Brookfield’s $100 Billion Fund Drives AI Data Center Onsite Power Strategy 2026

Brookfield Commercial Projects Pivot to AI Infrastructure Dominance 2026

Brookfield has strategically shifted from a general infrastructure investor to a primary developer of specialized AI data centers, a move driven by the explosive demand for compute power from technologies like Manus AI.

- Prior to 2025, Brookfield’s portfolio consisted of broad infrastructure and renewable power assets. From 2025 onward, its strategy narrowed to launching targeted, multi-billion-dollar programs specifically designed to build the physical foundation for the AI industry.

- The defining action was the November 2025 launch of a $100 billion global AI Infrastructure program, established with founding partners NVIDIA and the Kuwait Investment Authority (KIA), signaling a full commitment to financing the end-to-end AI value chain.

- This strategic pivot is commercially validated by its October 2025 partnership with Bloom Energy to build “AI factories, ” a project that adopts onsite power generation as a core solution to the immense energy needs of modern data centers.

- Brookfield further solidified this new focus by expanding into the Middle East with a $20 billion strategic investment partnership with Qai in December 2025, marking its first major AI infrastructure capital deployment in the region.

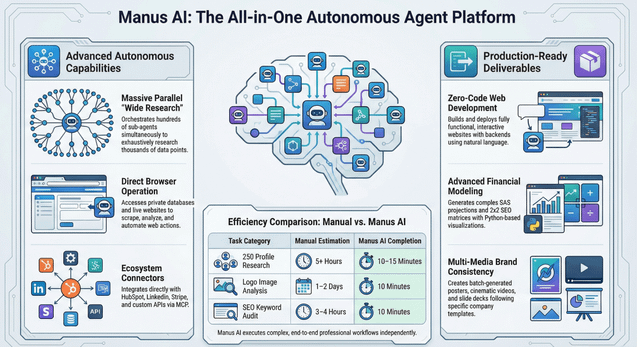

Manus AI Capabilities Drive Infrastructure Demand

This infographic explains how platforms like Manus AI, mentioned as a key driver in the section, create the demand for compute infrastructure. It directly illustrates the reason for Brookfield’s strategic pivot to AI data centers.

(Source: Reddit)

Brookfield Investment Analysis: Capital Deployment for AI Infrastructure 2026

Brookfield is deploying capital at an unprecedented scale, transforming its role from a passive investor to a program lead by establishing massive, dedicated funds to build out the global physical layer for artificial intelligence.

- The launch of the $100 billion global AI Infrastructure program in November 2025 establishes Brookfield as a central capital provider for the entire AI hardware ecosystem, designed to fund everything from data centers to the underlying power infrastructure.

- Its $20 billion partnership with Qai in December 2025 demonstrates a clear strategy of deploying this capital through regionally focused joint ventures to secure market access and align with national AI initiatives.

- The $5 billion strategic partnership with Bloom Energy shows Brookfield is not just funding data centers but is also directly investing in critical enabling technologies, specifically dedicating significant capital to solve the onsite power generation challenge.

AI Market Growth Fuels Infrastructure Investment

This chart’s forecast of exponential AI market growth provides the context for Brookfield’s large-scale capital deployment. It justifies the creation of the $100 billion fund mentioned in the section.

(Source: Carleton Torpin)

Table: Brookfield AI Infrastructure Investment Commitments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Qai Partnership | December 2025 | Formed a $20 billion strategic investment partnership to develop AI infrastructure in the Middle East, marking Brookfield’s first major AI investment in the region. | Brookfield and Qai Form $20 Billion Strategic Investment Partnership |

| Global AI Infrastructure Program | November 2025 | Launched a $100 billion program with NVIDIA and the Kuwait Investment Authority to invest across the full AI infrastructure value chain. | Brookfield Launches $100 Billion AI Infrastructure Program |

| Bloom Energy Partnership | October 2025 | Announced a $5 billion strategic partnership to build “AI factories, ” with Bloom Energy becoming the preferred onsite power provider for Brookfield’s AI strategy. | Brookfield and Bloom Energy Announce $5 Billion Strategic AI Infrastructure Partnership |

Brookfield Partnership Strategy: Alliances for AI Infrastructure Leadership 2026

Brookfield’s partnership strategy centers on creating vertically integrated consortiums that combine capital, technology, and energy expertise to de-risk and accelerate the construction of gigawatt-scale AI infrastructure.

- The alliance with NVIDIA and the Kuwait Investment Authority (KIA) as founding partners for its $100 billion fund provides Brookfield with immediate access to leading-edge AI hardware technology and deep pools of sovereign wealth capital.

- The October 2025 partnership with Bloom Energy is a critical move that positions the fuel cell company as the preferred onsite power provider, directly addressing the energy bottleneck that constrains AI data center development.

- By partnering with Qai to establish a $20 billion fund in Qatar, Brookfield is strategically aligning with national AI ambitions to secure long-term projects and government support in a key high-growth region.

Mapping the AI Infrastructure Ecosystem

This market map visualizes the AI infrastructure stack, showing where key partners like NVIDIA fit. It directly supports the section’s focus on Brookfield’s strategy of forming vertically integrated consortiums.

(Source: Next Big Teng – Substack)

Table: Brookfield Strategic AI Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Qai | December 2025 | A $20 billion joint investment fund focused on deploying AI infrastructure in the Middle East, leveraging regional capital and strategic alignment. | Brookfield and Qai Form $20 Billion Strategic Investment Partnership |

| NVIDIA & Kuwait Investment Authority (KIA) | November 2025 | Founding partners in a $100 billion global program, combining Brookfield’s capital with NVIDIA’s AI technology leadership and KIA’s financial backing. | Brookfield Launches $100 Billion AI Infrastructure Program |

| Bloom Energy | October 2025 | A $5 billion partnership making Bloom Energy the preferred provider of onsite power for Brookfield’s “AI factories, ” securing a solution for high-density energy needs. | Brookfield and Bloom Energy Announce $5 Billion Strategic AI Infrastructure Partnership |

Brookfield Geographic Analysis: Global Expansion into AI Infrastructure Hotspots 2026

Brookfield has rapidly expanded its AI infrastructure focus from its traditional North American and European bases to a global footprint, with the Middle East emerging as a primary target for new, large-scale data center and power deployments.

- Before 2025, Brookfield’s infrastructure assets were geographically diverse but not specifically concentrated in emerging AI hubs. The firm’s strategy was not explicitly tied to the specialized needs of AI compute.

- In 2025, this strategy shifted with the launch of a “global” $100 billion program, establishing a worldwide mandate to fund and build AI infrastructure wherever demand is highest.

- The December 2025 announcement of a $20 billion partnership with Qai in Qatar represents Brookfield’s first major AI infrastructure initiative in the Middle East, a region making significant sovereign investments in AI capabilities.

- This global expansion is essential to support the worldwide compute demands of companies like Meta, particularly after its acquisition of the Singapore-founded Manus AI, whose agentic technology requires immense, distributed infrastructure to function at scale.

Technology Maturity: Onsite Power Reaches Commercial Scale for AI Data Centers

Brookfield’s investments confirm that onsite power generation has progressed from a niche backup solution to a commercially essential, primary power strategy required to enable the development of gigawatt-scale AI facilities.

- Between 2021 and 2024, onsite power for data centers, such as fuel cells or microgrids, was predominantly used for redundancy and grid resilience rather than as a primary power source.

- The October 2025 partnership between Brookfield and Bloom Energy to build “AI factories” marks a critical inflection point, elevating fuel cells to a core component of the main power architecture for new data center projects.

- This shift is a direct response to the maturation of AI agents like Manus, whose enormous computational workloads make traditional grid connections insufficient and unreliable for sustained, high-density operations.

- Brookfield’s decision to name Bloom Energy its “preferred onsite power provider” for its AI strategy serves as commercial validation that the technology is mature enough for deployment at the scale of its $100 billion program.

Brookfield SWOT Analysis: Strengths and Risks in the AI Infrastructure Market 2026

Brookfield has leveraged its financial strength and partnership capabilities to secure a leadership position in the AI infrastructure market, but its success is now directly linked to the volatile AI sector and the immense execution risk of building gigawatt-scale energy and data infrastructure.

- The analysis shows Brookfield’s core strength is its ability to organize and deploy massive capital, demonstrated by its $100 billion fund and significant regional partnerships.

- A key opportunity is its first-mover advantage in creating integrated solutions that solve the critical energy bottleneck for AI, a differentiator that is difficult for competitors to replicate.

- The primary weakness and threat is the high capital intensity and operational complexity of deploying novel power solutions and data centers at an unprecedented scale and speed.

Table: SWOT Analysis for Brookfield’s AI Infrastructure Strategy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Diversified infrastructure investor with deep capital pools and a global asset base. | Launched a $100 B AI-specific fund. Formed strategic alliances with tech leaders (NVIDIA) and energy specialists (Bloom Energy). | Shifted from a generalist investor to a specialized, dominant capital provider and developer for the AI ecosystem, leveraging its financial power. |

| Weaknesses | Limited direct experience with the specialized, high-density power and cooling demands of cutting-edge AI hardware. | Success is now highly dependent on the execution of complex, energy-intensive data center projects. Capital is tied to the volatile tech sector. | Increased exposure to the physical constraints of the power grid and the operational risks of building at the frontier of data center design. |

| Opportunities | General growth in the global data center market. | Addressing the critical power-shortage bottleneck for AI compute. The Bloom Energy partnership provides a replicable onsite power solution. Geographic expansion into high-growth markets like the Middle East (Qai partnership). | Validated the opportunity to capture a market premium by providing an integrated solution (capital + power + real estate) that competitors cannot easily match. |

| Threats | Standard investment and operational risks in large-scale infrastructure projects. | Intense competition from other capital consortiums (e.g., Black Rock/Microsoft fund). Regulatory hurdles in energy and data center permitting. Geopolitical risks impacting AI chip supply chains. | The scale of AI demand, driven by agents like Manus, could outpace the ability to build power and data infrastructure, leading to project delays and cost overruns. |

Forward-Looking Insights: Brookfield’s Next Steps for AI Infrastructure 2026

Brookfield’s primary strategic focus for the next 12-18 months will be the physical execution of its first “AI factories, ” where the success of the Bloom Energy onsite power deployments will serve as the critical proof point for its entire $100 billion AI infrastructure strategy.

- Monitor for the announcement of the first specific project sites under the $100 billion program, as their location and projected power capacity will reveal Brookfield’s initial geographic and technical priorities.

- The performance and reliability data from the initial Bloom Energy fuel cell installations will be the most important metric to track, as this will determine the financial and operational viability of scaling this power solution globally.

- Expect Brookfield to announce further partnerships with energy companies and utilities to secure long-term fuel supplies, such as natural gas or hydrogen, for its growing fleet of Bloom Energy-powered facilities.

- The pace of capital deployment from its funds, including the $20 billion vehicle with Qai, will be a direct indicator of how quickly it can convert its financial advantage into revenue-generating physical assets.

Frequently Asked Questions

What is the main change in Brookfield’s investment strategy for 2026?

Brookfield has strategically pivoted from being a general infrastructure investor to a primary developer of specialized AI data centers. Starting in 2025, its focus narrowed to launching large-scale programs specifically to build the physical infrastructure required by the AI industry, driven by demand from technologies like Manus AI.

How much capital has Brookfield committed to its new AI strategy?

Brookfield has committed capital at a massive scale through several key initiatives. This includes launching a $100 billion global AI Infrastructure program in November 2025, a $20 billion strategic investment partnership with Qai for the Middle East in December 2025, and a $5 billion partnership with Bloom Energy for onsite power in October 2025.

Who are Brookfield’s main partners in these AI infrastructure projects?

Brookfield’s key partners include NVIDIA and the Kuwait Investment Authority (KIA) as founding partners for its $100 billion global program; Bloom Energy, which is its preferred onsite power provider for building “AI factories”; and Qai, with whom it formed a $20 billion joint venture to develop AI infrastructure in the Middle East.

Why is Brookfield partnering with Bloom Energy?

Brookfield’s partnership with Bloom Energy is a core part of its strategy to solve the immense energy challenge posed by AI data centers. The $5 billion partnership positions Bloom Energy’s fuel cells as the primary onsite power solution for Brookfield’s “AI factories,” addressing the energy bottleneck that often constrains data center development and ensuring a reliable power source for high-density compute workloads.

Where is Brookfield focusing its geographic expansion for AI infrastructure?

While its main $100 billion program is global, the analysis highlights a significant expansion into the Middle East. The December 2025 announcement of a $20 billion partnership with Qai in Qatar represents Brookfield’s first major AI infrastructure deployment in the region, aligning with national AI initiatives and targeting a key high-growth market.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.