Fuel Cell Energy Data Center Strategy 2025: A Pivot to Power AI’s Energy Demand

Fuel Cell Energy Commercial Projects Signal Strategic Pivot to Data Centers in 2025

In 2025, Fuel Cell Energy executed a significant strategic pivot, shifting from a diversified clean energy solutions provider to a specialized supplier for the power-intensive data center market. This move redirects the company’s mature fuel cell technology to address the escalating energy crisis driven by AI and hyperscale computing, moving from bespoke projects to a focused, scalable market application.

- Between 2021 and 2024, Fuel Cell Energy focused on demonstrating the versatility of its technology through unique, high-profile projects. Key examples include the world’s first “Tri-gen” plant with Toyota at the Port of Long Beach, producing electricity, hydrogen, and water, and the ongoing Joint Development Agreement (JDA) with Exxon Mobil to develop carbon capture solutions.

- The strategy changed in 2025 with a concentrated effort on the data center sector. A landmark partnership was formed on March 10, 2025, with natural gas producer Diversified Energy and infrastructure firm TESIAC to supply 360 megawatts of net-zero power to data centers, primarily targeting sites in Virginia, West Virginia, and Kentucky.

- This domestic focus was complemented by international expansion into the same vertical. On July 10, 2025, Fuel Cell Energy signed a Memorandum of Understanding (MOU) with Korean developer Inuverse to deploy its fuel cell solutions for the AI Daegu Data Center, targeting the hyperscale and AI markets in South Korea.

- This transition from broad applications to a dedicated data center focus indicates a strategic decision to capitalize on an immediate and high-growth market where its technology’s core benefit, reliable baseload power, provides a direct solution to grid constraints.

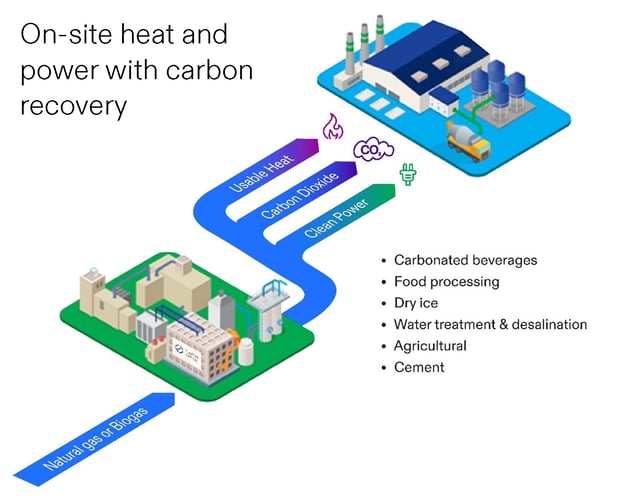

Fuel Cell Tech Creates Power, Heat, CO2

This diagram explains the core technology FCE is leveraging for its data center pivot, illustrating how it converts fuel into power, heat, and capturable CO2.

(Source: FuelCell Energy)

Fuel Cell Energy Investment Analysis: Capitalizing Projects Amidst Financial Pressures 2025

Fuel Cell Energy’s 2025 strategy is supported by project-specific financing and equity programs, but these measures are dwarfed by the capital raised by direct competitors, highlighting a significant financial challenge to scaling operations. The company is funding its growth and backlog conversion through smaller, targeted capital infusions rather than large-scale institutional investment.

- To fund operations and its growing backlog, Fuel Cell Energy expanded its “at-the-market” (ATM) equity program to $200 million on December 30, 2025. This mechanism allows the company to sell shares to raise capital incrementally, but also signals a continued reliance on dilutive financing.

- For specific international projects, the company secured project-level debt. On December 1, 2025, it announced $25 million in debt financing from the U.S. Export-Import Bank (EXIM) to support the production of fuel cell modules for its Gyeonggi Green Energy project in South Korea.

- In stark contrast, competitor Bloom Energy secured a massive investment partnership with global asset manager Brookfield in October 2025. Brookfield committed up to $5 billion to install Bloom’s solid oxide fuel cells, demonstrating the immense capital flowing into the sector and creating a significant competitive gap.

- While Fuel Cell Energy holds a net cash position of $197.8 million, its financing activities are orders of magnitude smaller than its main rival, underscoring the critical need for capital efficiency to execute on its $1.19 billion backlog.

Table: Key Investment and Financing Events (2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| ATM Equity Program | Dec 30, 2025 | Expansion of the Open Market Sale Agreement to $200 million to provide ongoing operational and project capital. | Fuel Cell Energy Expands ATM Equity Program to $200 … |

| U.S. EXIM Bank | Dec 1, 2025 | Secured $25 million in debt financing to fund module production for the Gyeonggi Green Energy project in Korea, supporting international backlog execution. | Fuel Cell Energy Secures $25 M in Repeat EXIM Financing for … |

| Bloom Energy / Brookfield | Oct 14, 2025 | (Competitive Context) Brookfield committed up to $5 billion to finance and install Bloom Energy’s fuel cells, establishing a major capital advantage for a key competitor. | Brookfield commits up to $5 bn in fuel cell deal with Bloom … |

Fuel Cell Energy Partnership Strategy: Building a Data Center Power Ecosystem in 2025

In 2025, Fuel Cell Energy transitioned its partnership strategy from technology development and demonstration to building vertically integrated commercial ecosystems aimed squarely at the data center market. These new alliances are designed to create a full-stack, turnkey solution for off-grid power, marking a definitive shift toward scalable commercial deployment.

- The period between 2021 and 2024 was characterized by partnerships focused on technology advancement and unique applications. This included the long-term JDA with Exxon Mobil to co-develop carbon capture technology and the collaboration with IBM to apply AI for performance optimization.

- The defining partnership of 2025 was the formation of the Dedicated Power Partners (DPP) venture with Diversified Energy and TESIAC. This collaboration creates an end-to-end solution, combining a fuel source (natural gas), technology (fuel cells), and infrastructure development to deliver 360 MW of power directly to data center customers.

- Fuel Cell Energy expanded this data center strategy internationally by signing an MOU with Korean developer Inuverse. This alliance provides a direct channel into the booming South Korean AI and hyperscale data center market, leveraging a local partner’s development expertise.

- These 2025 partnerships represent a move from proving technological viability to establishing commercial delivery mechanisms. The structure of the DPP venture in particular indicates a repeatable model for future off-grid data center projects.

Table: Evolution of Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Inuverse | Jul 10, 2025 | MOU to deploy fuel cell power solutions for the AI Daegu Data Center in South Korea, expanding the data center pivot into a key international market. | Fuel Cell Energy and Inuverse Partner for Data Center … |

| Diversified Energy & TESIAC | Mar 10, 2025 | Formation of an Acquisition and Development Company (ADC) to supply 360 MW of power to U.S. data centers, creating a vertically integrated ecosystem. | Diversified Energy, Fuel Cell Energy, and TESIAC … |

| Exxon Mobil | Ongoing (Extended Apr 2024) | Long-term Joint Development Agreement to advance carbonate fuel cell technology for industrial carbon capture, representing a technology-focused collaboration. | Recently Updated and Extended Joint … – Fuel Cell Energy, Inc. |

| Toyota | Sep 7, 2023 | Completion of a “Tri-gen” plant at the Port of Long Beach, demonstrating a unique application for producing power, hydrogen, and water from a single system. | Fuel Cell Energy and Toyota Announce Completion of … |

Fuel Cell Energy’s Geographic Focus Narrows to U.S. and Korean Data Center Hubs

Fuel Cell Energy’s geographic strategy in 2025 consolidated from a broad international presence to a targeted focus on the United States and South Korea, aligning its commercial activities directly with the epicenters of the data center construction boom.

- Between 2021 and 2024, the company pursued opportunities across multiple regions, reflecting a more diversified approach. This included major projects in South Korea (Gyeonggi Green Energy), the U.S. (Connecticut, New York, California), Canada (CRIN-funded pilot), and early-stage agreements in Malaysia (MHB MOU) and Africa (Oando MOU).

- In 2025, the focus sharpened dramatically. The partnership with Diversified Energy and TESIAC specifically targets the U.S. data center alley in Virginia, along with emerging hubs in West Virginia and Kentucky, to deploy 360 MW of power.

- Simultaneously, the MOU with Inuverse for the AI Daegu Data Center deepens Fuel Cell Energy’s commitment to South Korea, a market where it already has a significant installed base, by pivoting towards the high-growth AI infrastructure segment.

- This geographic concentration allows Fuel Cell Energy to direct its limited resources toward markets with the most acute and immediate demand for its grid-independent power solutions, moving away from exploratory efforts in other regions.

Fuel Cell Energy Deploys Mature MCFC Technology for Commercial Scale Data Centers

Fuel Cell Energy is leveraging its commercially mature Molten Carbonate Fuel Cell (MCFC) and solid oxide platforms as a ready-now solution for the data center market, shifting the technology’s application from bespoke demonstrations to scalable, repeatable deployments.

- From 2021 to 2024, the company focused on validating its core technology in novel applications. The Toyota Tri-gen project showcased the unique multi-output capability of its MCFC platform, while the ongoing work with Exxon Mobil centers on its inherent carbon capture properties. Its Solid Oxide (SOEC) platform for hydrogen production was announced in late 2022 and began testing at Idaho National Laboratory.

- In 2025, the strategy shifted to deploying this proven technology at scale to solve an immediate commercial problem. The 360 MW DPP venture and the Inuverse MOU are predicated on the ability of its fuel cells to provide reliable, combustion-free baseload power, a critical need for data centers facing grid delays.

- This pivot does not represent a change in the core technology but rather a strategic redeployment. The company is marketing a mature, validated product to a new, high-growth customer segment, treating it as an off-the-shelf solution for the data center energy crisis.

SWOT Analysis: Fuel Cell Energy’s High-Stakes Data Center Pivot in 2025

Fuel Cell Energy’s 2025 pivot to data centers leverages its unique technological strengths to address a timely market opportunity but simultaneously exposes its long-standing financial weaknesses and elevates competitive threats. The strategy is a calculated move that magnifies both the potential rewards and the inherent risks.

- The company’s core strength, its differentiated high-temperature fuel cell technology, has found a perfect market fit in the power-starved data center industry.

- However, its weakness in achieving profitability is now under greater scrutiny, as it must execute on a massive backlog without the large-scale capital of its primary competitors.

- The emergence of the AI-driven energy crisis presents a powerful opportunity, but the intense competition, highlighted by Bloom Energy’s multi-billion-dollar partnerships, poses a substantial threat.

Table: SWOT Analysis for Fuel Cell Energy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Differentiated MCFC technology with unique capabilities for tri-generation (Toyota) and integrated carbon capture (Exxon Mobil JDA). | Application of mature MCFC and solid oxide platforms for reliable, grid-independent baseload power, directly addressing the data center energy crisis via the 360 MW DPP venture. | The technology’s core benefit (reliable power) was validated as a critical solution for a large-scale, urgent commercial market, moving beyond niche applications. |

| Weaknesses | A long history of unprofitability and reliance on dilutive equity financing to fund operations. | Persistently negative gross margins (averaging -18.7%) and an expanded $200 million ATM equity program to fund growth. | Financial pressure intensified. The need to execute on a massive $1.19 billion backlog profitably is now the central challenge, with no demonstrated history of doing so. |

| Opportunities | Broad opportunities in the energy transition, including hydrogen production (IIJA Hydrogen Hubs) and general decarbonization. | A specific, massive, and immediate market opportunity emerged: the “data center energy crisis” and the “Bring Your Own Power” model for AI infrastructure. | The market opportunity became highly focused and urgent, creating a demand-pull for Fuel Cell Energy’s specific value proposition that did not exist previously. |

| Threats | Established competition from better-capitalized fuel cell manufacturers like Bloom Energy and Plug Power. | The competitive threat escalated dramatically with Bloom Energy’s $5 billion partnership with Brookfield, creating a significant capital and deployment advantage. | The scale of capital required to compete effectively in the data center market was clarified, revealing a major disadvantage for Fuel Cell Energy. |

Fuel Cell Energy Outlook: Execution on Backlog is the Sole Determinant of Success

Fuel Cell Energy’s future success depends entirely on its ability to execute its $1.19 billion project backlog profitably, with the 360 MW data center venture serving as the ultimate test of its 2025 strategic pivot. The company has successfully aligned its technology with a major market need; now it must prove it can deliver at scale and with positive margins.

- The primary indicator of success for investors and partners will be a tangible improvement in gross margins and demonstrable progress toward the 100 MW annualized production rate the company stated is necessary to achieve positive adjusted EBITDA.

- The execution of the Dedicated Power Partners venture with Diversified Energy and TESIAC is the single most critical initiative. Its progress will signal whether the company’s new, integrated ecosystem model is commercially viable.

- Fuel Cell Energy must operate with superior capital efficiency. Reliant on smaller project financing and ATM equity offerings, it cannot match the financial firepower of Bloom Energy and must demonstrate an ability to generate returns with less capital.

- The focus has shifted from securing agreements to profitable delivery. The market is no longer judging Fuel Cell Energy on its technological promise but on its operational and financial performance.

Frequently Asked Questions

What is Fuel Cell Energy’s new strategy for 2025?

In 2025, Fuel Cell Energy executed a major strategic pivot, shifting its focus from diverse clean energy projects to specifically supplying reliable, baseload power for the high-demand data center market, driven by the energy needs of AI and hyperscale computing.

How is Fuel Cell Energy implementing its new data center strategy?

The company formed a key partnership with Diversified Energy and TESIAC to supply 360 megawatts of power to data centers in the U.S. (Virginia, West Virginia, and Kentucky). It also expanded this strategy internationally by signing an MOU with Korean developer Inuverse for the AI Daegu Data Center.

What is the biggest financial challenge Fuel Cell Energy faces?

Fuel Cell Energy’s main challenge is a significant capital disadvantage. While it funds projects through smaller means like a $200 million equity program and specific project debt, its direct competitor, Bloom Energy, secured a $5 billion investment partnership. This puts pressure on FCE to execute its $1.19 billion backlog with much greater capital efficiency.

Why is Fuel Cell Energy’s technology a good fit for data centers?

The company’s mature fuel cell technology provides a reliable, grid-independent source of baseload power. This directly solves a critical problem for the data center industry, which is facing an ‘energy crisis’ and significant delays in connecting to an overstrained electrical grid.

How does the 2025 strategy differ from what Fuel Cell Energy was doing before?

Prior to 2025, the company focused on demonstrating its technology’s versatility through high-profile, unique projects, such as the ‘Tri-gen’ plant with Toyota and a carbon capture development agreement with Exxon Mobil. The new strategy moves away from these bespoke applications to a scalable, repeatable commercial model focused on a single high-growth market.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.