Offshore Wind: Top 10 Projects in USA in 2025

From Ambitious Blueprints to Steel in the Water: Charting the Rise of U.S. Offshore Wind

For years, the story of U.S. offshore wind was one of immense potential, a colossal ambition largely confined to planning documents and optimistic forecasts. The narrative was simple: a massive coastline with powerful, untapped winds. Yet, the reality on the water remained sparse. Now, that story is fundamentally changing. As we move through 2025, the sector is in the midst of a dramatic and challenging transition from a nascent industry to one of active, large-scale construction. With a potential generating capacity pipeline that has surged by 53% in a single year to over 80, 523 MW, the U.S. is finally moving to turn its paper ambitions into powerful, steel-and-rotor realities, even as it navigates fierce political and supply chain headwinds.

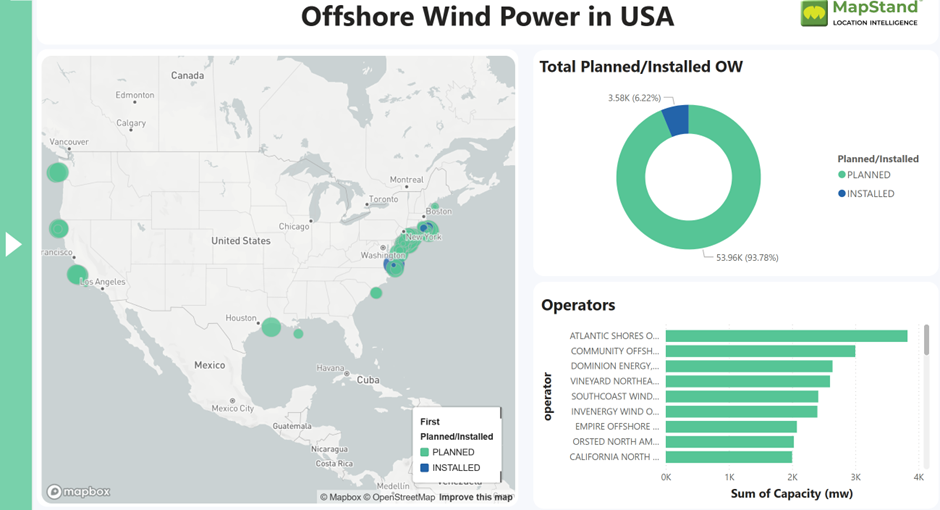

Vast US Offshore Wind Pipeline Still in Planning

This dashboard illustrates the industry’s transition from blueprints to construction, showing that over 93% of capacity is planned while only a fraction is installed. It highlights the massive gap between ambition and current operational assets.

(Source: MapStand)

The Titans of the Atlantic: Top 10 U.S. Offshore Wind Installations

The landscape of American energy is being reshaped by a handful of pioneering offshore wind projects. These installations, ranging from operational trailblazers to gigawatt-scale giants under construction, represent the first wave of a new industrial era. The following projects are pivotal to the industry’s trajectory, showcasing the scale, key players, and progress defining the sector in 2025.

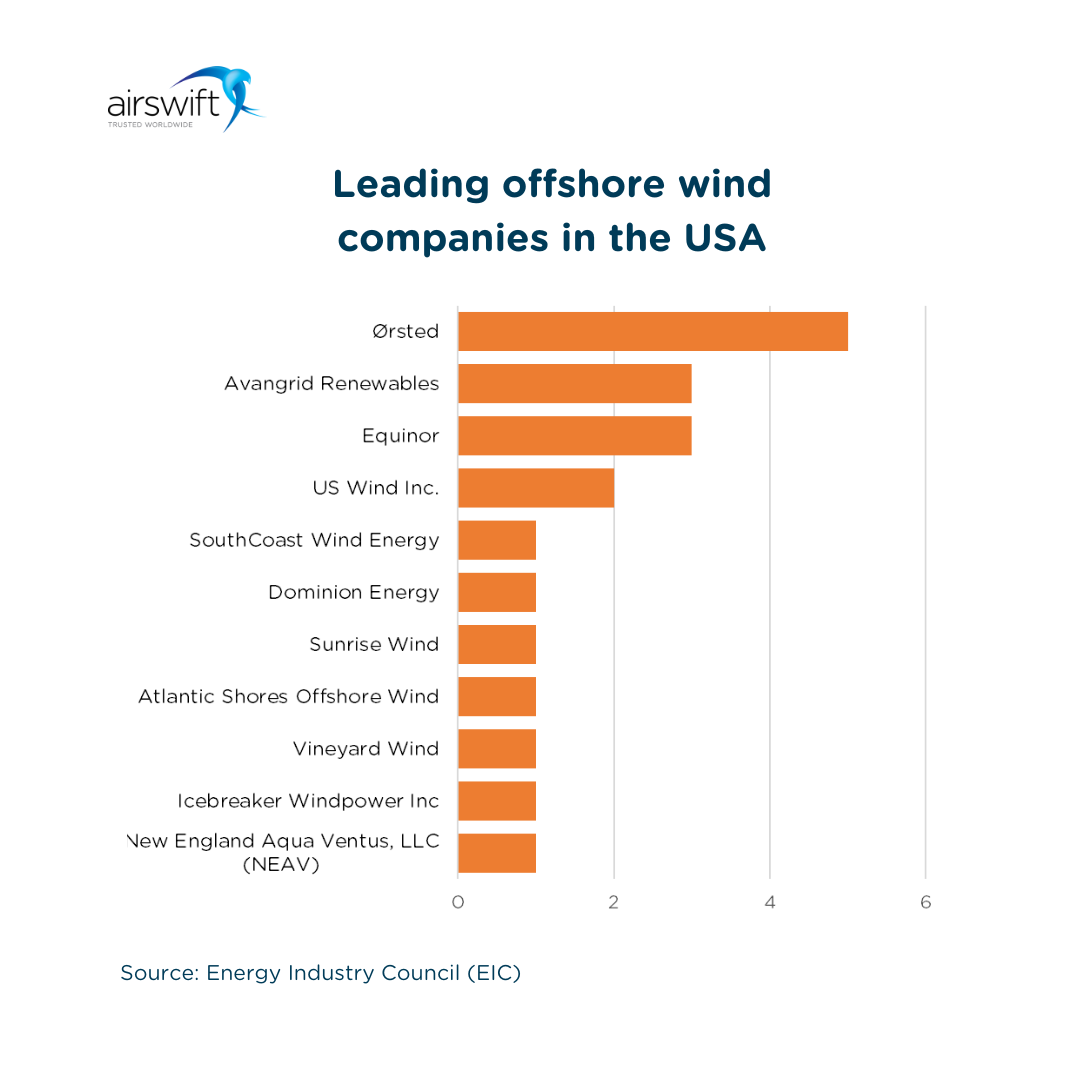

Ørsted, Avangrid Lead US Offshore Wind Development

This chart ranks the key corporate players, or “titans,” driving the U.S. offshore wind build-out. Ørsted, Avangrid Renewables, and Equinor are shown as the dominant forces in the market.

(Source: Airswift)

1. Coastal Virginia Offshore Wind (CVOW)

Company: Dominion Energy, Stonepeak

Installation Capacity: 2, 600 MW

Applications: Grid-scale electricity generation for Virginia.

Source: Dominion says largest US offshore wind project on track

2. Kitty Hawk Wind

Company: Avangrid (Iberdrola)

Installation Capacity: 2, 400 MW

Applications: Grid-scale electricity generation for North Carolina.

Source: Offshore wind energy

3. US Wind Maryland Project

Company: US Wind

Installation Capacity: 1, 710 MW

Applications: Grid-scale electricity generation for Maryland.

Source: Maryland Ups US Wind’s Capacity Award to 1.7 GW

4. Sunrise Wind

Company: Ørsted, Eversource

Installation Capacity: 924 MW

Applications: Grid-scale electricity generation for New York.

Source: US Reviewing Five Offshore Wind Farms Under Construction

5. Empire Wind 1

Company: Equinor

Installation Capacity: 810 MW

Applications: Grid-scale electricity generation for New York.

Source: U.S. Empire Wind offshore project aims to deliver first …

6. Vineyard Wind 1

Company: Avangrid (Iberdrola), CIP

Installation Capacity: 806 MW

Applications: Grid-scale electricity generation for Massachusetts.

Source: Offshore wind energy

7. New England Wind 1

Company: Avangrid (Iberdrola)

Installation Capacity: 791 MW

Applications: Grid-scale electricity generation for Massachusetts.

Source: Offshore wind energy

8. Revolution Wind

Company: Ørsted, Eversource

Installation Capacity: 704 MW

Applications: Grid-scale electricity generation for Rhode Island and Connecticut.

Source: US Court allows Ørsted to resume 700 MW Revolution …

9. South Fork Wind

Company: Ørsted, Eversource

Installation Capacity: 132 MW

Applications: Powering approximately 70, 000 homes in New York.

Source: Offshore Wind Power Facts | ACP

10. Block Island Wind Farm

Company: Ørsted

Installation Capacity: 30 MW

Applications: Grid-scale electricity generation for Rhode Island.

Source: Top 5 Biggest Offshore Wind Farms In U.S

Table: Top 10 U.S. Offshore Wind Projects by Capacity (2025)

| Company | Installation Capacity (MW) | Applications | Source |

|---|---|---|---|

| Dominion Energy, Stonepeak | 2, 600 | Grid-scale electricity generation for Virginia | Dominion says largest US offshore wind project on track |

| Avangrid (Iberdrola) | 2, 400 | Grid-scale electricity generation for North Carolina | Offshore wind energy |

| US Wind | 1, 710 | Grid-scale electricity generation for Maryland | Maryland Ups US Wind’s Capacity Award to 1.7 GW |

| Ørsted, Eversource | 924 | Grid-scale electricity generation for New York | US Reviewing Five Offshore Wind Farms Under Construction |

| Equinor | 810 | Grid-scale electricity generation for New York | U.S. Empire Wind offshore project aims to deliver first … |

| Avangrid (Iberdrola), CIP | 806 | Grid-scale electricity generation for Massachusetts | Offshore wind energy |

| Avangrid (Iberdrola) | 791 | Grid-scale electricity generation for Massachusetts | Offshore wind energy |

| Ørsted, Eversource | 704 | Grid-scale electricity generation for Rhode Island and Connecticut | US Court allows Ørsted to resume 700 MW Revolution … |

| Ørsted, Eversource | 132 | Powering approximately 70, 000 homes in New York | Offshore Wind Power Facts | ACP |

| Ørsted | 30 | Grid-scale electricity generation for Rhode Island | Top 5 Biggest Offshore Wind Farms In U.S |

From Niche Power to Core Infrastructure

The range of project capacities reveals a clear adoption curve driven by major energy developers. The industry has decisively moved beyond small-scale demonstrators. While the 30 MW Block Island Wind Farm served as a vital proof-of-concept, the market’s center of gravity now lies with gigawatt-scale developments. The presence of utility giant Dominion Energy leading the nation’s largest project, the 2, 600 MW Coastal Virginia Offshore Wind (CVOW), signals a critical shift. Offshore wind is no longer a peripheral green-tech experiment; it is being integrated as a core component of state and utility energy strategies. This is further reinforced by global energy leaders like Ørsted, Avangrid (Iberdrola), and Equinor, who are leveraging their international expertise to build projects like Vineyard Wind 1 (806 MW) and Empire Wind 1 (810 MW) that will power entire regions, not just niche communities.

Turbine Capacity Growth Fuels Gigawatt-Scale Projects

The exponential growth in individual turbine capacity, approaching 12 MW, is the key technological driver enabling the industry’s shift from niche demonstrators to gigawatt-scale infrastructure.

(Source: Reuters)

The Atlantic Advantage: An East Coast Powerhouse Emerges

The geographic focus of the U.S. offshore wind industry is unmistakable: all ten of the top projects are located off the Atlantic coast. This concentration is not accidental. It is driven by a powerful confluence of favorable wind resources, shallow continental shelf waters, and, most importantly, proximity to the nation’s largest coastal population centers with high electricity demand and ambitious clean energy mandates. We are seeing the formation of distinct regional hubs. A New England cluster, encompassing Massachusetts, Rhode Island, and New York, is home to a dense portfolio of projects including Vineyard Wind 1, Revolution Wind, and the operational South Fork Wind. Further south, a Mid-Atlantic hub is taking shape with Virginia’s massive CVOW project and North Carolina’s equally ambitious Kitty Hawk Wind (2, 400 MW), backed by strong state-level support. This regional clustering is critical for developing localized supply chains, specialized labor pools, and port infrastructure necessary for long-term growth.

Map Shows US Offshore Wind Clustered on East Coast

This map provides a clear visual of the “Atlantic Advantage,” showing the high concentration of offshore wind projects along the U.S. East Coast. It pinpoints the locations of key developments, reinforcing the article’s geographic analysis.

(Source: La Tene Maps)

Navigating the Gauntlet from Development to Operation

The status of these top projects provides a stark look at the industry’s maturity and its current bottlenecks. The technology itself is mature, as proven by the fully operational Block Island Wind Farm and the recently completed South Fork Wind. These pioneers have de-risked the operational phase. However, the real test for the U.S. market is the transition from paper to power. The “Under Construction” status of projects like CVOW, Vineyard Wind 1, and Revolution Wind represents the industry’s most critical and challenging stage. The fact that CVOW is reportedly 66% complete by late 2025 is a significant milestone. Conversely, the “Construction Paused” status of the 924 MW Sunrise Wind project and the legal battle that temporarily halted the 704 MW Revolution Wind project underscore the immense non-technical risks—political, legal, and financial—that define this scaling phase. The next wave of projects, such as the approved 1, 710 MW US Wind Maryland Project, shows a robust future pipeline, but their success hinges on the lessons learned from the current construction cohort.

Developers Navigate the US Offshore Wind Pipeline

This chart visualizes the development “gauntlet,” breaking down the project pipeline by status, including planned, under construction, and cancelled capacity. It highlights the significant construction pipeline led by companies like Dominion.

(Source: FactSet Insight)

The 80 GW Pipeline: A Future Forged in Steel and Strategy

The current landscape of U.S. offshore wind installations signals a sector at a crucial inflection point. The dominant theme is the high-stakes race to convert the massive 80, 523 MW project pipeline into tangible, power-generating assets. The near-term focus is on completing the approximately 5 GW of capacity currently under construction. Success here is paramount to building investor confidence and a resilient domestic supply chain. Leadership in this phase is being defined by two distinct strategic models. Dominion Energy exemplifies the vertically integrated utility approach, focusing its immense resources on a single, landmark project (CVOW) within its home state. In contrast, global veterans like Ørsted and Avangrid are pursuing a diversified portfolio strategy, managing multiple projects across different states and navigating complex multi-jurisdictional challenges. An emerging and critical insight is the growing role of the judiciary. The court injunction in January 2026 that allowed Revolution Wind to resume construction provides a fragile but essential backstop against political volatility, suggesting that legal and regulatory navigation will be as important as engineering and finance in shaping America’s offshore wind future.

US Offshore Wind Capacity Forecasted to Exceed 60 GW

This forecast shows the massive scale of the U.S. offshore wind pipeline, projecting cumulative capacity will surge to approximately 60 GW by 2035. This visualizes the industry’s long-term ambition to convert its vast pipeline into generating assets.

(Source: Reuters)

Frequently Asked Questions

What is the largest offshore wind project in the U.S. mentioned in the article?

The largest project is the Coastal Virginia Offshore Wind (CVOW), developed by Dominion Energy and Stonepeak. It has a planned installation capacity of 2,600 MW and is currently under construction off the coast of Virginia.

Why are all the top 10 offshore wind projects located on the Atlantic coast?

The projects are concentrated on the Atlantic coast due to a powerful combination of factors: strong and consistent wind resources, relatively shallow continental shelf waters that are suitable for construction, and close proximity to major coastal population centers with high electricity demand and ambitious clean energy mandates.

Are all the projects listed in the article already built and generating power?

No, the projects are in different stages of development. While smaller trailblazers like the Block Island Wind Farm (30 MW) and South Fork Wind (132 MW) are fully operational, many of the larger, gigawatt-scale projects like CVOW and Vineyard Wind 1 are currently in the ‘Under Construction’ phase. The article notes this is the industry’s most critical and challenging stage.

Who are the major companies leading the development of U.S. offshore wind?

The article identifies several key players, including U.S. utility giant Dominion Energy and global energy leaders such as Ørsted, Avangrid (the U.S. subsidiary of Iberdrola), Equinor, and US Wind. These companies are leveraging their resources and international experience to build the first wave of large-scale U.S. projects.

What is the total potential generating capacity of the U.S. offshore wind pipeline?

According to the article, the potential generating capacity pipeline for U.S. offshore wind has surged to over 80,523 MW as of 2025, which represents a 53% increase in a single year.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.