Step Fun’s AI Infrastructure Strategy 2026: Building China’s Sovereign Compute Ecosystem

Step Fun Commercial Scale Projects Pivot from Model Development to Ecosystem Architecture 2026

Step Fun has transitioned from a consumer of AI infrastructure to a primary architect of a self-reliant domestic ecosystem, expanding its application focus from foundational models to industry-specific deployments in automotive and media.

- Between its founding in 2023 and the end of 2024, Step Fun concentrated on developing large-scale models like the trillion-parameter Step-2, primarily leveraging third-party infrastructure from providers such as Byte Dance’s Volcano Engine.

- In 2025, the company’s strategy shifted to vertical integration with the launch of the AI-Chip Ecosystem Alliance in July 2025, a direct initiative to unify domestic hardware and software and reduce reliance on foreign technology.

- This ecosystem strategy enabled new commercial applications, demonstrated by a July 2025 partnership with Geely Auto Group to integrate advanced AI into vehicles and a November 2025 agreement with Huanxi Media for AI-native content creation.

- The company also began providing full-stack, open-source solutions like GELab-Zero in November 2025, which bundles the model with the necessary inference infrastructure to accelerate developer adoption on its domestic technology stack.

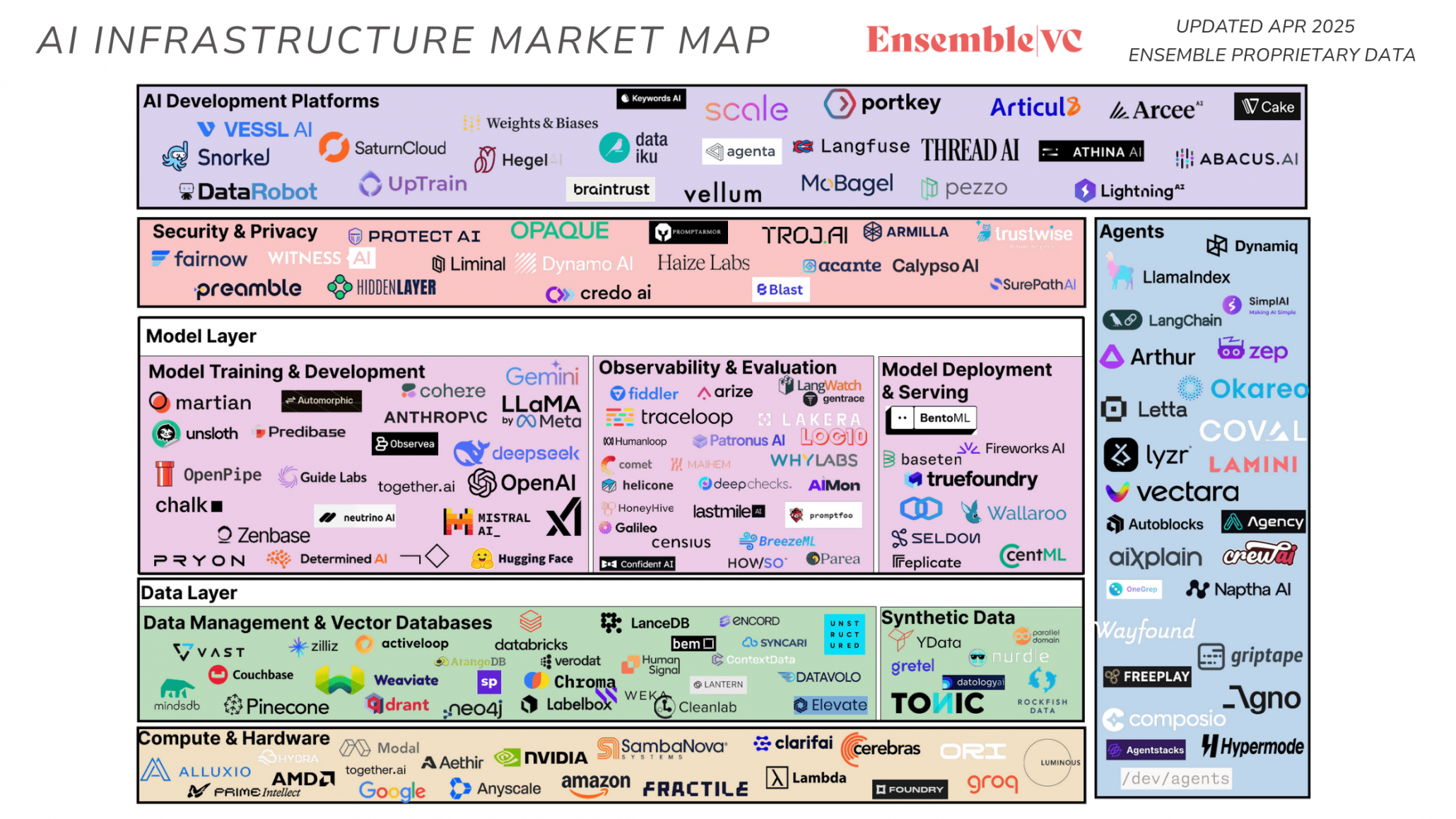

Mapping the AI Infrastructure Ecosystem

This market map illustrates the AI infrastructure landscape, providing context for Step Fun’s strategic pivot from a consumer to an architect of this ecosystem.

(Source: Ensemble VC)

Step Fun Investment Analysis: State-Aligned Capital Fuels Infrastructure Independence

Step Fun has secured significant, state-aligned capital to fund its strategic transition from a model developer to a core infrastructure orchestrator for China’s AI industry.

- Initial funding efforts culminated in a major Series B round in December 2024 for “several hundred million dollars, ” which established its position as a top-funded AI startup with a valuation over $2.4 billion.

- A pivotal financial milestone was reached in January 2026 with a Series B+ round exceeding RMB 5 billion (approximately $700 million), led by state-linked entities like Shanghai SDIC Leading Fund and China Life Private Equity Investment.

- This new capital is explicitly directed towards building petabyte-scale storage and compute infrastructure required for its 22 foundation models, marking a significant internal build-out compared to its earlier reliance on external cloud services.

- The scale of investment, while substantial for a startup, is part of a national trend, with giants like Alibaba committing $53 billion over three years, contextualizing Step Fun’s role as a key player in a much larger national AI infrastructure initiative.

Step Fun Secures $700M Round

This timeline highlights Step Fun’s key financial milestones, including the pivotal $700 million Series B+ round that directly funds its infrastructure independence strategy.

(Source: Hello China Tech)

Table: Step Fun Investment and Funding Analysis

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Series B+ Funding | Jan 2026 | Raised over $700 million led by state-linked funds to support R&D and the build-out of domestic AI infrastructure, reducing reliance on foreign technology. | Kr-Asia |

| Series B Funding | Dec 2024 | Raised “several hundred million dollars” to develop foundational AI models, achieving a valuation over $2.4 billion. | Silicon Angle |

| LLM Storage Infrastructure | Jul 2025 | Invested in a petabyte-scale storage solution using Juice FS to manage massive datasets for training its 22 foundation models efficiently. | Juice FS |

| Series B Funding | Jan 2025 | Completed a Series B round led by Fortera Capital with participation from Tencent Investment, securing early backing from top-tier corporate and venture investors. | GPCA |

Step Fun Partnership Strategy: From Technical Integration to Sovereign Ecosystem Creation

In 2025, Step Fun executed a deliberate pivot from leveraging existing infrastructure partners to actively forming and leading alliances designed to create a sovereign Chinese AI technology stack.

- Prior to 2025, partnerships were primarily technical integrations with infrastructure providers like NVIDIA and Byte Dance or academic collaborations with Peking University, all focused on accelerating internal model development.

- The most significant strategic shift occurred in July 2025 with the formation of the AI-Chip Ecosystem Alliance, where Step Fun united domestic chipmaker Huawei Ascend with other model developers like Mini Max to build a viable alternative to the NVIDIA ecosystem.

- Simultaneously, the company expanded into vertical applications, partnering with Geely Auto Group in July 2025 to deploy embodied intelligence in vehicles and with Huanxi Media in November 2025 to develop AI-native media applications, proving the commercial value of its domestic stack.

Table: Step Fun Strategic Partnership Analysis

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Huanxi Media Group | Nov 2025 | Strategic cooperation to develop AI-native applications for the media industry, demonstrating a commercial use case for Step Fun’s foundational models. | Wilson Sonsini |

| Geely Auto Group | Jul 2025 | Ecosystem partnership to integrate Step Fun’s AI models into Geely vehicles, advancing automotive embodied intelligence and creating a large-scale deployment channel. | Globe Newswire |

| AI-Chip Ecosystem Alliance | Jul 2025 | Led the formation of an alliance with Huawei Ascend, Mini Max, and others to create a self-reliant domestic AI ecosystem from chips to models, directly countering reliance on foreign tech. | Asia Financial |

| Byte Dance’s Volcano Engine | 2023–2024 | Utilized Byte Dance’s cloud platform for large model training, representing its earlier strategy of leveraging existing third-party AI infrastructure. | Pandaily |

Step Fun Geographic Focus: A China-Centric Strategy for AI Sovereignty

Step Fun’s activities are overwhelmingly concentrated in China, reflecting its strategic mission to build a domestic, self-reliant AI infrastructure in response to global technology restrictions.

- Founded in Shanghai in April 2023, Step Fun has maintained its operational and strategic focus entirely within China, leveraging local talent from institutions like Microsoft Research Asia to build its core team.

- The company’s major funding rounds, particularly the $700 million Series B+ in January 2026, were led by Shanghai-based and state-linked funds, reinforcing its alignment with national and regional goals for technological sovereignty.

- The formation of the Shanghai-based AI-Chip Ecosystem Alliance and the Shanghai General Chamber of Commerce AI Committee in July 2025 further solidifies its role as a key actor in building China’s primary domestic AI hub.

China’s AI Closes Gap with US

This chart shows the shrinking performance gap between top Chinese and US AI models, highlighting the competitive national landscape that drives Step Fun’s China-centric strategy.

(Source: Gray Matters)

Step Fun Technology Maturity: From Foundational Research to Full-Stack Deployment

Step Fun has rapidly advanced its technology from developing large-scale foundational models to deploying full-stack, open-source solutions that integrate both models and infrastructure, signaling a move towards commercial-ready, ecosystem-enabling products.

- In 2024, the company focused on achieving scale and performance with research-intensive models like the trillion-parameter Step-2, demonstrating its R&D capabilities in a competitive market.

- A significant maturity milestone was reached between 2025 and early 2026 with the release of technologies like GELab-Zero, the first open-source GUI agent that includes both the model and the plug-and-play local deployment infrastructure.

- The launch of Step-Audio R 1.1, which achieved a world-leading 96.4% accuracy on the Speech Reasoning benchmark in January 2026, validates the performance of its infrastructure and training methods at a commercial-grade level.

- The strategic use of Mixture of Experts (Mo E) architecture in models like Step 3 is a key indicator of technological maturity, focused on optimizing computational cost and efficiency for real-world deployment.

Step Fun Model Ranks Top-Tier

This benchmark data directly validates Step Fun’s technology maturity, showing its model achieves leading performance against competitors in reasoning and coding tasks.

(Source: Hugging Face)

Step Fun SWOT Analysis: Balancing Ecosystem Leadership with Execution Risk

Step Fun has successfully leveraged its strong technical leadership and state backing to build a formidable position in China’s AI race, but its capital-intensive strategy and reliance on a nascent domestic hardware ecosystem present significant long-term risks.

- The company’s core strength evolved from its founder’s pedigree to proven leadership in orchestrating a national AI ecosystem.

- Its primary weakness shifted from high cash burn to a deep strategic dependence on the success of its domestic chip partners.

- The main opportunity grew from capturing market share to defining the entire domestic technology stack, while the primary threat solidified around geopolitical pressures and the performance gap of domestic hardware.

Table: SWOT Analysis for Step Fun

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong founding team with elite R&D background from Microsoft Research Asia. Aggressive fundraising capability demonstrated by securing hundreds of millions in Series B funding. | Proven ability to act as a strategic nexus, leading the AI-Chip Ecosystem Alliance. State-linked backing validated by the $700 million Series B+ round. Prolific open-source model releases. | The company validated its ability to transition from a technology developer to a strategic ecosystem leader with government and industry support. |

| Weaknesses | Highly capital-intensive model with high cash burn for compute resources. Reliance on third-party infrastructure providers like Byte Dance and foreign hardware from NVIDIA. | Deep strategic dependency on the success and performance of domestic chip partners like Huawei Ascend. Commercialization is still in early stages despite high valuation. | The company traded reliance on foreign tech for a new dependency on the unproven performance and scalability of the domestic chip ecosystem. |

| Opportunities | Opportunity to capture market share in China’s booming generative AI market by building superior models like the trillion-parameter Step-2. | Opportunity to become the central architect of China’s sovereign AI stack. Ability to set standards for domestic hardware-software co-optimization. | The opportunity expanded from competing within the market to defining the market’s foundational “rails, ” creating a powerful strategic moat. |

| Threats | Intense competition from other “AI Tigers” like Zhipu AI and Moonshot AI. Geopolitical risks of US export controls on advanced chips. | Direct exposure to US-China technology restrictions. Risk that the domestic chip ecosystem (e.g., Huawei Ascend) fails to match the performance of NVIDIA’s platforms, hindering competitiveness. | The geopolitical threat became more acute and central to its strategy, making the performance of its domestic alliance its primary point of failure. |

Forward-Looking Insights: Commercial Viability of China’s Sovereign AI Stack is the Key Test for Step Fun

The critical factor for Step Fun in the year ahead will be the tangible adoption and performance of its domestic “model-chip” ecosystem, which will determine if its strategy to build a sovereign AI stack is commercially viable.

- Success will be measured by the rate at which alliance members and the wider Chinese market adopt domestic processors like Huawei’s Ascend for training and inference, providing a real-world validation of the alternative to NVIDIA’s ecosystem.

- The company is under pressure to demonstrate a clear path to profitability from its application partnerships with firms like Geely and Huanxi Media to justify its high valuation and massive capital expenditure on infrastructure.

- Continued releases of full-stack, open-source solutions like GELab-Zero will be crucial for attracting developers to its domestic ecosystem and creating the network effects needed to secure its long-term strategic influence.

Frequently Asked Questions

What is Step Fun’s main strategic goal as of 2026?

As of 2026, Step Fun’s primary goal is to build a sovereign, self-reliant Chinese AI ecosystem. The company has pivoted from focusing on model development to becoming a primary architect of a domestic technology stack, aiming to unify local hardware and software to reduce reliance on foreign technology.

How has Step Fun’s approach to AI infrastructure changed over time?

Initially, between 2023 and 2024, Step Fun was a consumer of AI infrastructure, using third-party cloud services like ByteDance’s Volcano Engine to train its models. In 2025, its strategy shifted to vertical integration, and it began building its own petabyte-scale compute and storage infrastructure, funded by its Series B+ round in January 2026.

Who are Step Fun’s key partners in its ecosystem-building strategy?

Step Fun’s key partners include domestic chipmaker Huawei Ascend and other model developers like MiniMax, with whom it formed the AI-Chip Ecosystem Alliance. It has also formed commercial partnerships with Geely Auto Group to integrate AI into vehicles and with Huanxi Media to develop AI-native content.

How is Step Fun financing its expensive infrastructure build-out?

Step Fun is financing its strategy with significant state-aligned capital. A key event was its Series B+ funding round in January 2026, where it raised over $700 million (RMB 5 billion) led by state-linked entities like Shanghai SDIC Leading Fund and China Life Private Equity Investment. This capital is explicitly for building its domestic AI infrastructure.

What is the biggest risk to Step Fun’s new strategy?

The biggest risk identified is Step Fun’s deep strategic dependency on the performance of its domestic chip partners, such as Huawei Ascend. The success of its sovereign ecosystem strategy is threatened by the risk that this domestic hardware may fail to match the performance and competitiveness of leading foreign platforms like NVIDIA’s.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.