Next Era’s Nuclear Power Strategy: How the Duane Arnold Plant Revival Fuels AI Data Centers in 2025

Next Era Commercial Projects Pivot to Nuclear Power for AI Data Center Demands 2025

Next Era Energy has executed a decisive strategic pivot, embracing nuclear power as a core solution to provide the carbon-free, baseload energy required by the artificial intelligence industry. This move marks a fundamental shift from its historical renewables-centric model to a diversified “all-forms-of-energy” approach designed to capture the high-value AI power market.

- Between 2021 and 2024, Next Era’s strategy centered on expanding its leadership in renewable energy, typified by large-scale solar and storage agreements such as the 2.5 GW deal to supply Meta Platforms with clean power. This period focused on meeting corporate demand for variable renewable energy sources.

- The strategic inflection occurred in 2025 with the announcement of a landmark partnership with Google to restart the 615 MW Duane Arnold Energy Centre, a decommissioned nuclear plant in Iowa. This project directly addresses the AI industry’s need for 24/7, high-reliability power, a requirement that intermittent renewables alone cannot fulfill.

- This adoption of nuclear power is not an isolated action but a response to a clear market signal. The broader technology sector’s search for reliable, clean power was validated when companies like Meta issued requests for proposals from nuclear developers in late 2024 to support their own AI data centers, confirming the industry-wide trend Next Era is positioned to lead.

Investment Analysis: Next Era’s Capital Plan for Nuclear and AI Infrastructure

Next Era’s capital allocation strategy has been recalibrated to fund its pivot towards serving the AI sector, with a significant portion of its expanded investment plan now dedicated to acquiring and developing the thermal assets necessary to secure long-term, high-value data center contracts.

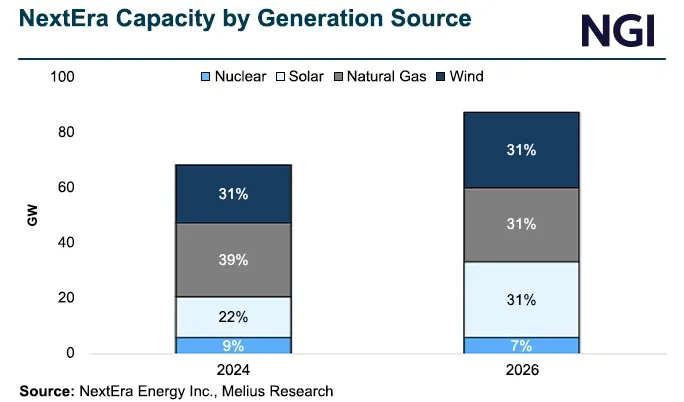

NextEra’s Power Generation Capacity by Source

This chart details NextEra’s power generation capacity in gigawatts, broken down by source. It highlights the company’s substantial portfolio across nuclear, natural gas, wind, and solar energy.

(Source: Natural Gas Intelligence)

- The company’s updated capital expenditure plan allocates approximately $75 billion through 2028 for new generation, storage, and transmission projects, a significant increase driven by investments required for the AI data center build-out.

- The 25-year Power Purchase Agreement (PPA) with Google for 100% of the Duane Arnold plant’s output is the financial cornerstone of this strategy. This long-term contract de-risks the substantial capital investment needed for the plant’s revival and locks in a predictable revenue stream tied directly to the AI economy.

- The company’s commitment was further solidified in December 2025 with the acquisition of Symmetry Energy Solutions. This move was made to expand its capabilities in firm power delivery, a necessary component to complement variable renewables and provide the 24/7 reliability demanded by its new technology partners.

Table: Next Era’s Key AI-Related Financial Commitments and Agreements

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Capital Expenditure Plan | Through 2028 | $75 Billion plan for generation, storage, and transmission, with a significant portion earmarked for AI data center infrastructure. | Next Era Energy Is Betting on a Hybrid Growth and Utility … |

| Google / Duane Arnold Energy Centre | 2025-10-27 | 25-year PPA for 615 MW of nuclear output to power AI data centers, de-risking the plant’s revival. | Next Era Energy and Google Announce New Collaboration to … |

| Symmetry Energy Solutions Acquisition | 2025-12-08 | Acquisition to expand natural gas capabilities, supporting the strategy to provide firm, 24/7 power for data centers. | Next Era Energy Resources to Acquire Symmetry … |

Partnership Data: Next Era’s Strategic Alliance with Google for Nuclear Power

Next Era anchored its nuclear-for-AI strategy in a deep, symbiotic partnership with Google, moving beyond a conventional supplier relationship to establish a comprehensive collaboration spanning infrastructure, technology, and strategic alignment.

- The definitive alliance was announced on December 8, 2025, establishing a landmark strategic partnership to jointly develop gigawatt-scale data center campuses powered by a diversified energy portfolio.

- The centerpiece of this collaboration is the agreement to restart the Duane Arnold nuclear plant to supply Google’s AI operations with reliable, carbon-free baseload power, targeting an early 2029 restart.

- The partnership creates a feedback loop, as Next Era will utilize Google Cloud’s AI models, including “Times FM 2.5, ” to modernize its own grid operations, demonstrating a strategic integration that strengthens both companies.

- In March 2025, Next Era further embedded itself in the AI ecosystem by joining the AI Infrastructure Partnership (AIP) alongside Google, Nvidia, Microsoft, and x AI, ensuring direct alignment with the infrastructure roadmaps of top AI developers.

Table: Next Era’s Key AI and Nuclear Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| 2025-12-08 | Landmark strategic partnership for joint data center campus development and co-creation of AI grid management tools. | Next Era Energy and Google Cloud Announce Landmark … | |

| Google / Duane Arnold Energy Centre | 2025-10-27 | Specific PPA to restart the 615 MW nuclear plant to provide baseload, carbon-free power for AI operations. | Google partners with Next Era Energy to restart Iowa … |

| AI Infrastructure Partnership (AIP) | 2025-03-19 | Joined coalition with AI leaders like Nvidia and Microsoft to align on infrastructure investment and development. | Black Rock, Global Infrastructure Partners, Microsoft, and … |

Geography: Next Era’s Strategic U.S. Midwest Focus for Nuclear Revival

Next Era Energy’s geographic strategy for powering AI has become highly targeted, concentrating on the U.S. Midwest to leverage existing nuclear infrastructure, a deliberate shift from its prior, more diffuse focus on renewable-rich regions.

- During the 2021-2024 period, Next Era’s project development was geographically distributed across the United States, driven by the availability of prime solar and wind resources to serve a wide range of corporate partners.

- The 2025 pivot to serve AI demand established a new geographic anchor in Palo, Iowa, the location of the Duane Arnold Energy Centre. This site selection was determined not by renewable potential but by the strategic availability of a shuttered nuclear asset ideal for recommissioning.

- This action indicates that Next Era’s future site selection for large-scale, baseload AI power projects may be increasingly dictated by proximity to existing or potential nuclear assets rather than by the location of solar and wind resources alone.

Technology Maturity: Next Era Validates Nuclear Plant Revival as a Commercial Strategy

Next Era Energy is deploying a novel commercial model by applying it to a mature technology, validating the recommissioning of existing nuclear plants as a rapid, commercially scalable solution to meet the immediate power demands of the AI sector.

- From 2021-2024, Next Era’s technological focus was on deploying commercially mature and scaled renewable technologies like solar, wind, and battery storage to meet the ESG goals of corporate partners.

- In 2025, the company shifted its application of mature technology by initiating the revival of a decommissioned nuclear plant. While nuclear energy is a long-established technology, its application as a revived asset dedicated to powering a private data center campus is a new commercial validation.

- The plan to restart the 615 MW Duane Arnold facility by early 2029, fully contracted under a 25-year PPA with Google, confirms this is not a pilot project but a full-scale commercial deployment. It establishes a repeatable model for converting dormant energy assets into revenue-generating infrastructure for the digital economy.

SWOT Analysis: Next Era’s Nuclear Pivot Risks and Opportunities 2025

Next Era Energy’s pivot to include nuclear power capitalizes on its operational strengths to seize a dominant position in the AI energy market, but it simultaneously introduces significant execution risks and complicates its established green-energy brand identity.

Table: SWOT Analysis for Next Era’s AI-Nuclear Strategy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Market leadership in developing and operating renewable energy projects (e.g., 2.5 GW Meta deal). Established project finance and execution capabilities. | Leveraging deep operational expertise to manage complex, large-scale thermal asset projects like the Duane Arnold nuclear plant revival. | The company validated its ability to translate its core strength in large-scale energy project management from renewables to the more complex nuclear sector. |

| Weaknesses | A renewables-heavy portfolio could not fully meet the 24/7 reliability demands of emerging sectors like AI. | Significant execution risk associated with the ambitious 15-30 GW data center power build-out and the unprecedented task of restarting a shuttered nuclear plant. | The strategy to capture AI demand introduced a new class of technical and project management risk not present in its standard renewable developments. |

| Opportunities | Growing corporate demand for renewable PPAs to meet sustainability targets. | Capturing the “nearly inelastic demand” from the AI sector with long-term, high-value contracts. Pioneering the “Bring Your Own Generation” (BYOG) model with Google. | The market opportunity shifted from a broad ESG-driven corporate base to a specialized, high-growth AI sector demanding extreme reliability, a niche Next Era is now positioned to dominate. |

| Threats | Standard regulatory, permitting, and interconnection challenges for renewable energy projects. | New regulatory hurdles, public perception challenges, and long-term liability specific to operating and restarting nuclear facilities. Controversy over its “all-forms-of-energy” pivot. | The pivot introduced a new layer of complex, nuclear-specific regulatory and political risk on top of the existing threats faced by its renewables business. |

Forward-Looking Insights: Next Era’s Nuclear Proof-of-Concept for the AI Era

Next Era Energy’s trajectory in 2026 and beyond hinges on the successful and timely execution of the Duane Arnold nuclear plant restart, a project that now serves as the critical proof-of-concept for its entire AI-focused, diversified power generation strategy.

- The primary indicator of future success will be adherence to the timeline and budget for the early 2029 restart of Duane Arnold. This project’s performance will be the definitive signal of Next Era’s ability to deliver on its ambitious 15 GW AI power-up plan.

- A successful revival of the plant will likely serve as a catalyst for similar deals. The market should monitor for new nuclear-for-AI announcements from Next Era with other members of the AI Infrastructure Partnership, including Microsoft, Nvidia, or x AI.

- The success of this nuclear strategy solidifies a new model for powering the digital economy. It validates the conversion of dormant thermal assets into dedicated, high-reliability infrastructure for critical industries, potentially creating a new asset class for energy investors and operators to follow.

Frequently Asked Questions

What is NextEra’s new strategy for powering AI data centers?

NextEra has pivoted from a strategy centered on renewable energy to a diversified “all-forms-of-energy” approach. This new strategy embraces nuclear power as a core solution to provide the 24/7, carbon-free, baseload energy required by the artificial intelligence industry, as demonstrated by the revival of the Duane Arnold nuclear plant.

Why is NextEra reviving the Duane Arnold nuclear plant?

The Duane Arnold plant is being revived to meet the specific demands of the AI industry for high-reliability, continuous power. The project, backed by a 25-year Power Purchase Agreement (PPA) with Google for 100% of its 615 MW output, directly addresses a need that intermittent renewables like solar and wind cannot fulfill alone.

Who are NextEra’s key partners in this nuclear and AI initiative?

NextEra’s primary partner is Google, with whom it has a landmark strategic partnership to develop data center campuses and a specific PPA for the Duane Arnold plant. NextEra has also joined the AI Infrastructure Partnership (AIP) alongside other industry leaders like Nvidia, Microsoft, and xAI to align on infrastructure roadmaps.

What is the timeline for the Duane Arnold plant restart?

The definitive agreements and partnerships for the Duane Arnold plant revival were made in 2025. The project is targeting an early 2029 restart to begin supplying its 615 MW of carbon-free baseload power to Google’s AI operations.

What are the main risks NextEra faces with its new nuclear strategy?

The main risks include significant execution risk associated with the unprecedented task of restarting a shuttered nuclear plant. The company also faces new regulatory hurdles, public perception challenges, and long-term liabilities that are specific to operating nuclear facilities, which are more complex than the risks in its traditional renewables business.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.