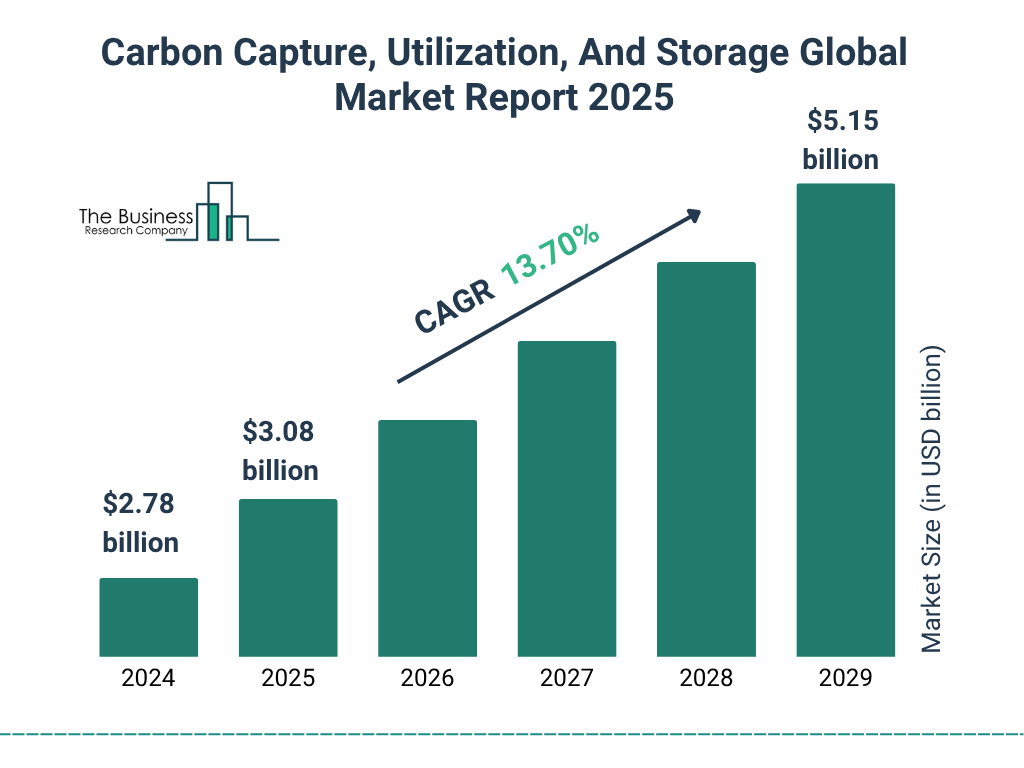

Global CCUS Market To Surpass $5 Billion By 2029

This chart shows the global Carbon Capture, Utilization, and Storage market growing from $2.78 billion in 2024 to $5.15 billion in 2029, at a CAGR of 13.70%. The market size for 2025 is projected to be $3.08 billion.

(Source: The Business Research Company)

Chevron’s 2025 Investment Analysis: Allocating Billions to a High-Risk CCUS Service Model

Chevron’s 2025 investment strategy dedicates significant new capital to build out its CCUS service business while continuing its venture-style approach to de-risk capture technology costs. This financial commitment signals a clear intent to transform CCUS from a cost center into a potentially profitable business line, though it is backstopped by a portfolio of early-stage technology investments rather than proven, scaled solutions.

Oil & Gas CCS Market Poised For Strong Growth

The chart forecasts the Oil and Gas Carbon Capture and Storage market size increasing from $4.02 billion in 2024 to $15.71 billion by 2034. This represents a significant investment opportunity within the sector.

(Source: Precedence Research)

- In 2025, Chevron earmarked a planned $1.5 billion investment for projects aimed at lowering carbon intensity and expanding its new energies business, which explicitly includes carbon capture initiatives. This targeted allocation reinforces the commercial pivot seen this year.

- Looking ahead, the company announced a 2026 capital expenditure budget of $18 billion to $19 billion, which incorporates continued funding for its lower-carbon businesses like CCUS. This maintains the high-level capital guidance range of $18 billion to $21 billion per year through 2030.

- The company’s venture strategy continued in 2025 with a $45 million investment in ION Clean Energy to advance technology for lowering capture costs. This follows the pattern set between 2021-2024, which included leading funding rounds for Svante ($318 million Series E) and Carbon Clean ($150 million Series C).

Table: Chevron’s Low-Carbon & CCUS Investments (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Corporate CAPEX | 2026 | Announced $18 B – $19 B capital expenditure budget, which includes an unspecified allocation for lower-carbon businesses like CCUS and hydrogen. | Chevron Announces 2026 Capex Budget |

| Corporate CAPEX | 2026-2030 | Reduced long-term capex guidance to $18 B – $21 B per year while outlining a plan for >10% annual growth in adjusted free cash flow. | Chevron Outlines Plan for Sustained Cash Flow Growth |

| Low-Carbon Projects | 2025 | Planned investment of $1.5 Billion for projects aimed at lowering carbon intensity and expanding its new energies business, including carbon capture. | Chevron Carbon Capture Initiatives for 2025 |

| ION Clean Energy | 2025 (Implied) | Venture investment of $45 Million in a company developing technology to lower the cost of CCUS, a critical barrier to profitability. | Chevron Carbon Capture 2025: A Bold Strategy Unveiled |

Chevron’s CCUS Partnership Network 2025: Forging Alliances for Market Creation

In 2025, Chevron’s partnerships evolved from foundational project development to strategic alliances designed to manufacture demand and build international service chains. This shift reflects a move from securing assets and technology to actively constructing a commercial ecosystem for its CCUS services.

- The joint development with Engine No. 1 and GE Vernova, announced in January 2025, is the most strategically significant new alliance. It aims to create a closed-loop business model by building new gas-fired power plants for a captive customer base (data centers) while providing the carbon storage service.

- The Bayou Bend CCS joint venture was solidified in 2025 as a partnership between energy majors Chevron, Equinor, and Total Energies. This transformed the project from an early-stage venture into a cornerstone infrastructure asset for a Gulf Coast third-party service business.

- In August 2025, Chevron entered a new consortium with BHP, Mitsui & Co., and Asian steelmakers. This partnership extends its strategic focus to the hard-to-abate steel sector and explores creating a CCUS service hub in Asia, representing both geographic and market diversification.

- These 2025 alliances build upon the foundational partnerships established between 2021-2024. Earlier agreements with companies like Talos Energy for Bayou Bend and Enterprise Products Partners for infrastructure studies were crucial precursors to the commercially-focused JVs of today.

Table: Chevron’s Key CCUS & Low-Carbon Partnerships (2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| BHP, Mitsui & Co., Asian Steelmakers | Aug 2025 | To launch a CCUS Hub Study to accelerate the decarbonization of the hard-to-abate steel sector in Asia by exploring scalable utilization and storage solutions. | Global industry leaders launch CCUS Hub Study |

| Equinor, Total Energies | Jun 2025 | To develop the Bayou Bend project, a large-scale carbon dioxide (CO 2) transportation and storage hub in Southeast Texas for industrial emitters. | Bayou Bend project aims to advance carbon dioxide |

| Baker Hughes | May 2025 | To adopt the flare.IQ technology at the Chevron Richmond facility to enhance flaring operations and reduce emissions. | Chevron Richmond installs Baker Hughes flare.IQ |

| Engine No. 1, GE Vernova | Jan 2025 | To develop up to 4 GW of natural gas-fired power plants for U.S. data centers, designed with the flexibility to integrate CCS to create a new market for low-carbon power. | engine no. 1, chevron and GE vernova to power U.S. data |

Chevron’s Global CCUS Footprint: From Australian Setbacks to a US Gulf Coast Hub Strategy

Chevron’s CCUS geographical focus is consolidating around a large-scale commercial hub in the U.S. Gulf Coast, while its Asia-Pacific activities shift from operating a single troubled asset to exploring a broader service model. This regional pivot directs new investment toward North America, where policy and industrial concentration offer a clearer path to commercialization.

- The U.S. Gulf Coast is now the definitive strategic center for Chevron’s CCUS business. The Bayou Bend project in Texas is the anchor for a planned service hub targeting the region’s dense network of industrial emitters.

- Australia remains a significant region due to the massive Gorgon gas project, but the CCUS facility’s persistent underperformance, which worsened in 2025, makes it an operational liability rather than a blueprint for growth.

- In 2025, Chevron signaled a strategic reset in the Asia-Pacific by partnering with JX Nippon, BHP, and others to study a cross-border CO₂ value chain. This moves beyond operating a single asset toward building a regional service business, potentially storing CO₂ from Japan in Australia.

- California continues to serve as a testbed for decarbonizing Chevron’s own operations. The deployment of Baker Hughes’ flare.IQ technology in May 2025 and earlier projects like the San Joaquin Valley CCS initiative reflect a focus on lowering the carbon intensity of existing assets.

Chevron’s CCUS Technology Status: Commercial Ambition Clashes with Operational Reality

While Chevron is building a commercial strategy based on the premise of mature CCUS technology, its own operational data from its largest-scale project shows the technology remains unreliable and has not achieved its designed performance. The company’s portfolio approach to investing in next-generation technologies is a hedge against this reality but does not resolve the immediate credibility gap.

Post-Combustion Tech Dominates Growing CCS Market

This stacked bar chart illustrates the growth of the Carbon Capture and Storage market segmented by technology. It shows post-combustion methods as the largest segment, with significant growth projected through 2034.

(Source: Global Market Insights)

- The Gorgon project, intended to be a global showcase of commercial-scale CCUS, recorded its worst-ever performance in 2025. Its failure to operate at even 50% of its 4 MTPA design capacity due to technical issues like sand clogging injection wells directly contradicts the notion that the technology is ready for reliable, widespread deployment.

- From 2021 to 2024, Chevron’s technology strategy focused on building a venture portfolio of emerging, lower-cost capture systems through investments in companies like Svante (solid sorbent) and Carbon Clean (modular). This approach acknowledges the cost and efficiency limitations of current technologies.

- This strategy continued in 2025 with a $45 million investment in ION Clean Energy’s amine-based solvent and the adoption of proven, smaller-scale solutions like Baker Hughes’ flare.IQ. This demonstrates a focus on incremental cost reduction and efficiency gains rather than a breakthrough in large-scale operational reliability.

- Chevron’s plan to integrate CCUS into new power plants for data centers assumes a level of “plug-and-play” technological readiness and reliability that is not supported by the real-world performance of its own multi-billion dollar Gorgon facility.

Chevron’s 2025 CCUS SWOT Analysis: A Strategic and Operational Review

Chevron’s CCUS strategy demonstrates strong commercial vision and capital commitment, but it is severely undermined by a critical weakness in operational execution and intense competitive pressure. The company is attempting to build a sophisticated service business on a technological foundation that its own flagship project proves is unstable.

CCUS Market to See 24% Annual Growth Through 2032

The CCUS market is projected to expand significantly from a base of $4.76 billion to $26.74 billion by 2032. This reflects a strong compound annual growth rate (CAGR) of 24.08% for the 2025-2032 period.

(Source: SNS Insider)

- Strengths: Chevron’s primary strength is its clear strategic pivot to a hub-and-service business model, exemplified by the data center initiative, and its diversified venture portfolio in next-generation capture technologies.

- Weaknesses: The glaring and worsening underperformance of the Gorgon CCS project is a fundamental weakness, creating a significant credibility gap that damages the business case for its future projects.

- Opportunities: The greatest opportunity lies in creating a new, closed-loop market by providing low-carbon power to the rapidly growing AI and data center industry, effectively manufacturing demand for its services.

- Threats: The main external threat comes from competitors like Exxon Mobil, which appears to be commercially ahead in the U.S. Gulf Coast with 9.8 million tons per year of secured third-party CO 2 offtake agreements.

Table: SWOT Analysis for Chevron’s CCUS Strategy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated / Worsened |

|---|---|---|---|

| Strength | Established Chevron New Energies division; committed $10 B to lower-carbon projects; formed foundational JVs for hubs like Bayou Bend. | Pivoted to a profitable service model with market-creation partnerships (Engine No. 1); solidified hub partnerships with majors (Equinor, Total Energies). | The strategy shifted from internal goal-setting and asset acquisition to active, external market creation, validating a more aggressive commercial posture. |

| Weakness | Gorgon’s underperformance was a known operational issue, with capture rates well below the 4 MTPA target. | Gorgon’s performance worsened to its lowest level on record, capturing just 30% of reservoir CO 2 and becoming a major credibility crisis. | The operational weakness is no longer just a technical problem; it is a severe strategic liability that directly contradicts the technical assumptions of the new service-oriented business plan. |

| Opportunity | Focused on building hubs to serve existing industrial emitters along the U.S. Gulf Coast. | Creating a new, captive market by proposing to build up to 4 GW of CCUS-enabled power generation for data centers. | The opportunity evolved from capturing existing demand to manufacturing entirely new, integrated demand for both natural gas and carbon storage services. |

| Threat | General competition from other oil and gas majors entering the CCUS space. | Direct, quantifiable competition from Exxon Mobil, which has secured 9.8 MTPA of commercial offtake agreements for its Gulf Coast hub. | The competitive threat became concrete. While Chevron developed an innovative strategy on paper, its primary competitor gained a significant first-mover advantage in securing actual customers. |

Future Outlook for Chevron’s CCUS Business: Bridging the Vision-Execution Gap is Critical

The success of Chevron’s entire CCUS strategy in the year ahead depends on its ability to solve the technical failures at Gorgon and demonstrate tangible commercial progress on the Bayou Bend hub, as its innovative vision currently lacks a foundation of proven operational competence. Without demonstrating it can execute, its strategy remains a high-risk blueprint.

- The primary indicator to watch is any reported improvement at the Gorgon facility. Resolving the technical issues is essential for lending any credibility to its claims about the reliability of CCUS at scale.

- Tangible progress on the Bayou Bend project, specifically the announcement of firm commercial offtake agreements, is necessary to prove its hub strategy can compete with rivals like Exxon Mobil, which are already signing customers.

- The data center initiative with Engine No. 1 will be the ultimate test of the market-creation strategy. Key milestones to watch for include site selection, permitting progress, or a final investment decision on the first power plant.

- The central challenge for Chevron is bridging the significant gap between its ambitious commercial vision and its poor operational track record. Failure to prove its technical competence will leave its CCUS strategy vulnerable to being dismissed as a speculative and unbankable plan.

Frequently Asked Questions

What is the main change in Chevron’s CCUS strategy in 2025?

In 2025, Chevron shifted its strategy from primarily using Carbon Capture, Utilization, and Storage (CCUS) to decarbonize its own operations to building a commercial service model. The new focus is on creating markets for carbon storage as a service for third-party industrial clients, exemplified by the Bayou Bend project and a new partnership to power data centers with CCUS-enabled natural gas plants.

Why is the Gorgon CCUS project in Australia considered a problem for Chevron?

The Gorgon project is a major problem because of its severe and worsening underperformance. In 2025, it operated at less than half its design capacity, capturing only 30% of the intended reservoir CO2 due to technical issues like sand clogging injection wells. This failure undermines the credibility of CCUS technology at scale and highlights a significant execution risk in Chevron’s broader strategy.

How is Chevron planning to make money from its new CCUS service hubs?

Chevron aims to generate revenue by charging industrial customers to transport and permanently store their CO₂ emissions. Its key project, the Bayou Bend CCS hub on the U.S. Gulf Coast, is designed to serve as a large-scale storage site for the region’s emitters. Additionally, Chevron is creating its own demand by partnering to build new power plants for data centers, which would then become customers for its carbon storage services.

What is the biggest threat to the success of Chevron’s CCUS business?

The biggest threat is twofold: a severe internal credibility gap and strong external competition. The operational failures at the Gorgon project undermine the technical foundation of its business plan. Externally, competitors like ExxonMobil are moving faster, having already secured significant commercial agreements (9.8 million tons per year) for their own Gulf Coast hub, giving them a first-mover advantage in the same market Chevron is targeting.

What is the partnership with Engine No. 1 and GE Vernova, and why is it significant?

This 2025 partnership is a plan to develop up to 4 GW of new natural gas-fired power plants specifically for the growing data center industry, with the plants designed to integrate CCUS. It is strategically significant because it represents a shift from serving existing emitters to actively creating a new, captive market. This closed-loop model would allow Chevron to profit from both the sale of its natural gas and the subsequent carbon storage service.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.