Doosan Fuel Cell’s SOFC Pivot: Inside the 2025 Strategy for Data Center and Maritime Markets

Doosan’s Commercial Scale Projects Show a Decisive Shift to SOFC in 2025

In 2025, Doosan Fuel Cell executed a strategic pivot from its legacy Phosphoric Acid Fuel Cell (PAFC) business toward next-generation Solid Oxide Fuel Cell (SOFC) technology to target high-growth, energy-intensive markets.

- Between 2021 and 2024, Doosan’s commercial activity was dominated by the deployment of its mature PAFC technology in large-scale utility projects within South Korea, such as the 50 MW Daesan Hydrogen Fuel Cell Power Plant and the Shinincheon Bitdream plant, establishing it as a market leader in stationary power.

- The strategic shift became evident on July 28, 2025, when Doosan commenced mass production of SOFC systems at a new 50 MW factory, leveraging technology from its partner Ceres Power to directly compete for data center and maritime contracts.

- This pivot was underscored by a major commercial disruption on April 2, 2025, when Doosan terminated ₩818 billion (approximately $560 million) in PAFC supply contracts, including a 110 MW deal with Korea Hydro & Nuclear Power, signaling a decisive move away from its legacy project pipeline due to financial and execution challenges.

- To support its new SOFC focus, Doosan established a consortium on November 10, 2025, with industrial giants SK ecoplant and Hyosung Heavy Industries specifically to supply hydrogen backup power solutions for data centers, a market its PAFC technology was less suited to serve.

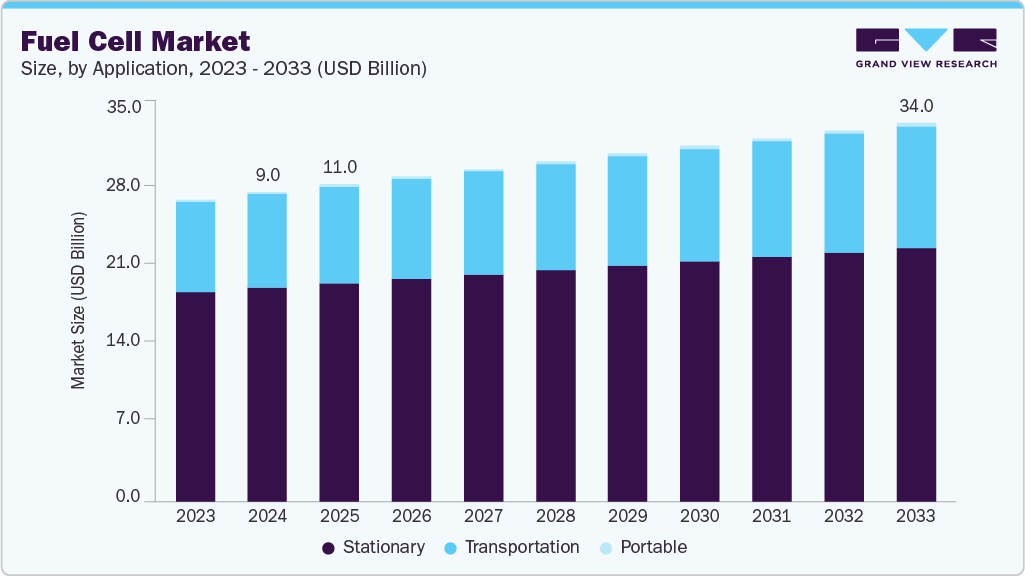

Fuel Cell Market Sees Stationary Power Dominate Growth

This chart shows the fuel cell market growing from 2023 to 2033, with stationary applications consistently making up the largest segment. The total market is projected to reach $34.0 billion by 2033.

(Source: Source)

Investment Data Reveals a High-Stakes Capital Shift at Doosan Fuel Cell

Doosan Fuel Cell’s investment strategy in 2025 reflects a concentrated capital deployment into its SOFC manufacturing capabilities, a move made amid significant financial volatility and a clear break from past revenue models.

Fuel Cell Market Poised for Explosive Growth

This chart projects a massive increase in the fuel cell market size, rising from USD 8.19 billion in 2025 to USD 43.78 billion by 2030. The forecast indicates a compound annual growth rate (CAGR) of 39.81%.

(Source: Source)

- The company’s commitment to the SOFC pivot is demonstrated by its investment in a new dedicated factory in Jeollabuk-do, South Korea, which began mass production in July 2025 with an initial capacity of 50 MW per year, representing a major capital expenditure to industrialize the new technology.

- Despite severe financial headwinds, including a trailing twelve-month net loss of -₩18.12 billion as of August 2025 and the cancellation of $560 million in contracts, market confidence in the SOFC strategy was bolstered when UBS upgraded Doosan’s stock to ‘Buy’ on October 1, 2025, more than doubling its price target to KRW 40, 000 based on future earnings potential.

- Parent company Doosan Corp. reinforced this strategic direction by establishing a $75 million technology fund on September 30, 2025, explicitly targeting investments in green energy and fuel cells to create long-term synergies with its subsidiary’s new SOFC business.

- The financial instability of the legacy PAFC business model is clear, but the company is attempting to build a new recurring revenue base, securing a 20-year, ₩411.8 billion ($308 million) long-term service agreement in September 2025 and a ₩96.4 billion power purchase agreement with KEPCO in November 2025.

Table: Doosan Fuel Cell Investment & Financial Milestones

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| UBS Stock Upgrade | October 1, 2025 | Upgraded rating to ‘Buy’ with a price target of KRW 40, 000, citing earnings turnaround potential from the new SOFC business. | Doosan Fuel Cell stock rating upgraded to Buy at UBS… |

| Doosan Corp. Technology Fund | September 30, 2025 | Parent company established a $75 million fund to invest in new technologies, including fuel cells, to support its subsidiaries’ growth. | Doosan’s 2025 SOFC Strategy: A High-Stakes Pivot |

| SOFC Factory Mass Production | July 28, 2025 | Commenced mass production at a new plant with an initial 50 MW annual capacity, a critical capital investment for the SOFC pivot. | Doosan launches 50 MW SOFC factory… |

| Hy Axiom Pre-IPO Funding | May 12, 2023 | Initiated pre-IPO funding for its US subsidiary, Hy Axiom, aiming to raise $200 million at a $1.4 billion valuation to fund expansion. | Doosan begins pre-IPO funding round for US fuel cell unit … |

Doosan Fuel Cell’s Partnership Strategy Drives Its 2025 Market Entry

Doosan Fuel Cell leverages a targeted network of strategic alliances to acquire core technology, de-risk market entry, and secure access to specific high-value sectors like data centers and maritime, a strategy that intensified in 2025.

- From 2021 to 2024, partnerships were aimed at diversifying its technology portfolio, such as the April 2022 agreement with Ballard Power Systems to develop PEM fuel cells for mobility and the March 2021 Mo U with Hyundai Heavy Industries (KSOE) for marine SOFC development.

- The company’s SOFC strategy is entirely dependent on its technology licensing and supply agreement with UK-based Ceres Power, which enabled the landmark start of mass production in July 2025 and is worth over $57 million to Ceres.

- In 2025, Doosan formed a powerful domestic consortium with SK ecoplant and Hyosung Heavy Industries to penetrate the South Korean data center market, creating an end-to-end solution for hydrogen backup power.

- The maritime ambition, initiated through earlier partnerships, is now supported by a tangible supply chain, as shown by the January 2025 order placed with Alleima for advanced steel products required for the mass production of its stationary and marine SOFC systems.

Table: Doosan Fuel Cell Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| HD Hyundai | November 27, 2025 | Partnered to develop a future-ready distributed power model, aiming to create integrated energy solutions for various applications using eco-friendly technologies. | Media Center – News |

| SK ecoplant, Hyosung Heavy Industries | November 10, 2025 | Signed a strategic cooperation agreement to supply hydrogen fuel cells as backup power for data centers in South Korea. | Doosan Fuel Cell Teams up with SK and Hyosung… |

| Ceres Power | July 28, 2025 (Mass Production) | Began mass production of SOFC systems using Ceres’ licensed technology, targeting data center and commercial markets. | Case study | Ceres – Powering ahead in South Korea |

| Alleima | January 24, 2025 | Placed an order for high value-added steel products to support the mass production of SOFCs for stationary and maritime applications. | Alleima receives an order for mass production of fuel cells … |

| Shell, Hyundai (KSOE), Hy Axiom | October 11, 2022 | Formed a consortium to develop and demonstrate a 600 k W SOFC auxiliary power unit on a vessel, aiming to decarbonize shipping. | Shell-led consortium to explore Solid Oxide Fuel Cell … |

Doosan Fuel Cell’s Geographic Focus Deepens in South Korea and Targets Global Niches

Doosan’s geographic strategy is centered on solidifying its domestic leadership in South Korea by targeting advanced applications, while simultaneously using strategic partnerships to test and enter high-value international markets.

Asia Pacific Identified as Fastest-Growing Fuel Cell Market

This chart shows the global fuel cell market growing to $18.16 billion by 2030, with the Asia Pacific region representing the largest market share. A market snapshot identifies Asia Pacific as the fastest-growing region.

(Source: Source)

- Between 2021 and 2024, Doosan’s activities were overwhelmingly concentrated in South Korea, where it supplied its PAFC technology to the world’s largest fuel cell power plants, including projects in Daesan and Incheon, cementing its position as the top domestic supplier with over 560 MW installed.

- In 2025, the focus within South Korea shifted from large, uniform utility projects to more specialized, high-tech applications, exemplified by the partnership with SK ecoplant and Hyosung to provide SOFC backup power for the nation’s growing data center industry.

- International expansion efforts have evolved from broad export agreements, like its entry into China in 2022, to more targeted, application-specific demonstrations. A key example is the March 2025 partnership between its subsidiary Doosan Mobility Innovation and So Cal Gas in the U.S. to demonstrate its DS 30 W hydrogen drone.

- The company is laying the groundwork for a major push into the global maritime sector, a goal supported by its technology partner Ceres Power in the UK, its supply chain partner Alleima, and its consortium with global players like Shell and KSOE.

Doosan’s SOFC Technology Reaches Commercial-Scale Maturity in 2025

In 2025, Doosan Fuel Cell transitioned its SOFC technology from the development and demonstration phase to commercial-scale manufacturing, marking a critical step in its strategic pivot away from its mature PAFC product line.

Global Fuel Cell Market to Reach $57 Billion by 2032

This chart forecasts the global fuel cell market revenue to grow from $7.29 billion in 2023 to $57.89 billion by 2032. The market is projected to expand at a compound annual growth rate (CAGR) of 25.89%.

(Source: Source)

- From 2021 to 2024, Doosan’s primary commercial offering was its well-established PAFC technology, notably the Pure Cell® M 400. During this period, its SOFC technology was in development, validated through milestones like the March 2024 marine environmental testing pass for its SOFC stack.

- The pivotal moment of technology maturation occurred on July 28, 2025, with the official commencement of mass production at its 50 MW SOFC factory. This event shifted the technology from a pilot-stage product to a commercially available system ready for market deployment.

- Alongside stationary power, Doosan achieved commercial maturity in a niche mobility segment with the March 2025 launch of the DS 30 W, the world’s first mass-produced hydrogen fuel cell drone, demonstrating its ability to industrialize fuel cell technology for specialized applications.

- While the company continues to innovate on its legacy PAFC line, developing a biogas-fueled model with Korea Western Power in June 2025, all major strategic and investment signals point to SOFC as the core technology for future growth.

SWOT Analysis: Doosan’s High-Stakes Pivot to SOFC in 2025

Doosan’s strategic pivot in 2025 introduces both significant opportunities in high-growth markets and substantial execution risks tied to its new SOFC technology and financial instability.

Hydrogen Fuel Cell Market to Exceed $76B by 2030

This chart forecasts the hydrogen fuel cells market growing from $16 billion in 2025 to a projected $76.85 billion in 2030. This growth is driven by a compound annual growth rate (CAGR) of 36.7% from 2026 to 2030.

(Source: Source)

- The company’s core strength has shifted from its established PAFC market dominance to a diversified technology portfolio underpinned by key strategic partnerships, most notably with Ceres Power.

- A persistent weakness in profitability was severely exacerbated in 2025 by the $560 million contract cancellations, highlighting the execution risk in its legacy business and increasing pressure on the new SOFC venture to succeed.

- The primary opportunity has moved from capturing large but lower-margin domestic utility projects to penetrating lucrative global markets like data centers and maritime shipping, where SOFC technology offers a competitive advantage.

- Threats have evolved from general market competition to the specific, acute risk of failing to successfully ramp up SOFC production and secure major commercial orders in a tight timeframe, which could cede ground to established SOFC players like Bloom Energy.

Table: SWOT Analysis for Doosan

| SWOT Category | 2021 – 2024 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Dominant PAFC market share in South Korea (>560 MW installed). Strong order book and participation in the world’s largest fuel cell plants. | Strategic technology partnership with Ceres Power for SOFC. Diversified product portfolio including PAFC, SOFC, and PEM drones. Formation of powerful domestic consortia (SK ecoplant, Hyosung). | The company’s strength is no longer just its legacy PAFC business but its ability to form critical alliances to acquire and commercialize next-generation SOFC technology for new markets. |

| Weaknesses | Consistent net losses and reliance on the capital-intensive stationary power market. Limited international presence beyond initial exports to China. | Massive ₩818 billion ($560 million) in PAFC contract cancellations in April 2025, revealing severe execution risk and financial instability. Negative profit margin of -4.33%. | The financial precarity of the business was validated. The weakness shifted from general unprofitability to a demonstrated inability to execute on its existing backlog, making the success of the SOFC launch a necessity. |

| Opportunities | Capitalize on South Korea’s Hydrogen Economy Roadmap by supplying large-scale utility projects (e.g., Daesan plant). Expand into mobility via PEM partnership with Ballard. | Penetrate high-growth, energy-intensive markets like AI data centers and commercial power with new SOFC systems. Enter the global maritime sector via consortium with Shell and KSOE. | The opportunity shifted from fulfilling government-mandated clean energy quotas with PAFC to capturing high-value commercial markets with a more efficient and scalable SOFC technology. |

| Threats | Competition from other fuel cell technology providers like Bloom Energy (SOFC) and Plug Power (PEM). Dependence on the Korean domestic market. | High execution risk on the SOFC factory ramp-up and securing first commercial orders by the end-of-2025 target. Failure would cede the market to more established SOFC players. | The threat became more specific and acute. It is no longer just about market competition but about the immediate, internal risk of failing to execute its high-stakes pivot, making the next 12-18 months critical. |

Forward-Looking Insights: Doosan’s Future Hinges on Securing Landmark SOFC Deals in 2025

Doosan Fuel Cell’s survival and relevance in the global fuel cell market now depend entirely on its ability to convert its new 50 MW SOFC production capacity into significant commercial contracts before year-end and into 2026.

- The most critical event to watch is the announcement of the first commercial sales of its new SOFC systems, which the company anticipates before the end of 2025. A landmark deal in the data center or maritime sector would serve as the ultimate validation of its high-risk strategic pivot.

- The company’s planned showcase at CES 2026 in January will be a key marketing event to generate global leads for its SOFC solutions, particularly for AI infrastructure. The market’s reaction and any resulting sales announcements will be a strong indicator of early traction.

- New long-term service and power purchase agreements, like those signed with Ulsan Eneroot and KEPCO in late 2025, will be crucial for providing revenue stability. However, the market will be watching to see if the value of new SOFC-related contracts can offset the massive $560 million loss from the terminated PAFC deals.

- Progress in the maritime sector is a key long-term indicator. An announcement of the first deployment or a major supply agreement for a marine SOFC system would open a significant new revenue stream and validate years of development with partners like Shell and KSOE.

Frequently Asked Questions

Why did Doosan Fuel Cell pivot from PAFC to SOFC technology in 2025?

Doosan Fuel Cell pivoted to Solid Oxide Fuel Cell (SOFC) technology to target high-growth, energy-intensive markets like data centers and maritime shipping. Its legacy Phosphoric Acid Fuel Cell (PAFC) technology was less suited for these applications, and the company made the strategic shift to capture new opportunities where SOFC offers a competitive advantage.

What significant financial challenges did Doosan face during its 2025 pivot?

The company faced major financial challenges, highlighted by the cancellation of ₩818 billion (approximately $560 million) in legacy PAFC supply contracts in April 2025. This, combined with a trailing twelve-month net loss of -₩18.12 billion as of August 2025, underscores the financial instability and high stakes of its transition to SOFC.

Who are Doosan’s key partners in its new SOFC strategy?

Doosan’s SOFC strategy relies heavily on key partnerships. UK-based Ceres Power is its core technology partner, providing the licensed SOFC technology. For market entry, Doosan formed a domestic consortium with SK ecoplant and Hyosung Heavy Industries to target the data center market, and it works with Shell and HD Hyundai (KSOE) to develop solutions for the maritime sector.

What was the most critical operational milestone for Doosan’s SOFC pivot in 2025?

The most critical milestone was on July 28, 2025, when Doosan commenced mass production of SOFC systems at its new 50 MW factory in Jeollabuk-do, South Korea. This event marked the transition of its SOFC technology from a developmental product to a commercially available system, which is the cornerstone of its new market strategy.

What new markets is Doosan specifically targeting with its SOFC technology?

Doosan is specifically targeting two new primary markets with its SOFC technology: 1) the data center market, where it aims to provide hydrogen fuel cells for backup power solutions, and 2) the global maritime sector, where it is developing SOFC auxiliary power units to help decarbonize shipping.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Ceres Power SOFC 2025: Fuel Cell & Hydrogen Analysis

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.