Grid Constraints in 2025: 10 Companies Maximizing Growth by Solving the Power Crisis

From Pilots to Commercial Scale: How Companies are Monetizing Grid Constraints in 2025

The strategic response to energy grid constraints has fundamentally shifted from passive mitigation to active monetization, driven by the unprecedented power demand from artificial intelligence and data centers. Between 2021 and 2024, the focus was on pilot projects for grid-enhancing technologies and early-stage utility partnerships. Starting in 2025, the crisis in power availability forced a pivot to deploying commercially viable, grid-independent solutions, with large energy consumers now directly funding and developing new energy infrastructure.

- Between 2021 and 2024, deployments of grid-enhancing technologies (GETs) and battery storage were primarily limited to utility-led pilot programs aimed at testing technical viability and ancillary service models. Companies like Smart Wires and Fluence Energy engaged in these projects, but commercial adoption was not yet widespread.

- The dynamic changed in 2025 as the AI-driven power crisis made grid connection delays a primary business constraint. This accelerated the adoption of on-site generation, transforming fuel cells from niche industrial applications into primary power sources for critical infrastructure.

- The collaborations between data center giant Equinix and both Bloom Energy and Oklo Inc. signal a major strategic shift. Large power users are now bypassing traditional utility interconnection queues by forming direct alliances with alternative energy providers to secure power for growth.

- This trend is further validated by Fuel Cell Energy‘s strategic collaboration with Sustainable Development Capital LLP to develop up to 450 MW of on-site power for data centers. This moves fuel cell technology from a backup or supplemental power source to a core component of energy infrastructure for the AI industry.

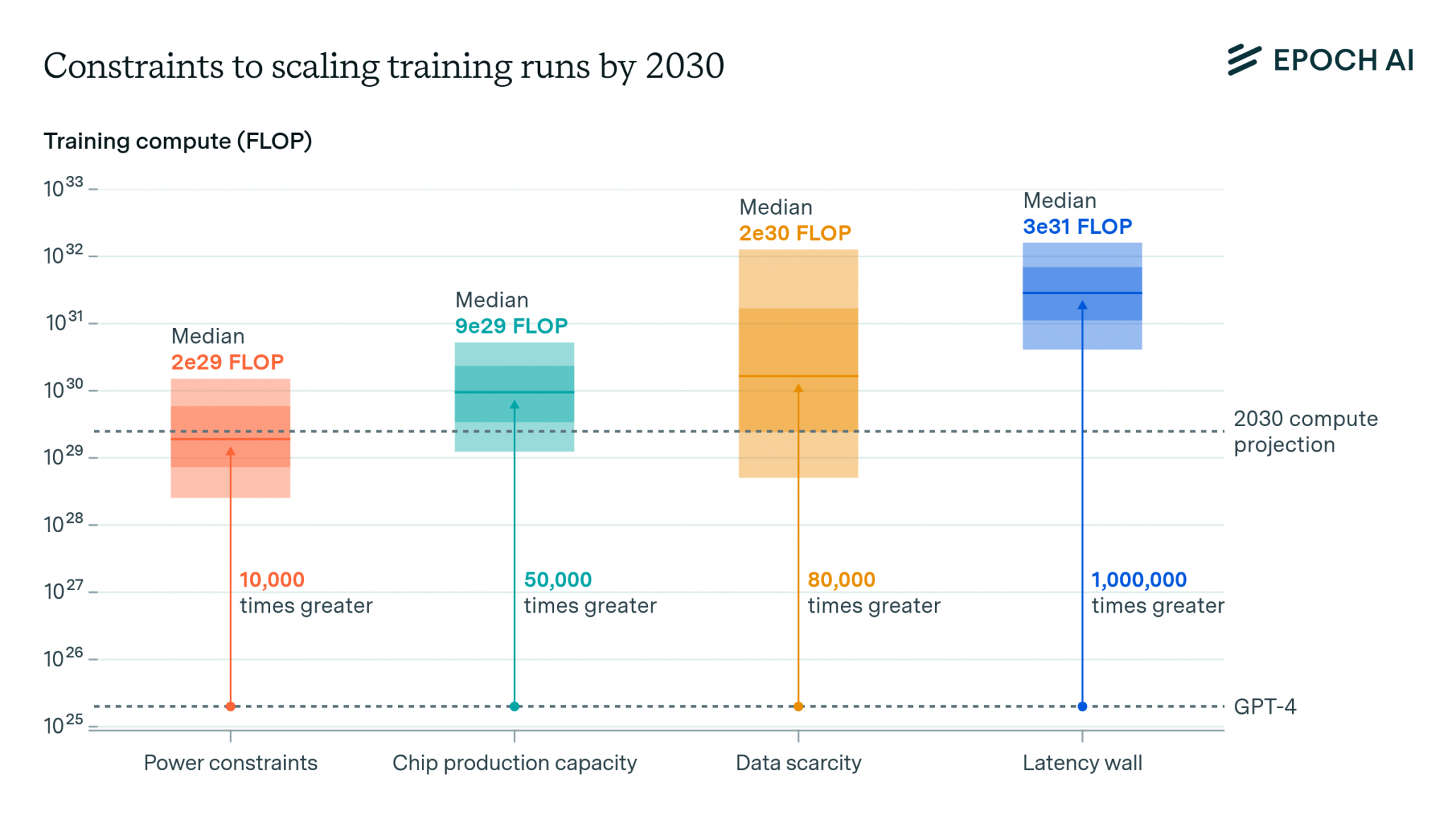

Power Constraints Are a Key AI Bottleneck

This chart quantifies the article’s core premise: that power constraints are the primary bottleneck for scaling AI, forcing companies to find new commercial solutions starting in 2025.

(Source: Epoch AI)

Strategic Capital Deployment: Tracking 2025 Investments in Grid-Adjacent Solutions

Investment in 2025 pivoted from broad clean energy funding toward targeted capital deployment into companies offering immediate, scalable solutions to grid bottlenecks. This financial backing, from both corporate giants and private equity, validates business models that either bypass or enhance existing grid infrastructure. The trend shows that capital now follows power availability, with investors funding the quickest path to secure reliable electricity.

Power Sector M&A Value Spikes in 2025

This chart perfectly illustrates the section’s theme of ‘strategic capital deployment’ by showing a dramatic spike in M&A value in 2025, validating the pivot to funding scalable grid solutions.

(Source: Deloitte)

- Hyperscale data center operators have evolved from passive energy consumers to active strategic investors in the energy sector. Google’s acquisition of Intersect Power demonstrates a move to secure its energy supply chain through vertical integration, ensuring its growth is not throttled by grid limitations.

- Private equity has shown significant confidence in the distributed energy model as a scalable solution to grid constraints. EQT‘s acquisition of Scale Microgrids in January 2025 was explicitly intended to fund the company’s growth and accelerate the deployment of its microgrid solutions.

- Growth capital is increasingly focused on enabling technologies that maximize the efficiency of the existing grid. The $30 million investment in Corinex in April 2025 was aimed at scaling the deployment of its grid flexibility solutions, indicating strong investor belief in software and hardware that can defer costly infrastructure builds.

Table: Key Investments in Grid Constraint Solutions (2025-2026)

| Acquirer / Investor | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google (Alphabet) / Intersect Power | Jan 20, 2026 | Acquisition of a power company to directly secure energy supply for its growing data center operations, bypassing utility dependence and grid constraints. | The race for electricity: Why Google is acquiring a power… |

| EQT / Scale Microgrids | Jan 9, 2025 | Acquisition by a global investment firm to support Scale Microgrids‘ growth in the distributed energy market through investments in its technology and commercial platform. | EQT to acquire distributed energy company Scale Microgrids |

| Energy Growth Momentum, Suma Capital, Adara Ventures / Corinex | Apr 8, 2025 | A $30 million investment round to scale the deployment of Corinex‘s grid visibility and flexibility solutions, signaling investor confidence in grid modernization technology. | Corinex Announces $30 Million Investment Led by Energy … |

Strategic Alliances in 2025: How Partnerships are Bypassing Grid Expansion Delays

Partnerships formed in 2025 and early 2026 reveal a clear pattern: energy users, technology providers, and financiers are collaborating to build customized, grid-adjacent power systems. This marks a departure from the traditional, centralized utility model, as companies forge alliances to achieve energy resilience and bypass interconnection delays that stall growth.

- The alliance between Fuel Cell Energy and SDCL to develop up to 450 MW of on-site power for data centers establishes a scalable “power-as-a-service” model. This structure allows data center operators to procure reliable, on-site power without the large upfront capital expenditure, directly addressing grid constraints.

- Hyperscalers are forming innovative partnerships with utilities to co-develop infrastructure. Microsoft’s collaboration with Black Hills Energy in Wyoming sets a new precedent where a data center’s power demand is used to fund and strengthen the local grid, turning a potential strain into a catalyst for modernization.

- Data center operators are securing their power supply chains by partnering directly with multiple alternative energy providers. Equinix‘s collaboration with both Bloom Energy for fuel cells and Oklo Inc. for next-generation fission demonstrates a portfolio approach to securing reliable, carbon-free power for AI-driven growth.

- Global utilities are partnering with software companies to maximize the capacity of existing infrastructure. Iberdrola’s pilot project with Plexigrid to use real-time data and simulation for grid optimization highlights the demand for intelligent software to manage increasingly complex power flows as a faster alternative to physical upgrades.

Table: Key Partnerships Addressing Grid Constraints (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 21, 2026 | Strategic collaboration to develop and finance up to 450 MW of on-site fuel cell systems for AI-driven data centers, bypassing grid constraints and interconnection delays. | Sustainable Development Capital LLP and Fuel Cell Energy … |

| Microsoft & Black Hills Energy | Jan 13, 2026 | A novel utility partnership to ensure Microsoft‘s data center growth in Wyoming strengthens, rather than strains, the local grid through direct investment in grid upgrades. | Building Community-First AI Infrastructure |

| Equinix with Bloom Energy & Oklo Inc. | Aug 14, 2025 | Collaboration to supply fuel cell and advanced fission power, enabling Equinix to expand its AI-ready data centers despite grid limitations. | Equinix Collaborates with Leading Alternative Energy … |

| Iberdrola & Plexigrid | Jul 21, 2025 | A pilot project at Iberdrola‘s Global Smart Grids Innovation Hub to use software for real-time grid simulation and forecasting to unlock existing grid capacity. | Planning the Future of the Grid: Iberdrola and … |

Geographic Hotspots: Where Grid Constraints Are Driving Energy Innovation in 2025

The United States has emerged as the primary market for deploying grid-bypass and optimization technologies, driven by its high concentration of power-hungry data centers and an active investment community. While grid modernization is a global imperative, the acute power shortages for the American tech sector have made it the epicenter of commercial activity for on-site and distributed energy solutions.

Flexible AI Unlocks Gigawatts in US Hotspots

This chart directly supports the ‘Geographic Hotspots’ theme by showing where in the U.S. grid-enhancing innovations can add the most capacity, identifying regions like PJM and the Southeast.

(Source: Deloitte)

- Between 2021 and 2024, the geographic focus for grid modernization was relatively distributed, with Europe and the U.S. both seeing pilot projects for GETs and energy storage. European grid operators like Tenne T were early investors in network upgrades to support renewable integration.

- Since 2025, the United States has become the dominant geography for commercializing grid-constraint solutions. The 60% growth in U.S. installations reported by Switched Source for its grid-enhancing technology in 2025 confirms this trend.

- The majority of high-profile partnerships and investments are concentrated in the U.S. market. The collaborations involving Microsoft in Wyoming, Fuel Cell Energy, Bloom Energy, and Equinix are all centered on solving power shortages for American data centers.

- While Europe remains a significant market for large-scale utility investment in grid infrastructure, as evidenced by Iberdrola‘s global investment plans, the corporate-led, grid-bypass movement is most advanced in the U.S. This is a direct result of the unprecedented power demand from its domestic AI industry.

Technology Maturity Curve: On-Site Generation Achieves Commercial Scale for Grid-Constrained Industries

The severe power constraints of 2025 have dramatically accelerated the technology maturity curve for on-site generation, pulling solutions like fuel cells from niche applications into large-scale commercial deployment for critical infrastructure. While next-generation technologies like advanced fission are now entering commercial validation, fuel cells and grid-enhancing software have proven their viability at scale in the current market environment.

Solar and Storage Capacity Additions Skyrocket in 2025

The chart’s massive spike in solar and storage additions for 2025 visually represents the ‘dramatically accelerated’ technology maturity curve and commercial scaling of on-site generation mentioned in the section.

(Source: National Center for Energy Analytics)

- During the 2021-2024 period, fuel cells from providers like Bloom Energy and Fuel Cell Energy were largely confined to industrial pilots or backup power roles. Similarly, GETs from companies like Smart Wires and software from Plexigrid were primarily in the utility pilot and testing phase.

- In 2025, fuel cell technology achieved commercial scale as a primary power source for data centers. The multi-billion dollar deployment partnership for Bloom Energy and Fuel Cell Energy‘s 450 MW development pipeline confirms this transition from pilot to bankable solution.

- Grid-enhancing hardware and software also reached commercial maturity. The 60% increase in U.S. installations for Switched Source and Corinex‘s $30 million funding round to scale deployment show that utilities are now adopting these technologies as standard operational tools, not just experimental projects.

- Next-generation nuclear, represented by Oklo Inc.‘s microreactors, has progressed to the commercial validation stage through its agreement with Equinix. This is a critical step forward, but the technology has not yet reached the same level of widespread commercial deployment as fuel cells.

SWOT Analysis: Competitive Advantages in a Grid-Constrained Energy Market

In the current energy market, a company’s ability to provide reliable, scalable, and grid-independent power has become a decisive competitive strength. The primary opportunity is the explosive, non-negotiable demand for electricity from the AI sector, while the most significant threat remains the slow pace of permitting and regulation, which affects all energy infrastructure projects.

AI Drives Massive Data Center Power Demand

This chart quantifies the primary ‘Opportunity’ described in the SWOT analysis, showing the explosive AI-driven power demand that creates the market for grid constraint solutions.

(Source: Boston Consulting Group)

- Strengths: Companies that offer proven, on-site power generation solutions are positioned to capture immense value by directly solving their customers’ most critical growth constraint.

- Weaknesses: The reliance on technologies that are not yet at full commercial scale or cost-competitiveness without subsidies remains a weakness for firms developing next-generation solutions.

- Opportunities: The unprecedented surge in electricity demand from data centers, projected to grow at 23% annually, creates a massive, crisis-driven market for any viable power solution.

- Threats: The primary threat has shifted from technology cost to deployment speed. Permitting and regulatory delays for new energy infrastructure, including alternative and decentralized systems, remain the key bottleneck.

Table: SWOT Analysis for Monetizing Grid Constraints

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Expertise in niche technologies like fuel cells and grid optimization software. | Proven ability to provide grid-independent power at a commercial scale, bypassing interconnection queues. | The market validated that power availability is more critical than power cost for high-growth sectors, turning technical expertise into a core strategic advantage. |

| Weaknesses | High capital cost and limited scale of alternative generation technologies. | Long development and regulatory timelines for novel technologies like advanced fission (Oklo Inc.). Supply chain constraints for mature hardware. | While cost is now a secondary concern for customers like data centers, the inherent development time for new nuclear and manufacturing capacity for all hardware has become the main weakness. |

| Opportunities | Growing demand for renewable energy integration and grid stability services. | Massive, unforeseen electricity demand from AI and data centers (estimated additional 400 TWh by 2030 in the U.S.). | The market opportunity expanded from incremental grid support to providing foundational, baseload power for a rapidly growing global industry. |

| Threats | Competition from traditional, low-cost power generation and policy uncertainty. | Physical delivery constraints, including grid capacity, interconnection backlogs, and slow permitting for all energy projects. | The primary bottleneck shifted from market competition to physical and regulatory infrastructure limitations, a threat that affects incumbents and innovators alike. |

Forward Outlook: Expect a Bifurcated Energy System as Hyperscalers Build Parallel Grids

If the gap between AI-driven electricity demand and public grid capacity continues to grow, the most critical trend to watch is the vertical integration of hyperscalers into energy generation and development. This will lead to the formation of private, resilient energy ecosystems that operate in parallel to the traditional utility grid, fundamentally bifurcating the energy system.

US AI Data Center Power Demand Skyrockets

This chart’s long-term forecast of skyrocketing AI power demand provides the fundamental reason for the ‘Forward Outlook,’ explaining why hyperscalers would be driven to build parallel energy systems.

(Source: Deloitte)

- Signal 1: Acquisition as a Core Strategy. Google’s acquisition of Intersect Power is a leading indicator of this trend. Watch for other technology giants with massive power needs to follow suit, buying rather than just contracting with power generation companies to secure their long-term energy supply.

- Signal 2: Direct Infrastructure Co-Investment. The partnership model pioneered by Microsoft and Black Hills Energy, where a data center funds specific grid upgrades in exchange for guaranteed power, will likely become more common. Watch for more direct co-investment deals between large power users and utilities.

- Signal 3: Corporate De-Risking of New Technology. The willingness of companies like Equinix to anchor projects with next-generation technology providers like Oklo Inc. is a key signal. This shows that large energy consumers are now acting as the primary financiers and validators of new energy technologies, accelerating their path to market.

Frequently Asked Questions

Why did the strategy for dealing with grid constraints change so dramatically in 2025?

The strategy shifted from small pilot projects to large commercial deployments because the unprecedented power demand from AI and data centers made grid connection delays a primary business constraint. Companies could no longer afford to wait in long utility interconnection queues, forcing them to directly fund and build their own grid-independent power solutions to ensure growth.

What are the main technologies companies are using to bypass the traditional power grid?

Companies are primarily using on-site generation technologies. The article highlights fuel cells (from providers like Bloom Energy and Fuel Cell Energy), microgrids (Scale Microgrids), and next-generation advanced fission (Oklo Inc.) as key solutions that allow large energy users to secure reliable power directly, bypassing grid limitations.

How are tech giants like Google and Microsoft responding to the power shortage for their data centers?

They have evolved from passive energy consumers to active investors and developers. Google is pursuing vertical integration by acquiring a power company (Intersect Power) to control its energy supply. Microsoft is forming novel partnerships with utilities (like Black Hills Energy) to co-invest in grid upgrades that directly support their data centers.

What is the biggest challenge or threat to deploying these new energy solutions?

According to the SWOT analysis, the primary threat is no longer technology cost but the speed of deployment. The main bottlenecks are slow permitting and regulatory delays for new energy projects, long grid interconnection backlogs, and supply chain constraints for hardware, which affect all energy infrastructure projects.

What does the article mean by a “bifurcated energy system”?

A “bifurcated energy system” refers to a future where two parallel energy systems exist: the traditional public utility grid and private, resilient energy ecosystems built and operated by large corporations (like hyperscalers). This trend is driven by tech giants vertically integrating into power generation to secure their energy supply, creating a separate infrastructure to power their operations.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.