Bloom Energy On-Site Power Solutions Capture AI Data Center Market 2025

Bloom Energy Commercial Projects Secure On-Site Power for AI Data Centers 2025

Bloom Energy has successfully repositioned its commercial strategy to capitalize on the AI infrastructure boom, shifting from a general-purpose clean power provider to a critical enabler for power-constrained data centers. The company’s focus is now on providing large-scale, on-site power generation to bypass the grid limitations that have become the primary bottleneck for AI expansion.

- Between 2021 and 2024, Bloom Energy served a diverse industrial and commercial client base, where its technology was often adopted for corporate sustainability goals or as a source of resilient backup power.

- The strategic inflection point occurred in late 2025 with the announcement of a landmark $5 billion partnership with infrastructure investor Brookfield, squarely targeting the AI data center market. This deal validated a decisive pivot toward serving the acute power needs of hyperscalers and data center developers.

- This shift in customer focus demonstrates that the market now views on-site power not as an alternative, but as an essential component for new AI facility construction, required to overcome multi-year delays in utility grid connections.

- The adoption of Bloom Energy’s solution for this application signals a broader industry recognition that the physical constraints of the power grid present a more immediate threat to AI growth than semiconductor availability.

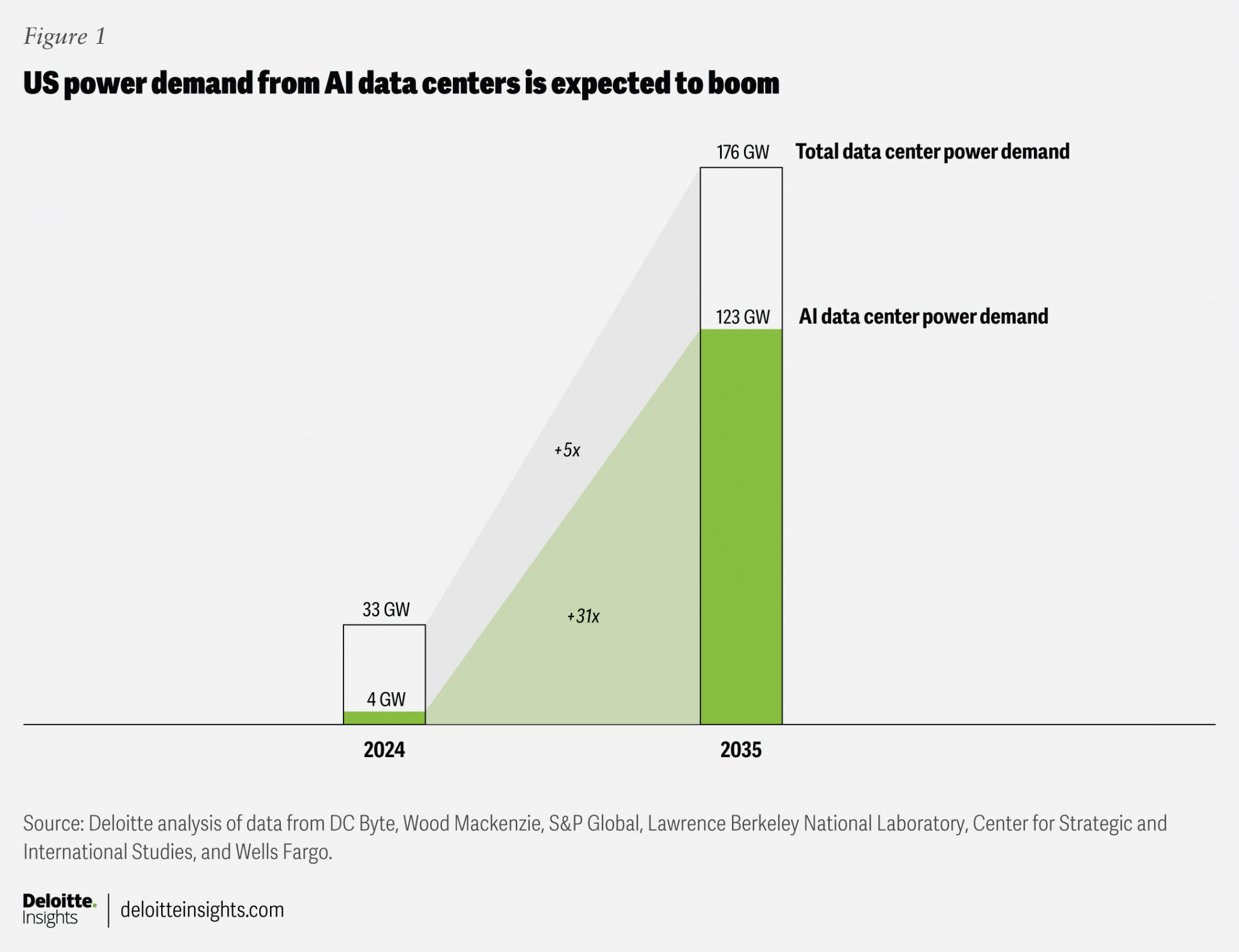

AI Data Center Power Demand Soars

This forecast shows AI data center power demand growing 31-fold by 2035, illustrating the critical grid constraints that Bloom Energy’s on-site power solutions aim to solve.

(Source: Deloitte)

Bloom Energy Investment Analysis: Funding the AI Power Revolution

A multi-billion dollar strategic investment has redefined Bloom Energy’s financial and operational trajectory, validating its business model as a direct financing and deployment solution for the AI industry’s power infrastructure crisis. This funding moves beyond general corporate investment and establishes a dedicated capital vehicle to build out on-site power at scale.

- The cornerstone investment is the $5 billion strategic partnership with Brookfield announced in October 2025, structured specifically to finance integrated, on-site power solutions for AI data centers.

- This capital is not a simple equity injection but rather a dedicated financing mechanism that enables data center developers to procure power infrastructure as an operational expenditure, de-risking project budgets and timelines.

- This investment vehicle confirms that sophisticated infrastructure investors like Brookfield recognize the bankability of Bloom Energy’s technology as a primary, mission-critical power source for the multi-trillion dollar AI build-out.

Table: Bloom Energy AI Infrastructure Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield | October 13, 2025 | A $5 billion strategic partnership to create a new financing model for deploying integrated, on-site power solutions. The goal is to directly address the power bottleneck for AI data centers by providing a scalable, grid-independent energy source. | Brookfield and Bloom Energy Announce $5 Billion … |

Bloom Energy Strategic Partnerships Target AI Infrastructure Power Constraints

Bloom Energy has executed a pivotal alliance with global infrastructure investor Brookfield, creating a vertically integrated solution that directly addresses the AI industry’s systemic power constraints. This partnership combines Bloom’s proven energy technology with Brookfield’s massive capital and development expertise to deliver energy as a service.

- The definitive partnership was formed in October 2025, establishing a $5 billion collaboration with Brookfield to develop and finance on-site power generation for AI data centers.

- The strategic objective is to circumvent grid-interconnection delays, which have become the primary obstacle to bringing new AI computing capacity online, by building power generation directly at the data center site.

- This alliance is a direct market response to the reality that by 2025, the availability of power, not the availability of AI chips, became the central limiting factor for the industry’s growth.

- By joining Bloom Energy’s fuel cell technology with Brookfield’s financial strength, the partnership provides a one-stop solution for data center developers, bundling the energy infrastructure with the facility itself.

Table: Bloom Energy Strategic Partnerships for AI

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield | October 13, 2025 | Strategic partnership to develop a new model for AI infrastructure featuring integrated, on-site power solutions. The alliance aims to deploy Bloom’s technology at scale to meet the extreme energy demands of new data centers. | Brookfield and Bloom Energy Announce $5 Billion … |

Bloom Energy Regional Analysis: North America Leads On-Site Power for AI

Bloom Energy’s strategic focus is heavily concentrated in North America, directly aligning with the region’s dominant role in the global AI data center construction boom and its well-documented grid capacity shortfalls. This geographic alignment positions the company to capture demand where the gap between AI power requirements and grid supply is the widest.

North America Dominates AI Infrastructure Market

North America’s 42% market share underscores its central role in AI, aligning with Bloom Energy’s strategic focus on the region’s power-constrained data centers.

(Source: Research Nester)

- Prior to 2025, Bloom Energy’s geographic deployment was more distributed, serving a variety of industrial customers across different regions for general decarbonization and energy resiliency purposes.

- The 2025 partnership with Brookfield, a major North American infrastructure player, and reports citing data center investment as a significant driver of U.S. GDP growth, signal a decisive focus on the United States market.

- Activity is centered on key data center markets like Virginia, Texas, and Arizona, where explosive demand for AI compute has overwhelmed local utility capacity and created project backlogs measured in years.

- This regional strategy allows Bloom Energy to target customers facing the most acute pain points, offering a solution that accelerates their time-to-market for new AI facilities by months or even years.

Bloom Energy Technology Maturity: Commercial Scale On-Site Power Validated by AI Demand

Bloom Energy’s solid oxide fuel cell technology has achieved full commercial validation as a mission-critical solution for the AI infrastructure market, transitioning from a niche clean energy option to a bankable, mainstream enabler of the AI build-out. The extreme power demands of AI have fundamentally shifted the technology’s value proposition from a “nice-to-have” for sustainability to a “must-have” for project viability.

AI Infrastructure Market Growth Validates Technology

The projection of a $356 billion market by 2032 validates the commercial necessity for enabling technologies like Bloom’s fuel cells to support this massive expansion.

(Source: Fortune Business Insights)

- In the period from 2021 to 2024, Bloom’s Energy Server technology was proven and commercially available but primarily competed with the grid on factors like carbon reduction, resiliency, or long-term cost predictability for a broad set of customers.

- The market dynamic changed completely in 2025, as AI-driven power demand began to severely outstrip grid supply. Bloom’s technology is now positioned as a primary power source that enables multi-billion dollar data center projects to proceed on schedule.

- The $5 billion partnership with Brookfield in October 2025 represents the definitive validation point. It proves the technology is commercially mature and financeable at an unprecedented scale specifically for powering high-density AI workloads.

- This shift confirms that for the AI data center application, Bloom Energy’s technology has moved beyond the early adopter phase and is now being deployed as a core infrastructure component at commercial scale.

SWOT Analysis: Bloom Energy’s Position in the AI Infrastructure Market 2025

Bloom Energy’s strategic pivot to power AI data centers leverages its proven technology to address a critical market failure, creating a significant growth opportunity. However, this focused strategy also introduces dependencies on a concentrated set of partners and the sustained, high-growth trajectory of the AI market itself.

Risk Analysis Pinpoints Infrastructure Bottlenecks

This analysis highlights ‘Limited capacity bottlenecks’ as a key risk, directly mirroring the market failure that creates a strategic opportunity for Bloom Energy’s solutions.

(Source: ScienceDirect.com)

- Strengths: The company’s core strength is its commercially mature on-site power technology, which is now amplified by the market’s urgent need to bypass grid constraints.

- Weaknesses: The AI strategy’s success is heavily dependent on the execution of its partnership with Brookfield, creating concentration risk.

- Opportunities: The addressable market has expanded to include the entire multi-trillion dollar AI infrastructure build-out, with the potential to become a standard solution for new data centers.

- Threats: The primary external threat is a market correction or slowdown in AI-related capital expenditures, which would reduce demand for new data center capacity.

Table: SWOT Analysis for AI Infrastructure Growth

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Proven fuel cell technology with a track record of reliability and low emissions for industrial customers. | Technology is now a direct solution to the primary AI bottleneck: power availability. The $5 B partnership with Brookfield provides financial validation and a scalable deployment model. | The technology’s value proposition shifted from a sustainability or resiliency feature to a mission-critical enabler for the entire AI industry. The market validated this by dedicating billions in financing. |

| Weaknesses | Higher upfront cost compared to grid power. Perceived as a niche solution for specific use cases. | Dependence on the Brookfield partnership for the AI strategy. Potential manufacturing constraints if demand from the AI sector grows faster than projected. | The risk profile shifted from competing against the grid on cost to being able to execute deployments at the massive scale and speed required by data center developers. |

| Opportunities | General corporate decarbonization trends and demand for backup power. | The unprecedented $6.7 trillion AI infrastructure build-out represents a massive new addressable market. The potential to become the default power solution for new AI data centers. | The market opportunity expanded from general industry to becoming a foundational element of the digital economy’s next wave. The problem Bloom solves became more urgent and valuable. |

| Threats | Competition from other clean technologies like solar and wind. Long-term improvements in grid infrastructure. | A “bullwhip effect” or market correction in AI spending could evaporate demand. Competing on-site power technologies or rapid advancements in grid-scale storage could emerge. | The primary threat is now tied to the macroeconomic health of the AI sector itself, rather than direct competition with traditional utility models. |

Bloom Energy 2025 Outlook: Execution on Brookfield Partnership is Key

The single most critical factor for Bloom Energy’s success in the year ahead is its ability to execute on the $5 billion Brookfield partnership, successfully deploying its on-site power solutions at the speed and scale demanded by the AI data center construction pipeline. The market has validated the strategy; now the focus shifts entirely to operational delivery and converting the partnership’s capital into operating assets.

U.S. AI Infrastructure Growth Outlook

The projected 28.5% CAGR in the U.S. AI infrastructure market quantifies the massive demand pipeline that Bloom Energy must execute against in 2025 and beyond.

(Source: Grand View Research)

- Recent data from late 2025 confirms that power has definitively replaced semiconductors as the primary bottleneck for AI, placing Bloom Energy in an exceptionally strong market position with a validated, ready-to-deploy solution.

- Success in 2026 will be measured by tangible metrics: the number of megawatts deployed under the Brookfield agreement and whether this financing model can be replicated with other infrastructure investors.

- Investors and competitors should monitor for announcements of specific data center projects being powered by the Bloom-Brookfield partnership, as these will serve as the first concrete proof points of successful execution.

- The primary forward-looking risk is a significant slowdown in data center capital expenditure, which would soften demand. Additionally, major announcements from utilities about accelerated grid upgrades in key data center alleys could alter the competitive dynamic.

Frequently Asked Questions

Why did Bloom Energy shift its focus to the AI data center market?

Bloom Energy shifted its focus to capitalize on the AI infrastructure boom, as the primary bottleneck for AI expansion has become grid power limitations, not semiconductor availability. The company repositioned itself to provide on-site power generation, bypassing multi-year grid connection delays and becoming an essential component for new AI facility construction.

What is the significance of the $5 billion Brookfield partnership?

Announced in October 2025, the $5 billion partnership with Brookfield is a cornerstone investment that validates Bloom’s technology for the AI market. It creates a dedicated financing model that allows data center developers to acquire on-site power as an operational expense, de-risking projects and accelerating timelines by providing a scalable, grid-independent energy source.

How does Bloom Energy’s solution solve the problem for AI data centers?

Bloom Energy’s solid oxide fuel cell technology provides large-scale, on-site power generation directly at the data center location. This allows developers to circumvent the multi-year delays associated with connecting to the traditional power grid, enabling them to bring new AI computing capacity online much faster.

What is the biggest risk to Bloom Energy’s new AI-focused strategy?

According to the analysis, the primary threats are a market correction or slowdown in AI-related capital expenditures, which would reduce demand for new data centers. The strategy’s success is also heavily dependent on the execution of its single, large-scale partnership with Brookfield, which introduces concentration risk.

When did this strategic pivot for Bloom Energy occur?

The strategic inflection point occurred in late 2025. This was solidified by the announcement of the landmark $5 billion partnership with Brookfield on October 13, 2025, which marked a decisive pivot from serving a general industrial base to specifically targeting the acute power needs of the AI data center market.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.