Ballard Power’s 2025 Commercialization Strategy: Fuel Cell Dominance in Heavy-Duty Transport

Ballard Power Commercial Scale Projects Drive Fuel Cell Adoption 2025

In 2025, Ballard Power Systems executed a strategic pivot from broad research and development to a focused commercialization model, securing large-scale orders in heavy-duty transport that signal a market shift from pilot projects to fleet-level adoption.

- Between 2021 and 2024, Ballard’s activities centered on development partnerships, such as with Ford Trucks and Linamar Corporation for automotive applications, and technology validation projects. In contrast, 2025 was defined by major commercial supply agreements that provide a significant revenue backlog and validate market readiness.

- The company solidified its leadership in the bus sector by securing a multi-year agreement with Manufacturing Commercial Vehicles (MCV) in March 2025 for 50 fuel cell engines, demonstrating a move toward scalable deployments beyond the historic 1, 000-engine order from Solaris announced in 2024.

- Ballard established a strong foothold in the rail market by converting development work into firm orders, including a 1.5 MW order to convert three locomotives for Sierra Northern Railway in June 2025 and a long-term supply agreement with Canadian Pacific Kansas City (CPKC) in April 2025.

- The company successfully entered the heavy-duty marine sector with a landmark 6.4 MW order from e Cap Marine in July 2025 to power two Samskip container vessels, proving its technology’s viability in a new hard-to-abate vertical.

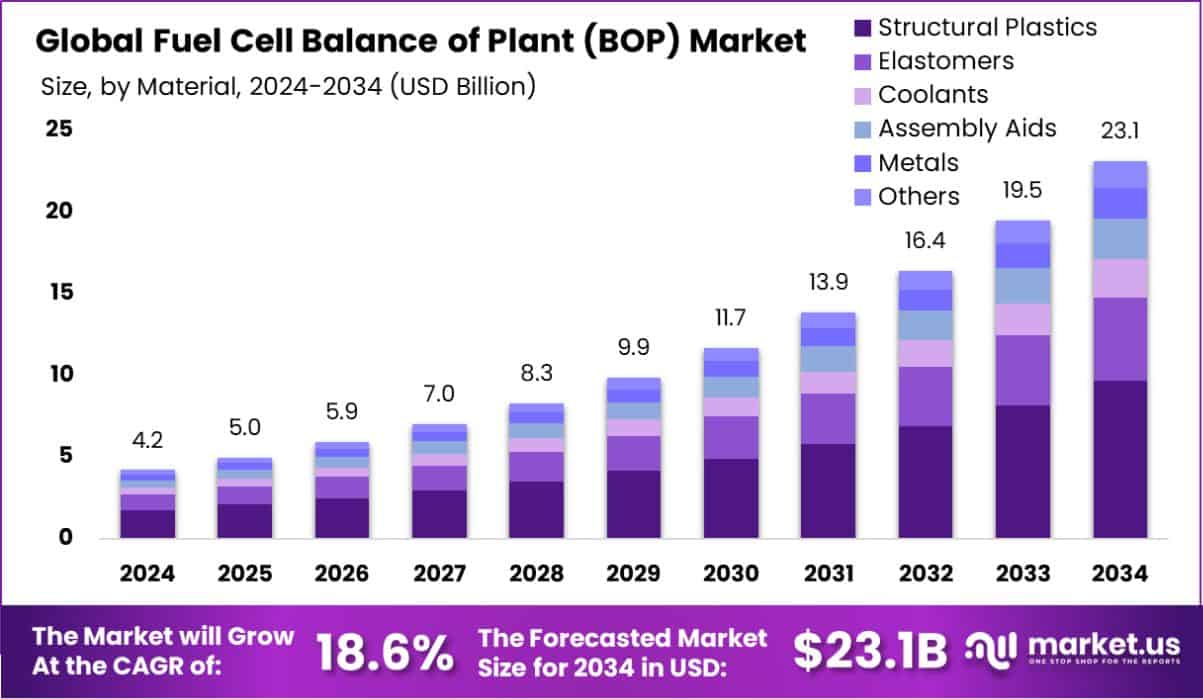

Fuel Cell Component Market to Reach $23.1B

This bar chart shows the projected growth of the global Fuel Cell Balance of Plant (BOP) market, forecasting an increase from $5.0 billion in 2025 to $23.1 billion by 2034. The data indicates a strong compound annual growth rate of 18.6%.

(Source: Source)

Ballard Power Investment Analysis Reveals Capital Discipline in 2025

Ballard’s 2025 investment strategy reflects a clear pivot to capital discipline, where it deliberately paused major expansion projects to align with market realities while leveraging its strong cash reserves to fund a more focused commercial plan.

- In 2024, Ballard announced a major capital expenditure plan to invest approximately $160 million in a new 3-gigawatt Gigafactory in Texas, supported by $94 million in U.S. federal grants and tax credits.

- By May 2025, the company reversed course and placed the final investment decision for the Texas facility on hold, citing a “multi-year push-out of the hydrogen industry” as the primary reason for conserving capital.

- This disciplined approach extended to its global strategy, with the new leadership confirming in October 2025 that new investments in China were “materially on pause” to avoid capital deployment in a market showing increasing preference for domestic suppliers.

- This strategic shift is underpinned by a strong balance sheet, which reported $525.7 million in cash and cash equivalents with no bank debt as of Q 3 2025, providing a crucial buffer to execute its strategy without requiring near-term financing.

Table: Ballard Power Strategic Investment Decisions and Financial Position (2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| New Investments in China | 2025-10-16 | New investments were put “materially on pause” to conserve capital in response to a market shift favoring domestic suppliers. | Ballard’s Chinese hydrogen fuel cell efforts ‘materially on … |

| Corporate Cash Reserves | 2025-09-30 | Maintained a strong liquidity position with $525.7 million in cash and no debt, enabling the execution of its long-term strategy amidst market headwinds. | After restructuring, Ballard Power Systems reports strong … |

| Fuel-Cell Gigafactory | 2025-05-07 | Paused the final investment decision on a Texas gigafactory, despite a $40 million DOE grant, due to slower-than-expected hydrogen market adoption. | ‘Multi-year push-out of the hydrogen industry’ | Ballard puts … |

Ballard Power Partnership Strategy Targets High-Volume Supply Agreements in 2025

In 2025, Ballard’s partnerships evolved from broad co-development initiatives to strategic, high-volume supply agreements that directly support its new commercial focus on the bus, rail, truck, and marine markets.

- The partnership with Ford Trucks, announced in September 2025, aims to integrate fuel cell systems into heavy-duty vehicles, representing a focused push into the long-haul trucking market in line with the new commercial strategy.

- The June 2025 Memorandum of Understanding with India’s Adani Group to evaluate a joint venture for fuel cell manufacturing marks a strategic entry into a high-growth market, directly supporting the goal of commercial expansion.

- Ballard converted a long-standing development relationship with Canadian Pacific Kansas City (CPKC) into a Long-Term Supply Agreement in April 2025, securing a recurring supply model for its established hydrogen locomotive program.

- The renewed Memorandum of Understanding with Kolon Industries in January 2026 is a critical move to secure the supply chain for key components like the Moisture Control Device, de-risking production as commercial orders scale.

Table: Ballard Power Systems Strategic Partnerships and Collaborations (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Kolon Industries | 2026-01-08 | Signed an MOU to deepen collaboration on the production and supply of key fuel cell components, ensuring supply stability and supporting innovation. | Ballard & Kolon Aim to Advance Fuel Cell Excellence |

| Ford Trucks | 2025-09-30 | Partnered to co-develop and integrate fuel cell systems into heavy-duty trucks, specifically targeting the Ford F-MAX model. | Ballard’s 2025 Pivot: How Fuel Cells Are Winning Big |

| Adani Group | 2025-06-24 | Signed an MOU to evaluate a joint venture for manufacturing hydrogen fuel cells in India, targeting the mining, logistics, and transport sectors. | Adani Group Announces Mo U with Ballard for Hydrogen … |

| Canadian Pacific Kansas City (CPKC) | 2025-04-30 | Announced a Long-Term Supply Agreement to provide fuel cell engines for CPKC’s expanding hydrogen locomotive fleet. | CPKC expands Ballard-powered hydrogen locomotive fleet |

| Vertiv | 2025-02-03 | Formed a strategic partnership to co-develop a turnkey fuel cell backup power solution for data centers and critical infrastructure. | Ballard and Vertiv combine to deliver zero-emission UPS system |

Ballard Power Geographic Focus Shifts to Europe and North America in 2025

In 2025, Ballard Power recalibrated its geographic strategy, pausing new investments in China to concentrate on securing large-scale commercial deployments in Europe and North America while positioning for future growth in India.

- Between 2021 and 2024, Ballard pursued a wider global strategy, which included a $130 million investment plan announced in 2022 for a manufacturing facility in Shanghai, China.

- This strategy was revised in 2025 when the company put new investments in China “materially on pause, ” a direct response to a market that is increasingly favoring domestic suppliers and presents reduced near-term growth opportunities.

- The company’s commercial focus pivoted heavily toward Europe, as demonstrated by the 6.4 MW marine order to power Samskip vessels and the 5 MW bus engine agreement with MCV for the European and Middle Eastern markets.

- North America remains a core market for Ballard Power, with key orders in the rail sector from Sierra Northern Railway in California and a long-term agreement with CPKC, even as the Texas gigafactory investment was put on hold.

- The June 2025 MOU with Adani Group to explore a manufacturing joint venture signals a new strategic entry into the high-potential Indian market, aligning with a long-term global growth plan.

Ballard Power Technology Maturity Reaches Commercial Viability in 2025

Ballard Power’s technology strategy in 2025 marked a clear progression from foundational research to the launch of market-specific, next-generation products engineered to lower lifecycle costs and accelerate commercial adoption in its targeted heavy-duty sectors.

- The 2021–2024 period was characterized by technology development and validation, including the successful test of a liquid hydrogen-powered fuel cell with Chart Industries in 2022 and the development of a 3 MW marine fuel cell concept with ABB.

- In 2025, Ballard Power launched a suite of commercially focused products, including the FCmove®-MD for medium-duty vehicles, the ninth-generation FCmove®-SC for transit buses, and the high-power, scalable FCmove®-XD for truck and rail applications.

- The launch of the FCmove®-SC in September 2025 was explicitly aimed at lowering lifecycle costs to move “on the road to diesel parity, ” a critical milestone for achieving commercial scale in the competitive transit bus market.

- While the core focus remained on heavy-duty motive, the integration of Ballard Power technology into the Dragonfly aircraft and a shore power system at the Port of Esbjerg in 2025 validated the technology’s versatility and performance across a range of applications.

Ballard Power SWOT Analysis Shows Strategic Realignment in 2025

Ballard Power’s 2025 strategic realignment leveraged its strengths in technology leadership and a robust cash position to mitigate weaknesses in profitability and counter threats from a slowing market, creating distinct opportunities in focused commercial segments.

- The analysis shows a clear shift from a company pursuing broad, capital-intensive expansion to a more resilient, commercially disciplined enterprise.

- Strengths in technology and finance were used to address market threats directly, leading to a more focused and defensible business model.

- Opportunities evolved from speculative market growth to tangible, large-scale orders in specific, high-potential sectors.

Table: SWOT Analysis for Ballard Power

| SWOT Category | 2021 – 2024 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Broad PEM fuel cell technology portfolio; partnerships with major OEMs like Ford Trucks and Linamar. | Strong liquidity with $525.7 million in cash and no debt; established technology leadership in heavy-duty motive applications. | The company’s strong cash position transitioned from a growth fund to a strategic buffer, enabling it to execute a disciplined realignment without near-term financial distress. |

| Weakness | Persistent net losses and high cash burn from R&D and scaling efforts; revenue volatility. | Continued net loss of $119.8 million on $90.2 million revenue in 2025; high operating expenses. | The weakness was explicitly acknowledged and addressed with the July 2025 announcement of a major restructuring to reduce operating expenses by over 30% and achieve positive cash flow by 2027. |

| Opportunity | Anticipated demand from government incentives like the IRA; growing global interest in hydrogen. | Secured landmark, multi-megawatt commercial orders in bus (MCV), rail (Sierra Northern), and marine (e Cap Marine) sectors. | Vague market opportunities crystallized into specific, high-volume commercial wins in targeted heavy-duty segments, validating the new, focused strategy. |

| Threat | Slow hydrogen infrastructure development; competition from batteries and other fuel cell providers. | A “multi-year push-out of the hydrogen industry”; increasing preference for domestic suppliers in the Chinese market. | The market slowdown became an explicit threat, forcing Ballard Power to prudently pause major capital projects in Texas and China and align its strategy with market realities. |

Ballard Power’s 2026 Outlook: Execution on Order Book is Key to Validating Strategy

Ballard Power’s success in the year ahead hinges on its ability to execute its substantial order book and convert the impressive revenue growth seen in Q 3 2025 into consistent financial performance, which will be the ultimate validation of its new commercial-first strategy.

- The primary milestone to monitor is the company’s progress toward its publicly stated goal of achieving positive cash flow by the end of 2027, a key metric for the success of its realignment.

- Having guided for revenue to be heavily weighted to the second half of 2025, the upcoming full-year financial results will be critical in assessing whether the 120% year-over-year revenue surge in Q 3 was sustained.

- The conversion of the memorandum of understanding with the Adani Group into a definitive joint venture and firm commercial orders will be a significant catalyst for Ballard’s expansion into the high-potential Indian market.

- Recent analyst upgrades, such as TD Cowen’s upgrade to “Hold” in January 2026, suggest that while 2026 will remain challenging, the market is beginning to acknowledge that the company’s decisive actions have reduced near-term risks.

Frequently Asked Questions

What was the major change in Ballard Power’s strategy in 2025?

In 2025, Ballard Power shifted its strategy from broad research and development to a focused commercialization model. This pivot involved securing large-scale commercial orders in the heavy-duty transport sectors (bus, rail, and marine), signaling a move from pilot projects to fleet-level adoption.

Why did Ballard decide to put the Texas Gigafactory project on hold?

Ballard paused the final investment decision for its Texas gigafactory in May 2025 due to a perceived “multi-year push-out of the hydrogen industry.” The company decided to conserve capital and align its investments with the actual pace of market adoption, despite having secured U.S. federal grants for the project.

What were some of Ballard’s key commercial orders in 2025?

In 2025, Ballard secured several significant commercial orders, including a multi-year agreement with Manufacturing Commercial Vehicles (MCV) for 50 bus engines, a 1.5 MW order to convert locomotives for Sierra Northern Railway, a long-term supply agreement with Canadian Pacific Kansas City (CPKC), and a landmark 6.4 MW order from e Cap Marine to power two Samskip container vessels.

How is Ballard managing its finances during this strategic shift?

Ballard is practicing capital discipline by pausing major investments in both the U.S. (Texas gigafactory) and China. This approach is supported by a strong balance sheet, which included $525.7 million in cash and no debt as of Q3 2025. Additionally, the company announced a restructuring plan to reduce operating expenses by over 30% and aims to achieve positive cash flow by the end of 2027.

Which geographic regions is Ballard focusing on after 2025?

In 2025, Ballard recalibrated its geographic focus to concentrate on commercial deployments in Europe and North America, while pausing new investments in China. The company is also positioning for future growth in India, highlighted by its June 2025 Memorandum of Understanding with the Adani Group to explore a manufacturing joint venture.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.