Elcogen Fuel Cell Strategy 2025: Scaling Solid Oxide Technology from Pilot to Industrial Production

Elcogen’s Commercial Scale Projects Show Shift from Validation to Industrial Deployment 2025

In 2025, Elcogen transitioned from technology validation to deploying its solid oxide systems at industrial scale in hard-to-abate sectors, a significant shift from the pilot and demonstration projects that characterized the 2021-2024 period.

- The launch of the 360 MW “ELCO I” factory in September 2025 marked a pivotal change, enabling Elcogen to supply large-scale projects like the SYRIUS green steel initiative and the 2.6 MW Multi PLHY electrolyzer, which began operation in October 2025.

- This contrasts with the previous period (2021-2024), which focused on smaller-scale validations, such as the successful 2, 000-hour field test with Convion and the >100 k W Solid Oxide Electrolyser (SOE) demonstration in the BECCU project.

- In 2025, partnerships expanded into new commercial applications, including a Memorandum of Understanding (Mo U) with Casale SA for green ammonia and ongoing supply to Watt Any Where for off-grid ethanol-to-power generators, demonstrating broader market acceptance beyond initial R&D collaborations.

- The diversity of applications in 2025, from mobile power generation with Watt Any Where to industrial decarbonization with the SYRIUS project, indicates that Elcogen’s component-supplier model is successfully enabling market entry across multiple segments simultaneously.

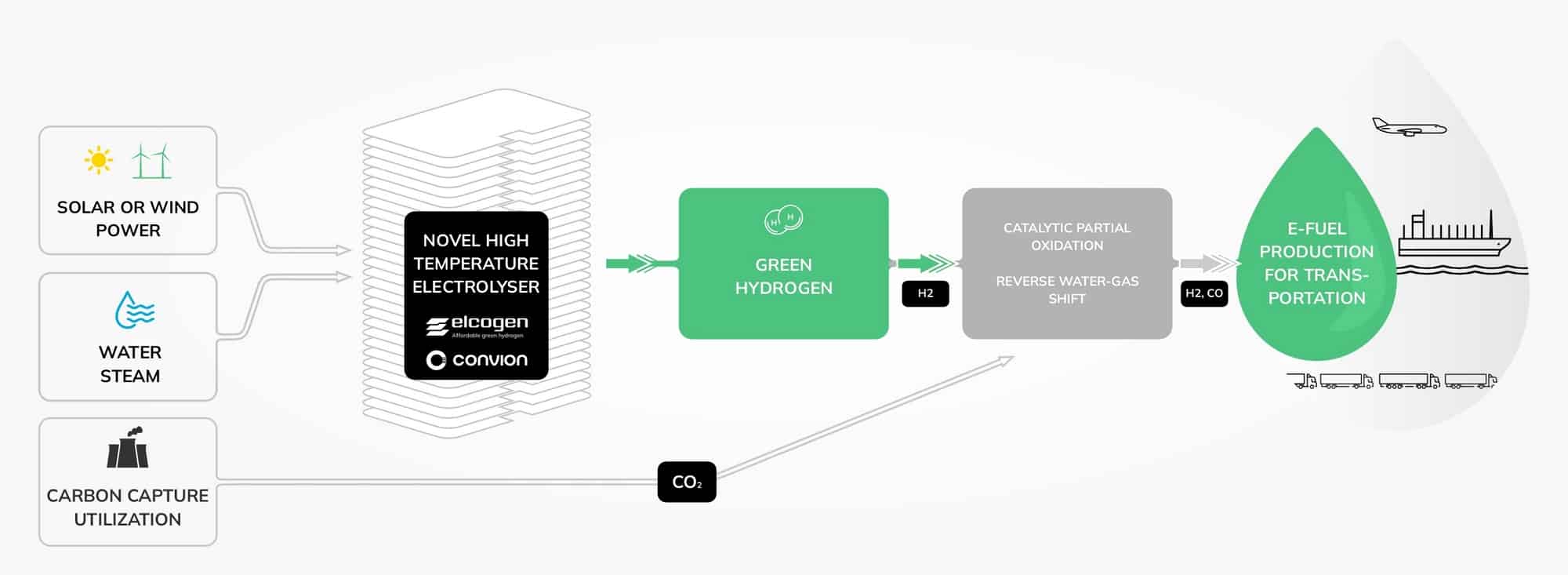

Elcogen Powers the E-Fuel Value Chain

This chart illustrates a complete industrial application of Elcogen’s electrolyzer technology, which directly supports the section’s focus on the shift to industrial-scale deployment in sectors like e-fuels.

(Source: Elcogen)

Investment Analysis: Elcogen Secures Targeted Capital for Manufacturing Expansion

Elcogen’s investment strategy in 2025 focused on securing substantial project-specific and manufacturing-focused capital, directly leveraging the foundational strategic equity raised between 2022 and 2024 to build out its production capabilities.

- In 2025, funding became highly targeted, with a €50 million capital investment for the “ELCO I” factory, a €24.9 million grant from the EU Innovation Fund for the same facility, and a €10 million Horizon Europe grant for a 4.5 MW electrolyser project.

- This follows a period of broad strategic fundraising from 2022-2024, which secured over €140 million from investors like HD Hyundai (€45 million), Hydrogen One (€24 million), and Baker Hughes, establishing the financial base for the 2025 expansion.

- The shift from securing general corporate funding to attracting large-scale, non-dilutive grants and direct project capex demonstrates growing confidence from public bodies and partners in Elcogen’s commercial execution.

Table: Elcogen Key Investments (2022 – 2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Horizon Europe | Oct 2025 | €10 M grant to support the integration of a 4.5 MW solid-oxide electrolyser project, funding specific large-scale deployments. | World’s largest solid-oxide electrolyser in an… |

| “ELCO I” Factory Capex | Sep 2025 | €50 M capital expenditure from stakeholders including Baker Hughes and HD Hyundai for the new factory, increasing capacity to 360 MW. | Elcogen launches new high-volume solid oxide fuel cell |

| EU Innovation Fund | Apr 2025 | €24.9 M grant to directly support construction and scaling of the new “ELCO I” factory, de-risking the massive capacity expansion. | EU Innovation Fund backs Elcogen’s expansion plans |

| Smart Cap | Jan 2025 | €5 M investment from an Estonian state-owned venture fund to accelerate growth and business development in line with the new factory opening. | Elcogen Secures €5 M Investment from Smart Cap for Growth |

| HD Hyundai | Oct 2023 | €45 M strategic investment to deepen collaboration on marine and stationary power systems and support factory construction. | Estonian hydrogen innovator Elcogen gets a €45 M… |

| Hydrogen One | May 2022 | €24 M investment to fund the expansion of facilities and establish a new automated production line, an early step toward mass manufacturing. | Elcogen receives €24 million investment from Hydrogen One |

Partnership Strategy: Elcogen Moves from R&D Alliances to Commercial Market Creation

In 2025, Elcogen’s partnerships evolved from technology co-development agreements to strategic alliances focused on commercial deployment and market creation in specific high-value sectors like green ammonia and steel.

- A key shift in 2025 was the Mo U with Casale SA to integrate Elcogen’s SOEC technology into green ammonia plant designs, opening a new end-market, and the SYRIUS project collaboration to decarbonize steel manufacturing.

- This builds upon the 2021-2024 period, which established a network of technology development partners, including AVL for MW-scale module design, HD Hyundai for marine applications, and Baker Hughes for reversible systems.

- The 2025 field test validation with long-term partner Convion and the reported pilot project with energy major Shell signal that earlier R&D collaborations are maturing into commercially significant relationships that drive offtake for the new factory.

Table: Elcogen Strategic Partnerships (2023 – 2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Convion | Dec 2025 | Successfully completed a field test of an industrial-scale SOEC system, providing real-world validation for commercial deployment in hydrogen applications. | News |

| Casale SA | May 2025 | Signed an Mo U to jointly develop and integrate SOEC technology into Casale’s plant designs for green ammonia and sustainable chemicals. | Elcogen and Casale SA collaborate to drive innovation… |

| SYRIUS Project Partners | Mar 2025 | Deployment of the world’s largest SOEC in a steel plant, demonstrating the technology’s viability for decarbonizing heavy industry. | Elcogen Launches Largest SOEC Project in Europe |

| AVL List Gmb H | Jul 2024 | Collaboration to develop MW-scale SOEC stack modules, a critical step for scaling up to industrial-grade hydrogen plants. | Elcogen partners with AVL to develop cutting-edge… |

| HD Hyundai | Oct 2023 | Deepened collaboration alongside a strategic investment to develop emission-free power systems for marine propulsion and stationary power. | HD Hyundai makes a Strategic Investment in Elcogen |

Elcogen’s Geographic Footprint: Consolidating in Europe, Expanding Globally

Elcogen consolidated its position as a central European technology provider in 2025 by anchoring its industrial-scale manufacturing in Estonia, while using pan-European projects and global partnerships to secure market access beyond its initial Nordic and Asian collaborations.

SOFC Market Growth by Region

This forecast identifies Asia-Pacific as the fastest-growing regional market, providing relevant global context for the section’s discussion of Elcogen’s European consolidation and global expansion strategy.

(Source: MarketsandMarkets)

- The launch of the 360 MW “ELCO I” factory in Tallinn, Estonia, in September 2025 firmly established the country as Elcogen’s manufacturing hub, a strategic decision supported by local funding from Smart Cap.

- While the 2021-2024 period was marked by forging key partnerships in South Korea with HD Hyundai and KEPCO, 2025 saw a pivot to securing major European industrial projects, such as the SYRIUS green steel project and the Multi PLHY electrolyzer deployment.

- Partnerships in 2025 with Swiss-based Casale SA and French-Swiss startup Watt Any Where demonstrate an expansion into new European markets, complementing the established R&D and system integration work in Finland and the Netherlands.

Technology Maturity: Elcogen’s Solid Oxide Tech Reaches Commercial Scale

In 2025, Elcogen’s solid oxide technology transitioned from demonstration-scale validation to commercial readiness for mass manufacturing and deployment in multi-megawatt industrial applications.

Elcogen Stack Performance Validated

This chart shows the power and voltage curve of an Elcogen stack, offering direct, technical proof of the performance and commercial readiness that defines the technology’s maturity, as described in the section.

(Source: www.magnex.co.jp)

- The most significant proof of maturity in 2025 was the inauguration of the 360 MW “ELCO I” factory, shifting the company’s focus from producing pilot-scale stacks to mass-producing cells and modules for commercial orders.

- This follows the 2021-2024 period where maturity was defined by technical milestones, including a 2, 000-hour industrial field test with Convion and R&D agreements with TNO and AVL to design next-generation systems.

- The deployment of Elcogen’s technology in the world’s largest SOEC projects for steel (SYRIUS) and industrial use (Multi PLHY) in 2025 validates its performance and reliability at a scale required by hard-to-abate sectors.

- Key performance metrics were commercially proven in 2025, with SOFC stacks achieving up to 75% electrical efficiency and SOEC systems demonstrating energy consumption as low as 39 k Wh/kg of hydrogen, moving these figures from the lab to real-world applications.

SWOT Analysis: Elcogen’s Strategic Pivot to Mass Production

Elcogen’s strategic shift in 2025 leveraged its technological strengths and early partnerships to address the weakness of limited production capacity, successfully mitigating it through massive factory expansion and securing large-scale projects that capitalize on market opportunities in industrial decarbonization.

SOFC Market Opportunity to Exceed $10B

This chart quantifies the significant market opportunity in industrial decarbonization that the SWOT analysis identifies. The strong projected growth directly supports the company’s strategic pivot to mass production.

(Source: Market Data Forecast)

- Strengths in high-efficiency and reversible technology, established in the 2021-2024 period, were validated at commercial scale in 2025 through projects like Multi PLHY.

- The primary weakness of limited manufacturing capacity (10 MW) was directly resolved in 2025 by the launch of the 360 MW “ELCO I” factory.

- Opportunities in the growing hydrogen market, identified through partnerships with HD Hyundai and Baker Hughes, are now being actively pursued through commercial projects with Casale (green ammonia) and in the SYRIUS project (green steel).

- The threat of market adoption speed remains, but is mitigated by securing offtake-oriented partnerships, turning a potential weakness into a manageable execution risk.

Table: SWOT Analysis for Elcogen

| SWOT Category | 2021 – 2024 | 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High-efficiency SOFC/SOEC technology demonstrated in pilots. Strong R&D partnerships (AVL, TNO). Fuel flexibility proven with partners like Watt Any Where. | Validated record-high 75% stack efficiency. Reversible capability deployed in industrial settings. Established as a critical European supplier. | Technology performance transitioned from validated potential to commercially proven at scale, solidifying its competitive advantage. |

| Weaknesses | Limited production capacity (10 MW). Heavy reliance on partners for system integration. Commercial deployments were small-scale demonstrations. | Dependence on partners for commercial success remains. Potential for factory underutilization if market adoption is slow. | The core weakness of production capacity was resolved with the 360 MW factory. However, this created a new dependency on securing sufficient commercial offtake. |

| Opportunities | Growing demand for green hydrogen. IPCEI and EU funding mechanisms. Initial MOUs in marine (HD Hyundai) and stationary power. | Massive market growth forecast for SOFC/SOEC (CAGR >30%). Entry into new markets: green ammonia (Casale) and green steel (SYRIUS). | Elcogen successfully moved to capitalize on market opportunities by securing large-scale, high-value projects in hard-to-abate sectors. |

| Threats | Competition from established SOFC players and other electrolyzer technologies (PEM, Alkaline). Risk of funding dependency for scaling. | Market adoption speed of partners’ end-products. Execution risk of ramping up a 36-fold capacity increase. Need to secure large, firm offtake agreements. | The primary threat shifted from technology risk to commercial execution risk. Success now hinges on market traction matching the new production capacity. |

Forward-Looking Insights: Elcogen’s 2026 Success Hinges on Factory Utilization

Elcogen’s success in the year ahead depends entirely on its ability to convert its newly established 360 MW manufacturing capacity into a consistent stream of commercial offtake agreements with its system integrator partners.

- The most critical indicator to watch is the factory’s utilization rate. Securing large, recurring orders from partners like Convion, Watt Any Where, and new system integrators is necessary to justify the €50 million investment and achieve economies of scale.

- Progress on the Casale SA Mo U will be crucial. Moving from an agreement to a commercial, integrated green ammonia solution would validate a new, high-volume market vertical for Elcogen’s SOEC technology.

- The performance data from the SYRIUS and Multi PLHY projects are vital. Successful, efficient operation in these demanding industrial environments will provide the definitive proof point needed to unlock further deployments in hard-to-abate sectors.

Frequently Asked Questions

What was the biggest change for Elcogen in 2025?

The most significant change in 2025 was Elcogen’s transition from pilot-scale validation to industrial-scale production. This was marked by the launch of its new 360 MW “ELCO I” factory in Estonia, which increased its manufacturing capacity 36-fold and enabled the company to supply large commercial projects.

How did Elcogen fund its massive factory expansion?

The “ELCO I” factory was funded through a targeted strategy combining different capital sources. This included a €50 million capital expenditure from stakeholders like Baker Hughes and HD Hyundai, a €24.9 million non-dilutive grant from the EU Innovation Fund, and a €5 million investment from the Estonian state-owned venture fund, SmartCap.

What new markets did Elcogen’s technology enter in 2025?

In 2025, Elcogen expanded into new high-value industrial markets. It entered the green steel sector through the SYRIUS project and the green ammonia and sustainable chemicals market via a Memorandum of Understanding (MoU) with Casale SA. This is in addition to its ongoing work in off-grid power generation with Watt Any Where.

What are some examples of Elcogen’s industrial-scale projects in 2025?

Key industrial-scale projects in 2025 include the SYRIUS green steel initiative, which involved deploying the world’s largest Solid Oxide Electrolyser (SOEC) in a steel plant, and the 2.6 MW Multi PLHY electrolyzer, which began operation in October 2025. These projects demonstrate the technology’s readiness for hard-to-abate sectors.

What is the main challenge for Elcogen moving forward from 2025?

According to the analysis, Elcogen’s biggest challenge is to secure sufficient commercial offtake to utilize its new 360 MW factory capacity. Success now hinges on converting its partnerships and demonstration projects into large, recurring commercial orders to justify the manufacturing investment and achieve economies of scale.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Elcogen's 2025 SOFC & Solid Oxide Fuel Cells Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Ceres Power SOFC 2025: Fuel Cell & Hydrogen Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.