Bloom Energy’s On-Site Power Solutions Target AI Data Center Bottleneck in 2025

Bloom Energy Commercial Scale Projects Target AI Data Center Power Demand in 2025

Bloom Energy has strategically positioned its on-site power generation technology to directly address the critical energy bottleneck created by the AI infrastructure boom, shifting its focus toward the high-growth data center market.

- Prior to 2025, on-site power solutions were applied across a broad range of industrial uses without a singular, dominant driver. The period from 2021 to 2024 saw incremental adoption but lacked the urgency now present in the market.

- In October 2025, Bloom Energy announced a definitive pivot with its $5 billion strategic partnership with Brookfield to deploy on-site power generation specifically for AI data centers. This move directly targets the grid-level constraints that threaten to slow down the AI industry’s expansion.

- This strategic shift validates on-site power as a commercially viable and critical solution for the AI industry’s power-constrained growth. It positions Bloom Energy as an essential enabler for hyperscalers and data center operators who cannot wait for multi-year grid upgrades to bring new compute capacity online.

AI Data Center Power Demand to Surge

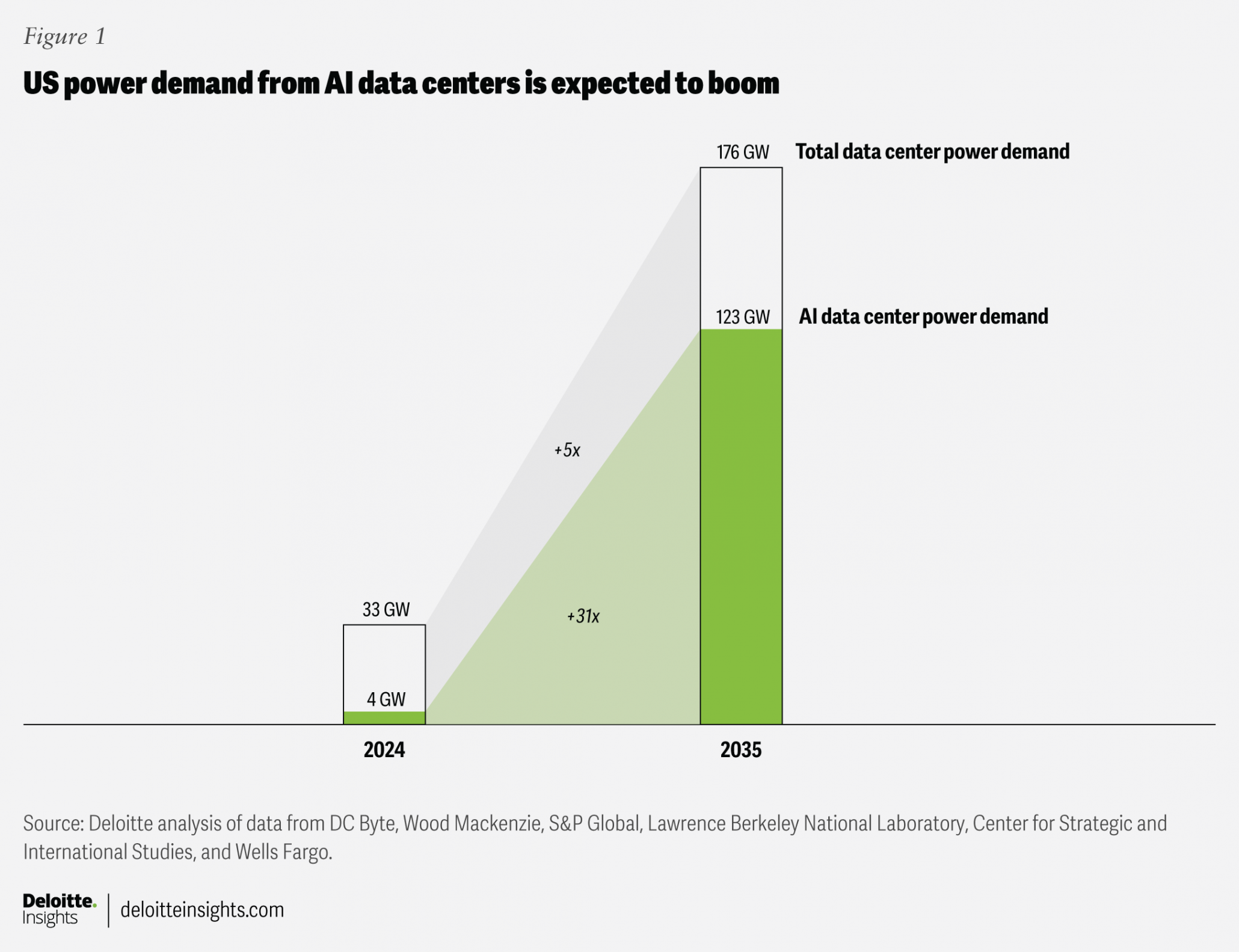

This chart directly quantifies the explosive growth in power demand from AI data centers, which is the critical bottleneck Bloom Energy’s on-site power solutions are positioned to solve.

(Source: Deloitte)

Bloom Energy’s Brookfield Alliance Secures Critical Role in 2025 AI Infrastructure Build-Out

Bloom Energy secured a pivotal role in the AI supply chain through its $5 billion strategic partnership with Brookfield, positioning its on-site power solutions as a direct remedy for the grid-level energy constraints hindering AI data center deployment.

- The partnership, announced on October 13, 2025, is designed to deploy Bloom Energy’s on-site power generation solutions to provide predictable, clean, and reliable electricity for Brookfield’s growing portfolio of AI data centers.

- This alliance directly bypasses the primary bottleneck identified in the market: the slow pace of utility grid upgrades and new power plant construction. The text notes that lead times for new data center power connections can exceed 1-3 years.

- The strategic value of this partnership is magnified by the immense capital flowing into the sector, including Microsoft’s $100 billion Cap Ex guidance for 2025 and forecasts of global data center Cap Ex surpassing $1 trillion by 2029, creating a massive addressable market for Bloom Energy.

Table: Bloom Energy Key Strategic Partnership

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield | October 2025 | A $5 billion strategic partnership to deploy Bloom Energy’s on-site power generation solutions for Brookfield’s AI data centers. The goal is to directly address the energy bottleneck for AI infrastructure build-outs. | Brookfield and Bloom Energy Announce $5 Billion … |

Bloom Energy’s North American Focus Aligns with Epicenter of AI Infrastructure Growth

Bloom Energy’s strategic focus on North America aligns directly with the region’s dominant role in AI infrastructure investment and the escalating power demand from its rapidly expanding data centers.

North America to Dominate AI Infrastructure Market

The chart validates the section’s regional focus by showing North America commanding a dominant share of the AI infrastructure market, confirming its role as the industry’s epicenter.

(Source: Research Nester)

- From 2021 to 2024, AI infrastructure growth was global, but by 2025, North America has solidified its position as the investment epicenter. This is evidenced by the US-centric CHIPS Act, which provides billions in funding to secure the domestic semiconductor supply chain with companies like Intel, TSMC, and Samsung building new fabs in the US.

- The region faces an acute power challenge, with AI data centers in the U.S. projected to increase power demand from 4 gigawatts (GW) to 123 GW by 2035. This creates a significant domestic market for alternative power solutions.

- Bloom Energy’s partnership with Brookfield, a major North American infrastructure investor, anchors its strategy within this key geography, placing it at the heart of the AI build-out where the need for reliable, scalable power is most urgent.

Bloom Energy’s On-Site Power Reaches Commercial Scale for AI Data Center Market

Bloom Energy’s power generation technology has transitioned to a commercially critical solution for the AI industry, validated by its large-scale deployment agreement to solve the immediate power constraints of hyperscale data centers.

AI Infrastructure Market Poised for Rapid Growth

This chart illustrates the massive scale of the AI infrastructure market, providing essential context for why Bloom Energy’s validation as a critical commercial solution is so significant.

(Source: Data Bridge Market Research)

- Between 2021 and 2024, on-site fuel cell technology was a proven but supplementary power solution for data centers, often used for backup or to supplement grid power.

- The announcement of the $5 billion Brookfield partnership in October 2025 marks a critical shift, elevating the technology to a primary power source capable of supporting entire AI data center deployments at scale. This move validates its commercial readiness for the AI market’s demanding requirements.

- This transition from a general-purpose industrial technology to a mission-critical enabler for the AI sector shows that the technology is mature enough to address the physical limitations of the power grid, which has become the main obstacle to AI’s growth.

SWOT Analysis: Bloom Energy’s Position in the AI Infrastructure Growth Ecosystem

Bloom Energy’s primary strength lies in its ability to directly address the energy bottleneck of the AI infrastructure boom, though its growth is dependent on the capital deployment of partners and the overall pace of data center construction.

Framework Highlights Key AI Data Center Risks

This risk framework highlights ‘limited capacity bottlenecks’ and ‘dependency on key suppliers’, which directly correspond to the strengths and weaknesses identified in Bloom Energy’s SWOT analysis.

(Source: ScienceDirect.com)

- The company’s core strength is its commercially ready technology that offers a direct solution to the power constraints hindering the $1 trillion data center market.

- Its main weakness is a dependency on the construction and investment timelines of its partners, which can be slowed by other supply chain issues like transformer or chip shortages.

- The analysis shows a clear validation of its strategy in 2025, moving from a theoretical opportunity to a commercially executed plan with a major infrastructure partner.

Table: SWOT Analysis for AI Infrastructure Growth

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Proven fuel cell technology with industrial and commercial applications. | Targeted solution for the acute AI data center power bottleneck. Technology provides predictable, reliable power independent of grid constraints. | The Brookfield partnership validated the technology as a mission-critical, large-scale solution specifically for the high-growth AI infrastructure market. |

| Weakness | Dependent on industrial customer capital expenditure cycles. Perceived as a supplementary power source for data centers. | Growth is tied to the capital deployment and construction timelines of partners like Brookfield. Not a direct hardware provider, so it is one step removed from the core AI investment. | The dependency on partners was reframed as a symbiotic relationship, where Bloom Energy’s solution enables its partners’ growth in a constrained environment. |

| Opportunity | Growing demand for cleaner and more reliable power across industries. | Massive, power-constrained AI data center market projected to surpass $1 trillion in Cap Ex by 2029. Hyperscalers like Microsoft and AWS are spending hundreds of billions. | The AI energy crisis of 2025 transformed the opportunity from a general trend to an urgent, specific market need that Bloom Energy is uniquely positioned to fill. |

| Threat | Competition from other distributed energy resources and improvements in grid infrastructure. | A slowdown in AI hardware availability (e.g., GPUs, transformers) could delay data center projects, impacting demand for power solutions. Long-term grid modernization could reduce the need for on-site generation. | The immediate threat of grid inadequacy became a primary driver for Bloom Energy’s business case, solidifying its near-term market position despite long-term competitive risks. |

Future Outlook: Bloom Energy’s Growth Hinges on Scaling AI Data Center Deployments

The primary indicator for Bloom Energy’s success in 2025 and beyond will be the execution speed of its $5 billion partnership with Brookfield and its ability to secure similar agreements with other data center developers and hyperscalers.

U.S. AI Infrastructure Market Sees Explosive Growth

This chart projects the rapid growth of the U.S. AI infrastructure market, illustrating the significant future opportunity for Bloom Energy if it successfully executes its deployment strategy.

(Source: Grand View Research)

- The market is defined by a conflict between digital speed and physical pace. Bloom Energy’s forward-looking strategy must focus on demonstrating it can deliver physical power infrastructure at a speed that matches the AI industry’s ambitions.

- The analyst opinion in the provided data states that ultimate winners in the AI race will master the physical supply chain, with energy being a critical resource. The Brookfield deal is a direct move to secure this advantage for its customers.

- Future growth will depend on replicating this partnership model. Key targets include other major infrastructure investors like the Black Rock consortium and hyperscalers like Microsoft, Google, and AWS, which are collectively spending hundreds of billions on new infrastructure and developing their own custom chips.

Frequently Asked Questions

What is the main problem Bloom Energy is solving for the AI industry in 2025?

Bloom Energy is solving the critical energy bottleneck for the AI industry. The electrical grid cannot be upgraded fast enough to power the massive expansion of AI data centers, and Bloom’s on-site power generation solutions allow companies to bypass these multi-year delays for grid connections.

What significant event occurred in October 2025 for Bloom Energy?

In October 2025, Bloom Energy announced a $5 billion strategic partnership with Brookfield. This deal was pivotal as it is specifically for deploying on-site power generation for AI data centers, validating Bloom’s technology as a primary, large-scale solution for the industry’s power constraints.

Why is Bloom Energy’s on-site power a more immediate solution than using the traditional power grid for new data centers?

Traditional grid upgrades and new power connections for data centers can have lead times exceeding 1 to 3 years. Bloom Energy’s on-site solutions can be deployed more quickly, providing predictable and reliable power that allows data center operators to bring new AI compute capacity online without waiting for the slow pace of utility upgrades.

According to the SWOT analysis, what is a primary weakness for Bloom Energy’s AI strategy?

The primary weakness identified is that Bloom Energy’s growth is dependent on the capital deployment and construction timelines of its partners, like Brookfield. Delays in data center construction, potentially caused by other supply chain issues like transformer shortages, could slow down demand for its power solutions.

Why is North America a key focus for Bloom Energy’s strategy?

By 2025, North America solidified its position as the epicenter for AI infrastructure investment, driven by initiatives like the CHIPS Act. The region faces a severe power challenge, with projected AI data center power demand in the U.S. growing from 4 GW to 123 GW by 2035. This creates a massive and urgent domestic market for Bloom’s solutions.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.