AFC Energy’s Ammonia Cracking Pivot 2025: From Fuel Cells to Integrated Hydrogen Solutions

AFC Energy Commercial Scale Projects Redefine Off-Grid Power 2025

In 2025, AFC Energy executed a strategic pivot from demonstrating fuel cell technology in isolated pilots to pursuing full-scale commercialization, driven by an integrated strategy combining its proprietary ammonia cracking technology with aggressively cost-reduced generators.

- Between 2021 and 2024, the company’s focus was on technology validation through pilot deployments with construction firms like Mace, Kier, and ACCIONA to prove the viability of its H-Power generators as diesel replacements.

- The strategy shifted decisively in 2025 as the joint venture with Speedy Hire, Speedy Hydrogen Solutions, became a key revenue driver through its initial order of 20 H-Power generators, validating the commercial model.

- AFC Energy expanded into high-visibility markets to prove performance under demanding conditions, supplying a 200 k W liquid-cooled fuel cell system via its partner TAMGO to power the inaugural FIA Extreme H World Cup.

- The company’s commercial approach broadened from selling hardware to providing a complete energy ecosystem, underpinned by the launch of the Hy-5 ammonia cracker and a joint venture with Industrial Chemicals Group (ICL) to produce low-cost hydrogen at the point of use.

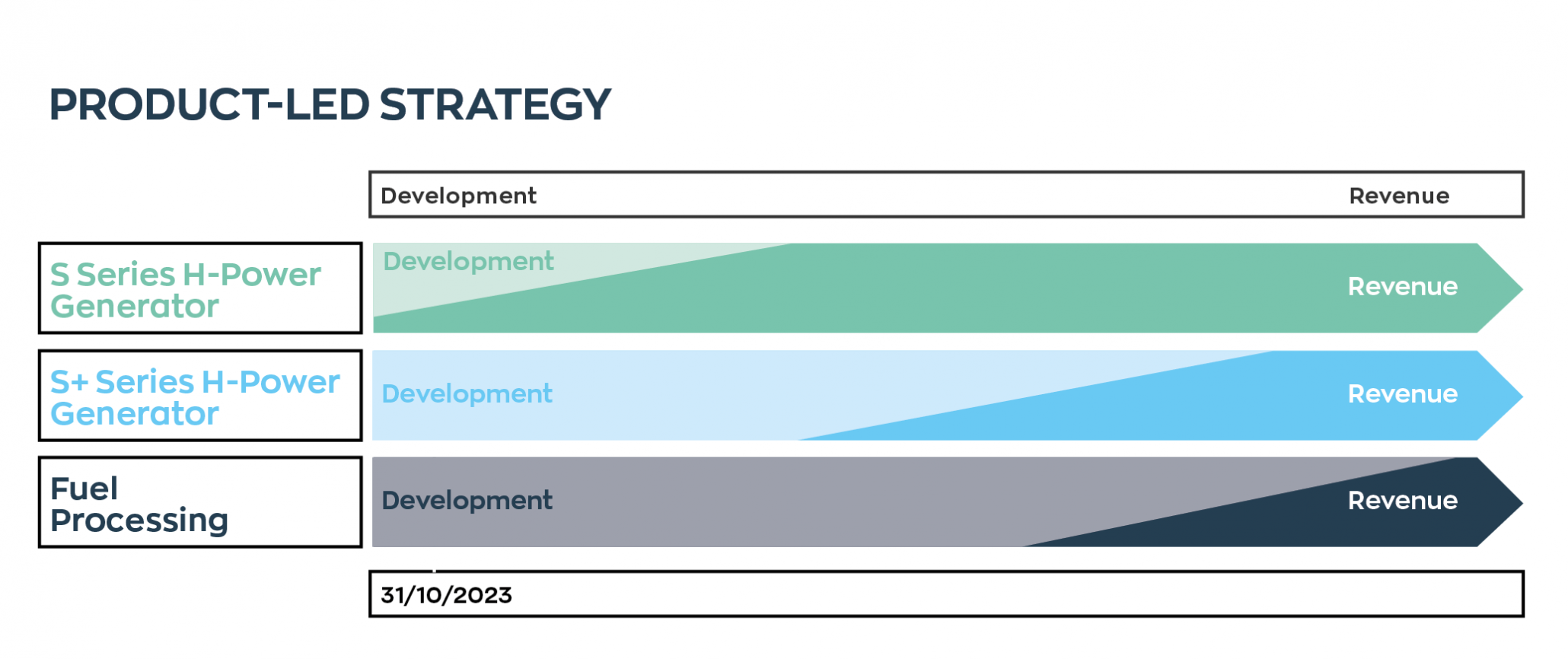

AFC Energy’s Roadmap to Commercialization

This chart illustrates AFC Energy’s strategic pivot from development to commercial revenue generation, directly supporting the section’s focus on its 2025 commercialization strategy and product-led approach.

(Source: AFC Energy)

Investment Analysis: AFC Energy Secures Capital for Commercial Push

AFC Energy successfully secured significant growth capital in 2025 to finance its strategic shift towards commercial-scale manufacturing and deployment, reflecting renewed investor confidence in its integrated ammonia-to-power strategy.

- The company raised £25 million in a heavily oversubscribed funding round in July 2025, providing the necessary capital to accelerate the commercial rollout of its next-generation fuel cell generators and its new Hy-5 ammonia crackers.

- Financial results for the year ending October 31, 2025, reflect a company in a pre-commercial investment phase, with a post-tax loss of £17.4 million driven by an increase in R&D spending to £9.5 million.

- The achievement of £4 million in nascent revenue for the fiscal year, primarily from generator sales to the Speedy Hire joint venture, provided an early proof point of the commercial model that the new investment is intended to scale.

Table: AFC Energy Investment and Financial Milestones

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| FY 2025 Financial Results | Year End Oct 31, 2025 | Reported a post-tax loss of £17.4 million and revenue of £4 million. The results highlight the company’s transition phase, with heavy investment in R&D (£9.5 million) ahead of full commercialization. | AFC Energy losses broadly stable as it focuses on costs |

| Corporate Fundraising | July 2025 | Successfully raised £25 million in an oversubscribed placing. The funds are earmarked to accelerate the commercial deployment of its fuel cell generators and Hy-5 ammonia crackers. | AFC Energy Secures GBP 25 M to Fuel Commercial Push |

| ABB Investment | April 2021 | ABB made a strategic investment in AFC Energy as part of a broader partnership to jointly develop high-power e-mobility and data center solutions, validating the technology for high-growth sectors. | ABB expands partnership with investment in AFC Energy to … |

Partnership Strategy: AFC Energy Builds a Commercial Hydrogen Ecosystem

In 2025, AFC Energy established a comprehensive partnership ecosystem to de-risk its commercial strategy by securing manufacturing scale with Volex, market access with Speedy Hire, and a low-cost hydrogen supply chain with ICL.

- The strategic manufacturing partnership with Volex Plc, announced in June 2025, is fundamental to achieving the company’s targeted 85% reduction in generator build costs and enabling mass production to meet future demand.

- To solve the hydrogen fuel challenge, AFC Energy formed a 50:50 joint venture with Industrial Chemicals Group (ICL) in July 2025 to produce and sell low-cost hydrogen from ammonia, aiming for a subsidy-free price point.

- A Joint Development Agreement (JDA) with an undisclosed S&P 500-listed industrial company, signed in June 2025, serves as crucial third-party validation for its ammonia cracker technology and creates a pathway for developing a range of scalable systems for global markets.

- The long-standing joint venture with Speedy Hire matured into a key commercial channel, providing a direct route to the UK construction and temporary power markets and generating the company’s initial significant revenues in 2025.

Table: AFC Energy Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Industrial Chemicals Group (ICL) | July 2025 | Formation of a 50:50 joint venture to produce and sell hydrogen from ammonia using AFC’s cracking technology. The goal is to disrupt the UK market by offering a competitive price without government subsidies. | New JV with Industrial Chemicals Group |

| Volex Plc | June 2025 | A global strategic manufacturing partnership to scale up production of fuel cell generators, reduce costs through economies of scale, and support a global rollout. | AFC Energy Cuts Hydrogen Generator Build Cost by 85% … |

| Unnamed S&P 500 Partner | June 2025 | A Joint Development Agreement (JDA) to co-develop a range of highly efficient ammonia crackers for hydrogen production, providing key technology validation from a major industrial player. | AFC Energy Signs Joint Development Deal with S&P 500 … |

| Speedy Hire (Speedy Hydrogen Solutions JV) | Nov 2023 – Present | An ongoing joint venture for the hire of H-Power generators in the UK. This partnership provides a direct channel to the temporary power market and was the primary driver of AFC’s £4 million revenue in FY 2025. | AFC Energy |

AFC Energy Regional Growth: UK Focus with Global Expansion Pathways

While AFC Energy’s commercial activities in 2025 consolidated around the UK market, its strategic partnerships simultaneously established critical footholds for future expansion into Europe and the Middle East.

- From 2021 to 2024, the company’s activities were geographically dispersed, with pilot projects in the UK (with Kier and Mace), Spain (with ACCIONA), and a key hydrogen supply agreement in Germany with Air Products.

- In 2025, the UK became the primary commercial focus, with the Speedy Hire joint venture driving initial sales and the new ICL partnership targeting the disruption of the domestic UK hydrogen market.

- International growth remains a core objective, supported by the Volex partnership, which provides a global manufacturing and supply chain footprint for future deployments.

- The distribution agreement with TAMGO for the MENA region and the development work with a global S&P 500 company ensure that pathways to major international industrial and energy markets remain open and active.

AFC Energy Technology Maturity: Validating an Integrated Commercial System

In 2025, AFC Energy’s technology strategy matured from demonstrating fuel cell viability to proving the commercial readiness of an integrated system, combining dramatically lower-cost generators with a proprietary ammonia-to-hydrogen fuel solution.

Advanced Cracker Tech Boosts Hydrogen Conversion

This diagram perfectly illustrates the technological maturity of AFC’s proprietary ammonia cracking solution mentioned in the text. It shows the improved efficiency that underpins the company’s integrated commercial system.

(Source: Ammonia Energy Association)

- Between 2021 and 2024, the primary focus was on deploying first-generation H-Power systems like the 10 k W “Power Tower” and developing the underlying ammonia cracking technology, which was successfully commissioned at a scale of 400 kg/day in late 2023.

- A significant leap in fuel cell maturity occurred in 2025 with the announced ~85% reduction in the build cost of its 30 k W generator and the delivery of a new high-power 200 k W S+ liquid-cooled platform, signaling a transition from prototypes to cost-competitive, manufacturable products.

- The ammonia cracker technology advanced from an R&D initiative to a commercially branded product, the Hy-5, with a specified production capacity of up to 500 kg/day and confirmed deliveries scheduled for 2026. This transformed the cracker from a supporting technology into the central pillar of the company’s integrated strategy.

SWOT Analysis of AFC Energy’s Strategic Pivot

AFC Energy’s 2025 strategic pivot amplified its strengths in integrated technology development and its partnership-led model, but also shifted its primary risks from technology validation to commercial execution and manufacturing scale-up.

- The strategic reset validated the company’s core strength, which is its ability to integrate proprietary fuel cell and fuel processing technologies into a single customer solution.

- Weaknesses have shifted from technical hurdles to operational challenges, including the need to scale manufacturing with Volex and manage the cash burn required for commercial expansion.

- The greatest opportunity is no longer just displacing diesel generators but establishing a new, decentralized hydrogen production and power market based on its ammonia cracking ecosystem.

- Threats now include not only other fuel cell developers but also any company offering a competitive off-grid power solution, with AFC’s success being highly dependent on the performance of its strategic partners.

Table: SWOT Analysis for AFC Energy

| SWOT Category | 2021 – 2024 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Proprietary alkaline fuel cell technology; partnership-led approach for market entry (e.g., ABB, Speedy Hire). | Vertically integrated technology stack (fuel cell + ammonia cracker); proven ability to raise significant capital (£25 M); partnership model validated with initial revenue. | The strategy shifted from selling a product to selling an entire ecosystem. The ICL and Volex partnerships in 2025 created a complete manufacturing and fuel supply chain. |

| Weaknesses | Pre-revenue status with reliance on capital markets; high production costs for generators; dependence on nascent hydrogen infrastructure. | Ongoing financial losses (£17.4 M) despite initial revenue; commercial success is now dependent on partners’ execution; manufacturing scale-up is unproven. | The company addressed the infrastructure weakness with its ammonia cracker strategy but created a new execution-dependent weakness around manufacturing scale and JV success. |

| Opportunities | Displacing diesel generators in off-grid markets (construction, events); expanding into e-mobility charging with ABB. | Creating a decentralized hydrogen production market with ammonia; achieving total cost of ownership parity with diesel; leveraging global partners (Volex, S&P 500 Co.) for scale. | The opportunity grew from a niche generator market to a potentially much larger distributed energy market by solving the hydrogen logistics problem. |

| Threats | Competition from other fuel cell technologies (e.g., PEM) and incumbent diesel generator providers; slow adoption of hydrogen. | Competition from integrated energy solution providers; failure of a key partner (e.g., Volex, ICL) to deliver; inability to achieve target price points without subsidies. | The competitive threat evolved. It is no longer just about fuel cell performance but about the economic viability of the entire ammonia-to-power ecosystem. |

Forward-Looking Insights: 2026 Hinges on Commercial Execution

AFC Energy’s success in 2026 is contingent on its ability to flawlessly execute its manufacturing and commercial partnerships, translating the strategic reset of 2025 into scalable revenue and tangible market share.

- The primary milestone to watch is the successful mass production of low-cost generators through the Volex partnership, which is critical to fulfilling potential demand from the Speedy Hire joint venture and achieving cost parity with diesel.

- The joint venture with ICL must deliver on its promise of producing and selling hydrogen at a disruptive, subsidy-free price point, as this is the economic foundation of the entire integrated strategy.

- The first commercial deliveries of the Hy-5 ammonia cracker, scheduled for 2026, will serve as the ultimate validation of the company’s pivot and its ambition to become a key enabler of the off-grid hydrogen economy.

Frequently Asked Questions

What was AFC Energy’s main strategic shift in 2025?

In 2025, AFC Energy pivoted from demonstrating its technology in pilot projects to full-scale commercialization. The new strategy focuses on providing an integrated solution by combining its cost-reduced H-Power generators with its proprietary Hy-5 ammonia cracking technology to create a complete off-grid power ecosystem.

How is AFC Energy planning to make hydrogen fuel more affordable and accessible?

AFC Energy is addressing the hydrogen fuel challenge through its ammonia cracking technology. The company formed a 50:50 joint venture with Industrial Chemicals Group (ICL) to use its Hy-5 ammonia crackers to produce and sell low-cost hydrogen from ammonia directly at the point of use, with the goal of achieving a competitive price without government subsidies.

What were the key financial highlights for AFC Energy in its 2025 fiscal year?

For the fiscal year ending October 31, 2025, AFC Energy reported its first significant revenue of £4 million. Reflecting its investment in growth, the company also posted a loss of £17.4 million, driven by increased R&D spending. A major milestone was successfully raising £25 million in July 2025 to fund its commercial rollout.

Who are AFC Energy’s key strategic partners and what is their purpose?

AFC Energy’s strategy relies on a new ecosystem of partners established in 2025. Volex Plc is the strategic manufacturing partner to scale production and cut costs. The joint venture with Industrial Chemicals Group (ICL) is for producing low-cost hydrogen. The long-standing joint venture with Speedy Hire serves as a primary sales channel to the UK market.

What is the significance of the Volex manufacturing partnership?

The strategic manufacturing partnership with Volex, announced in June 2025, is fundamental to AFC Energy’s commercial plan. It is designed to enable mass production of the fuel cell generators and is key to achieving the company’s target of an 85% reduction in generator build costs, making the product commercially competitive.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.