The Great Reallocation 2026: Why the Power Grid, Not Chips, Is AI’s Next Bottleneck

AI’s Power Demand Shock: Data Center Growth Outpaces Grid Capacity

The primary risk to the expansion of Artificial Intelligence is no longer the availability of semiconductor chips, but the structural inability of electrical grids to meet the sector’s exponential power demand. While the 2021-2024 period was defined by a battle for silicon, the market since 2025 has revealed a more profound constraint: access to utility-scale power. This shift from a manufacturing bottleneck to an infrastructure bottleneck is creating systemic risks for tech sector growth and new opportunities for the energy industry.

- Between 2021 and 2024, the narrative focused on the semiconductor shortage that cost the auto industry an estimated $210 billion in revenue. The competition was for manufacturing capacity at foundries like TSMC, with automakers creating direct partnerships to secure supply of both legacy and advanced chips.

- Since 2025, the constraint has shifted to the grid. A single hyperscale AI data center now requires 100 to 300 megawatts (MW) of continuous power, equivalent to a mid-sized city. This demand is fundamentally altering the energy market.

- In the U.S. alone, AI data centers were projected to require an additional 10 gigawatts (GW) of power in 2025, exceeding the total generating capacity of states like Utah. This demonstrates a demand growth rate that public infrastructure planning cannot accommodate.

- Projections now indicate that without massive grid investment, AI-related electricity consumption could outstrip the U.S. grid’s net capacity by 2030, confirming that power availability, not silicon, is the true long-term limiting factor for AI.

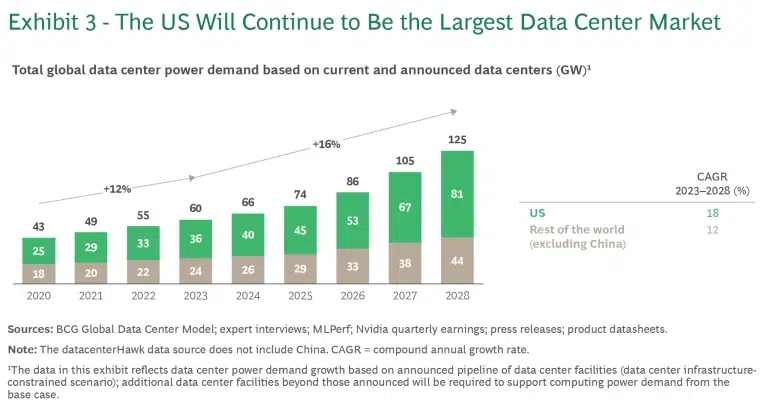

Data Center Power Demand to Triple

This chart directly quantifies the ‘exponential power demand’ discussed in the section, showing that global data center power needs are projected to nearly triple by 2028.

(Source: Boston Consulting Group)

Geographic Hotspots: Where AI’s Power Thirst Is Straining Regional Grids

The global race for AI dominance is concentrating development in specific geographic regions with available power, transforming grid access into the primary factor for site selection and creating intense strain on local energy infrastructure. This geographic consolidation marks a stark departure from the previous focus on diversifying global semiconductor supply chains.

North America Leads AI Datacenter Market

This forecast highlights North America’s market dominance, illustrating the ‘geographic hotspots’ where the concentration of AI development is creating intense strain on local power grids.

(Source: EnkiAI)

- From 2021 to 2024, geographic strategy centered on de-risking semiconductor supply chains, with initiatives like the U.S. CHIPS Act and automaker partnerships with domestic foundries like Global Foundries aimed at reducing reliance on Asia.

- In 2025-2026, the focus has pivoted to securing locations with ready access to power. North America’s dominance in the AI data center market, projected to reach $60.5 B by 2030, means its regional grids are experiencing the most acute stress.

- Utility interconnection queues have become the new competitive battleground. Data center developers are prioritizing sites with faster grid connection timelines over traditional incentives like tax breaks or fiber optic availability.

- This creates a strategic dilemma. While automakers like Honda and Tesla are developing more efficient AI chips to reduce power consumption per vehicle, data centers are locked into a cycle of consuming ever-increasing amounts of centralized power, making them a less flexible and more demanding customer for grid operators.

Technology Maturity: From Silicon to Megawatts, AI’s Infrastructure Demands Evolve

The infrastructure required to support AI has matured from a dependency on commercially available advanced silicon to a critical dependency on commercially available utility-scale power, a resource with far less elasticity and longer development cycles. This mismatch in technological clockspeeds, where AI computation advances exponentially while grid infrastructure evolves linearly, has become the central challenge.

Grid Connection Timelines Lag Data Center Builds

This chart visualizes the ‘mismatch in technological clockspeeds’ by showing that grid connection timelines can take 2-3 years, a significant lag compared to the pace of AI hardware advances.

(Source: EnkiAI)

- In the 2021-2024 period, the technology challenge was scaling manufacturing for advanced semiconductors. The bottleneck was at the leading-edge foundry and packaging level, such as TSMC’s advanced node capacity, which was increasingly consumed by AI chip production.

- Since 2025, the constraint has shifted to the electrical grid, a technology that operates on decade-long planning and construction timelines. While the semiconductor industry delivers performance doubling every two years, new high-voltage transmission lines can take over ten years to permit and build.

- The demand from a single AI facility (100-300 MW) is no longer a standard industrial load but a utility-level requirement that local distribution networks were never designed to handle, forcing costly and time-consuming substation and transmission upgrades.

- This technological mismatch creates a strategic opening for the automotive sector. While data centers are purely parasitic loads, the rise of electric vehicles and vehicle-to-grid (V 2 G) technology allows automakers to position themselves as partners in providing grid stability, a capability data centers lack.

SWOT Analysis: Navigating AI’s Shift from Chip Competition to Power Constraints

The strategic landscape is being redefined by the power bottleneck, fundamentally altering the calculus for technology companies, automakers, and energy providers. What were once strengths, such as the ability to outbid competitors for chips, are becoming less relevant than the ability to secure long-term power contracts and grid interconnections.

Table: SWOT Analysis for AI Infrastructure’s Shift to Power Constraints

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High margins on AI chips (NVIDIA’s 78%) and pricing power allowed tech firms to secure priority access to semiconductor supply. | Massive capital deployment (Mc Kinsey forecasts $5.2 trillion in data center investment by 2030) enables direct investment in dedicated energy infrastructure. | Financial strength is being redeployed from securing component supply to directly funding or procuring energy generation, bypassing traditional utility models. |

| Weaknesses | High dependency on a few semiconductor foundries, primarily TSMC in Taiwan, created significant geopolitical and supply chain risk. | Extreme and inelastic power demand (100-300 MW per facility) with multi-year lead times for grid connections has become the new primary dependency. | The core vulnerability has shifted from a concentrated, high-velocity manufacturing base to a dispersed, slow-moving, and highly regulated utility infrastructure. |

| Opportunities | Automakers like Ford and GM forged direct partnerships with chipmakers (Global Foundries) to secure capacity and influence design for long-term supply. | For energy companies: massive new demand for Power Purchase Agreements (PPAs) and grid services. For automakers: leverage EV fleets and V 2 G technology to become grid partners, monetizing distributed energy assets. | The opportunity has evolved from supply chain optimization to direct participation in the energy ecosystem, creating new revenue streams and strategic positioning. |

| Threats | Chip shortages caused major production disruptions, costing the automotive industry an estimated $210 billion in 2021 and forcing idle plants. | Grid capacity limits and interconnection delays are now throttling or halting AI data center growth entirely. Power scarcity is becoming the new, more intractable shortage. | The existential threat has transitioned from a temporary component shortage to a permanent, infrastructure-level failure to deliver the energy required for growth. |

Forward Outlook: If AI Hits the Power Wall, Watch for Energy Sector Integration

As power availability solidifies its position as the primary limiting factor for AI growth over the next 12-18 months, technology giants will move aggressively to vertically integrate into the energy sector. Expect a wave of direct investments in generation, strategic partnerships with utilities, and acquisitions of energy-related technology to secure the power needed to fuel their expansion.

Explosive AI Chip Sales Drive Power Crisis

The exponential growth in AI chip revenue provides the essential context for this outlook, explaining the scale of the hardware boom that is causing the industry to hit a ‘power wall’.

(Source: EnkiAI)

- If this happens: Large-scale data center projects announced in 2024 and 2025 begin to face public delays or cancellations, with developers explicitly citing the inability to secure timely grid interconnection as the cause.

- Watch this: Major AI players like Microsoft, Amazon, and Google will escalate their energy strategies from signing PPAs to directly funding or acquiring renewable generation assets, battery storage projects, or even small modular reactor (SMR) developers to create captive power supplies.

- This could be happening: Automakers with mature EV programs, such as Tesla, begin marketing their collective battery capacity as a distributed power plant. They could offer grid stabilization services that directly compete with or complement the needs of large data centers, turning their EV customers into an energy asset.

- This could be happening: A new class of “energy-first” data center developers emerges, whose core competency is not IT architecture but navigating utility regulations, securing land with pre-approved power access, and rapidly deploying grid infrastructure. The ultimate winners in the AI race will be those who master both the semiconductor supply chain and the energy ecosystem.

Frequently Asked Questions

Isn’t the biggest challenge for AI getting enough advanced chips?

While a semiconductor shortage was the primary bottleneck from 2021 to 2024, the market has shifted. Since 2025, the main constraint on AI expansion has become the structural inability of electrical grids to meet the massive power demands of new data centers, making power, not chips, the key limiting factor.

How much power does a modern AI data center actually use?

A single hyperscale AI data center now requires between 100 to 300 megawatts (MW) of continuous power. This is a massive amount of energy, equivalent to the demand of a mid-sized city, and it places unprecedented strain on local and regional power grids.

Why can’t the energy grid just expand to meet this new demand from AI?

The core problem is a mismatch in development timelines. AI technology and demand are growing exponentially, while energy infrastructure, like new high-voltage transmission lines, operates on a linear, decade-long cycle for permitting and construction. The grid was not designed to accommodate such rapid, large-scale increases in demand.

How are tech companies trying to solve this power problem?

Leading tech companies are moving beyond simply buying power to vertically integrating into the energy sector. This includes directly funding or acquiring renewable generation assets like solar and wind farms, investing in battery storage, and even exploring technologies like small modular reactors (SMRs) to create their own dedicated, captive power supplies.

Does this power crisis create opportunities for other industries?

Yes. It creates huge opportunities for energy companies through demand for Power Purchase Agreements (PPAs). It also presents a unique opening for the automotive sector. Automakers with large EV fleets can leverage vehicle-to-grid (V2G) technology, positioning their collective car batteries as a distributed power plant that can sell grid stability services, a capability data centers lack.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.