Pony.ai AI Infrastructure: Commercialization Strategy and 2026 Outlook

Pony.ai’s Commercial Projects Signal Shift from R&D to Scaled Deployment in 2026

Pony.ai has decisively shifted from research-oriented pilots to a commercially-driven enterprise by establishing large-scale production joint ventures and launching revenue-generating services globally. The period between 2021 and 2024 was characterized by securing initial permits and conducting limited-scale tests, while the period from 2025 to 2026 is defined by mass manufacturing, international expansion, and a clear focus on achieving profitability through its AI-powered autonomous vehicle infrastructure.

- Between 2021 and 2024, Pony.ai achieved foundational milestones, such as obtaining China’s first commercial taxi license in 2022 to operate a fleet of 100 robotaxis in Guangzhou. This contrasts sharply with its post-2025 strategy, which includes an agreement with Xihu Group to deploy over 1, 000 robotaxis in Shenzhen and the February 2026 start of mass production of the Toyota b Z 4 X robotaxi.

- The company’s autonomous trucking segment progressed from forming a joint venture with SANY in 2022 to announcing its Gen-4 autonomous truck system in November 2025. This new system is projected to reduce the bill-of-materials cost by approximately 70%, demonstrating a clear pivot towards creating an economically viable logistics solution for mass deployment in 2026.

- Geographically, operations before 2025 were primarily focused on testing in China and the U.S. The strategy has since become global, marked by the deployment of robotaxis in Doha, Qatar, in September 2025 and strategic partnerships with Uber for the Middle East and Bolt for Europe to integrate into established ride-hailing networks.

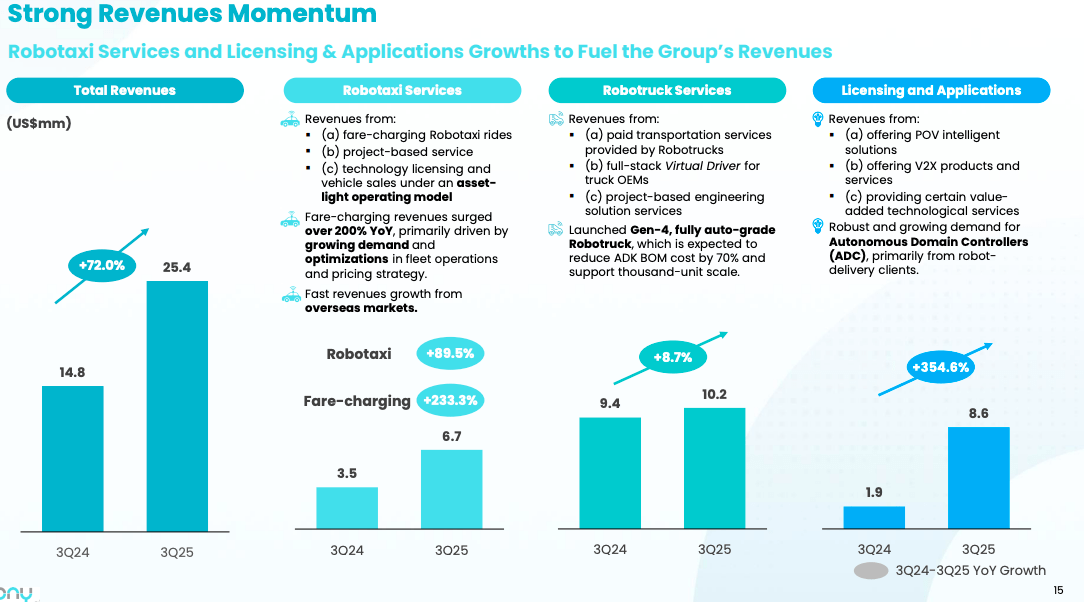

Pony.ai’s Revenue Growth Signals Commercialization

This chart illustrates the revenue surge from commercial services, directly supporting the section’s focus on the shift from R&D to scaled, revenue-generating deployment.

(Source: Seeking Alpha)

Pony.ai Investment Analysis: IPO and Strategic Funding Fuel 2026 Commercial Push

Pony.ai secured the necessary capital for its intensive global scaling strategy through a successful, though recalibrated, Nasdaq IPO in 2024 and high-value strategic investments from key commercial partners. This funding, particularly from entities like NEOM and Toyota, is directly tied to de-risking manufacturing and enabling market entry, providing a clear financial path to support its aggressive fleet expansion and technology deployment through 2026.

- In November 2024, Pony.ai raised between $260 million and $413 million in its Nasdaq IPO at a debut valuation of approximately $5.25 billion. This event provided substantial liquidity for operations, even as the valuation reflected a market correction from its $8.5 billion private valuation peak in March 2022.

- A pivotal strategic investment came in October 2023 from Saudi Arabia’s NEOM Investment Fund (NIF), which injected $100 million. This capital is directly linked to a joint venture to establish AV manufacturing and services in the MENA region, securing both funding and a critical new market.

- The company’s joint venture with Toyota and GAC Toyota (GTMC) is backed by an investment exceeding $139.2 million, announced in August 2023. This funding is dedicated to the mass production of fully driverless robotaxis, directly connecting capital to manufacturing scale.

- Validation from the public technology investment sector came in August 2025, when ARK Invest invested approximately $12.9 million in the company, signaling confidence from a prominent institutional investor focused on disruptive technologies.

Table: Pony.ai Key Investments and Strategic Funding (2022-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| ARK Invest | Aug 2025 | An institutional investment of $12.9 million, signaling confidence from a major technology-focused fund in Pony.ai’s commercialization path. | Pony.ai Attracts Premium Capital… |

| Initial Public Offering (IPO) | Nov 2024 | Raised $260 million to $413 million via Nasdaq IPO (ticker: PONY) at a $5.25 billion valuation to fund large-scale commercialization and global expansion. | Pony AI fetches $5.25 bln valuation… |

| NEOM Investment Fund | Oct 2023 | A strategic investment of $100 million tied to a joint venture for AV development, manufacturing, and service deployment in Saudi Arabia and the MENA region. | NEOM Investment Fund Invests USD 100 M… |

| Toyota & GAC Toyota (GTMC) JV | Aug 2023 | An investment of over $139.2 million (RMB 1 billion) to establish a joint venture for the mass production of fully driverless robotaxis in China. | Pony.ai, Toyota to Form Joint Venture… |

| Series D Financing | Mar 2022 | Raised an undisclosed amount at an $8.5 billion valuation, bringing total balance sheet liquidity to nearly $1 billion to fund R&D and commercial deployment. | Pony.ai Announces First Close of Series D… |

Pony.ai’s Partnership Ecosystem: How Alliances with Toyota and Tencent Accelerate AI Infrastructure

Pony.ai has constructed a multifaceted partnership ecosystem designed to secure its core AI technology stack, de-risk capital-intensive vehicle manufacturing, and accelerate commercial market access. These alliances provide the essential hardware, software, and go-to-market channels required to transition its autonomous driving solutions from development to scaled global operations.

- To achieve manufacturing scale, Pony.ai established deep joint ventures with industrial giants, including the 2023 JV with Toyota and GAC for robotaxis and the 2022 JV with SANY for autonomous trucks. These partnerships offload the burden of vehicle production and create dedicated pathways for large-scale fleet deployment.

- The company’s AI infrastructure is built on collaborations with technology leaders. It leverages NVIDIA’s DRIVE Orin platform as its core high-performance computer, partners with Tencent Cloud (April 2025) for cloud computing and AI model training, and works with Moore Threads (February 2026) to diversify its GPU supply chain with domestic hardware.

- For market entry, Pony.ai forged strategic alliances with mobility service leaders, including Uber (May 2025) for the Middle East and Bolt (November 2025) for Europe. These agreements integrate its robotaxis into existing ride-hailing networks, providing immediate access to a massive user base.

Mapping the AI Infrastructure Ecosystem

This market map illustrates the AI infrastructure landscape, providing visual context for the partnerships with hardware and software companies that Pony.ai relies on.

(Source: Next Big Teng – Substack)

Table: Pony.ai Strategic Partnerships for AI Infrastructure and Commercialization

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Moore Threads | Feb 2026 | A strategic technology partnership to utilize domestically developed GPUs from China to accelerate L 4 autonomous driving development and diversify its hardware supply chain. | Pony.ai partners with Moore Threads… |

| Bolt | Nov 2025 | A mobility service integration to introduce Pony.ai’s Level 4 autonomous driving technology and robotaxis into Bolt’s European ride-hailing network. | Bolt partners with China’s Pony.ai… |

| Uber | May 2025 | A strategic partnership to deploy Pony.ai robotaxis on the Uber platform, starting with a key Middle Eastern market and planning for further international expansion. | PONY AI Inc. and Uber Announce… |

| Tencent Cloud | Apr 2025 | A strategic technology partnership leveraging Tencent’s cloud computing, big data, and AI model training infrastructure to support AV development and data processing. | PONY AI Inc. and Tencent Cloud Announce… |

| NEOM | Oct 2023 | A $100 M joint venture to develop and deploy AV services, vehicles, and smart infrastructure in Saudi Arabia, providing access to a well-funded new market. | NEOM Investment Fund Invests USD 100 M… |

| Toyota | Aug 2023 | A major joint venture with over $139.2 M invested to mass-produce robotaxis based on Toyota vehicle platforms for the Chinese market. | Pony.ai, Toyota to Form Joint Venture… |

| SANY | Jul 2022 | A joint venture to develop and mass-produce Level 4 autonomous trucks, combining Pony.ai’s AI with SANY’s manufacturing expertise for the logistics sector. | Pony.ai partners with Sany… |

| NVIDIA | Jun 2022 | A core technology partnership to build its proprietary Autonomous Driving Controller (ADC) on the NVIDIA DRIVE Orin platform for mass production. | Pony.ai Autonomous Driving Controller… |

Pony.ai’s Geographic Expansion: From China’s Tech Hubs to Global Markets

Pony.ai is executing a deliberate shift from a primarily China-focused operational footprint to a global deployment strategy, establishing key commercial and R&D beachheads in the Middle East, Europe, and Southeast Asia. While operations between 2021 and 2024 centered on securing permits and testing in Chinese Tier-1 cities and the U.S., the period from 2025 onwards is defined by active international market entry backed by strategic partnerships.

- During the 2021-2024 period, Pony.ai’s activities were concentrated in China, securing driverless test permits in Beijing and the first commercial taxi license in Guangzhou, alongside testing operations in U.S. states like Arizona and California.

- Starting in 2025, the company initiated a significant global expansion, beginning with the deployment of robotaxis on public roads in Doha, Qatar, in September 2025. This move was solidified by the $100 million joint venture with NEOM to create a manufacturing and deployment hub for the entire MENA region.

- Entry into the European market was advanced through a November 2025 partnership with ride-hailing operator Bolt and an earlier 2024 agreement with Emile Weber to establish an R&D and deployment base in Luxembourg.

- In Southeast Asia, Pony.ai established a crucial foothold by partnering with Singapore’s largest transport provider, Comfort Del Gro, in September 2025 to launch autonomous mobility services in the strategic city-state.

Pony.ai Technology Maturity: Reaching Commercial Scale with Gen-7 AV System

Pony.ai’s autonomous vehicle technology has matured from an advanced R&D and pilot phase to a commercially scalable, mass-producible system designed for economic viability. The period between 2021 and 2024 was focused on iterative system development and securing initial regulatory approvals, while the period from 2025 to today is marked by the launch of automotive-grade hardware and the start of mass production, validating the technology’s readiness for large-scale commercial deployment.

- Between 2021 and 2024, Pony.ai focused on refining its technology through different system generations, such as its 6 th generation AV system unveiled in 2022. Key milestones were regulatory, including obtaining the first taxi license in China, which proved the basic viability of its service model.

- The launch of its seventh-generation (Gen-7) Robotaxi system in April 2025 represented a major shift towards commercialization. This system features a 100% automotive-grade Autonomous Driving Kit (ADK) designed for mass production, enhanced stability, and lower lifecycle costs.

- Technological readiness for mass production was confirmed in February 2026 when Pony.ai and its joint venture partners began manufacturing robotaxis based on the Toyota b Z 4 X electric SUV, equipped with the Gen-7 system.

- The focus on economic viability, a key indicator of technological maturity, is evident in the Gen-4 autonomous truck system announced in November 2025. This system is projected to reduce the bill-of-materials cost per vehicle by approximately 70%, making autonomous logistics a more feasible commercial product.

Pony.ai’s Autonomous Driving System Architecture

This diagram shows the core technical process of the autonomous system, providing a visual explanation for the technology maturation discussed in the section.

(Source: NVIDIA)

Pony.ai SWOT Analysis: Strategic Strengths and Market Outlook 2026

Pony.ai’s strategic position is defined by the significant competitive advantage of its joint venture model for mass production and its robust, partner-backed AI infrastructure. However, the company must navigate the challenges of high operational costs and intense market competition to convert its technological leadership into sustainable profitability. The period from 2025 to 2026 has validated its manufacturing-led strategy and diversified its geographic risk.

- Strengths in its deep partnerships with OEMs like Toyota and SANY provide a clear and de-risked path to vehicle production at scale.

- Weaknesses remain in its high cash burn, with operating losses of $112.4 million in the first nine months of 2024, and a heavy reliance on regulatory approvals for expansion.

- Opportunities lie in monetizing its technology through licensing and expanding into untapped global markets, particularly the well-funded Middle East and the large European ride-hailing market.

- Threats include intense competition from other AV leaders like Baidu and We Ride, potential supply chain disruptions, and the constant risk of safety incidents that could impact public and regulatory acceptance.

High R&D Spending Drives Operating Losses

This chart breaks down Pony.ai’s financials, visually confirming the “high operational costs” mentioned in the SWOT analysis as a key challenge to profitability.

(Source: The AV Market Strategist – Substack)

Table: SWOT Analysis for Pony.ai

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong R&D capabilities, early regulatory wins (e.g., first taxi license in China), and major funding rounds (Series D at $8.5 B valuation). | Mass production JVs with Toyota and SANY in motion. A diversified, robust AI infrastructure with NVIDIA, Tencent, and Moore Threads. Successful $413 M IPO providing capital. | The strategy of using JVs for manufacturing was validated with the start of b Z 4 X robotaxi production in Feb 2026. Financial viability was bolstered by the IPO and strategic investments. |

| Weaknesses | High R&D cash burn, limited commercial revenue, heavy reliance on the Chinese market, and a suspended permit in California in late 2021. | Continued high operating losses (reported $112.4 M loss for 9 M 2024) and dependence on partners for market access (e.g., Uber, Bolt). | While cash burn remains high, the 2024 IPO provided a significant capital runway. Geographic dependency has been actively mitigated through expansion into the Middle East and Europe. |

| Opportunities | Dual-market potential in robotaxis and robotrucks. Untapped international markets. Licensing proprietary AV technology. | Entry into the MENA region via the $100 M NEOM deal. Access to European market via Bolt partnership. Launch of cost-reduced Gen-4 truck system to capture logistics market. | The company has acted decisively on these opportunities, securing major partnerships and funding to enter the Middle East, Europe, and Southeast Asia, turning potential into active projects. |

| Threats | Intense competition from domestic rivals (e.g., Baidu). Shifting U.S.-China geopolitical tensions impacting U.S. operations and supply chains. | Continued competition from well-funded rivals like We Ride (also IPO’d in 2025). Global regulatory fragmentation could slow expansion. Public safety concerns. | Pony.ai has diversified its geographic risk away from over-reliance on China/U.S. and diversified its hardware supply chain with partners like Moore Threads, partially mitigating geopolitical threats. |

Pony.ai’s 2026 Outlook: Profitability and Fleet Expansion Are Critical Tests

Pony.ai’s success through 2026 will be measured by its ability to execute its aggressive fleet expansion to over 3, 000 vehicles and, most critically, achieve its publicly stated goal of reaching a key profitability target. The company’s recent activities indicate it has assembled the necessary manufacturing, technology, and market-access partnerships to attempt this transition from a high-growth, high-burn R&D firm to a commercially sustainable enterprise.

- The primary metric to monitor is the company’s progress toward its goal of hitting a key profit target by early 2026, a statement made by its Chief Financial Officer. Achieving this would validate its entire business model.

- The production rate of the Toyota b Z 4 X robotaxi, which started mass production in February 2026, will be a direct indicator of whether the company can meet its target of operating a fleet of over 3, 000 vehicles by the end of the year.

- The upcoming commercial launches of robotaxi services in the Middle East with Uber and in Europe with Bolt will serve as the first major tests of Pony.ai’s technology and operational model in complex international markets outside of China.

- The successful mass production and deployment of its cost-reduced Gen-4 autonomous truck system, scheduled for 2026, is crucial for opening a significant second revenue stream in the logistics sector and diversifying its business beyond passenger mobility.

Pony.ai Forecasted to Reach Positive Cash Flow

This forecast shows Pony.ai’s path to profitability, illustrating the critical test of turning its high cash burn into positive free cash flow as outlined in the outlook.

(Source: TIKR.com)

Frequently Asked Questions

What is Pony.ai’s core strategy for mass-producing its autonomous vehicles?

Pony.ai’s primary strategy is to form deep joint ventures (JVs) with established automotive and industrial giants. For its robotaxis, it created a JV with Toyota and GAC Toyota with an investment of over $139.2 million. For its autonomous trucks, it formed a JV with SANY. This approach offloads the capital-intensive burden of vehicle manufacturing and provides a direct, scaled path to production.

How did Pony.ai finance its shift from R&D to large-scale commercialization?

Pony.ai secured capital through a multi-pronged approach. This includes its November 2024 Nasdaq IPO which raised between $260 million and $413 million, and several high-value strategic investments tied to market entry and manufacturing, such as the $100 million from Saudi Arabia’s NEOM Investment Fund and over $139.2 million from its joint venture with Toyota.

What is the main difference between Pony.ai’s focus before 2025 and its focus in 2025-2026?

Before 2025, Pony.ai was primarily in a research and development phase, focused on securing initial permits, conducting limited-scale tests (like its 100-robotaxi fleet in Guangzhou), and refining its technology. From 2025 onwards, the focus has decisively shifted to commercialization, characterized by mass manufacturing (with Toyota), aggressive international expansion (Middle East, Europe), and a clear goal of achieving profitability.

Besides manufacturing, what other key partnerships are critical to Pony.ai’s AI infrastructure?

Pony.ai has built a comprehensive partnership ecosystem for its AI infrastructure. This includes using NVIDIA’s DRIVE Orin platform for its core computing, collaborating with Tencent Cloud for cloud computing and AI model training, and working with Moore Threads to diversify its GPU supply chain with domestic hardware. For market access, it has partnered with ride-hailing leaders like Uber and Bolt.

What are the biggest opportunities and challenges for Pony.ai in its 2026 outlook?

The biggest opportunity for Pony.ai is to successfully monetize its technology on a global scale by entering new, well-funded markets like the Middle East (via its NEOM deal) and Europe (with Bolt). The biggest challenge is managing its high operating costs (reported $112.4 million loss in 9 months of 2024) to reach its stated goal of profitability by early 2026, while navigating intense competition and fragmented global regulations.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- IMO Decarbonization & Net Zero 2025: Policy Collapse

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.