Oracle’s 2025 Nuclear Power Strategy: How SMRs Will Fuel the AI Data Center Revolution

Oracle’s SMR Projects Signal a 2025 Shift to Nuclear-Powered Data Centers

Oracle is leading a fundamental industry shift by integrating nuclear power directly with its AI data centers, a strategic move to solve the energy constraints that have historically limited large-scale computational growth.

- Between 2021 and 2024, the primary challenge for hyperscalers was the emerging “power crisis” driven by AI, with grid capacity becoming the main bottleneck for expansion. During this period, companies like Amazon Web Services (AWS) began addressing this by acquiring a 960 MW data center campus powered by an existing nuclear plant, signaling a move toward, but not direct integration with, nuclear energy.

- The strategy changed significantly in 2025, as Oracle moved beyond purchasing power to co-locating generation. The company announced plans for a gigawatt-scale data center powered directly by three Small Modular Reactors (SMRs), representing a direct fusion of energy and compute infrastructure.

- This adoption is not isolated to Oracle. The urgent demand for reliable, carbon-free baseload power is driving competitors like Meta to also pursue nuclear solutions, with plans to procure 1 GW to 4 GW of new nuclear generation capacity. This validates SMRs as a critical technology for the entire AI sector.

Oracle’s Multi-Billion Dollar AI Investments Drive Need for Nuclear Energy

Oracle‘s massive capital expenditure on AI infrastructure, totaling hundreds of billions of dollars, necessitates a parallel investment in dedicated, gigawatt-scale power sources like SMRs to ensure the operational viability and financial return of these projects.

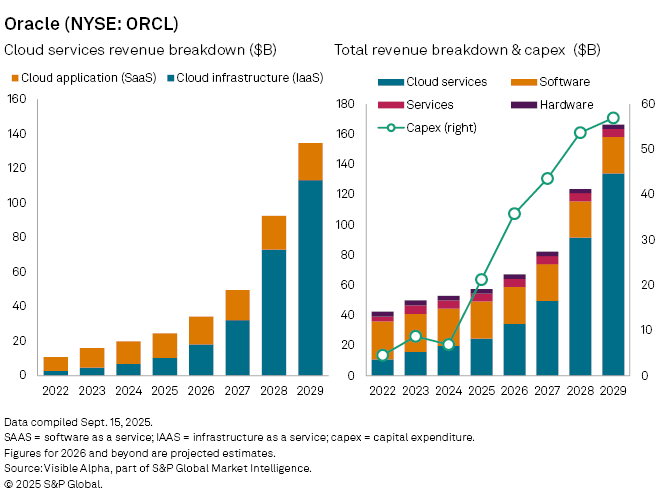

Oracle’s Capital Expenditure Skyrockets Amid AI Demand

This chart illustrates the dramatic growth in Oracle’s annual capital expenditure, highlighting a massive increase in spending to support accelerated AI demand and cloud growth.

(Source: S&P Global)

- The scale of investment is defined by the $500 billion “Stargate” project, a joint venture with Open AI and Soft Bank. This initiative, which aims to build massive AI data center capacity, creates an unprecedented power demand that cannot be met by conventional grid connections alone.

- A landmark $300 billion, five-year cloud computing contract with Open AI beginning in 2027 underpins the financial logic for these infrastructure investments. This massive contract backlog of $455 billion as of September 2025 provides the future revenue needed to justify the high upfront capital costs of building proprietary energy sources like SMRs.

- Oracle‘s international expansion, including a $14 billion commitment in Saudi Arabia and $5 billion in the UK, establishes a global footprint for its AI cloud. This expansion will require localized, scalable power solutions, with the U.S. SMR project serving as a strategic blueprint for achieving energy sovereignty in other regions.

Table: Oracle’s Key AI Infrastructure Investments Fueling Energy Demand

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Stargate Project | 2025-2029 | A $500 billion joint venture with Open AI and Soft Bank to build massive AI data center capacity in the U.S. The project’s immense energy needs are a primary driver for exploring alternative power sources like SMRs. | LA Times |

| Open AI Cloud Contract | Announced 2025 (Starts 2027) | A $300 billion, five-year contract to supply Open AI with compute capacity. This long-term commitment financially justifies the large-scale investment in both data centers and dedicated power generation. | Intuition Labs.ai |

| International Expansion | 2025 | Commitments include $14 billion in Saudi Arabia, $5 billion in the UK, and $3 billion in Germany and the Netherlands. These investments create a global need for reliable, large-scale power infrastructure to support new AI regions. | W.Media |

Oracle’s Strategic Energy Partnerships Secure Power for AI Dominance

Oracle‘s partnership strategy extends beyond AI developers to include energy technology providers, creating an integrated ecosystem designed to solve the critical power bottleneck for its data centers.

- Oracle‘s primary energy initiative involves a plan to build a 1 GW+ data center powered by three co-located SMRs. While the nuclear developer has not been named, this move establishes a new precedent for vertical integration of power and computation in the tech industry.

- A key near-term energy partnership is with Bloom Energy, announced in July 2025, to deliver on-site fuel cell power to AI data centers. This collaboration provides a rapid power solution, with a 90-day delivery timeline, to bridge the gap while long-term nuclear projects are developed.

- The company is also collaborating with Volta Grid to engineer scalable power solutions capable of managing the volatile and high-intensity energy demands of AI workloads. This partnership addresses the technical power quality and management challenges specific to running large-scale GPU clusters.

Table: Oracle’s Key Energy Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Nuclear Developers (TBD) | Announced Sep 2024 | Plan to build a 1 GW+ data center powered by three SMRs. The project aims to secure a long-term, carbon-free, and grid-independent power source for next-generation AI workloads. | Data Center Dynamics |

| Bloom Energy | Announced Jul 2025 | Collaboration to rapidly deploy on-site fuel cell power to AI data centers within a 90-day timeline. This provides immediate power to meet urgent demand while larger energy projects are underway. | Bloom Energy |

| Volta Grid | Announced Oct 2025 | Partnership to engineer scalable and resilient power solutions to manage the volatile energy demands of AI data centers, ensuring operational stability for high-performance computing. | Volta Grid |

Oracle’s Global AI Expansion Demands Diverse Regional Energy Strategies

While Oracle‘s pioneering nuclear strategy is centered in the United States, its aggressive multi-billion dollar expansion into Europe and the Middle East will force the development of region-specific, large-scale energy solutions to support its global AI ambitions.

- Between 2021 and 2024, Oracle‘s data center footprint was more traditionally dispersed and reliant on grid power. The company’s strategic focus had not yet fully pivoted to integrating novel, large-scale energy generation with its infrastructure.

- Since the start of 2025, the United States has become the clear center of gravity for Oracle‘s most innovative energy projects. The SMR-powered data center initiative and the major Stargate sites in Texas and Wisconsin are located in the U.S. to support key partners like Open AI.

- This U.S.-centric model is poised for international adaptation. Recent investment commitments, including $14 billion in Saudi Arabia and over $5 billion across Europe, create new frontiers where Oracle must solve similar energy challenges, potentially exporting its SMR integration strategy to new markets.

SMR Technology Moves from R&D to Commercial Application for Oracle’s AI Data Centers

The urgent power demands of AI have accelerated the commercial viability of Small Modular Reactors, moving them from a theoretical energy solution to a critical infrastructure component for technology leaders like Oracle.

- From 2021 to 2024, SMRs were largely in the R&D and regulatory approval stages within the energy sector. Tech companies focused on improving data center efficiency and securing renewable energy through Power Purchase Agreements rather than investing in nuclear generation.

- Oracle‘s 2024 announcement to deploy three SMRs for a 1 GW+ data center marked a major validation point for the technology, shifting it from a long-term utility-sector solution to a commercially viable application for a specific, high-demand industrial use case.

- The technology’s maturity is further confirmed by parallel interest from other tech giants. AWS‘s acquisition of a nuclear-powered campus and Meta‘s strategic initiative to procure new nuclear capacity show that SMRs are now considered a mature enough option to be integrated into long-term corporate strategy for the 2030 s.

SWOT Analysis: Oracle’s Position in the Nuclear-Powered AI Market

Oracle‘s strengths lie in its bold energy strategy and deep enterprise roots, but it faces significant financial and execution risks, while the market presents opportunities for energy sovereignty and threats from competitive and regulatory hurdles.

How Oracle’s AI Compute Spending Compares

This chart compares cloud capital expenditure as a percentage of revenue, showing Oracle’s highly aggressive investment strategy against its main competitors in the AI compute market.

(Source: SemiAnalysis)

- Oracle transformed its market position by leveraging its strengths in enterprise data to secure massive AI contracts, which in turn justified a pioneering move into SMRs.

- However, this aggressive strategy introduced significant weaknesses, including a substantial debt load and investor anxiety over the execution risk of an unprecedented infrastructure build-out.

- The opportunity to achieve energy independence and leapfrog cloud competitors is substantial, but it comes with threats from regulatory delays and similar strategic moves by rivals.

Table: SWOT Analysis for Oracle’s Energy-for-AI Strategy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Lagging cloud market share but strong in enterprise databases. | First-mover commitment to co-located SMRs; $455 B contract backlog; partnerships with Open AI and NVIDIA. | Validated a new strategy by shifting from a software provider to an integrated AI and energy infrastructure leader. |

| Weaknesses | Perceived as a legacy tech provider; slower cloud growth than rivals. | $104 B debt load; extreme stock volatility (down 40% from peak); high execution risk on data center construction. | The “all-in” AI strategy introduced significant financial precarity and exposed the company to massive execution risk. |

| Opportunities | Growing demand for cloud computing and enterprise data management. | Achieve energy sovereignty by bypassing constrained power grids; capture sovereign AI contracts; build a differentiated, power-resilient AI cloud. | The global AI power crisis created a unique opening for an energy-first strategy to gain market share from established cloud leaders. |

| Threats | Intense competition from established hyperscalers like AWS and Microsoft Azure. | Regulatory hurdles and long timelines for SMR deployment; supply chain risks for both GPUs and energy hardware; competitors like AWS and Meta pursuing similar nuclear strategies. | The scale of the AI race magnified all external risks, from supply chain dependencies to a more crowded field of competitors targeting nuclear power. |

Outlook 2026: Oracle’s Success Hinges on Executing its SMR and Data Center Roadmap

The next 24 months are critical for Oracle, as its ability to execute the physical construction of its SMR-powered data centers and begin converting its historic backlog into cash flow will determine the success of its high-risk, high-reward energy strategy.

- The key signal to monitor is progress on the SMR-powered gigawatt data center. Any announcements regarding the nuclear technology partner, site selection, or regulatory filings will serve as critical validation points for the company’s long-term vision.

- Near-term execution on the Stargate project sites in Texas and Wisconsin is a leading indicator of success. Meeting deployment targets, such as deploying 64, 000 NVIDIA GB 200 GPUs by 2026, is entirely dependent on having the necessary power infrastructure in place.

- Investor reaction to Oracle‘s capital expenditures and debt load will remain a defining factor. The company must demonstrate tangible progress on its infrastructure build-out to restore market confidence and prove that its energy-first strategy is financially sustainable.

- For energy professionals tracking this shift, understanding the specific commercial activities and partnerships driving these projects is essential. A dedicated research platform can provide the granular data needed to analyze these competitive moves and guide strategic decisions.

Frequently Asked Questions

Why is Oracle turning to nuclear power for its data centers?

Oracle is turning to nuclear power to solve the “power crisis” driven by the massive energy demands of AI. Conventional power grids cannot support the gigawatt-scale expansion required for its projects. Small Modular Reactors (SMRs) provide a dedicated, reliable, carbon-free baseload power source that allows Oracle to build massive data centers independent of grid constraints.

What specific nuclear project has Oracle announced?

Oracle has announced plans to build a gigawatt-scale (1 GW+) data center that will be directly powered by three co-located Small Modular Reactors (SMRs). This initiative, announced in September 2024, represents a direct fusion of energy generation and compute infrastructure, though the specific nuclear developer has not yet been named.

How is Oracle paying for these massive AI and energy investments?

Oracle is financing these large-scale infrastructure projects based on its massive future revenue commitments. The article highlights a $300 billion, five-year cloud contract with OpenAI (starting in 2027) and a total contract backlog of $455 billion. This guaranteed future income provides the financial justification for the high upfront capital costs of building both the AI data centers and their dedicated SMR power sources.

Are other major tech companies also exploring nuclear power?

Yes, Oracle is not alone. The article states that competitors are also pursuing nuclear solutions to meet their AI power demands. Amazon Web Services (AWS) acquired a 960 MW data center campus already powered by a nuclear plant, and Meta has plans to procure 1 GW to 4 GW of new nuclear generation capacity.

What are the main risks involved in Oracle’s nuclear power strategy?

According to the SWOT analysis, the main risks include significant financial pressure, highlighted by a $104 billion debt load; high execution risk in constructing such novel and large-scale projects on time; and external threats like long regulatory timelines for SMR deployment and increasing competition from rivals like AWS and Meta who are also pursuing nuclear energy strategies.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.