Offshore Wind: Top 10 Companies in USA in 2025

Storm and Steel: The High-Stakes Battle for America’s Offshore Wind Future

Imagine a courtroom in early 2026. Billions of dollars in energy infrastructure hang in the balance, and with them, the clean energy goals of entire states. This isn’t a fictional drama; it was the reality for Danish energy giant Ørsted. After a federal stop-work order threatened to derail its nearly complete Revolution Wind project, a judge’s ruling allowed construction to resume, sending a powerful signal across the U.S. energy landscape. In 2025, the American offshore wind industry is a story of this very tension: a colossal 80, 523 MW project pipeline fueled by state-level ambition clashing with fierce political and regulatory headwinds. This conflict is defining which companies will lead and which projects will transform from ambitious blueprints into steel in the water, powering the nation’s energy transition against all odds.

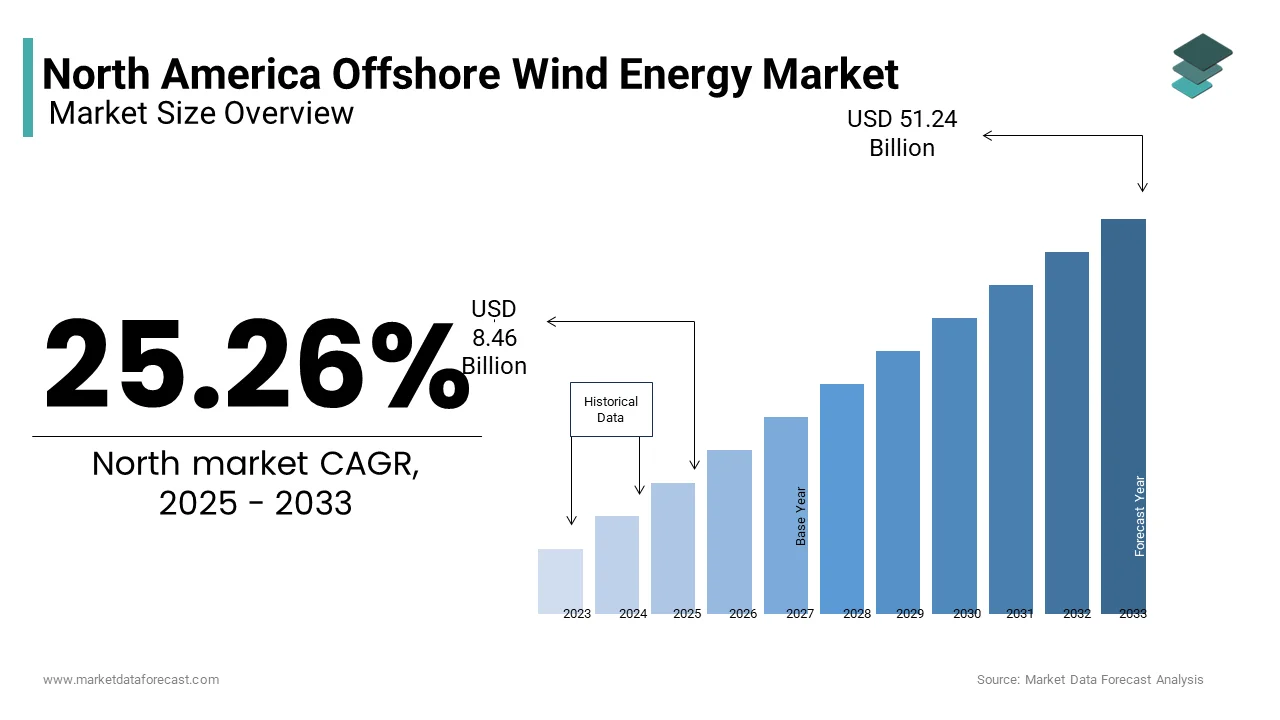

North American Offshore Wind Market Eyes $51 Billion

The North American offshore wind market is projected to see explosive growth, quantifying the multi-billion dollar stakes in the industry’s future. This forecast underscores the significant financial investment driving the sector’s expansion.

(Source: Market Data Forecast)

Installations: From Coastal Plans to Giga-Scale Power

Despite the volatile environment, a core group of global developers and domestic utilities are pushing forward with massive projects, representing billions in investment and the foundation of a new American industry. These installations are the battlegrounds where the future of U.S. offshore wind is being decided.

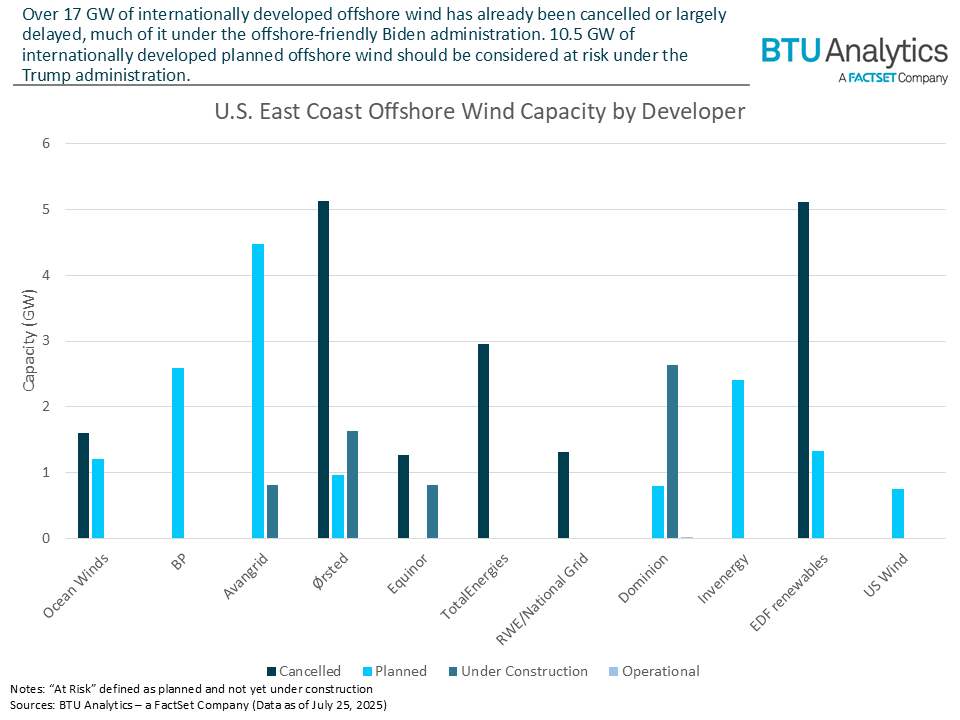

US East Coast Developers Navigate Project Pipeline

A breakdown of US East Coast offshore wind capacity reveals the current project landscape by developer. The data shows significant under-construction capacity alongside major cancellations, illustrating the industry’s volatility.

(Source: FactSet Insight)

1. Revolution Wind

Company: Ørsted

Installation Capacity: 704 MW

Applications: Powering Rhode Island and Connecticut. The project is nearly 90% complete and became a legal test case after successfully challenging a Trump administration stop-work order in January 2026.

Source: Orsted wins reprieve on Revolution Wind project halted by …

2. Empire Wind 1

Company: Equinor

Installation Capacity: 810 MW

Applications: Designed to power over 500, 000 homes in New York. The project reached a critical milestone by securing a $3 billion financing deal in early 2025 and will use 54 of Vestas‘ V 236-15.0 MW turbines.

Source: Equinor’s $3 B Financing Deal for Empire Wind 1 Project

3. Coastal Virginia Offshore Wind (CVOW)

Company: Dominion Energy

Installation Capacity: 2.6 GW

Applications: The largest offshore wind farm currently under construction in the U.S., located 27 miles off Virginia Beach. It is critical for the state’s clean energy goals and for powering the region’s massive data center alley.

Source: Leading Environmental Support for the Largest U.S. …

4. Vineyard Wind 1

Company: Iberdrola (via Avangrid) and Copenhagen Infrastructure Partners

Installation Capacity: 806 MW

Applications: The nation’s first commercial-scale offshore wind project, which began delivering power in early 2024. It utilizes GE Vernova‘s Haliade-X turbines.

Source: Avangrid, CIP Announce First Power from Nation-Leading …

5. Atlantic Shores Project 1

Company: Atlantic Shores Offshore Wind (Shell & EDF Renewables)

Installation Capacity: 1, 510 MW

Applications: The first project in a larger 5 GW portfolio, awarded by the New Jersey Board of Public Utilities to deliver renewable power to the state.

Source: About Us

6. New England Wind 1

Company: Iberdrola (via Avangrid)

Installation Capacity: 791 MW

Applications: A new project awarded in September 2024 to supply power to New England, further cementing Avangrid’s footprint in the region.

Source: Iberdrola is awarded a 791 MW offshore wind farm in the …

7. Sunrise Wind

Company: Ørsted and Eversource

Installation Capacity: 924 MW

Applications: A large-scale project under development to deliver offshore wind power to New York.

Source: US offshore wind farms in service, in construction and …

8. Leading Light Wind (Scrapped)

Company: Invenergy

Installation Capacity: 2.4 GW

Applications: Originally awarded a contract to supply power to New Jersey, the project was scrapped in November 2025 due to economic pressures, highlighting market fragility.

Source: Offshore wind developer scraps New Jersey project

9. California Offshore Lease (Paused)

Company: RWE

Installation Capacity: Lease Area (OCS-PO 561)

Applications: A lease for future floating offshore wind development off the coast of Humboldt, California. In a sign of political risk, RWE stopped development activities in the U.S. in April 2025.

Source: Major offshore wind developer has stopped activities in …

Table: Key U.S. Offshore Wind Projects (2025-2026)

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| Ørsted | 704 MW | Powering Rhode Island & Connecticut | CNBC |

| Equinor | 810 MW | Powering over 500, 000 New York homes | Carbon Credits |

| Dominion Energy | 2.6 GW | Largest US project; powering Virginia, including data centers | Tetra Tech |

| Iberdrola (Avangrid) | 806 MW | First US commercial-scale project | Vineyard Wind |

| Atlantic Shores (Shell & EDF) | 1, 510 MW | Delivering renewable power to New Jersey | Atlantic Shores |

| Iberdrola (Avangrid) | 791 MW | New England power supply | Iberdrola |

| Ørsted | 924 MW | Delivering power to New York | Reuters |

| Invenergy | 2.4 GW (Scrapped) | Planned for New Jersey power supply | APP.com |

| RWE | Lease Area (Paused) | Planned floating wind in California | Reuters |

From Grid Supply to Data Centers: Adoption Goes Deeper

The applications for these giga-scale projects reveal a strategic broadening of industry adoption. While the primary driver remains utility-scale power to meet state-mandated clean energy targets in places like New York, New Jersey, and New England, a crucial new application is emerging. Dominion Energy’s lawsuit challenging the federal project pause explicitly cited the risk to Virginia’s power grid, which supports one of the world’s largest concentrations of data centers. This directly links offshore wind not just to residential customers but to the foundational infrastructure of the digital economy. This diversification is significant. It shows that offshore wind is no longer seen as just a supplemental green energy source but as a critical, high-capacity power solution for industrial-scale energy consumers. The involvement of established American utilities like Dominion Energy alongside European powerhouses like Ørsted and Equinor signifies a deeper integration into the domestic energy system, with a wider and more influential set of stakeholders invested in its success.

Ørsted and Avangrid Lead US Developer Rankings

A ranking of the top offshore wind developers in the USA shows a concentrated market led by a few key players. Avangrid’s strong position supports its continued expansion with new projects like New England Wind 1.

(Source: Airswift)

Global Turbine Market Features Key Western Players

In 2024, Chinese manufacturers lead the global wind turbine market, highlighting intense competition. Companies like GE Vernova, used in the Vineyard Wind 1 project, remain key non-Chinese players in the global supply chain.

(Source: Windletter – Substack)

Next-Gen Turbines Push Past 15 MW Rating

This forecast shows a clear industry trend toward larger and more powerful offshore wind turbines, with ratings set to exceed 15 MW. Projects like Empire Wind 1 are pioneering the adoption of this next-generation technology.

(Source: Windletter – Substack)

The East Coast’s Wind Rush: A Tale of Two Coasts

Geographically, the data paints a stark picture: the U.S. offshore wind industry is overwhelmingly an East Coast phenomenon. States from Massachusetts down to Virginia form an unbroken corridor of activity, driven by strong political will and clear procurement targets. New York, with projects like Empire Wind 1 and Sunrise Wind, and New Jersey, with the Atlantic Shores project, are creating a multi-gigawatt demand center. Virginia stands out with Dominion Energy‘s massive 2.6 GW CVOW project, demonstrating the power of a regulated utility model to advance a single, state-backed development. This East Coast “wind rush” is a direct result of coordinated state-level policies that have created a bankable market despite federal instability. In sharp contrast, the West Coast remains in its infancy. The mention of RWE’s paused lease in California underscores this divide. While California has immense potential, its deeper waters require more complex floating turbine technology and its market is years behind. The East Coast’s progress provides a playbook for mainstream adoption, proving that state leadership is the most critical factor in turning potential into power.

Giga-Scale Ambition Meets Steel-in-the-Water Reality

These installations signal that U.S. offshore wind is transitioning from a speculative concept to a commercial reality, albeit a fragile one. The technology itself is clearly mature. The deployment of proven, next-generation turbines like GE Vernova’s Haliade-X in Vineyard Wind 1 and the landmark order for Vestas‘ V 236-15.0 MW turbines for Empire Wind 1 show that the hardware is ready for giga-scale deployment. Furthermore, Equinor securing a $3 billion financing package for Empire Wind 1 demonstrates that, despite the risks, sophisticated investors are willing to commit capital. The true measure of maturity, however, is not just technological readiness but project execution. The fact that Vineyard Wind 1 is operational and Revolution Wind is nearly complete proves projects can be built. Yet, the cancellation of Invenergy‘s Leading Light Wind and RWE’s pause show that market and political viability, not technology, are the primary hurdles. Maturity in this sector is now defined by the ability to navigate legal and political challenges to reach construction, making projects like CVOW and Revolution Wind critical benchmarks for the entire industry.

US Offshore Wind Installations to Spike After 2025

After years of slow progress, annual offshore wind installations are forecast to surge dramatically from 2025 onward. This impending boom represents the industry’s transition from planning to large-scale physical deployment.

(Source: Windpower Engineering & Development)

Navigating the Tides of Change: The Future of U.S. Offshore Wind

The U.S. offshore wind market is at a defining crossroads. The dominant theme for 2025-2026 is the clash between state-led momentum and federal-level risk. The key signal for the future is the industry’s successful use of the legal system to defend its investments. Ørsted‘s court victory for Revolution Wind was not just a win for one project; it created a crucial precedent, suggesting a legal moat can be built around projects with firm contracts and state backing. This will likely embolden other developers like Dominion Energy and Equinor to protect their multi-billion-dollar assets through litigation if necessary. Looking ahead, we can expect a “flight to quality.” Investment will consolidate around developers with strong balance sheets and projects that have already passed critical milestones like financial close and the start of construction. The immense 80.5 GW pipeline represents a powerful long-term vision, but the near-term focus will be on de-risking and execution. The leadership of companies like Ørsted, fighting on the legal front, and Dominion Energy, leveraging its regulated utility model, shows two distinct but powerful pathways to building a resilient American offshore wind industry, even in the most turbulent political seas.

US Offshore Wind Capacity to Exceed 60 GW

The long-term forecast for US offshore wind shows cumulative capacity potentially surpassing 60 GW by 2035. Growth will be driven first by fixed-bottom projects, followed by an expansion into floating wind technology.

(Source: Reuters)

Frequently Asked Questions

What are the main challenges facing the U.S. offshore wind industry?

The main challenges are fierce political and regulatory headwinds at the federal level, which clash with state-level ambitions. The article points to project cancellations due to economic pressures (Leading Light Wind) and companies pausing development due to political risk (RWE) as key examples of these hurdles.

Who are the major companies leading U.S. offshore wind development?

The market is led by a mix of global energy developers and domestic utilities. Key players mentioned are Ørsted (Revolution Wind), Equinor (Empire Wind 1), Dominion Energy (CVOW), and Iberdrola/Avangrid (Vineyard Wind 1, New England Wind 1). Other significant developers include Shell and EDF Renewables (Atlantic Shores).

Why is most U.S. offshore wind activity concentrated on the East Coast?

The East Coast dominates due to strong political will and coordinated state-level policies that have created clear procurement targets and a bankable market. In contrast, the West Coast is years behind, facing challenges like deeper waters that require more complex floating turbine technology.

What was the significance of the legal ruling for Ørsted’s Revolution Wind project?

The project was nearly 90% complete when it was halted by a federal stop-work order. Ørsted successfully challenged this in court, and a judge’s ruling in January 2026 allowed construction to resume. This was significant because it set a legal precedent, signaling that developers can protect their projects against federal interference through the legal system.

Besides powering homes, what are other key applications for offshore wind energy?

A crucial emerging application is powering industrial-scale energy consumers. The article highlights that Dominion Energy’s Coastal Virginia Offshore Wind (CVOW) project is critical for supplying power to Virginia’s massive data center alley, linking offshore wind directly to the infrastructure of the digital economy.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- IMO Decarbonization & Net Zero 2025: Policy Collapse

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.