Critical Minerals: The Real Bottleneck for AI and Data Center Growth in 2025

AI’s Material Appetite: How the Mineral Demand Shock is Reshaping Data Center Projects in 2025

The rapid expansion of Artificial Intelligence is no longer constrained by algorithms or semiconductor capacity, but by a physical-world bottleneck: the supply of critical minerals. The AI-driven demand shock for materials to build and power data centers has collided with an inelastic and geopolitically fraught supply chain, moving the constraint from a future risk to a present-day reality that dictates the pace and cost of infrastructure deployment.

- Between 2021 and 2024, the industry operated on forecasts, with the IEA projecting data center electricity use to double by 2026 and analysts noting the chronic underinvestment in the mining sector. This period was defined by an awareness of a looming problem, exemplified by China’s 2023 export controls on niche metals like gallium and germanium, which served as an early warning signal.

- From 2025 to today, this theoretical risk has materialized into a direct economic constraint. Hyperscaler CAPEX is projected to jump 44% year-over-year to $371 billion in 2025, and the IEA’s forecast for electricity demand has been revised upward to 945 TWh by 2030. This demand surge has driven copper prices up 28% in 2025 to around $5.10 per pound and triggered more aggressive geopolitical actions, including China’s October 2025 export controls on rare earths.

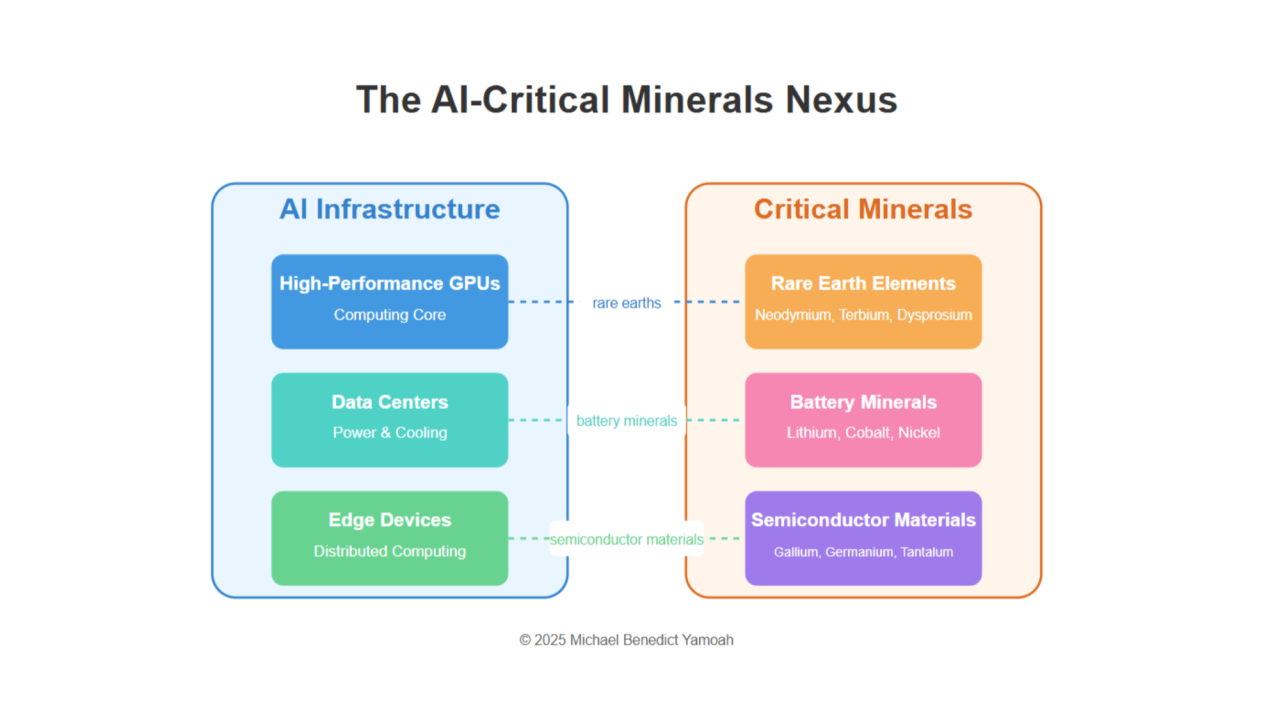

AI’s Mineral Dependencies Visualized

This chart shows the specific critical minerals required for key AI hardware, illustrating the material appetite driving the supply chain crisis.

(Source: LinkedIn)

Strategic Investments Surge to Secure Critical Minerals for AI Infrastructure

In response to escalating supply chain vulnerabilities and geopolitical weaponization, a significant shift in capital allocation occurred in late 2025. The passive approach of relying on commodity markets has been replaced by aggressive, direct investment aimed at building alternative, non-Chinese mineral supply chains to secure the physical inputs for AI infrastructure.

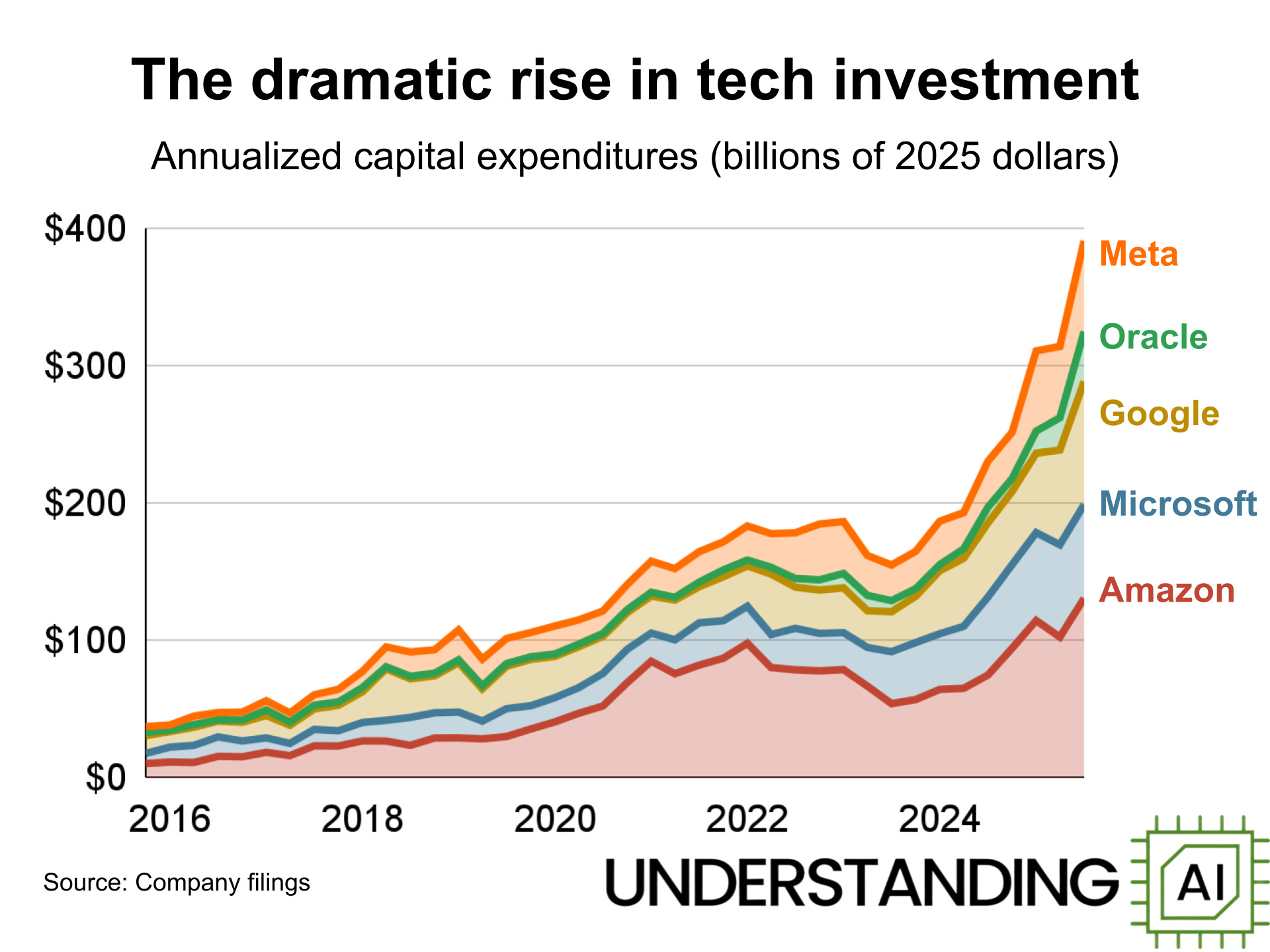

Big Tech CapEx Soars for AI

This chart quantifies the investment surge in AI infrastructure, showing the massive capital expenditure by major tech firms that is driving demand for materials.

(Source: Understanding AI)

- The formation of the $1.8 billion Orion Critical Mineral Consortium in October 2025 marks a pivotal moment, representing a large-scale, coordinated effort to develop secure and responsible mineral sources specifically for the U.S. and its allies. This moves beyond policy papers to direct capital deployment.

- Element USA’s $850 million investment in a Louisiana rare earth and critical minerals refining facility, announced in December 2025, is a direct countermeasure to China’s processing dominance. This investment aims to establish a domestic refining capability, a critical missing link in the Western supply chain.

- This contrasts sharply with the 2021-2024 period, which was characterized by broad underinvestment. The top 30 global miners only increased CAPEX by a modest 6.2% in 2023, an insufficient response to the demand signals from AI and decarbonization technologies.

Table: Strategic Investments in Critical Mineral Supply Chains (2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Element USA | Dec 2025 | Announced an $850 million investment to build a rare earth and critical minerals refining facility in Louisiana. The project directly addresses the lack of domestic refining capacity in the U.S. | Louisiana Secures Element USA’s $850 Million Investment … |

| Orion Critical Mineral Consortium | Oct 2025 | A $1.8 billion mission-driven consortium was formed to strengthen U.S. and allied supply chains by developing secure and responsible mineral sources. | $1.8 Billion Orion Critical Mineral Consortium formed to … |

| Geologic AI | Jul 2025 | Secured $44 million in funding to advance its AI-driven mineral discovery platform. This investment aims to shorten the notoriously long timelines for finding new mineral deposits. | Geologic AI secures $44 M to advance AI-driven mineral … |

Corporate and Geopolitical Alliances Form to Counter AI’s Mineral Supply Chain Risk

The recognition of mineral constraints has catalyzed the formation of both high-level geopolitical alliances and direct corporate partnerships. These collaborations are designed to de-risk supply chains by diversifying sources, securing offtake, and investing in new extraction technologies, representing a strategic shift from passive procurement to active supply chain management.

- In December 2025, the U.S. initiated an eight-nation alliance focused on coordinating the entire AI supply chain, including critical minerals, energy, and logistics. This government-led effort complements the EU’s 15 existing partnerships with resource-rich nations like Chile and Canada, creating a bloc aimed at countering Chinese dominance.

- Hyperscalers are now engaging in direct partnerships with producers, exemplified by the recent agreement between Amazon Web Services (AWS) and Rio Tinto. This deal secures a supply of low-carbon copper from Rio Tinto’s Nuton bioleaching technology for use in AWS’s U.S. data centers, linking infrastructure growth directly to specific, sustainable mining outputs.

- These targeted actions in 2025 are an evolution from the foundational work done between 2021-2024, such as the establishment of the broader Minerals Security Partnership (MSP). The recent partnerships are more commercially specific, linking end-users like AWS directly to mining innovation.

Table: Key Partnerships to Secure Mineral Supply Chains (2023–2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Government & Allies | Dec 2025 | Formation of an eight-nation alliance to coordinate development of semiconductors, critical minerals, and energy for AI infrastructure, aiming to create resilient, non-Chinese supply chains. | U.S. Launches Eight-Nation Alliance to Secure AI Supply … |

| Rio Tinto & AWS | 3 days ago | A corporate partnership to supply low-carbon copper produced with Rio Tinto’s Nuton technology for AWS’s U.S. data centers, ensuring a secure and sustainable mineral supply for a major hyperscaler. | Rio Tinto & AWS: Partnering for Sustainable Copper … |

| Vale, Manara Minerals, & Engine No. 1 | Jul 2023 | Vale established a partnership to invest in its Energy Transition Metals business, aiming to accelerate a $25-30 billion capital program to expand production of copper and nickel. | Vale announces strategic partnership with Manara … |

Geopolitical Chokepoints: How Mineral Concentration in China Constrains Global AI Expansion

The geographic concentration of mineral processing has shifted from a latent supply chain risk into an active geopolitical lever, primarily wielded by China. This dominance over refining gives China significant control over the physical inputs required for AI hardware, creating a critical vulnerability for Western nations and forcing a scramble to develop alternative, geographically diverse supply chains.

China’s Dominance in Critical Minerals

This chart visualizes China’s near-total control over the refining of essential data center minerals, explaining the geopolitical chokepoint described in the section.

(Source: Oil Price)

- Between 2021 and 2024, China’s market position was a known fact, with the country controlling over 90% of rare earth processing and a majority of many other critical minerals. Its 2023 export controls on gallium and germanium were a clear demonstration of its willingness to use this dominance as a strategic tool.

- This threat was fully realized in October 2025, when China imposed stringent export controls on rare earths and magnets, directly threatening the supply of essential components for AI chips, server hard drives, and cooling systems. This action escalated the risk from niche applications to the core of data center hardware.

- In response, investment is now flowing toward geopolitically stable regions to build alternative capacity. Key examples include Element USA’s $850 million refining facility in Louisiana and strategic initiatives in allied nations like Canada and Australia, which are leveraging their resource wealth to attract investment.

From Discovery to Deployment: Can Technology Overcome the Mineral Constraint on AI Growth?

While the long lead times for new mines remain a structural barrier, technology is emerging as a critical tool to mitigate mineral constraints. The industry is now deploying AI to accelerate mineral discovery and developing advanced materials to improve efficiency, representing a crucial, albeit long-term, response to the immediate supply shock.

- The period from 2021 to 2024 saw the initial application of AI in mineral exploration, with companies like Ko Bold Metals using algorithms to analyze geological data. This was largely in the R&D and pilot phase, with programs like DARPA’s Critical MAAS aiming to build foundational AI tools.

- In late 2024 and 2025, this approach has gained validation. The first AI-driven greenfield mineral discovery by Earth AI demonstrated the technology’s potential to shorten discovery timelines. Simultaneously, new material technologies are targeting efficiency, such as Green Critical Minerals’ VHD graphite for improved data center cooling and Rio Tinto’s Nuton bioleaching, which enables economic extraction from low-grade copper sources.

SWOT Analysis: Critical Mineral Constraints on the 2025 AI Infrastructure Boom

The AI industry’s primary strength in driving unprecedented demand for computing has simultaneously exposed its greatest weakness: a profound dependency on a fragile and geopolitically concentrated mineral supply chain. This dynamic has created immediate threats of supply disruption and cost inflation but is also forcing strategic opportunities in supply chain diversification and technological innovation.

Mapping Critical Mineral Risks

This risk-criticality matrix serves as a visual SWOT analysis, identifying the minerals that pose the greatest supply threat to the AI infrastructure boom.

(Source: Lux Research)

- Strengths: Unprecedented demand from AI is a powerful driver for innovation and investment in both mining technology and materials science.

- Weaknesses: The industry is fundamentally exposed to long mining lead times and concentrated processing chokepoints.

- Opportunities: The crisis is catalyzing massive investment in new, non-Chinese refining capacity and spurring the development of AI-driven exploration tools to accelerate discovery.

- Threats: The weaponization of export controls by dominant producers and intense competition for minerals from the defense and energy transition sectors pose immediate risks to project timelines and costs.

Table: SWOT Analysis for Critical Mineral Constraints on AI Infrastructure

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | AI demand was a strong growth driver for the tech sector. AI was used in mining (e.g., Ko Bold Metals) but was largely in pilot stages. | AI-driven demand is now the primary driver of new data center CAPEX ($371 B in 2025). AI for discovery is validated with first discoveries (Earth AI). | The feedback loop where AI demand drives the need for AI-based discovery tools has been validated, turning a strength into a solution. |

| Weaknesses | Known reliance on China for processing (90% of rare earths) and long mine lead times (16.5 years) were identified as structural risks. | The weakness was exploited. China’s October 2025 rare earth export controls turned the structural risk into an active, acute threat to AI hardware supply chains. | The theoretical vulnerability of a concentrated supply chain was proven to be a tangible weakness that can be activated at any time, increasing perceived risk. |

| Opportunities | Strategic alliances like the Minerals Security Partnership (MSP) were formed. Talk of “friend-shoring” and diversifying supply chains was prevalent. | Massive, targeted capital is deployed. The $1.8 B Orion Consortium and Element USA’s $850 M refinery are concrete actions to build alternative supply chains. | The opportunity shifted from policy discussion to direct, large-scale capital investment, validating the business case for building non-Chinese supply chains. |

| Threats | China’s 2023 export controls on gallium/germanium served as a warning. Competition with EVs for minerals was a known factor. | Threats escalated with China’s rare earth controls and rising competition from the defense sector, which projects a 135% increase in mineral demand. | The threat of geopolitical weaponization was validated and expanded, while competition for resources intensified with the addition of the defense sector as a major rival. |

Forward Outlook: Will Mineral Scarcity Stall the AI Revolution in 2026?

The primary battleground for AI supremacy in the next two years will be fought not over algorithms, but over access to physical raw materials. The ability to secure mineral supply chains will directly dictate the pace of infrastructure deployment, and companies that master the gritty reality of mining and refining will gain a decisive competitive advantage.

Future Demand to Strain Mineral Supply

This chart provides a forward outlook, projecting how future data center growth will significantly strain the global supply of specific critical minerals.

(Source: The Oregon Group)

- If this happens: If China further tightens export controls to include materials like copper or expands restrictions on magnet-related intellectual property, the impact on data center buildouts would be immediate and severe.

- Watch this: Monitor the offtake agreements made by hyperscalers like AWS, Microsoft, and Google, as these are the leading indicators of supply security strategies. Also, track the progress of new refining projects like Element USA’s Louisiana facility, as their timelines are critical to diversifying supply.

- These could be happening: Expect an increase in project delays for new data centers attributed to material shortages, not just grid access. We could also see more aggressive vertical integration, where tech companies acquire stakes in mining and refining operations to secure their own supply, fundamentally changing their business model.

Frequently Asked Questions

Why are critical minerals considered a major bottleneck for AI growth in 2025?

In 2025, the rapid expansion of AI created a massive ‘demand shock’ for materials needed to build and power data centers. This surge in demand, with hyperscaler capital expenditure jumping 44% to $371 billion, collided with a mineral supply chain that is slow to expand and concentrated in geopolitically sensitive regions, turning a future risk into a present-day constraint on infrastructure projects.

What specific actions are being taken to address the mineral supply chain risk?

Companies and governments are moving from passive reliance on markets to aggressive, direct action. Key examples include the formation of the $1.8 billion Orion Critical Mineral Consortium to develop secure sources, Element USA’s $850 million investment in a domestic refining facility in Louisiana, and direct corporate partnerships like the one between AWS and Rio Tinto to secure low-carbon copper.

How is China influencing the global supply of critical minerals for AI?

China dominates the processing of many critical minerals, controlling over 90% of rare earths. It has used this dominance as a geopolitical tool, first with export controls on gallium and germanium in 2023, and more significantly with stringent controls on rare earths and magnets in October 2025, directly threatening the supply of essential components for AI chips, hard drives, and cooling systems.

Can technology help solve the mineral scarcity problem?

Yes, technology is being deployed as a long-term solution. AI-driven platforms, like those from Geologic AI and Earth AI, are being used to accelerate the discovery of new mineral deposits, shortening notoriously long timelines. Additionally, new material technologies like Rio Tinto’s Nuton bioleaching are making it possible to economically extract minerals from low-grade sources, expanding the available supply.

What was the major shift in strategy regarding mineral supply chains between 2023 and 2025?

The strategy shifted from awareness and policy discussion to direct capital deployment. While the 2021-2023 period was characterized by forming broad alliances (like the Minerals Security Partnership) and acknowledging the risk, 2025 is defined by concrete, large-scale financial commitments (like the Orion Consortium and Element USA’s refinery) to actively build alternative, non-Chinese supply chains in response to the risk becoming an acute threat.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.