AI Supply Chain Meltdown 2026: Why HBM and Advanced Packaging Are the New Bottlenecks

AI Project Delays 2026: How Packaging and Memory Shortages Became the Core Constraint

The central constraint on Artificial Intelligence scaling has decisively shifted from GPU availability to the manufacturing capacity of High-Bandwidth Memory (HBM) and advanced chip packaging, creating a systemic risk that now dictates the pace of all AI hardware deployment. Between 2021 and 2024, these components were primarily technical challenges for chip designers, but since 2025, their scarcity has become a strategic crisis causing enterprise project delays of 40-60% and starving adjacent industries like automotive and consumer electronics of critical memory chips.

- In the 2021–2024 period, the AI industry’s primary concern was securing enough GPUs, with advanced packaging like TSMC’s Chip-on-Wafer-on-Substrate (Co Wo S) and HBM viewed as supply chain sub-components. While constraints were emerging, as evidenced by TSMC reporting capacity limitations in late 2023, they had not yet cascaded into a full-blown crisis impacting end-users.

- Starting in 2025, this dynamic inverted completely, with HBM and packaging becoming the principal bottlenecks. The entire global supply of AI-ready memory from producers like SK Hynix, Samsung, and Micron is reportedly sold out for 2026, a direct consequence of AI servers requiring vastly more memory per system than consumer devices.

- This structural shortage is now forcing manufacturers to reallocate fabrication capacity away from standard DRAM and NAND flash to produce more lucrative HBM. This pivot directly threatens the supply chains for smartphones, PCs, and vehicles, with projections showing AI data centers could consume 70% of all memory chips by 2026.

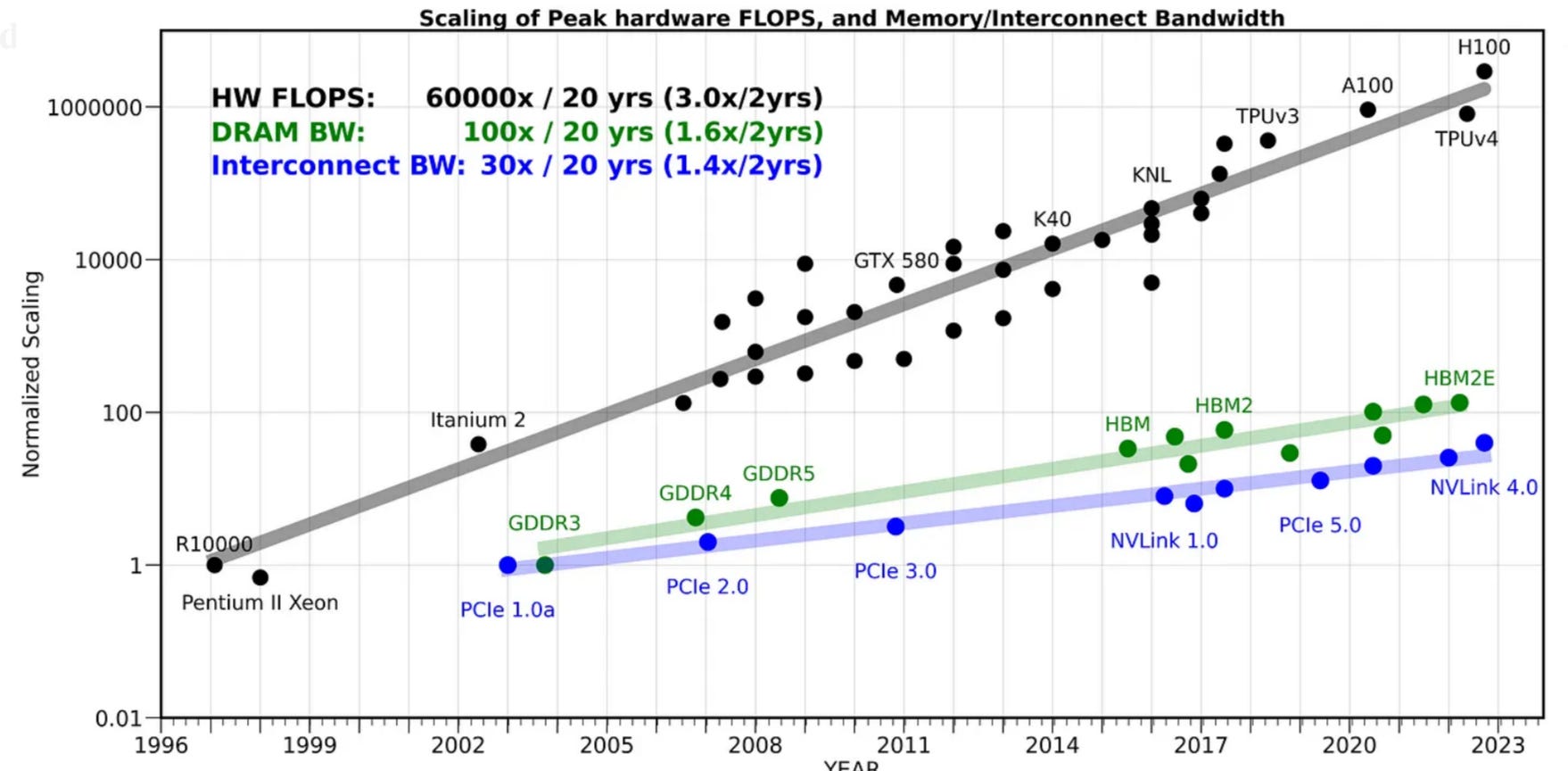

Compute Growth Outpaces Memory, Creating Bottleneck

This chart perfectly illustrates the core constraint discussed in the section, showing how memory and interconnect bandwidth growth has lagged far behind computational power, creating the memory bottleneck.

(Source: semivision – Substack)

Capital Floodgates Open: Record Investment Targets AI Packaging and Memory Shortages

In response to the severe supply crisis, the semiconductor industry has unleashed an unprecedented wave of capital expenditure, moving from tactical capacity adjustments in 2024 to massive, multi-billion-dollar strategic investments in 2025 and 2026 aimed at re-shoring and expanding HBM and advanced packaging manufacturing.

AI Packaging Market Forecast Shows Explosive Growth

This forecast visualizes the scale of the capital wave described in the section, showing how massive investments are expected to drive the packaging market to nearly half a trillion dollars.

(Source: Precedence Research)

- The scale of investment has escalated dramatically. Early indicators included SK Hynix’s late 2024 announcement of a nearly $4 billion advanced packaging facility in Indiana. This was a significant but isolated move compared to the industry-wide spending spree of 2025-2026.

- By 2026, capital expenditure plans reached historic levels. TSMC announced plans to invest up to $56 billion in a single year, a 30% increase from 2025, while committing to a separate $100 billion expansion in the United States focused on leading-edge fabs and advanced packaging.

- Nvidia announced its intention to invest up to $500 billion over four years to build out AI infrastructure and manufacturing in the United States, a clear signal that chip designers are now directly intervening to secure their supply chains.

- This trend is global, with Infineon raising its fiscal 2026 investment to €2.7 billion to meet AI chip demand and Global Foundries announcing a $16 billion plan to reshore essential chip manufacturing in the U.S.

Table: Major Semiconductor Investments to Address AI Supply Constraints

| Company | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| TSMC | 2026 | Announced $56 billion in planned capital expenditures for 2026, a 30% annual increase, to expand capacity for AI chips and advanced packaging. | Barron’s |

| Nvidia | 2025-2029 | Announced plans to invest up to $500 billion over four years to build out AI infrastructure and secure chip manufacturing capabilities within the United States. | Manufacturing Today |

| TSMC | 2025 | Expanded its planned U.S. investment to $100 billion to build three fabs and two advanced packaging facilities in Arizona, directly addressing the packaging bottleneck. | TSMC |

| Global Foundries | 2025 | Announced a $16 billion investment plan to reshore essential chip manufacturing in the U.S. to support growth in AI and other critical sectors. | Global Foundries |

| TSMC | 2026 | Committed $17 billion to upgrade its second planned fab in Japan to produce advanced 3-nanometre chips, diversifying its manufacturing footprint beyond Taiwan. | Reuters |

| SK hynix | 2024 | Announced a nearly $4 billion investment to build an advanced packaging fabrication and R&D facility for AI memory products in Indiana, USA. | Purdue University |

Geopolitical Chokepoints: How Packaging and HBM Supply Concentrate AI Power

The extreme geographic concentration of advanced packaging in Taiwan and HBM production in South Korea has transformed a supply chain efficiency into a critical geopolitical vulnerability, prompting a frantic global race since 2025 to de-risk and onshore these foundational technologies.

AI Supply Chain Faces Critical Geopolitical Vulnerabilities

This diagram directly addresses the section’s theme by identifying critical risks, including the ‘geopolitical tensions’ and ‘extreme supply concentration’ that define the geopolitical chokepoints.

(Source: Medium)

- Between 2021 and 2024, the semiconductor industry operated with a known but accepted reliance on Asia. TSMC’s dominance in advanced logic and packaging in Taiwan and the HBM oligopoly of SK Hynix and Samsung in South Korea were established facts of the global supply chain.

- Beginning in 2025, this concentration became an acute national security concern for the United States and its allies. The “Co Wo S crunch” at TSMC and the sold-out status of HBM exposed the fragility of the AI ecosystem, triggering massive government-backed diversification efforts.

- The direct result is a surge in strategic investments aimed at geographic diversification, including TSMC’s $100 billion commitment in Arizona, SK Hynix’s $4 billion packaging plant in Indiana, TSMC’s $17 billion fab in Japan, and Silicon Box’s $3.6 billion facility in Italy. These are explicit moves to build resilient, geographically distributed capacity.

- U.S. policy has also weaponized this chokepoint. The December 2024 strengthening of export controls specifically targeting China’s access to HBM technology confirms its status as a critical asset in the geopolitical contest over AI leadership.

From Niche to Non-Negotiable: The Maturation of HBM and 2.5 D Packaging Technology

High-Bandwidth Memory and 2.5 D advanced packaging have rapidly matured from specialized, high-end options to the indispensable foundation for all competitive AI accelerators, with the industry now focused on next-generation solutions because current technologies are already at their manufacturing capacity limits.

Chip Giants Compete on Packaging Technology

This chart demonstrates the technology’s maturation from niche to non-negotiable by showing the detailed, competing advanced packaging roadmaps from industry leaders like TSMC, Samsung, and Intel.

(Source: The Futurum Group)

- During the 2021-2024 period, HBM and packaging technologies like TSMC’s Co Wo S were established but not universally adopted. The chiplet model was an emerging paradigm, and designers were still exploring various architectures to balance performance and cost.

- The period from 2025 onward has seen these technologies become the de facto standard. The success of large language models proved that memory bandwidth is a primary performance driver, cementing the dominance of architectures like the Nvidia H 100 and AMD MI 300 X, which depend on HBM integrated via 2.5 D packaging.

- The current bottleneck is so severe that it is accelerating R&D into successor technologies. The industry is actively exploring solutions like glass core substrates, co-packaged optics (CPO), and hybrid bonding to overcome the physical and thermal limits of today’s silicon interposers, validating that the current technology is both mature and maxed out.

SWOT Analysis: Navigating the HBM and Advanced Packaging Bottleneck in 2026

The transition of HBM and advanced packaging from technical components to strategic bottlenecks has fundamentally reshaped the opportunities and threats facing the AI industry. The weaknesses of a concentrated supply chain, once a theoretical risk, have now materialized as acute, systemic constraints driving unprecedented investment and geopolitical maneuvering.

Table: SWOT Analysis of the AI Memory and Packaging Supply Chain

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed and What Was Validated |

|---|---|---|---|

| Strengths | Enabled continued performance gains as Moore’s Law slowed; improved yields via chiplet architectures. | Unlocks the performance of massive AI models; created a highly profitable, high-demand market for HBM and packaging suppliers. | The technology’s central role in AI performance was validated, justifying massive capital expenditure and confirming it as the only viable path for high-end AI. |

| Weaknesses | High manufacturing complexity, longer lead times, and higher costs compared to traditional memory and packaging. | Severe, multi-year capacity constraints; extreme geographic concentration in Taiwan (TSMC) and South Korea (SK Hynix, Samsung). | Theoretical weaknesses in capacity and geography became the primary, tangible bottlenecks throttling the entire AI industry’s growth. |

| Opportunities | Market entry for new packaging players; R&D into alternative integration methods and materials. | Explosive market growth (packaging market to hit $443 B by 2035); massive government incentives (U.S. CHIPS Act); accelerated innovation in next-gen tech like glass substrates. | The scale of the opportunity grew exponentially, attracting unprecedented levels of private and public investment to solve the bottleneck. |

| Threats | Potential for supply chain disruption due to geopolitical tensions; reliance on a few key suppliers. | Geopolitical conflict over Taiwan could halt AI hardware production; AI project delays of 40-60%; cannibalization of auto and consumer electronics supply chains. | Abstract geopolitical and supply chain risks materialized into concrete economic threats, creating a two-tiered AI market of companies with and without supply access. |

Forward Outlook: Navigating AI’s Supply Chain Choke Point Beyond 2026

The single most critical action for any entity serious about AI is to secure long-term, direct supply agreements for HBM and advanced packaging capacity, as the market is rapidly stratifying into tiers defined by supply access, not just by model sophistication.

- If demand for AI hardware continues to outpace the announced capacity expansions, watch for hyperscalers like Microsoft and Google, or even sovereign AI initiatives, to make direct equity investments in or acquire memory and packaging companies to vertically integrate their supply chains.

- If geopolitical instability around Taiwan persists or worsens, watch for an immediate flight of customers to alternative providers like Intel Foundry Services, even if their technology is not yet at parity with TSMC, as supply chain resilience becomes paramount over absolute performance.

- These trends are already materializing. The complete sell-out of HBM for 2026 confirms the extreme supply tension. The massive, multi-billion-dollar investments by TSMC, Nvidia, and SK Hynix to build new capacity in the U.S. and Japan are the first definitive moves to de-risk supply chains and build regional resilience ahead of potential disruption.

Frequently Asked Questions

Why has the bottleneck for AI hardware shifted from GPUs to other components in 2026?

While securing enough GPUs was the primary challenge from 2021-2024, the bottleneck has decisively shifted to High-Bandwidth Memory (HBM) and advanced packaging. The demand for these components, driven by the massive memory requirements of modern AI servers, has outstripped global manufacturing capacity. As a result, even if more GPUs were available, the lack of HBM and packaging capacity now dictates the pace of AI hardware deployment, with the entire 2026 supply reportedly sold out.

How is the AI-driven shortage of HBM affecting other industries like automotive and consumer electronics?

The immense profitability and demand for HBM in the AI sector are causing manufacturers to reallocate fabrication capacity away from producing standard memory like DRAM and NAND flash. This pivot directly threatens the supply chains for smartphones, PCs, and vehicles, which rely on these standard chips. Projections show that AI data centers could consume as much as 70% of all memory chips by 2026, starving other industries of critical components and causing project delays.

What are companies like TSMC and Nvidia doing to address the supply chain crisis?

In response to the crisis, semiconductor companies have unleashed historic levels of investment. For example, TSMC has announced plans for up to $56 billion in capital expenditure for 2026 and a separate $100 billion expansion in the U.S. focused on advanced packaging. Chip designers are also intervening directly, with Nvidia announcing a staggering $500 billion investment plan over four years to build out AI infrastructure and secure its own manufacturing capabilities in the United States.

Why is the geographic location of HBM and advanced packaging manufacturing considered a major geopolitical risk?

The manufacturing for these critical components is extremely concentrated geographically. The majority of advanced packaging, like CoWoS, is produced by TSMC in Taiwan, while the HBM market is dominated by SK Hynix and Samsung in South Korea. This concentration has turned a supply chain efficiency into a major vulnerability, as any regional instability, especially around Taiwan, could halt the global production of high-end AI hardware, prompting a frantic race to build new capacity in the U.S., Europe, and Japan.

What is the most critical action for companies looking to scale their AI capabilities in this environment?

The single most critical action is to secure long-term, direct supply agreements for HBM and advanced packaging capacity. The market is no longer defined just by the sophistication of a company’s AI models, but by its access to the physical hardware. As highlighted in the forward outlook, companies without secured supply face project delays of 40-60%, creating a two-tiered AI market of those with and without access to the necessary components.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.